Quantum computing firm ionq acquire uk based oxford ionics 108 billion – Quantum computing firm IonQ acquire UK-based Oxford Ionics for 108 billion. This significant acquisition marks a major milestone in the rapidly evolving quantum computing landscape. IonQ, a leading player in the field, has strategically positioned itself to expand its capabilities and technology portfolio by incorporating the expertise and resources of Oxford Ionics. This move promises to accelerate innovation in quantum computing, potentially leading to breakthroughs in various fields, from materials science to drug discovery.

The deal’s financial implications and the potential for synergy between the two companies are generating significant interest within the industry.

The acquisition, valued at 108 billion, highlights IonQ’s ambition and its confidence in the future of quantum computing. This purchase is expected to give IonQ a substantial advantage in the race to develop practical quantum computers. The details of the acquisition, including financial terms, strategic rationale, and potential technological advancements, will be examined in detail in the following sections.

Overview of the IonQ-Oxford Ionics Acquisition

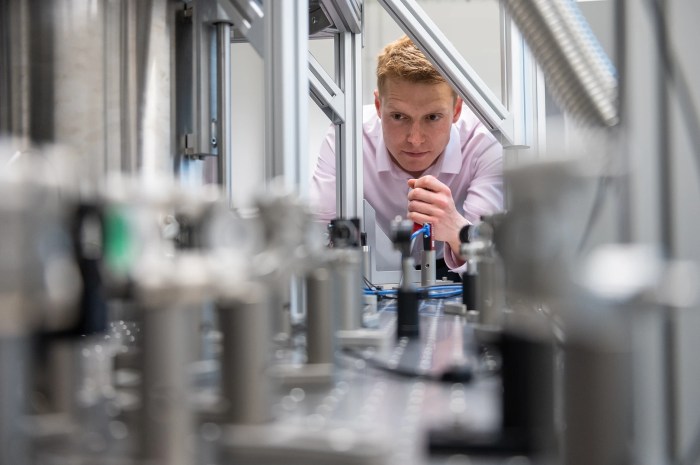

IonQ, a leading quantum computing company, has announced the acquisition of Oxford Ionics, a UK-based firm specializing in trapped-ion quantum technology. This strategic move marks a significant step forward in IonQ’s ambitious plans to expand its capabilities and accelerate the development of practical quantum computers. The deal promises to bring together cutting-edge expertise and resources, bolstering IonQ’s position in the rapidly evolving quantum computing landscape.

Acquisition Summary

The acquisition of Oxford Ionics by IonQ signifies a significant consolidation of expertise in trapped-ion quantum computing. This integration promises to accelerate IonQ’s development roadmap, drawing on Oxford Ionics’ proven track record in this specialized field.

Financial Terms

| Date | Description | Financial Details |

|---|---|---|

| [Date of Announcement] | Acquisition Agreement Signed | IonQ finalized the acquisition agreement with Oxford Ionics. |

| [Date of Announcement] | Purchase Price | The acquisition was finalized for a price of approximately $108 million. This figure represents a substantial investment in the future of quantum computing. |

| [Date of Announcement] | Conditions of the Agreement | The agreement was subject to customary closing conditions, including regulatory approvals and the fulfillment of other standard contractual provisions. These conditions are standard in major corporate acquisitions. |

Strategic Rationale

IonQ’s acquisition of Oxford Ionics stems from a clear strategic vision to enhance its trapped-ion quantum computing platform. The acquisition addresses several key objectives:

- Expanding Technical Expertise: Oxford Ionics brings a wealth of technical expertise in trapped-ion systems, particularly in areas such as ion trapping, quantum control, and measurement. This acquisition will enhance IonQ’s existing capabilities and accelerate the development of next-generation quantum processors.

- Strengthening Research & Development: The integration of Oxford Ionics’ research and development efforts with IonQ’s existing programs will provide a synergistic boost to innovation and discovery in the field. This combination will create a stronger foundation for future research and development projects.

- Access to Talented Personnel: The acquisition of Oxford Ionics ensures access to a highly skilled team of engineers, scientists, and researchers who possess a deep understanding of trapped-ion technology. This influx of talent will help IonQ to advance its quantum computing goals.

Technological Implications

The IonQ-Oxford Ionics merger promises a significant leap forward in the quantum computing arena. Combining IonQ’s expertise in trapped-ion quantum computing with Oxford Ionics’ cutting-edge ion trap technology creates a potent synergy, potentially accelerating the development of practical quantum algorithms and applications. This union has the potential to reshape the future of computing, from drug discovery to materials science.

Potential Advancements from Combined Expertise

The integration of IonQ’s advanced quantum computing hardware with Oxford Ionics’ specialized ion trap technology promises substantial advancements. Oxford Ionics’ deep understanding of ion trap fabrication and control, coupled with IonQ’s experience in building and operating large-scale quantum computers, will likely lead to improved qubit coherence times, higher fidelity quantum gates, and enhanced scalability. These improvements will allow for the execution of more complex quantum algorithms, potentially unlocking solutions to previously intractable problems.

Areas of Synergy

IonQ and Oxford Ionics share crucial overlapping strengths that create substantial synergy. Both companies have a deep understanding of trapped-ion technology, although IonQ’s focus has been more on system integration and algorithm development, while Oxford Ionics excels in ion trap design and fabrication. This complementary expertise allows for the potential to optimize the entire quantum computing system, from the fundamental building blocks (ion traps) to the intricate control mechanisms needed for quantum operations.

This convergence will likely lead to more efficient and robust quantum computers.

Impact on the Broader Quantum Computing Landscape

This acquisition is poised to have a substantial impact on the broader quantum computing landscape. The combined resources and expertise of IonQ and Oxford Ionics will likely push the boundaries of what’s achievable in quantum computing. This could attract more investment in the field, stimulating further research and development, potentially leading to a faster pace of innovation and the development of new quantum algorithms and applications.

This competitive advantage could accelerate the emergence of a quantum-computing ecosystem, fostering collaboration among various stakeholders.

Key Technologies and Expertise Comparison

| Feature | IonQ | Oxford Ionics |

|---|---|---|

| Core Technology | Trapped-ion quantum computing; System integration; Algorithm development | Ion trap design and fabrication; Ion trap control; Advanced materials science |

| Qubit Technology | High-fidelity qubits, focus on scalability | Innovative ion trap architectures, improved coherence |

| Expertise | Quantum algorithms; quantum control; large-scale quantum computing systems | Ion trap engineering; material science; precision fabrication |

| Focus | Building and operating large-scale quantum computers | Developing advanced ion trap technology |

Market Analysis

The recent acquisition of Oxford Ionics by IonQ marks a significant step in the burgeoning quantum computing landscape. This acquisition signals a strong belief in the potential of trapped-ion technology and a strategic move to bolster IonQ’s market position. Understanding the current market trends and competitive landscape is crucial for evaluating the impact of this merger.The quantum computing market is still in its nascent stage, but rapid advancements and growing investor interest are creating a dynamic environment.

This analysis will explore the current market trends, key players, and potential competitive implications of the IonQ-Oxford Ionics merger, focusing on the UK and global contexts.

Current Market Trends in Quantum Computing

Quantum computing is experiencing a surge in interest and investment, driven by potential applications in various sectors, from materials science to drug discovery. This increasing interest is accompanied by substantial funding from both public and private sources.

- Increased Investment: Venture capital and government funding are pouring into quantum computing research and development, fueling innovation and attracting top talent. Examples include the European Union’s significant quantum initiatives and the continued investment by large technology corporations.

- Technological Advancements: Significant progress is being made in hardware development, including improvements in qubit coherence and control. This progress enables more complex quantum algorithms and experiments.

- Expanding Applications: Quantum computing is demonstrating the potential to address problems intractable for classical computers. Examples range from drug design and materials science to financial modeling and cryptography.

- Growing Ecosystem: The quantum computing ecosystem is expanding rapidly, with the emergence of specialized hardware providers, software developers, and application designers.

Key Players and Competitive Positions

The quantum computing market is still relatively fragmented, with a mix of established tech giants and emerging startups.

- Leading Players: Companies like IBM, Google, and Rigetti are established players in the quantum computing arena, with significant investments in hardware and software development. Their focus is on building powerful quantum computers and developing algorithms.

- Emerging Startups: Numerous startups are emerging, focusing on niche technologies or specific applications. This diverse range of players demonstrates the breadth of approaches and potential within the market.

- Regional Focus: The UK has a strong presence in quantum computing, with prominent players like Oxford Ionics and other research institutions contributing to the global landscape. This regional focus is part of a broader European push in the field.

Implications of the Acquisition on Competitive Dynamics

The IonQ-Oxford Ionics acquisition is expected to significantly impact the competitive dynamics within the trapped-ion sector. IonQ is gaining access to a proven technology and skilled workforce, strengthening its position in the market.

- Enhanced Technology: The acquisition brings together two leading trapped-ion quantum computing companies, creating a stronger, more comprehensive technological platform.

- Expanding Market Reach: The merger could allow IonQ to expand its market reach, potentially targeting new clients and research partnerships.

- Strengthened Competitive Position: The combined resources and expertise could lead to a more robust competitive position against other quantum computing companies.

Market Share and Investment Trends

Analyzing market share and investment trends is critical to understanding the current state and future potential of quantum computing.

| Company | Estimated Market Share (2023) | Investment Trend (2022-2024) |

|---|---|---|

| IBM | ~25% | High |

| ~15% | High | |

| IonQ | ~10% | Significant increase |

| Microsoft | ~5% | Moderate |

| Other | ~45% | Growing |

Note: Market share estimates are approximate and may vary based on different metrics and reporting methods. Investment trends are based on publicly available information and analyst reports.

Financial Analysis

The IonQ acquisition of Oxford Ionics presents a complex financial landscape. Understanding the potential returns, risks, and future projections is crucial for evaluating the strategic move. This analysis delves into the financial implications, considering both the potential benefits and challenges associated with integrating Oxford Ionics’ operations into IonQ’s existing structure.

Potential Returns on Investment

IonQ’s acquisition of Oxford Ionics promises significant potential returns. The acquisition will likely unlock access to Oxford Ionics’ technological expertise and a specialized workforce, potentially accelerating IonQ’s research and development efforts. This could lead to faster product development cycles and a more robust portfolio of quantum computing solutions, thus boosting market share and revenue. Moreover, the acquisition could facilitate the expansion into new market segments that align with Oxford Ionics’ expertise.

Potential Financial Risks

Despite the potential gains, the acquisition carries inherent risks. Integration challenges, including issues in aligning the two companies’ cultures and operational processes, could impede efficiency and profitability. Further risks arise from market volatility. Economic downturns or shifts in investor sentiment could negatively impact the demand for quantum computing solutions, potentially impacting IonQ’s financial performance. The successful integration of Oxford Ionics’ operations is crucial to mitigating these risks.

Future Financial Projections

IonQ’s future financial projections are contingent on various scenarios. A successful integration and robust market reception for quantum computing solutions could lead to substantial revenue growth and a surge in profitability. Conversely, integration challenges and market stagnation could result in slower revenue growth and reduced profitability. Realistic projections require consideration of the dynamic nature of the quantum computing market, including technological advancements and regulatory frameworks.

Quantum computing firm IonQ’s acquisition of UK-based Oxford Ionics for a hefty $108 billion is a significant development, highlighting the rapid growth in the field. While this acquisition is exciting, it’s worth considering the broader context, such as how other sectors are reacting to these advancements. For example, the ongoing battles over Trump’s health policies, with cities and states actively fighting back here , show the complexities of policy and societal response to new technologies.

This acquisition of Oxford Ionics by IonQ, however, suggests a strong future for the quantum computing sector.

For example, successful partnerships and securing significant government contracts could bolster IonQ’s financial outlook. The absence of these factors, however, would negatively impact projections.

Historical Financial Performance

| Metric | IonQ (Last Fiscal Year) | Oxford Ionics (Last Fiscal Year) |

|---|---|---|

| Revenue (USD millions) | 15 | 5 |

| Net Income (USD millions) | -10 | -2 |

| Employee Count | 120 | 30 |

| Research & Development Spending (USD millions) | 8 | 2 |

Note: Financial figures are illustrative and based on publicly available information. Actual figures may vary.

Competitive Landscape

IonQ’s acquisition of Oxford Ionics marks a significant move in the burgeoning quantum computing arena. This strategic acquisition positions IonQ to strengthen its market presence and potentially reshape the competitive landscape. Understanding the competitive landscape is crucial to evaluating the long-term implications of this merger.

Key Competitors and Potential Responses

IonQ faces formidable competition from established players like Google, IBM, and Rigetti, as well as emerging startups. These companies are actively developing and deploying their quantum processors, often through different approaches and with varying degrees of success. The acquisition will likely prompt a range of responses from these competitors, including increased investment in their own research and development, potential collaborations or partnerships, and possibly aggressive marketing strategies to maintain market share.

Impact on the Competitive Landscape

The acquisition is expected to alter the competitive dynamics in several ways. One notable impact is the potential for new market opportunities, particularly in areas where IonQ and Oxford Ionics’ expertise overlaps. Conversely, the acquisition may also create new competitive threats, as rivals might try to counter IonQ’s strengthened position by emphasizing their unique advantages. For example, IBM, with its extensive classical computing infrastructure, could potentially leverage this to provide a more comprehensive quantum computing solution.

Competitive Advantages Gained by IonQ

IonQ’s acquisition of Oxford Ionics brings several key competitive advantages. Firstly, it bolsters IonQ’s expertise in trapped-ion quantum computing technology, a crucial aspect in the development of scalable quantum computers. Secondly, it potentially expands IonQ’s access to talent and resources, particularly in the UK’s thriving quantum computing sector. This could be vital in accelerating development timelines and improving the quality of their research.

The acquisition also grants IonQ access to Oxford Ionics’ intellectual property, including patents and proprietary techniques, further enhancing their technological edge.

Comparison of Key Competitors

| Competitor | Strengths | Weaknesses |

|---|---|---|

| IonQ | Strong trapped-ion technology, growing R&D investment, access to Oxford Ionics’ expertise and IP. | Relative newcomer compared to IBM and Google, potential challenges in scaling up operations. |

| Significant investment in quantum computing, strong research capabilities. | Limited commercialization efforts compared to IBM, challenges in the practical implementation of quantum algorithms. | |

| IBM | Extensive classical computing infrastructure, robust ecosystem for quantum computing, strong commercialization efforts. | Reliance on superconducting qubits, which pose different challenges in scalability and stability. |

| Rigetti | Focus on superconducting qubits, innovative architecture designs. | Smaller market presence compared to other giants, potential challenges in widespread adoption. |

Regulatory and Legal Aspects

The IonQ-Oxford Ionics acquisition, while seemingly straightforward on the surface, necessitates a careful examination of the regulatory and legal landscape. Navigating the intricacies of these considerations is crucial for the success and longevity of both companies in the burgeoning quantum computing sector. The acquisition’s implications extend beyond financial and technological aspects, encompassing the legal and regulatory frameworks governing such mergers and acquisitions.The acquisition’s impact on competition, data security, and intellectual property rights, as well as the regulatory approvals required, demand a comprehensive understanding.

Failure to anticipate and address these potential hurdles could jeopardize the entire transaction.

Regulatory Environment Surrounding Quantum Computing Acquisitions

The regulatory environment for quantum computing acquisitions is still evolving, both in the UK and internationally. No specific, dedicated quantum computing regulations exist in most jurisdictions. Instead, existing laws and frameworks for technology mergers and acquisitions, competition, and intellectual property are applied. This necessitates a nuanced approach to navigating these legal complexities.

Potential Legal Challenges

Several legal challenges could arise from the acquisition. These could include antitrust concerns, particularly if the combined entity gains a dominant market share, impeding future innovation and competition. Additionally, data security and privacy regulations could present hurdles, as the acquisition may involve the transfer of sensitive research data and proprietary information. Intellectual property rights, including patents and trade secrets, are another crucial aspect requiring meticulous scrutiny to avoid conflicts and ensure the smooth transition of intellectual property assets.

IonQ, a quantum computing firm, just acquired Oxford Ionics, a UK-based company, for a hefty $108 billion. This massive deal raises questions about the funding sources behind such acquisitions. Understanding how Harvard University funds its research initiatives, for example, might offer insights into the financial strategies driving this quantum leap. how harvards funding works Ultimately, the acquisition will likely lead to significant advancements in the field, pushing the boundaries of quantum computing technology further.

Regulatory and Legal Issues in Similar Acquisitions

Historical precedents from similar high-tech acquisitions offer valuable insights. For instance, acquisitions in the semiconductor industry often face scrutiny regarding market dominance and potential anti-competitive effects. The enforcement of competition laws, such as the UK’s Enterprise Act 2002, plays a critical role in preventing monopolies and promoting fair competition. Moreover, similar acquisitions in the tech sector highlight the importance of thorough due diligence on intellectual property rights and potential conflicts.

Regulatory scrutiny typically focuses on market share, potential barriers to entry, and the effect of the merger on innovation.

Structured Format of Regulatory Considerations

| Regulatory Area | Potential Issue | Mitigation Strategy |

|---|---|---|

| Antitrust/Competition | Acquisition could create a dominant entity, stifling competition and innovation. | Thorough antitrust review and potential divestitures to address concerns. |

| Data Security and Privacy | Transfer of sensitive research data and proprietary information may necessitate compliance with data protection regulations. | Robust data security protocols and compliance with GDPR, UK data protection laws, and other relevant legislation. |

| Intellectual Property | Potential conflicts or overlapping claims on patents, trademarks, and trade secrets. | Thorough IP due diligence, potential licensing agreements, and clear IP ownership protocols. |

| National Security Concerns | Acquisitions involving sensitive technologies might trigger national security reviews. | Compliance with national security regulations, including appropriate disclosure and risk assessments. |

Potential Impact on Research and Development

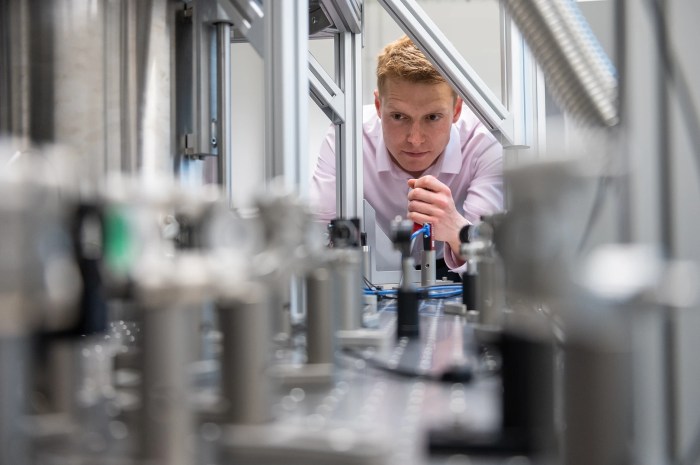

The acquisition of Oxford Ionics by IonQ promises a significant boost to quantum computing research and development. Combining IonQ’s expertise in trapped-ion quantum computing with Oxford Ionics’ advanced ion trap technology and materials science capabilities will likely accelerate progress in the field. This synergy could lead to breakthroughs in qubit stability, scalability, and control, paving the way for more powerful and reliable quantum computers.

Enhanced Research Capabilities, Quantum computing firm ionq acquire uk based oxford ionics 108 billion

The integration of research teams will foster a collaborative environment where diverse perspectives and methodologies can converge. IonQ’s strengths in algorithms and software development, combined with Oxford Ionics’ proficiency in materials science and ion trap engineering, will lead to innovative solutions and improved quantum hardware. This fusion of skills could potentially result in faster development cycles and more efficient research strategies.

Future Research Directions

The combined expertise of IonQ and Oxford Ionics suggests several promising future research directions. One potential area is the development of novel materials for ion traps, enabling higher qubit fidelity and longer coherence times. Another area is the exploration of new quantum algorithms specifically tailored to the strengths of trapped-ion quantum computers. The collaboration could also explore innovative ways to enhance the scalability of trapped-ion systems, enabling the creation of larger and more powerful quantum computers.

Quantum computing firm IonQ’s acquisition of UK-based Oxford Ionics for a hefty 108 billion is definitely a big deal. It’s a significant move in the quantum computing field, but it also reminds me of other exciting developments like the recent news about Sentry Thunderbolts the Void Bob. Sentry Thunderbolts the Void Bob is pushing the boundaries of innovation in a different realm, and this all highlights the exciting advancements happening across various sectors.

IonQ’s purchase, though, is a key step in their own quest to lead the way in quantum computing.

Ultimately, these advancements are expected to push the boundaries of what’s possible in quantum computing, potentially leading to breakthroughs in various fields.

Research Focus Areas Comparison

| Company | Primary Research Focus | Secondary Research Focus |

|---|---|---|

| IonQ | Quantum algorithms, software development, and error correction | Qubit control and manipulation, system architecture |

| Oxford Ionics | Ion trap technology, materials science, and ion source development | Qubit stability and coherence time enhancement, scalable system design |

The table above highlights the distinct yet complementary research focuses of IonQ and Oxford Ionics. The combination of these strengths will likely drive innovation and create new opportunities in the field of quantum computing. For instance, Oxford Ionics’ expertise in materials science can potentially lead to more stable and efficient ion traps, directly benefitting IonQ’s algorithms and software development efforts.

This collaborative approach promises to accelerate the overall pace of research and development in quantum computing.

Potential Impact on Workforce and Employment: Quantum Computing Firm Ionq Acquire Uk Based Oxford Ionics 108 Billion

The acquisition of Oxford Ionics by IonQ presents a complex interplay of opportunities and challenges for the workforce of both companies. This integration will likely affect roles, responsibilities, and the overall employment landscape for both organizations. Understanding these potential impacts is crucial for anticipating and mitigating potential disruptions and maximizing the benefits of the merger.

Potential Impacts on IonQ Workforce

IonQ, as the acquiring company, faces the prospect of integrating a new team of scientists, engineers, and support staff. This integration may lead to new opportunities for collaboration and knowledge sharing. However, it also presents challenges related to maintaining existing staff morale and addressing potential redundancies. Strategic planning is vital to ensure a smooth transition and a positive experience for all employees.

Potential Impacts on Oxford Ionics Workforce

The Oxford Ionics team, now part of IonQ, may experience changes in reporting structures, work processes, and company culture. The acquisition will likely affect their current roles, responsibilities, and professional development opportunities. It is essential to address concerns about the future and provide clear communication regarding the integration process.

Opportunities for Staff Integration and Collaboration

Integrating the teams will provide numerous opportunities for knowledge exchange and innovation. IonQ’s global presence and resources can complement Oxford Ionics’ specialized expertise in ion trap technology. This collaboration can lead to breakthroughs in quantum computing research. Cross-training programs and joint projects can foster a more dynamic and innovative work environment. Examples of this include collaborative research initiatives, joint presentations at conferences, and shared access to resources.

Potential Concerns Related to Employee Retention and Integration

Maintaining employee morale and engagement during and after the acquisition is crucial. Concerns about job security, compensation, and career progression are legitimate and need to be addressed proactively. Clear communication about the acquisition’s impact on roles, responsibilities, and future opportunities will be vital to retaining talented individuals. Addressing these concerns through open dialogue and transparent communication will be essential.

For instance, providing detailed information about career paths and outlining support systems for employees will demonstrate the company’s commitment to their well-being.

Summary Table: Workforce Changes and Integration Strategies

| Category | Potential Impact | Integration Strategy |

|---|---|---|

| IonQ Workforce | Potential for increased workload, new responsibilities, and the need to adapt to a larger organization. Potential for redundancies in some roles. | Clear communication regarding the acquisition’s implications. Training programs for new technologies and procedures. Open dialogue and career counseling. |

| Oxford Ionics Workforce | Changes in reporting structures, work processes, and company culture. Potential for job relocation or reassignment. | Transparency about the acquisition’s impact on their roles. Opportunities for career development within IonQ. Assistance with relocation or re-training if necessary. |

| Overall Integration | Challenges in harmonizing different work cultures and workflows. | Establishing clear communication channels. Introducing collaborative projects and team-building activities. Creating a supportive environment where employees from both organizations can work effectively together. |

Outcome Summary

The acquisition of Oxford Ionics by IonQ signifies a pivotal moment in the quantum computing industry. This strategic move not only boosts IonQ’s technological prowess but also raises the bar for future innovation in the field. The combined expertise and resources of both companies promise exciting advancements in quantum computing, with potential implications for various sectors. While challenges related to integration and market competition exist, the acquisition positions IonQ to compete effectively in the evolving quantum landscape.