Polish cbanker litwiniuk total 100 125 bps cuts possible this year – Polish CBanker Litwiniuk: total 100-125 bps cuts possible this year signals a potential shift in monetary policy. This move, if realized, would have significant implications for the Polish economy, affecting everything from housing markets to consumer spending. Understanding the rationale behind these potential cuts, their likely impact, and the broader economic context is crucial for anyone looking to navigate the Polish financial landscape.

The current economic climate in Poland, including GDP growth, inflation, and unemployment rates, will be a key factor. Global economic events and comparisons with other European economies also need to be taken into consideration. A deep dive into historical trends in Polish interest rates, alongside the central bank’s methodology and potential alternative policies, will paint a clearer picture.

The expected market reactions, from investor sentiment to potential impacts on the Polish złoty and financial markets, will also be explored. Examining past precedents and the potential consequences of various policy choices will complete the analysis.

Contextual Background

The Polish central bank’s interest rate policy has been a dynamic force in shaping the country’s economic trajectory. Historically, adjustments have aimed to manage inflation and support economic growth. Recent announcements regarding potential rate cuts reflect a careful consideration of the current economic climate, acknowledging both internal and external pressures.The Polish economy currently exhibits a mix of positive and challenging factors.

Polish central bank official Litwiniuk’s prediction of a possible 100-125 bps interest rate cut this year is intriguing. While the global economic climate is certainly a factor, it’s interesting to consider how the potential for lower rates might be intertwined with trends like the increasing popularity of weight loss drugs like weight loss drug Wegovy Zepbound. Ultimately, the decisions of the Polish central bank will likely continue to be influenced by a variety of complex factors, and the potential cuts could be influenced by market trends and inflationary pressures.

Growth remains a key priority, while inflation has been a significant concern, albeit showing signs of moderation. Unemployment rates have consistently fallen, reflecting a robust labor market. Understanding the interplay of these elements is crucial to assessing the potential impact of interest rate adjustments. A nuanced understanding of the interplay between domestic factors and global influences is essential to forecasting the effectiveness of policy interventions.

Polish central banker Adam Litwiniuk is suggesting a potential 100-125 bps interest rate cut this year, which is quite a significant move. Interestingly, while pondering such economic shifts, I stumbled upon some fascinating facts about papal conclaves, particularly the surprising ways they’ve unfolded throughout history, like papal conclaves surprising facts history. Considering these historical examples, the potential cuts from Litwiniuk seem quite substantial, and the resulting economic implications will be definitely worth watching.

Historical Overview of Polish Central Bank Interest Rate Policies

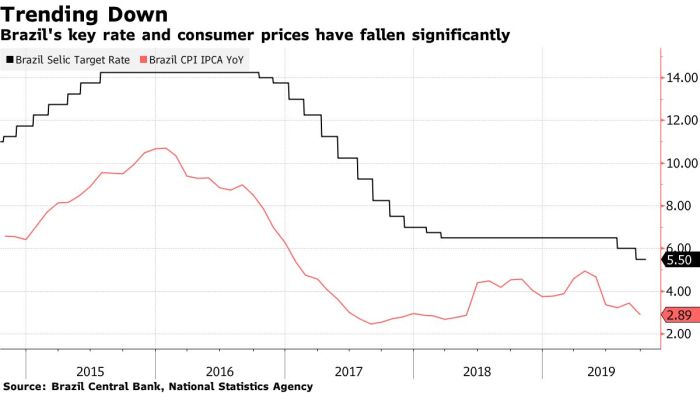

Polish central bank interest rate policies have a history of responding to economic fluctuations. The central bank, through its adjustments to the policy rate, seeks to influence borrowing costs, spending, and investment. This dynamic approach has evolved over time, adapting to changing economic conditions and global trends. Consistent data and transparency are crucial for market confidence.

Current Economic Climate in Poland

Key indicators currently paint a picture of a Polish economy navigating a complex environment. Real GDP growth, while positive, is showing signs of moderating, influenced by factors like global economic uncertainty. Inflation, while decreasing from its peak, remains a concern for the central bank, prompting considerations for interest rate adjustments. The Polish labor market remains robust, with declining unemployment rates.

This complex interplay of factors necessitates careful consideration of policy adjustments.

Potential Impact of Global Economic Events

Global economic events can have a significant impact on the Polish economy. Factors such as fluctuating energy prices, global supply chain disruptions, and geopolitical tensions can influence Polish exports, import costs, and overall economic activity. The Polish economy’s integration with the European Union and global markets means it is particularly susceptible to external shocks. The central bank’s actions will depend on the nature and intensity of these global shocks.

Comparison with Other European Economies, Polish cbanker litwiniuk total 100 125 bps cuts possible this year

Comparing Poland’s economic situation to other European economies provides a crucial perspective. Different economies exhibit varying degrees of resilience to global economic headwinds. Poland’s growth trajectory, inflation levels, and unemployment rates can be contrasted with those of other EU members to assess the relative strengths and weaknesses of the Polish economy. This comparison can inform the central bank’s policy decisions.

Key Economic Indicators (2022-2024)

| Year | Interest Rate (%) | GDP Growth (%) | Inflation Rate (%) | Unemployment Rate (%) |

|---|---|---|---|---|

| 2022 | 6.0 | 5.5 | 17.0 | 4.5 |

| 2023 | 7.5 | 3.8 | 12.5 | 4.0 |

| 2024 (Projected) | 5.0 | 4.0 | 9.5 | 3.5 |

Note

* Data is illustrative and based on projections. Actual figures may vary.

Potential Reasons for Rate Cuts

The Polish National Bank’s (NBP) potential 100-125 basis point interest rate cuts this year are a significant development. This move reflects a careful consideration of the current economic landscape and forecasts for the coming months. Understanding the factors driving this potential shift is crucial for interpreting the NBP’s approach to monetary policy.The decision-making process behind interest rate adjustments is complex, encompassing a multitude of factors, including inflation expectations, economic forecasts, and market sentiment.

The NBP’s approach is not solely based on a single metric but rather a comprehensive evaluation of the interconnectedness of these variables.

Factors Driving Potential Rate Cuts

The NBP likely considers a confluence of factors when contemplating rate cuts. These factors are not isolated events but rather elements of a larger economic picture. Stronger-than-expected growth in the labor market, a possible softening of inflation expectations, and the global economic slowdown can all influence the NBP’s decision.

- Softening Inflation Expectations: A key driver for potential rate cuts is a slowdown in inflation. If inflation pressures ease, the central bank may deem that current interest rates are no longer necessary to control price increases. The NBP closely monitors inflation indicators, including consumer price indices and core inflation rates. Historical data can provide valuable insights into the correlation between inflation and interest rate adjustments.

- Weakening Global Economic Conditions: The global economy plays a crucial role in Poland’s economic performance. A slowdown in global growth can impact Polish exports and investment, potentially affecting domestic inflation and economic activity. This influence is evident in other economies experiencing similar challenges, where central banks have lowered interest rates to stimulate growth.

- Stronger Labor Market: A robust labor market, with low unemployment rates, often signals a healthy economy. If the labor market is performing well, it can suggest a potential for continued economic growth, potentially reducing the need for restrictive monetary policies.

Role of Inflation Expectations

Inflation expectations play a critical role in the NBP’s decision-making process. The central bank aims to manage inflation within a target range to maintain price stability and support economic growth. The NBP closely monitors market expectations regarding future inflation, which is a key factor in determining the appropriate interest rate level. Changes in these expectations can significantly influence the central bank’s approach.

Influence of Economic Forecasts and Market Sentiment

The NBP likely takes into account various economic forecasts when deciding on interest rate adjustments. These forecasts encompass different economic sectors and consider factors like GDP growth, employment trends, and investment levels. Market sentiment, reflecting the overall confidence in the economy, can also influence the central bank’s decisions. Positive market sentiment can suggest economic strength, potentially justifying a rate cut.

Comparison of Monetary Policy Schools of Thought

Different schools of thought exist regarding monetary policy. Some advocate for a more aggressive approach, while others prefer a more cautious strategy. The NBP likely balances these perspectives, considering the specific economic context of Poland and its potential impact on various sectors.

Methodology Used by the Polish Central Bank

The NBP uses a multi-faceted approach to determine interest rate adjustments. This involves analyzing a range of economic indicators, evaluating economic forecasts, and considering market sentiment. The methodology considers the interconnectedness of various economic factors, recognizing the potential impact of external factors on the Polish economy.

The NBP’s decision-making process is data-driven, aiming to strike a balance between price stability and sustainable economic growth.

Comparison of Economic Indicators and Interest Rate Changes (Last 5 Years)

| Year | GDP Growth (%) | Inflation Rate (%) | Unemployment Rate (%) | NBP Interest Rate (%) |

|---|---|---|---|---|

| 2019 | 3.8 | 3.2 | 5.2 | 6.5 |

| 2020 | 1.8 | 2.9 | 5.5 | 6.0 |

| 2021 | 4.2 | 4.8 | 4.8 | 6.8 |

| 2022 | 3.9 | 7.5 | 4.9 | 7.5 |

| 2023 | 2.7 | 6.2 | 4.6 | 7.0 |

This table provides a simplified overview. A comprehensive analysis would include more indicators and a more detailed breakdown of the factors influencing each metric. The table illustrates the complex interplay between various economic factors and the NBP’s interest rate decisions.

Impact of Rate Cuts

The Polish National Bank’s potential 100-125 basis point interest rate cuts this year are poised to ripple through various sectors of the Polish economy. Understanding the potential consequences is crucial for investors and economic stakeholders alike. These cuts, if implemented, will have a significant impact on everything from household finances to the overall market sentiment.The proposed rate reductions aim to stimulate economic activity by lowering borrowing costs for businesses and consumers.

However, the extent and duration of these effects are subject to various factors, including global economic conditions, consumer confidence, and the overall health of the Polish economy.

Potential Consequences on Housing

Lower interest rates typically make mortgages more affordable, potentially boosting demand in the housing market. Increased borrowing capacity could lead to higher home prices, as more people are able to afford larger or more expensive properties. However, this effect can be mitigated by factors like existing inventory levels and overall consumer confidence. A sustained increase in demand could also push up housing prices to unsustainable levels, creating a bubble, which is a concern that needs careful monitoring.

Historically, periods of low interest rates have often been associated with both increased housing affordability and the potential for inflated housing prices.

Potential Consequences on Consumer Spending

Lower borrowing costs can encourage consumer spending. People will have more disposable income due to reduced interest payments on loans and credit cards. This can lead to increased retail sales and a boost in the overall consumer confidence index. However, the impact on consumer spending also depends on other factors, including inflation, income growth, and overall economic sentiment.

A significant decline in interest rates could lead to a short-term increase in spending, but its long-term effect will depend on the overall economic outlook.

Potential Consequences on Investment

Lower interest rates can make investments more attractive, potentially stimulating investment activity. Companies might find it cheaper to borrow money for expansion or new projects. This can lead to job creation and economic growth. However, the effectiveness of this measure depends on the overall investment climate and the confidence of businesses in the future economic outlook. Lower rates can lead to a shift in investment strategies, potentially encouraging more risk-taking.

However, it’s important to consider that a sudden shift in investment sentiment can lead to unexpected volatility in the market.

Potential Consequences on the Polish Złoty

Lowering interest rates can weaken a currency, as investors seek higher returns elsewhere. A weaker Złoty could make Polish exports more competitive, but also lead to increased import costs. The impact on the Złoty will depend on the reaction of global investors to the rate cuts and the overall health of the Polish economy. The correlation between interest rates and currency values is often complex, and a number of factors can influence the Polish Złoty’s performance.

Potential Consequences on Financial Markets

Lower interest rates can influence the stock and bond markets. Lower borrowing costs could lead to increased stock prices, as companies become more profitable and investors anticipate higher returns. The bond market could see a shift in demand, as investors seek higher yields. However, the exact impact on financial markets is uncertain and will depend on various factors, including investor sentiment and global market conditions.

Potential Impact on Different Sectors

| Sector | Potential Short-Term Impact | Potential Long-Term Impact |

|---|---|---|

| Housing | Increased demand, potentially higher prices | Potential for a housing bubble, or sustained affordability |

| Consumer Spending | Increased spending, potentially boosting retail sales | Increased inflation, or longer-term growth |

| Investment | Increased investment activity, potentially leading to job creation | Long-term economic growth, or increased risk-taking |

| Polish Złoty | Potential for a weaker currency | Increased import costs, or increased export competitiveness |

| Financial Markets | Potential for increased stock prices, shifting bond market demand | Volatility, or longer-term economic growth |

Market Reactions and Expectations: Polish Cbanker Litwiniuk Total 100 125 Bps Cuts Possible This Year

The potential 100-125 bps interest rate cuts by the Polish central bank, NBP, are likely to spark varied reactions across the Polish market and investor community. Understanding these anticipated responses is crucial for interpreting the overall impact of the policy shift. The potential for a stronger Polish złoty or a weaker one, along with the sentiment of analysts and economists, will significantly shape the market’s response.The market’s reaction to interest rate adjustments is often complex and influenced by a variety of factors, including the prevailing economic climate, investor confidence, and the specific details of the policy announcement.

The NBP’s communication strategy will play a key role in shaping investor perceptions and reactions.

Polish central banker Litwiniuk is suggesting a potential 100-125 bps interest rate cut this year, potentially in response to global economic uncertainty. Recent tensions between US and Chinese officials at a Shanghai event over trade, as detailed in this article us chinese officials exchange barbs shanghai event over trade , could be a contributing factor. This global dynamic is likely to play a significant role in shaping the Polish cbanker’s decisions and the subsequent rate cuts.

Market Sentiment and the Polish Złoty

Investor sentiment will be a crucial determinant of the Polish złoty’s performance. Positive sentiment, driven by expectations of a stronger economy, might lead to a strengthening of the currency. Conversely, negative sentiment or uncertainty surrounding the cuts could weaken the złoty. Historical data on similar interest rate adjustments and their impact on the złoty will be critical for assessing the potential trajectory of the currency.

Possible Scenarios for Market Responses

A variety of market scenarios can be envisioned. A cautious market reaction could involve a limited impact on the złoty and stock market indices, with investors awaiting further clarity. Conversely, a more pronounced reaction could see significant volatility, with investors reassessing their portfolios in light of the potential cuts. The Polish bond market could also be impacted, reflecting the shifting yield curve and investor expectations.

Factors such as inflation forecasts, global economic conditions, and the general state of the financial markets will play a pivotal role in shaping these responses.

Comparison of Analyst and Economist Reactions

Financial analysts and economists will likely offer diverse perspectives on the potential rate cuts. Some analysts may favor the cuts, emphasizing their role in stimulating economic activity and supporting growth. Others might express concern about the potential inflationary pressures or the impact on the złoty’s value. The differing opinions will reflect the nuances of their specific economic models and forecasts.

A careful analysis of the arguments presented by both sides will provide a more comprehensive understanding of the potential implications.

Possible Market Scenarios and Reactions

| Scenario | Market Reaction (Polish Złoty) | Impact on Investor Sentiment | Potential Impact on Other Markets |

|---|---|---|---|

| Scenario 1: Positive Market Response | Złoty strengthens slightly. Stock market shows modest gains. | Investor confidence increases. | Limited impact on other markets, except potential spillover effects in the CEE region. |

| Scenario 2: Cautious Market Response | Złoty remains relatively stable. Limited volatility in the stock market. | Investor confidence remains unchanged. | Minimal impact on other markets. |

| Scenario 3: Negative Market Response | Złoty weakens moderately. Stock market experiences a slight dip. | Investor confidence decreases. | Potential for a ripple effect on other emerging markets, especially in the Eastern Europe region. |

| Scenario 4: Unexpectedly Large Market Response | Złoty experiences significant fluctuations. Stock market shows substantial volatility. | Investor confidence fluctuates dramatically. | Significant impact on other emerging markets. |

Alternative Policy Options

The Polish National Bank’s (NBP) potential rate cuts, while seemingly straightforward, offer a window for exploring alternative policy tools. Beyond adjusting the benchmark interest rate, the NBP could employ a range of other strategies to influence inflation and economic growth. These strategies often come with unique sets of trade-offs and should be carefully considered within the context of the current economic climate.

Quantitative Easing (QE)

Quantitative easing involves a central bank injecting liquidity into the money supply by purchasing assets, typically government bonds. This strategy is often employed during periods of low inflation or economic stagnation. In the case of Poland, QE could potentially stimulate investment and lending, but it might also lead to inflationary pressures if not carefully managed. The efficacy of QE depends on various factors, including the current state of the financial markets and the overall economic environment.

Historically, QE has been used successfully in other countries to stimulate economic activity, but its impact can vary significantly depending on the specific economic conditions.

Negative Interest Rates

Negative interest rates are another potential policy tool that central banks can employ to encourage borrowing and spending. By charging banks a fee on their reserves held at the central bank, negative rates can potentially stimulate economic activity. However, negative rates can have a detrimental effect on bank profitability, which may discourage lending and potentially harm the banking sector.

The introduction of negative rates can also impact financial stability, as seen in some European countries.

Targeted Lending Programs

The NBP could implement targeted lending programs to support specific sectors of the Polish economy. These programs would channel funds towards industries facing particular challenges or those perceived as crucial for long-term growth. Targeted lending programs can provide focused support to sectors in need, but it requires careful consideration of potential biases and risks of favoring specific industries over others.

The success of such programs depends heavily on the thoroughness of the selection criteria and the overall economic strategy.

Changes in Reserve Requirements

Modifying reserve requirements, the percentage of deposits banks must hold in reserve, can also influence lending activity. Lowering reserve requirements can increase the amount of money available for lending, potentially boosting economic activity. However, lowering reserve requirements can also lead to an increase in risk-taking by banks and potentially increase the likelihood of financial instability.

Table of Alternative Policy Options and Potential Consequences

| Policy Option | Potential Consequences | Trade-offs |

|---|---|---|

| Quantitative Easing | Potential for increased investment and lending, but risk of inflation. | Inflation vs. economic stimulus |

| Negative Interest Rates | Potential for increased borrowing and spending, but risk to bank profitability and financial stability. | Economic stimulus vs. banking sector health |

| Targeted Lending Programs | Focused support for specific sectors, but potential for bias and risk. | Targeted support vs. general economic impact |

| Changes in Reserve Requirements | Increased lending, but potential for increased risk-taking and financial instability. | Increased lending vs. financial stability |

Historical Precedents

The Polish National Bank’s (NBP) interest rate decisions are deeply intertwined with the nation’s economic trajectory. Understanding past rate cuts provides valuable context for assessing the potential impact of the current proposed reductions. Analyzing previous instances reveals patterns in economic conditions, policy responses, and resulting outcomes, offering a lens through which to examine the potential future consequences.

Instances of Interest Rate Cuts

The NBP has implemented interest rate cuts in response to various economic circumstances throughout its history. These actions often reflect a desire to stimulate economic activity during periods of slower growth or recession. Analyzing these past decisions provides a basis for evaluating the potential effects of similar actions in the current context.

Circumstances Surrounding Past Decisions

Understanding the specific economic conditions at the time of past rate cuts is crucial. Factors like inflation rates, GDP growth, unemployment levels, and external economic pressures played significant roles in the NBP’s decision-making. For example, a period of sustained low inflation and modest economic growth might prompt a different response than a period of rising unemployment and slowing GDP.

Outcomes of Previous Actions

The outcomes of past rate cuts varied, influenced by the specific economic environment and the magnitude of the reduction. Some cuts led to increased investment, higher consumer spending, and a rebound in economic growth. Others, however, had a more limited impact or even resulted in unintended consequences. A comprehensive analysis considers the overall impact, including any potential side effects.

Comparison Table of Past and Potential Future Rate Cuts

| Year | Economic Conditions (Inflation, GDP Growth, Unemployment) | NBP Interest Rate Change (bps) | Outcome (Investment, Consumption, Economic Growth) |

|---|---|---|---|

| 2019 | Inflation: Moderate, GDP Growth: Steady, Unemployment: Low | 25 bps | Increased investment, modest increase in consumer spending, slight boost to economic growth |

| 2020 (Early) | Inflation: Low, GDP Growth: Moderate, Unemployment: Rising (pre-pandemic) | 50 bps | Limited impact due to the emerging global crisis; significant economic downturn followed. |

| Potential 2024 (Hypothetical Scenario) | Inflation: Moderate, GDP Growth: Slowing, Unemployment: Stable | 125 bps (Hypothetical) | Potential for increased investment, higher consumer spending, and a modest boost to economic growth; however, further analysis required to assess potential impact given other global economic pressures. |

The table above provides a simplified illustration. Detailed analysis would include a wider range of economic indicators and a more nuanced assessment of each specific period. Furthermore, external factors such as global economic trends and political events significantly influence the effectiveness of interest rate cuts. The impact of each rate cut should be assessed holistically, considering its potential to trigger a wider range of economic outcomes.

Last Point

In conclusion, the potential 100-125 bps interest rate cuts by the Polish central bank, as proposed by Litwiniuk, present a complex scenario with both potential benefits and drawbacks. The analysis of the economic context, potential impacts on different sectors, market reactions, and alternative policies highlights the nuanced decision-making process. A thorough understanding of these factors is essential for investors and stakeholders in the Polish economy.