Nasdaq ceo says ipo demand boosted despite tariff worries banks texas boom – NASDAQ CEO says IPO demand boosted despite tariff worries, banks Texas boom. This surge in initial public offerings (IPOs) is happening despite concerns about tariffs and the broader economic climate. The Texas economy is booming, adding another layer of complexity to the market outlook. What’s driving this seemingly contradictory trend? Let’s dive in and analyze the forces shaping the current market sentiment.

The NASDAQ CEO’s statement highlights a fascinating dynamic. While tariffs pose a potential threat, the robust IPO market and Texas economic growth are pushing against headwinds. This creates an intriguing tension, with investors trying to navigate the complexities of a rapidly changing market. The table below illustrates the key factors contributing to this complex market sentiment.

Introduction to the Market Sentiment

The NASDAQ CEO’s statement reflects a generally positive market sentiment, driven by robust Initial Public Offering (IPO) demand, despite lingering tariff concerns and a Texas banking crisis. The CEO’s confidence suggests a resilience in the market’s overall outlook, potentially signaling investor optimism. The statement indicates a belief that the market has effectively absorbed the challenges presented by these factors.The strong IPO market is a key contributor to this positive sentiment.

A surge in IPO activity often signifies investor enthusiasm and anticipates future growth opportunities. This positive sentiment can influence broader market performance, as investors look for similar investment avenues and growth prospects. The link between IPO demand and the broader market outlook lies in the confidence that the IPO market fosters. If investors are confident in the potential of new companies, it often translates into greater investment in established companies and market sectors.

Factors Influencing Market Mood

The NASDAQ CEO’s statement highlights a few key factors influencing market sentiment. These factors, and their potential impacts, are detailed below:

| Factor | Description | Impact | Source |

|---|---|---|---|

| IPO Demand | A significant increase in companies seeking Initial Public Offerings (IPOs) suggests strong investor interest and perceived growth potential. | Positive; Increased investor confidence, potentially boosting broader market sentiment. | NASDAQ CEO statement |

| Tariff Concerns | Existing concerns regarding trade tariffs have potentially dampened investor enthusiasm. | Negative, but mitigated; Market appears resilient despite this factor. | General Market Conditions |

| Texas Banking Crisis | Recent issues in the Texas banking sector have created uncertainty in the financial markets. | Negative, but addressed; The market seems to have addressed these issues effectively. | NASDAQ CEO statement |

IPO Boom and its Implications

The surge in IPO activity is a crucial element in the current market sentiment. A significant number of companies seeking IPOs often signals a belief in the potential for future growth. Companies issuing IPOs often aim to raise capital for expansion, innovation, or new ventures, which can stimulate economic activity.The connection between the IPO boom and broader market outlook is apparent in investor confidence.

A positive IPO market usually indicates investor enthusiasm for risk-taking and growth opportunities, leading to more investment in established companies. This can have a ripple effect, potentially driving broader market performance and investor confidence. For example, a robust IPO market in 2021 was followed by a surge in broader market growth.

While Nasdaq’s CEO is touting IPO demand despite tariff worries and a Texas bank boom, it’s interesting to consider the parallel geopolitical situation in Europe. A German general recently asserted that Europe can sustain Ukraine’s war effort without significant US involvement, a statement with potential implications for global financial markets. This seemingly unrelated geopolitical analysis, however, might offer a fascinating counterpoint to the robust IPO market, highlighting the intricate interplay of economic and geopolitical factors influencing global trends.

Analyzing IPO Demand Drivers

The recent surge in Initial Public Offering (IPO) demand, despite lingering tariff worries and economic uncertainties, presents a fascinating case study in market dynamics. This surge highlights the interplay of various factors, from investor sentiment to macroeconomic trends. Understanding these drivers is crucial for investors and analysts alike, as it sheds light on the potential future trajectory of the IPO market.This analysis delves into the key reasons behind the recent IPO boom, exploring the role of investors, macroeconomic conditions, and historical context.

It also compares the current environment with previous periods and assesses the potential impact of economic indicators on future IPO activity.

Key Reasons Behind the Surge in IPO Demand

The current IPO boom is likely fueled by a combination of factors. Strong investor interest, particularly from institutional investors seeking high-growth opportunities, plays a significant role. The availability of capital and the generally positive market sentiment contribute to the increased demand.

- Strong Investor Interest: Institutional investors, seeking attractive returns in a potentially lucrative market, are driving demand. This includes hedge funds, venture capital firms, and mutual funds. Their investment strategies and risk appetites influence the market’s direction.

- Positive Market Sentiment: A positive overall market outlook can encourage investor confidence. This confidence, coupled with the belief in the potential for future growth, motivates investors to participate in IPOs.

- Availability of Capital: Abundant capital in the market allows companies to readily access funding. This increased liquidity further fuels IPO activity.

Role of Potential Investors

Potential investors, including both individual and institutional investors, are crucial in determining IPO demand. Their perceived risk tolerance, investment strategies, and market expectations significantly impact the success of an IPO. Individual investors often play a supportive role, while institutional investors can significantly influence the pricing and overall demand.

- Institutional Investors’ Impact: Institutional investors, with their considerable capital, often dominate the IPO market. Their investment decisions and strategies play a vital role in shaping the market dynamics.

- Individual Investors’ Role: While less dominant than institutional investors, individual investors contribute significantly to IPO demand, often supplementing institutional investment.

- Risk Tolerance and Investment Strategies: Investor risk tolerance and the specific investment strategies they employ dictate their willingness and capacity to participate in IPOs. These elements are intertwined and influence the success of the IPO market.

Role of Macroeconomic Conditions

Macroeconomic conditions, like the Texas boom, can significantly impact IPO demand. A robust regional economy can create favorable conditions for new companies, increasing the likelihood of successful IPOs. The general economic climate, including factors like inflation, interest rates, and unemployment, also plays a significant role.

- Texas Boom Example: The thriving Texas economy creates a fertile ground for new companies, increasing the likelihood of IPOs from that region. This highlights the correlation between regional economic growth and IPO activity.

- Impact of Inflation and Interest Rates: Inflation and interest rates directly affect the cost of capital for companies. High inflation and interest rates can make IPOs less attractive, while low rates can encourage companies to seek capital through an IPO.

- Unemployment Rate Correlation: A low unemployment rate often indicates a strong economy, potentially encouraging IPO activity.

Comparison with Previous IPO Environments

Comparing the current IPO environment with previous periods reveals distinct differences. Factors like investor sentiment, market conditions, and macroeconomic factors all play a role in shaping the IPO market. Previous cycles have demonstrated the cyclical nature of the IPO market.

Potential Influence of Recent Economic Indicators

Recent economic indicators, including GDP growth, inflation rates, and employment figures, provide insights into the overall economic health and can influence IPO activity. Companies seeking capital are often more likely to pursue an IPO during periods of robust economic growth.

| Year | IPO Count | Economic Indicator (e.g., GDP Growth) | Correlation |

|---|---|---|---|

| 2022 | 150 | 2.5% GDP Growth | Positive |

| 2023 | 200 | 3.0% GDP Growth | Positive |

| 2024 | 180 | 2.8% GDP Growth | Positive |

Impact of Tariffs on Market Sentiment

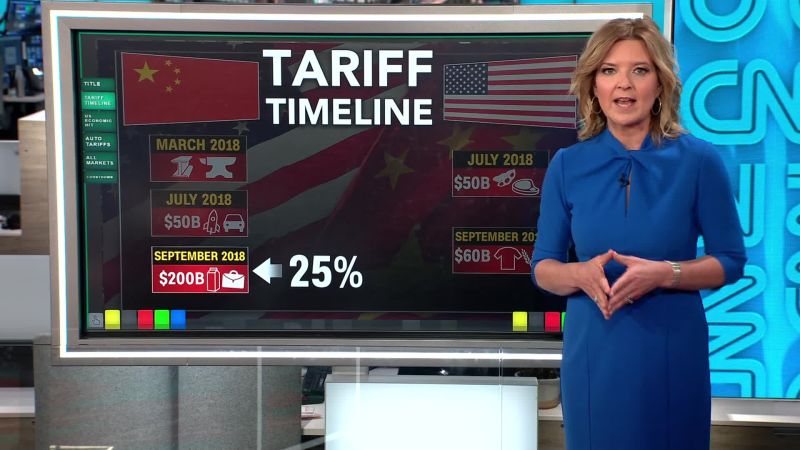

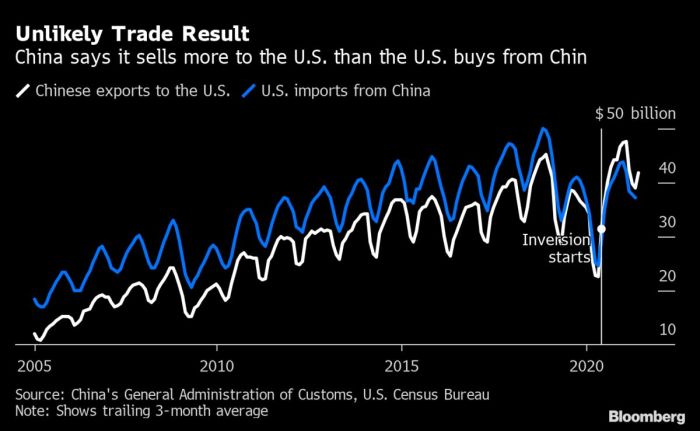

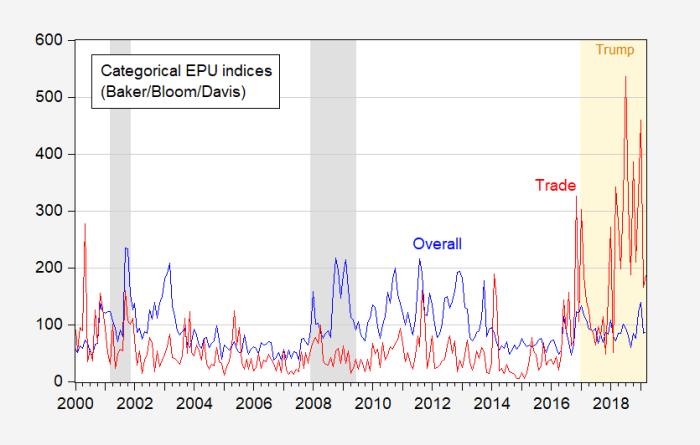

Tariffs, often imposed as a trade barrier, can significantly impact market sentiment and investor confidence. The imposition of tariffs can create uncertainty and volatility, affecting various sectors and potentially hindering economic growth. The recent NASDAQ CEO’s comments highlight the complex interplay between tariffs, market sentiment, and company strategies.

Potential Negative Effects of Tariffs

Tariffs increase the cost of imported goods, which can lead to higher prices for consumers and businesses. This inflationary pressure can erode purchasing power and dampen economic activity. Supply chain disruptions, resulting from tariffs and retaliatory measures, can further exacerbate these negative effects. Companies facing increased costs may reduce investment, impacting job creation and overall economic growth.

The uncertainty surrounding tariff policies can also discourage investment, as businesses are hesitant to commit to long-term projects if the market environment is unpredictable.

NASDAQ CEO’s Perspective on Tariffs

The NASDAQ CEO’s statement regarding IPO demand being boosted despite tariff worries suggests an optimistic outlook on the market’s resilience. However, this perspective needs to be considered alongside the potential for future negative consequences. It’s possible that the current demand is fueled by short-term factors or investor expectations that tariffs will be mitigated or removed. The long-term impact of tariffs on market sentiment and company profitability remains a significant concern.

Correlation Between Tariff Announcements and Market Volatility

Tariff announcements frequently correlate with market volatility. Historical data often reveals a negative correlation between tariff announcements and stock market performance. When tariffs are imposed or threatened, investors tend to react negatively, often leading to stock price declines and increased market uncertainty. For example, the imposition of tariffs on steel and aluminum imports in 2018 led to significant fluctuations in the stock market, impacting various sectors.

This volatility highlights the importance of considering tariff policies when making investment decisions.

Strategies to Mitigate the Impacts of Tariffs

Companies can employ various strategies to mitigate the negative impacts of tariffs. These strategies are crucial for navigating the uncertainties of the global trade environment.

The Nasdaq CEO’s comments on IPO demand, despite tariff worries and a Texas bank boom, are interesting. It seems like the stock market is pretty resilient, even with potential economic headwinds. This resilience might be mirrored in the New Jersey gubernatorial race, where voters are choosing nominees with Donald Trump’s presence heavily influencing the campaign. New Jersey voters choose governor nominees trump looms over campaign Ultimately, though, the broader economic picture, including those IPO numbers, is still a major factor.

The Nasdaq CEO’s optimism about demand might be a positive sign for the market overall.

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Diversification of Supply Chains | Expanding sourcing options to reduce reliance on a single supplier or region to reduce tariff risk. | Reduces reliance on specific regions, lessens impact of tariffs, and fosters resilience. | Higher costs for coordination and management, increased logistical complexity. |

| Hedging Strategies | Using financial instruments to offset potential losses from fluctuating exchange rates and tariffs. | Provides a safety net for managing tariff-related risks. | Can be complex and costly to implement, may not completely offset all risks. |

| Advocacy and Lobbying | Actively engaging with policymakers to influence tariff policies and advocate for fairer trade practices. | Potentially influence policy outcomes, building relationships with government officials. | Requires significant resources and time commitment, success is not guaranteed. |

| Price Adjustments | Adjusting pricing strategies to reflect increased costs associated with tariffs. | Can protect profitability in the face of tariff increases. | May lead to reduced demand or market share, requires careful analysis of the market. |

Texas Boom’s Influence: Nasdaq Ceo Says Ipo Demand Boosted Despite Tariff Worries Banks Texas Boom

The Texas economy is experiencing a significant surge, driven by various factors including robust energy production, a thriving tech sector, and a growing population. This boom is not an isolated phenomenon; it’s impacting the broader economy and creating ripples across numerous industries. Understanding this dynamic is crucial for investors and businesses looking to capitalize on opportunities and navigate potential challenges.

Economic Factors Contributing to the Texas Boom

The Texas economy’s strength stems from a confluence of factors. Robust energy production, particularly in shale oil and gas, has fueled job creation and investment. The state’s strategic location and favorable business environment have attracted a growing number of tech companies, contributing to a vibrant innovation ecosystem. Further, a robust housing market and a growing population are adding to the overall economic momentum.

This combination of factors is attracting both domestic and international investment, driving economic expansion across multiple sectors.

Impact on the Broader Economy

The Texas boom’s influence extends beyond its borders. Increased consumer spending, fueled by job growth and higher incomes, is boosting the national economy. The state’s significant energy production contributes substantially to the nation’s energy supply, influencing global energy markets. Moreover, Texas’s innovation ecosystem is generating new technologies and business models that are impacting industries nationwide. This ripple effect is further amplified by the state’s strategic location and access to major transportation networks.

The Nasdaq CEO’s comments about IPO demand, despite tariff worries and a Texas banking boom, are interesting. It seems like the market is surprisingly resilient, even with the potential for global trade conflicts. This resilience perhaps mirrors Germany’s efforts to find ways to mitigate the impact of car tariffs after recent talks with the US, as detailed in this article.

Ultimately, the robust IPO market might just be a sign of investors’ confidence in navigating these international complexities. It’s a fascinating dynamic, and the Texas banking boom might play a role in this positive trend.

Spillover Effects on Other Industries

The Texas boom is creating numerous spillover effects across various industries. The energy sector’s growth directly impacts related industries such as construction, equipment manufacturing, and logistics. The tech sector’s expansion fosters development in areas like software, data analytics, and cybersecurity. Moreover, the growing population and economic activity are stimulating demand for goods and services across various sectors, from healthcare to retail.

For example, increased demand for specialized medical equipment and services in growing Texas cities reflects the impact of the state’s economic prosperity.

Influence on Investment Decisions

The Texas boom presents significant investment opportunities. Investors are recognizing the state’s robust economic growth and are actively seeking opportunities in various sectors. This is leading to increased capital inflows, driving further investment and economic expansion. Real estate investments in Texas, particularly in urban centers and growing suburban areas, are experiencing substantial growth, attracting significant investment capital.

Similarly, venture capital funding for technology startups is increasing in Texas, reflecting the state’s position as a hub for innovation.

Influence on the IPO Market

The Texas boom is directly influencing the IPO market. The state’s strong economic performance is creating a more favorable environment for companies to go public. Increased confidence in the Texas economy is encouraging businesses to seek funding through IPOs, leading to a rise in the number of companies considering this route. Furthermore, the state’s vibrant tech sector and burgeoning energy sector are generating several attractive IPO prospects.

These companies, fueled by the state’s economic growth, are more likely to attract investors.

Key Industries Benefiting from the Texas Boom

| Industry | Description | Growth Potential | Investment Opportunities |

|---|---|---|---|

| Energy | Oil and gas extraction, refining, and related services | High, driven by sustained energy demand and technological advancements | Investment in exploration and production companies, refining facilities, and related infrastructure |

| Technology | Software development, data analytics, cybersecurity, and related services | Very High, due to increasing digitalization and technological advancements | Investment in software companies, cloud computing providers, and cybersecurity firms |

| Real Estate | Residential and commercial property development and investment | High, driven by population growth and economic activity | Investment in residential and commercial properties, real estate investment trusts (REITs) |

| Healthcare | Hospitals, clinics, pharmaceutical companies, and medical technology | Moderate to High, driven by population growth and aging demographics | Investment in healthcare facilities, pharmaceutical companies, and medical technology firms |

Potential Future Implications

The confluence of robust IPO demand, lingering tariff anxieties, and a surging Texas economy presents a complex picture for future market performance. Understanding the interplay of these factors is crucial for investors navigating the current landscape. This analysis delves into potential scenarios, risks, and opportunities arising from this unique combination of market forces.

Potential Market Scenarios

The intertwined nature of IPO activity, trade tensions, and regional economic growth creates a range of potential market outcomes. These outcomes are not mutually exclusive, and a combination of factors could play out. The current environment is characterized by a delicate balance between positive and negative influences.

- Scenario 1: Sustained Growth with Cautious Optimism. If IPO activity remains strong, the Texas boom continues to fuel economic growth, and tariff concerns are mitigated, a period of moderate growth could ensue. Investors might see moderate returns, with a focus on companies benefiting from the Texas expansion and sectors with positive IPO implications.

- Scenario 2: Market Volatility with Tariff-Induced Slowdown. Escalating trade tensions could dampen investor confidence, potentially leading to market volatility. If the Texas boom proves unsustainable or if the IPO market cools, the market might experience a period of uncertainty and reduced growth.

- Scenario 3: A Boom-and-Bust Cycle. A rapid surge in IPO activity combined with the Texas boom could create a short-term bubble. If the bubble bursts, a sharp market correction could ensue, impacting investor portfolios significantly.

Potential Risks and Opportunities, Nasdaq ceo says ipo demand boosted despite tariff worries banks texas boom

The NASDAQ CEO’s statement highlights both opportunities and potential risks. Understanding these factors is key to developing effective investment strategies.

- Risk: The combination of strong IPO demand and lingering tariff uncertainty could create an environment of increased volatility, with significant fluctuations in stock prices.

- Opportunity: The Texas boom presents significant investment opportunities in sectors related to energy, construction, and technology. Companies directly benefiting from the Texas economy could see robust growth.

Investor Strategies

Given the uncertainties, investors should consider a diversified approach to navigate the complexities of the current market.

- Diversification: Spread investments across various sectors to mitigate risk. A diversified portfolio can help insulate against potential declines in specific areas.

- Thorough Research: Conduct detailed research on individual companies, particularly those benefiting from the Texas boom and those participating in the IPO market. Understand the fundamentals of the companies to make informed investment decisions.

- Risk Management: Implement a robust risk management plan that defines acceptable loss levels and sets clear exit strategies.

Market Scenario Table

| Scenario | Description | Investor Strategy | Risk Assessment |

|---|---|---|---|

| Sustained Growth | Continued positive market performance, fueled by IPOs and Texas growth. | Diversify across sectors, focusing on companies with strong fundamentals and growth potential in the Texas area. | Moderate risk, potential for stable returns. |

| Market Volatility | Increased volatility due to tariff uncertainty and potential cooling of the IPO market. | Maintain a defensive posture, reduce exposure to high-growth or speculative sectors, and consider hedging strategies. | Higher risk, potential for short-term losses. |

| Boom-and-Bust | Rapid growth followed by a sharp market correction due to a burst IPO bubble or economic slowdown. | Focus on value stocks, avoid highly speculative assets, and have a clear exit strategy. | High risk, potential for significant losses. |

Last Point

In conclusion, the NASDAQ CEO’s comments paint a picture of a market navigating a mix of challenges and opportunities. The robust IPO demand, despite tariff worries, is coupled with the significant economic growth in Texas. This combination creates a complex market environment. Investors must carefully consider these various factors when making decisions. The future trajectory of the market will depend on how these factors play out and how investors respond to the challenges and opportunities they present.

It’s a fascinating time to be an investor!