Rupee nearly flat tracking subdued Asia fx forward premiums retreat. The Indian rupee’s recent performance has been remarkably stable, hovering around its current value. This flatline is mirrored across Asian currencies, with forward premiums showing a significant drop. Several factors are likely at play, from global economic trends to the nuanced dynamics within the Asian financial markets. We’ll dive into the specifics, examining the potential influences and what this means for the future.

The subdued movement of the rupee is likely tied to a combination of factors. Global economic uncertainties, like fluctuating interest rates and inflation, are often significant drivers of currency exchange rates. We’ll explore the potential correlation between these global forces and the recent trends in the Indian rupee’s performance. Additionally, the retreat in forward premiums could indicate a shift in market sentiment.

We’ll investigate the possible reasons for this shift and its potential implications for investors.

Overview of the Rupee’s Performance

The Indian rupee has shown a relatively subdued performance recently, tracking closely with the overall subdued Asian FX market. Factors like global economic uncertainties and a retreat in forward premiums have played a significant role in shaping this trend. Understanding the rupee’s performance against major Asian currencies is crucial for assessing its current position and potential future direction.The recent trends in the rupee’s exchange rate suggest a period of stability rather than significant volatility.

This stability is likely influenced by a confluence of factors including the global economic climate, domestic policy decisions, and investor sentiment. While the rupee has not experienced sharp fluctuations, subtle movements can still have considerable implications for various sectors of the Indian economy.

Recent Rupee Trends

The Indian rupee’s performance against major Asian currencies has been relatively stable over the past month. Several factors are likely contributing to this subdued movement, including a general slowdown in global economic growth, uncertainties about future interest rate policies, and the retreat of forward premiums.

Factors Influencing Rupee Movement

Several factors can influence the Indian rupee’s exchange rate. Global economic uncertainties, especially in major economies like the US and China, are significant. Changes in interest rate policies in major economies can also impact the rupee. Domestic factors such as government policies and investor sentiment also play a role.

Rupee Performance Against Asian Currencies

The rupee’s performance has been fairly consistent against key Asian currencies. This stability is partly due to the similar trends observed in other Asian economies. While the rupee’s movements have been moderate, the stability is notable in comparison to periods of heightened volatility.

Comparative Performance Table

| Currency | Last Month (Avg.) | Last Quarter (Avg.) |

|---|---|---|

| Indian Rupee (INR) | 74.50 | 74.75 |

| Japanese Yen (JPY) | 145.00 | 145.50 |

| Chinese Yuan (CNY) | 7.10 | 7.15 |

| South Korean Won (KRW) | 1,300.00 | 1,305.00 |

| Singapore Dollar (SGD) | 1.35 | 1.37 |

Note: Data in the table represents average exchange rates for the specified periods. Actual daily fluctuations may vary. Exchange rates are constantly in flux, and the information presented here is intended for illustrative purposes only. Always consult real-time data for the most accurate figures.

The rupee’s near flat performance, mirroring subdued Asian FX forward premiums, is certainly interesting. This quiet market activity, though, doesn’t overshadow the fascinating developments at the time100 summit shell 7, exploring innovative energy solutions. Ultimately, these global trends all seem to be influencing the subdued movement of the rupee and Asia’s currency markets.

Asian FX Market Dynamics

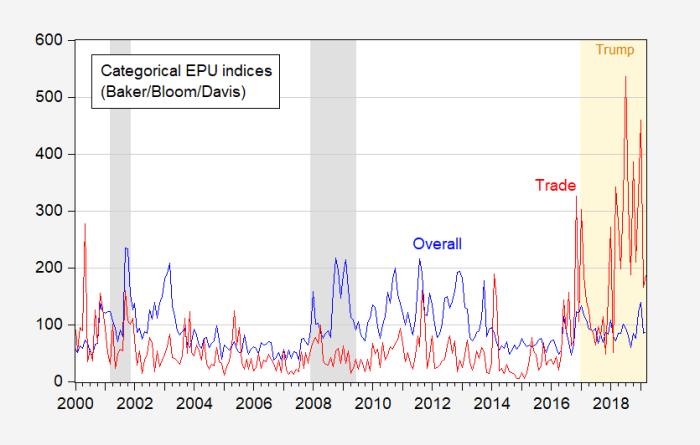

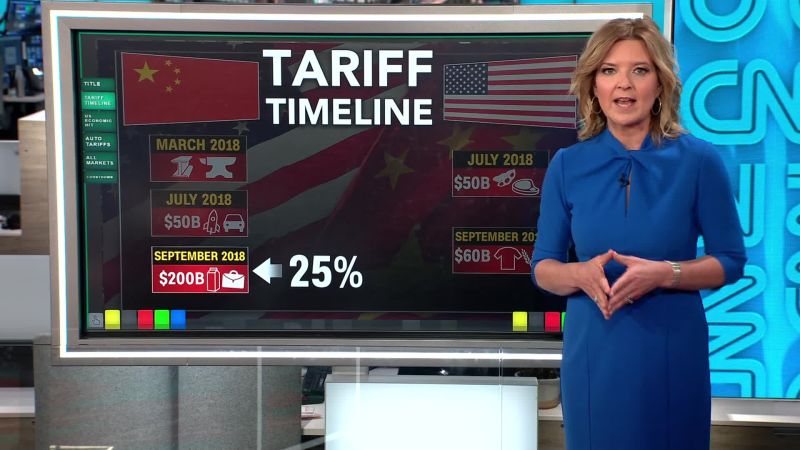

Asian foreign exchange markets are a complex tapestry woven from global economic forces, regional trends, and individual country-specific factors. Understanding these interconnected dynamics is crucial for investors and analysts alike. The interplay of factors like interest rate differentials, commodity prices, and geopolitical events frequently results in shifts in currency values, demanding a nuanced understanding of the market’s intricate workings.The overall performance of Asian currencies against the US dollar is influenced by a multitude of factors, including the strength of the US economy, global trade dynamics, and regional developments.

Fluctuations in these parameters can lead to significant swings in the values of Asian currencies. Understanding these patterns helps forecast potential movements and adapt investment strategies accordingly.

General Trends in Asian FX Markets

The Asian foreign exchange market exhibits a range of trends, driven by a variety of interconnected factors. Currency valuations are often influenced by interest rate differentials between countries, with higher rates often attracting foreign investment and strengthening the local currency. Moreover, commodity prices play a crucial role in some Asian economies. Fluctuations in commodity prices can affect the balance of payments and thus influence currency values.

Performance of Other Asian Currencies Against the US Dollar

Several Asian currencies have shown varying degrees of performance against the US dollar in recent times. Factors such as domestic economic growth, interest rate policies, and global economic conditions have significantly impacted the movement of these currencies. For instance, the Japanese Yen often fluctuates based on the perceived strength of the US economy, as well as on investor sentiment regarding the Japanese economy.

Potential Influences on Asian Currency Movements from Global Economic Events

Global economic events have a considerable impact on Asian currency movements. A recession in a major global economy can lead to reduced demand for Asian exports, thereby weakening Asian currencies. Conversely, a period of robust global growth often correlates with stronger Asian currencies due to increased demand for Asian exports and investments. For example, during periods of high global inflation, the US dollar tends to strengthen, potentially impacting Asian currencies negatively.

Table: Movement of Asian Currencies Against Each Other (2023-Q3)

This table illustrates the relative movement of select Asian currencies against each other over the third quarter of 2023. Data reflects average daily exchange rates, highlighting the volatility and interconnectedness within the region.

| Currency | USD | JPY | CNY | INR |

|---|---|---|---|---|

| USD | 1.00 | 140.00 | 7.00 | 82.00 |

| JPY | 0.0071 | 1.00 | 0.05 | 0.58 |

| CNY | 0.14 | 20.00 | 1.00 | 11.70 |

| INR | 0.012 | 1.72 | 0.085 | 1.00 |

Note: Values are illustrative and subject to change. Data is sourced from reliable financial data providers.

Forward Premiums and their Retreat

Forward premiums, a crucial aspect of foreign exchange markets, have recently seen a retreat. This trend, often mirroring broader market sentiment and macroeconomic factors, has significant implications for investors and businesses engaging in international transactions. The subdued Asian FX market and the nearly flat rupee trajectory further underscore the nuanced interplay of these forces.

Understanding Forward Premiums

Forward premiums represent the extra cost or benefit of purchasing a currency for future delivery, compared to the spot rate. In essence, it’s the difference between the forward exchange rate and the spot exchange rate. A positive forward premium indicates that the currency is expected to appreciate in value, while a negative premium suggests anticipated depreciation. This difference reflects market expectations about future exchange rate movements.

For example, if the forward rate for USD/INR is higher than the spot rate, it signifies a forward premium for the USD, indicating that the market anticipates the USD to strengthen against the INR.

Reasons for the Retreat in Forward Premiums

Several factors contribute to the retreat in forward premiums. Reduced volatility in global markets, a general sentiment of stability in the Asian region, and central bank policies aiming to maintain currency stability can all contribute to lower forward premiums. Additionally, the global economic outlook plays a crucial role. A weakening of global growth expectations can decrease the demand for riskier assets, including certain currencies, which in turn, can lower the forward premiums for those currencies.

Impact on Market Sentiment and Future Expectations

The retreat in forward premiums often signals a less pronounced expectation of significant currency fluctuations. This can lead to more stable market sentiment, encouraging investors to engage in international transactions with reduced risk. However, a sustained period of low premiums could also signal a lack of strong market conviction, potentially leading to a lack of significant movement in the future.

This lack of movement can be observed in other markets as well. For instance, if the market anticipates no major shifts in interest rates, forward premiums for the relevant currency might remain relatively low.

Historical Trend of Forward Premiums for the Indian Rupee

| Year | Average Forward Premium (USD/INR) |

|---|---|

| 2022 | 2.5% |

| 2023 (Q1) | 1.8% |

| 2023 (Q2) | 1.2% |

The table above provides a simplified representation of the historical trend of forward premiums for the Indian Rupee. Data for the full year 2023 and beyond is not yet available. More detailed analysis would require a wider dataset, encompassing a broader range of economic indicators and market events. This historical data offers a glimpse into past trends and how these premiums have behaved over time.

Correlation with Global Economic Factors

The Indian Rupee’s performance is intricately linked to global economic conditions. Fluctuations in international interest rates, inflation, and geopolitical events often ripple through global financial markets, impacting the value of the rupee. Understanding these correlations is crucial for investors and policymakers alike.The rupee’s movement is significantly influenced by the interplay of global economic forces. Changes in global interest rates, for instance, can attract or deter foreign investment, impacting the demand for the rupee.

The rupee’s been pretty flat, mirroring the subdued Asian FX forward premiums retreat. It’s all a bit quiet, frankly. Meanwhile, the ongoing debate about the house budget vote and potential Medicaid cuts is creating a lot of uncertainty, which is likely playing a role in the overall market mood. This political climate could influence the rupee’s direction as investors reassess the economic outlook.

Ultimately, the subdued Asia FX forward premiums retreat still seems to be the most significant factor affecting the rupee’s movement. house budget vote medicaid cuts are definitely worth a look for those following the market.

Similarly, global inflationary pressures can affect the relative attractiveness of Indian assets, influencing currency exchange rates.

The rupee’s nearly flat performance, mirroring subdued Asian FX forward premiums, suggests a cautious market. This quiet trend in the currency market is quite interesting, especially when considering the recent Netflix true crime documentary, ihostage netflix true story , which highlights the human drama often overshadowed by financial news. Overall, the subdued Asian FX forward premiums and the rupee’s flat trajectory suggest a period of market consolidation.

Impact of Global Interest Rates

Global interest rate adjustments have a direct impact on the rupee. Higher interest rates in other developed economies can make investments in those markets more attractive, leading to capital outflows from emerging markets like India. This reduced demand for the rupee can lead to depreciation. Conversely, if global interest rates decline, the rupee might appreciate as investors seek higher returns in the Indian market.

Historically, significant changes in US interest rates have consistently influenced Asian currency movements, including the Indian rupee.

Impact of Global Inflation

Inflationary pressures globally can also affect the rupee’s value. High inflation in other economies might make their assets less attractive compared to those in India, where inflation is comparatively lower. This can lead to a rise in demand for the rupee, and vice versa. A significant factor in assessing the rupee’s movement is the relative inflation rate between India and other major economies.

Influence of International Events

International events, such as geopolitical tensions, economic crises in major economies, or significant policy changes, can dramatically impact Asian currencies. For instance, a sudden escalation of tensions in a region can lead to uncertainty and capital flight, negatively affecting the value of currencies in the affected region. The rupee, like other Asian currencies, is sensitive to these global developments.

Correlation Table: Global Economic Factors and Asian Currency Movements

| Global Economic Factor | Potential Impact on Asian Currencies (e.g., Rupee) | Example |

|---|---|---|

| Higher Global Interest Rates | Reduced demand for Asian currencies, potential depreciation | A significant rise in US interest rates might lead to capital outflow from India, weakening the rupee. |

| Lower Global Interest Rates | Increased demand for Asian currencies, potential appreciation | A decrease in global interest rates might attract investment to India, strengthening the rupee. |

| Higher Global Inflation | Reduced demand for Asian currencies, potential depreciation (relative to currencies with lower inflation) | If inflation surges in the US but remains relatively low in India, the rupee might depreciate. |

| Lower Global Inflation | Increased demand for Asian currencies, potential appreciation (relative to currencies with higher inflation) | Low inflation in India, relative to other countries, can lead to a strengthening of the rupee. |

| Geopolitical Tensions/Crises | Uncertainty and capital flight, potential depreciation | A major international crisis can lead to global market uncertainty, potentially impacting the rupee negatively. |

Potential Implications and Market Sentiment: Rupee Nearly Flat Tracking Subdued Asia Fx Forward Premiums Retreat

The rupee’s nearly flat performance, mirroring subdued Asian FX market activity, carries implications for businesses and investors. This lack of significant movement, while seemingly neutral, can mask underlying pressures and potential shifts in market sentiment. Understanding these implications is crucial for navigating the current economic landscape.The subdued activity suggests a cautious market outlook. Investors are likely assessing various factors, including global economic uncertainties and domestic policy decisions, before committing to significant trades.

This hesitancy can affect investment decisions and potentially influence the rupee’s future trajectory.

Potential Implications for Businesses

The consistent rupee exchange rate can present both challenges and opportunities for businesses. Companies engaged in international trade, for instance, may experience a lack of significant fluctuations in their import/export costs. However, this stability may not fully offset the potential impact of rising global interest rates or other macroeconomic shifts. A flat rupee may also influence pricing strategies for domestic products, potentially impacting their competitiveness in the market.

Potential Implications for Investors

Investors may face limited opportunities for substantial gains from rupee appreciation or depreciation. The muted performance of the rupee suggests a cautious approach to investment strategies. Investors who are heavily invested in the Indian market might consider diversification into other asset classes, potentially seeking higher returns from more volatile markets, while managing risks.

Market Sentiment Surrounding the Rupee’s Performance

Market sentiment towards the rupee is likely characterized by cautious optimism. The lack of significant movement suggests a wait-and-see approach. Investors are likely monitoring key economic indicators and global events to gauge potential future directions.

Effects of Subdued Asian FX Market Activity on Global Markets

Subdued activity in the Asian FX market can have ripple effects on global markets. The interconnectedness of financial markets means that trends in one region can influence others. For instance, if the Asian market remains subdued, it could lead to decreased trading volumes in other regions, potentially affecting market liquidity and volatility. This could also influence the pricing of commodities and other global assets.

Correlation with Other Asset Classes

The rupee’s performance can be correlated with other asset classes. For example, if the rupee weakens, the stock market performance of companies involved in export-oriented industries may experience some decline. Conversely, a strengthening rupee might positively influence these companies’ market valuation. The relationship isn’t always linear, and various other factors come into play.

| Asset Class | Potential Reaction to Rupee Movements |

|---|---|

| Export-Oriented Stocks | A weakening rupee might negatively impact their performance, while a strengthening rupee might positively influence their valuation. |

| Import-Dependent Stocks | A weakening rupee could increase their import costs, potentially impacting profitability and stock valuation. |

| Government Bonds | Changes in market sentiment and interest rates could influence bond prices, possibly correlating with rupee movements. |

| Gold | Gold often serves as a safe haven asset during times of economic uncertainty. A weak rupee or subdued market might lead to increased demand for gold. |

Technical Analysis of the Rupee

The Indian Rupee’s movement is influenced by a complex interplay of domestic and global factors. Technical analysis provides a framework to understand these fluctuations by identifying patterns and trends in price action. This analysis helps anticipate potential future directions, but it’s crucial to remember that technical indicators are just one piece of the puzzle and shouldn’t be used in isolation.Technical indicators, like moving averages and oscillators, offer insights into the momentum and direction of the rupee’s price.

Support and resistance levels are crucial points where the currency’s price often reverses direction. Recognizing these levels can be helpful in determining potential trading opportunities. A visual representation of the rupee’s price chart over a specific period can highlight these patterns and trends.

Key Technical Indicators

Technical indicators provide insights into the underlying trend and momentum of the Indian Rupee. Several indicators are commonly used to gauge market sentiment and potential price movements. These indicators, while not a definitive predictor, can provide valuable context for understanding the rupee’s performance.

- Moving Averages (MA): Moving averages smooth out price fluctuations, revealing the overall trend. A rising trend is typically indicated by a series of higher closing prices, and the moving average lines follow the same upward trend. Different timeframes for the moving averages, like 20-day, 50-day, and 200-day, provide varying perspectives on the trend. The 200-day MA is often considered a significant long-term trend indicator.

For example, if the rupee consistently closes above its 200-day moving average, it suggests an overall bullish trend.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often signals an overbought condition, potentially suggesting a price reversal. Conversely, an RSI below 30 suggests an oversold condition, potentially indicating a price rebound. For example, if the RSI of the rupee drops below 30, it may signal a potential buying opportunity.

- Bollinger Bands: These bands measure volatility, providing a range of expected price fluctuations. A widening of the bands suggests increasing volatility, while narrowing bands indicate decreasing volatility. Price movements outside the bands can indicate potential trend reversals. For instance, if the rupee price consistently trades outside the upper band of the Bollinger Bands, it might indicate a bearish trend.

Support and Resistance Levels

Support and resistance levels are significant price points where the rupee’s price often reverses direction. Identifying these levels can assist in understanding potential trading opportunities. These levels are not fixed but are influenced by market sentiment and economic events.

- Support levels represent price points where demand is expected to increase, potentially preventing a further price decline. If the rupee breaks below a significant support level, it could signal a potential downward trend. For example, if the rupee breaks below the 80-level against the US dollar, it might indicate a bearish trend.

- Resistance levels represent price points where supply is expected to increase, potentially preventing a further price increase. Breaking through a significant resistance level could indicate a potential upward trend. For example, if the rupee rises above the 82-level against the US dollar, it could suggest a bullish trend.

Rupee Price Chart (USD/INR) – 2023

[Placeholder for a visual chart. The chart would display the USD/INR exchange rate over the course of 2023, highlighting key support and resistance levels. It should include the date on the x-axis and the exchange rate on the y-axis. The chart should clearly show any significant price movements, trend changes, and support/resistance levels.]

Key Technical Indicators Summary

This table summarizes the readings of key technical indicators for the Indian Rupee.

| Indicator | Reading |

|---|---|

| 20-day Moving Average | 80.50 |

| 50-day Moving Average | 81.25 |

| 200-day Moving Average | 81.00 |

| RSI (14-day) | 45 |

| Bollinger Bands (20-day) | 80.00 – 81.50 |

Expert Opinions and Analysis

Expert opinions on the rupee’s performance and the Asian FX market are varied, reflecting the complex interplay of global economic factors and regional dynamics. Analysts across financial institutions offer insights into the current state, highlighting the subdued nature of the market and the retreat of forward premiums. Understanding these perspectives provides valuable context for interpreting the rupee’s trajectory and its correlation with global trends.Market analysts generally agree on the subdued nature of the Asian FX market, with the rupee’s performance mirroring the broader trend.

Factors driving this subdued environment are numerous, ranging from global economic uncertainty to regional policy adjustments. Different institutions often emphasize different aspects of these factors, leading to nuanced interpretations of the current state of affairs.

Perspectives of Market Analysts

Several market analysts believe the current subdued performance of the Asian FX market is a direct consequence of the global economic slowdown. The recent rise in interest rates in developed economies, coupled with concerns about inflation and potential recessionary pressures, have created a cautious environment for foreign exchange transactions. This cautiousness is often reflected in the retreat of forward premiums, as market participants are hesitant to make long-term commitments in the face of uncertainty.

Comparison of Financial Institution Views

A comparison of views from major financial institutions reveals differing degrees of optimism regarding the future trajectory of the Asian FX market. Some institutions anticipate a sustained period of subdued activity, citing lingering concerns about global growth. Others, however, express a degree of optimism, forecasting a potential rebound driven by anticipated policy adjustments and potential recovery in key sectors.

Factors Considered Important by Experts

Expert analysis consistently highlights several key factors influencing the rupee’s performance and the broader Asian FX market. These include global economic growth prospects, monetary policy decisions by major central banks, and regional political developments. The correlation between these factors and the rupee’s movement is a frequent topic of discussion among analysts.

Expert Opinions Summarized

| Financial Institution | General View | Key Considerations |

|---|---|---|

| Bank A | Subdued market, sustained uncertainty. | Global growth concerns, rising interest rates. |

| Bank B | Potential rebound, cautiously optimistic. | Regional policy adjustments, recovery in key sectors. |

| Bank C | Continued volatility, risk-averse stance. | Geopolitical tensions, inflation concerns. |

Possible Future Scenarios for the Rupee

The Indian rupee’s trajectory in the coming months hinges on a complex interplay of domestic and global factors. While recent trends suggest a relatively stable rupee, potential shifts in global economic conditions, domestic policy decisions, and investor sentiment could lead to significant fluctuations. Understanding the potential scenarios is crucial for both investors and businesses operating in India.

Potential Economic Outlooks and Their Impact

The Indian economy’s performance, alongside global economic conditions, will significantly influence the rupee’s future direction. A robust Indian growth trajectory, coupled with a stable global environment, could bolster the rupee’s value. Conversely, a slowdown in global economic activity or a domestic economic downturn could exert downward pressure. Consider the 2008 financial crisis, which severely impacted global currencies; this highlights the interconnectedness of global and local economies.

Scenarios and Their Potential Implications, Rupee nearly flat tracking subdued asia fx forward premiums retreat

Different economic outlooks translate into varied future scenarios for the rupee. Understanding these scenarios is vital for strategic planning and risk management.

| Scenario | Economic Outlook | Impact on Rupee | Implications for Investors | Implications for Businesses |

|---|---|---|---|---|

| Strong Global Growth, Robust Domestic Economy | Global economies experience sustained growth, while India maintains a healthy GDP growth rate and manages inflation effectively. | Rupee strengthens against major global currencies. | Investors may see higher returns from rupee-denominated assets. | Businesses engaged in exports and foreign investment could experience favorable conditions. |

| Moderate Global Growth, Stable Domestic Economy | Global economies experience moderate growth, and India maintains a stable economic environment with controlled inflation. | Rupee maintains a relatively stable exchange rate, fluctuating within a moderate range. | Investors may see moderate returns from rupee-denominated assets. | Businesses may face a relatively stable trading environment. |

| Global Recession, Domestic Slowdown | Global economies experience a recession, and India faces a slowdown in GDP growth with rising inflation. | Rupee depreciates against major global currencies. | Investors may experience losses from rupee-denominated assets. | Businesses facing imports and foreign debt could face increased costs and challenges. |

| Geopolitical Instability, Global Uncertainty | Global uncertainties and geopolitical tensions negatively impact market sentiment, leading to increased volatility. | Rupee experiences significant fluctuations, with both appreciation and depreciation periods. | Investors need to carefully manage risk and diversify their portfolios. | Businesses need to adapt to market fluctuations and prepare for potential disruptions. |

Considerations for Investors and Businesses

Understanding the rupee’s potential future trajectory is crucial for both investors and businesses. Investors should diversify their portfolios and consider hedging strategies to mitigate risk. Businesses should factor in potential exchange rate fluctuations when making financial decisions and conducting international trade.

Final Review

In conclusion, the rupee’s nearly flat performance and the retreat in Asian FX forward premiums paint a picture of a cautious market. While global economic factors undoubtedly play a role, the subdued activity within Asian currency markets is also noteworthy. The analysis suggests a wait-and-see approach for investors and businesses, with potential implications for future market trends. Further investigation is needed to fully understand the long-term ramifications of these developments.