Selway tapped run secs trading markets division sources say that a key personnel shift is underway, raising questions about the future trajectory of this vital financial sector. This article delves into the background of the division, exploring the significance of “Tapped Run Secs,” analyzing the impact of the appointment, and examining the broader market dynamics. We’ll also evaluate the sources’ credibility and discuss potential future scenarios.

The Selway Tapped Run Secs Trading Markets Division plays a critical role in the overall financial landscape. Understanding its past performance, organizational structure, and the meaning behind “Tapped Run Secs” is essential to grasp the potential implications of this appointment. We’ll analyze potential benefits, drawbacks, and how market trends might affect the division’s operations.

Background on Selway Tapped Run Secs Trading Markets Division

The Selway Tapped Run Secs Trading Markets Division is a critical component of the broader Selway financial services organization, specializing in securities trading and market analysis. Its primary function is to execute buy and sell orders for various securities, from equities to bonds and derivatives, while maintaining a focus on maximizing profitability and mitigating risk. This division plays a pivotal role in the firm’s overall financial performance.The division’s operational structure is hierarchical, with a clear reporting line to the executive leadership.

This ensures accountability and facilitates swift decision-making within the market’s dynamic environment. The organizational chart likely delineates specific roles and responsibilities, such as traders, analysts, and risk managers. This structure is essential for efficient execution of market transactions.

Key Functions and Responsibilities

The division’s core responsibilities include executing trades, analyzing market trends, and managing risk associated with these transactions. They also likely contribute to portfolio management strategies and provide insights into market conditions to guide investment decisions. Furthermore, compliance with relevant regulations and market standards is paramount to the division’s operations.

Organizational Structure and Reporting Lines

The division likely has a tiered structure. At the top, senior management oversees the overall strategy and performance. Below this layer, there are likely specialized teams focused on different asset classes or trading strategies. Individual traders and analysts report to their respective team leads, who in turn report to senior management. This hierarchical structure ensures efficient communication and accountability.

Sources say Selway tapped the run SECs trading markets division. This move, while seemingly unrelated, might reflect a broader trend towards smarter, more sustainable travel practices. AI is rapidly changing how we plan and execute trips, and companies are increasingly incorporating these technologies into their operations, as seen in how travel is getting smart more sustainable with ai.

This could potentially be influencing Selway’s decisions in the trading markets division.

Past Performance Metrics and Achievements

Past performance metrics, including volume of trades, profitability, and risk management metrics, are crucial for evaluating the division’s effectiveness. Quantifiable data, like average daily trading volume, percentage of profitable trades, and average transaction costs, can offer a clear understanding of the division’s track record. These metrics, when analyzed over time, provide valuable insights into the division’s performance trends.

Role Within the Broader Financial Landscape

The Selway Tapped Run Secs Trading Markets Division operates within a complex financial landscape, interacting with various market participants, including other brokerage firms, institutional investors, and individual clients. Its activities have a direct impact on market liquidity and price discovery. The division’s role is pivotal in ensuring the smooth functioning of the financial markets.

Key Personnel

Understanding the expertise and experience of key personnel within the division is crucial for assessing its capabilities. This information helps understand the division’s depth of knowledge and its ability to adapt to market conditions.

| Name | Role | Areas of Expertise | Relevant Experience |

|---|---|---|---|

| Jane Doe | Head Trader | Equity Trading, Portfolio Management | 15+ years in the financial markets, including 10 years at a top-tier brokerage |

| John Smith | Senior Analyst | Market Analysis, Risk Management | PhD in Finance, 8+ years of experience in financial modeling and data analysis |

| Alice Johnson | Compliance Officer | Regulatory Compliance, Market Regulations | 5+ years in compliance roles, with extensive knowledge of SEC and FINRA regulations |

| Bob Williams | Junior Trader | Futures Trading, Algorithmic Trading | 2 years of experience, with a strong background in quantitative analysis |

Understanding the “Tapped Run Secs” Concept

The term “Tapped Run Secs” in trading markets, as sourced from Selway’s trading division, likely refers to a specific type of security or a strategy focusing on securities that have experienced a significant price run-up. This suggests a method to capitalize on these price movements, either by identifying and exploiting patterns or by anticipating market reactions. Understanding the precise definition requires further clarification.The meaning of “Tapped Run Secs” remains somewhat ambiguous without detailed context.

It could potentially refer to: 1) a specific type of security with a particular trading pattern; 2) a strategy that exploits price runs in a given security; or 3) a combination of both. Precise definitions, along with detailed methodologies and associated risks, are needed for comprehensive analysis.

Possible Interpretations of “Tapped Run Secs”

The term “Tapped Run Secs” may represent securities that have undergone a recent significant price increase (a “run”). The “tapped” aspect could indicate that the price increase has been substantial enough to attract significant attention or trading volume, or that the price has been “pulled” up by certain market forces. Alternatively, it might describe a strategy designed to capitalize on the momentum of an upward trend in specific securities.

Understanding the specifics is critical to interpreting the strategy’s underlying intent.

Potential Strategies and Methodologies

Various strategies can be associated with “Tapped Run Secs,” ranging from technical analysis to fundamental analysis, and even quantitative methods. For example, technical analysis might involve identifying patterns in price charts to anticipate further price movements. Fundamental analysis could focus on evaluating the underlying company’s financial performance and prospects. Quantitative methods could involve using algorithms to identify and track securities exhibiting certain characteristics.

Factors Influencing “Tapped Run Secs” Trading Activities

Several factors influence trading activities related to “Tapped Run Secs.” Market sentiment, news events, economic indicators, and regulatory changes can all significantly impact the price movements of securities. For example, positive news about a company can trigger a price increase, while negative news can cause a decline. Understanding the interplay of these factors is crucial for successful trading.

Furthermore, the specific characteristics of the “Tapped Run Secs” themselves—their industry, company financials, and trading history—also play a key role.

Comparison of Strategies for “Tapped Run Secs”

| Strategy | Description | Potential Advantages | Potential Disadvantages |

|---|---|---|---|

| Technical Analysis | Identifying patterns and trends in price charts to predict future movements. | Relatively straightforward to understand and implement. | Can be susceptible to market noise and may not capture underlying fundamental value. |

| Fundamental Analysis | Evaluating the underlying company’s financial performance and prospects to assess intrinsic value. | Provides a more comprehensive understanding of the security’s potential. | Requires more time and expertise to analyze the data, and may not always reflect immediate market trends. |

| Quantitative Analysis | Employing algorithms and mathematical models to identify and track securities with specific characteristics. | Can potentially identify patterns missed by other methods and can be automated. | Requires significant computational resources and expertise in programming and data analysis. |

| Momentum Trading | Capitalizing on recent price movements to identify and profit from trending securities. | Can lead to quick profits if trends are correctly identified. | Can lead to significant losses if trends reverse quickly. |

Analyzing the Impact of the Appointment

Selway’s appointment to the Tapped Run Secs Trading Markets Division marks a significant shift in the division’s leadership. Understanding the potential ramifications of this change requires a careful examination of the past performance and the likely future trajectory. The new leadership’s strategies and priorities will undoubtedly shape the division’s success or failure.The appointment of Selway to the Tapped Run Secs Trading Markets Division presents a unique opportunity to analyze the impact on the division’s performance, future direction, and stakeholder interests.

This analysis will explore the potential benefits and drawbacks of this appointment for various parties, from investors to employees, and consider the potential impact on key performance indicators.

Potential Implications for the Division’s Future Direction

The appointment of Selway likely signals a shift in the division’s strategic approach. Selway’s background and experience will influence the division’s priorities, resource allocation, and overall operational strategy. The direction taken by the division may be influenced by market trends, technological advancements, and regulatory changes. This will inevitably impact the success of trading strategies and the efficiency of market operations.

Potential Benefits and Drawbacks for Stakeholders

This appointment has potential benefits and drawbacks for various stakeholders. Investors will be keen to see if the new leadership can enhance profitability and return on investment. Employees may experience changes in work processes and responsibilities, which could be either positive or negative depending on the new strategies implemented. Customers may see changes in service quality and product offerings.

Comparison of Performance Before and After the Appointment

Unfortunately, a direct comparison of performance before and after the appointment is not readily available. Historical data on the division’s key performance indicators (KPIs) is necessary to assess the impact of the appointment. A thorough analysis of such data is essential to understand the changes in profitability, efficiency, and market share.

Potential Impact on Key Performance Indicators (KPIs)

| KPI | Potential Improvement | Potential Deterioration | Potential Impact (Neutral/Mixed) |

|---|---|---|---|

| Profitability | Increased efficiency, new strategies | Poor strategy execution, market downturn | Market conditions and strategy execution |

| Market Share | Stronger brand, improved strategies | Poor marketing campaigns, competition | Market competition, company resources |

| Operational Efficiency | Improved processes, new technologies | Resistance to change, inefficient implementation | Staff training, resources, time |

| Customer Satisfaction | Better service, product development | Changes in service, product quality | Customer feedback, market research |

Exploring Market Dynamics and Trends

The appointment of Selway to the Tapped Run Secs Trading Markets Division marks a significant shift, demanding a keen understanding of the current market landscape. Analyzing prevailing trends and the economic environment is crucial for evaluating potential opportunities and risks for the division. Understanding how external factors might influence their operations is paramount to strategic planning and successful execution.The current economic climate, characterized by [insert relevant economic descriptor, e.g., fluctuating interest rates, global uncertainty, inflationary pressures], presents a complex interplay of forces impacting various sectors, including the financial markets.

The trading division’s performance will be intrinsically linked to these macroeconomic factors, requiring a nuanced understanding of their potential impact.

Sources say Selway tapped run SEC’s trading markets division, which is pretty interesting. It’s a big deal in the financial world, and I’m always intrigued by these personnel moves. Speaking of noteworthy achievements, Simone Biles recently received the Time100 Impact Award, a huge honor for her groundbreaking work in gymnastics and inspiring millions. This makes me think about how Selway’s appointment might impact the markets and if they’ll see similar positive ripples in the financial world like the ones Biles created in the athletic world, Simone Biles gymnastics time100 impact award.

All this points to a fascinating time in both the athletic and financial realms.

Current Market Trends and Conditions

The global market is currently experiencing a period of [insert relevant market trend, e.g., consolidation, volatility, growth]. This volatility is impacting various asset classes, including equities, commodities, and fixed income instruments. Several key factors contribute to this dynamic environment, including [mention 2-3 key factors, e.g., geopolitical tensions, central bank policies, supply chain disruptions].

Economic Environment Influencing the Division

The economic environment plays a pivotal role in shaping the trading division’s performance. Fluctuations in [mention 2-3 key economic indicators, e.g., GDP growth, inflation rates, interest rates] directly affect market sentiment and trading volume. Furthermore, [mention a specific example of economic impact, e.g., rising interest rates can decrease demand for certain assets, potentially impacting the division’s trading strategies].

External Factors Affecting Division Operations

Several external factors can significantly impact the division’s operations. Geopolitical events, such as [mention 1-2 geopolitical events, e.g., escalating trade wars, regional conflicts], can trigger market volatility and affect investor confidence. Furthermore, unforeseen events like [mention 1-2 unforeseen events, e.g., natural disasters, pandemics] can disrupt supply chains and impact commodity prices, thereby affecting the trading division’s operations. Understanding these external factors is crucial for mitigating potential risks and capitalizing on opportunities.

Potential Risks and Opportunities

The current market environment presents both risks and opportunities for the trading division. Risks include [mention 2-3 specific risks, e.g., increased market volatility, reduced investor confidence, competitive pressures]. Opportunities include [mention 2-3 specific opportunities, e.g., potential for arbitrage, favorable market conditions for specific asset classes, innovative trading strategies]. A proactive risk management strategy and a well-defined opportunity identification framework are essential for navigating this dynamic environment.

Summary of Key Market Indicators

| Market Indicator | Description | Potential Influence on Division | Examples |

|---|---|---|---|

| Interest Rates | Level of borrowing costs | Higher rates can decrease demand for riskier assets, impacting trading strategies. | Federal Funds Rate, Bank Lending Rates |

| Inflation | General price increase | High inflation can erode purchasing power, potentially impacting demand for certain assets. | Consumer Price Index, Producer Price Index |

| GDP Growth | Measure of economic activity | Stronger growth can boost investor confidence and market activity. | Gross Domestic Product figures |

| Geopolitical Events | Political or international tensions | Can create uncertainty and market volatility, requiring adjustments to trading strategies. | Trade disputes, regional conflicts |

Sources and Credibility

Digging into the whispers about Selway’s appointment to the Tapped Run Secs Trading Markets Division requires a critical eye towards the sources. Just because something is reported doesn’t automatically make it true. We need to understand the reliability and potential biases of those spreading the news.Assessing the trustworthiness of financial news is crucial. Information, especially in rapidly changing markets, can be easily distorted or misinterpreted.

The credibility of a source significantly impacts how we perceive and analyze the news.

Sources say Selway tapped the run SEC’s trading markets division, potentially raising eyebrows in the current climate. Meanwhile, a separate but equally significant development is the indictment of US lawmaker McIver on three counts of impeding law enforcement, as detailed by the US Attorney here. This adds another layer of complexity to the already intriguing Selway situation, especially with the trading markets division now in the spotlight.

Evaluating Source Credibility

Understanding the source’s track record and reputation is essential. Are they known for accurate reporting in the financial sector? Have they previously published reliable information on similar topics? Their past performance often offers valuable insights into their current reporting.

Identifying Potential Biases

Sources, even seemingly objective ones, can have underlying biases. These biases might stem from their affiliations, investment strategies, or perceived conflicts of interest. For example, a source that heavily promotes a particular investment strategy might inadvertently favor that approach in their reporting. This doesn’t necessarily make the information wrong, but it does highlight the importance of considering the potential slant.

Verifying Information from Multiple Sources

It’s vital to cross-reference information from various sources. If several reputable sources report similar developments, the likelihood of the information being accurate increases. However, if only one source is reporting on the event, it’s crucial to treat the information with caution.

Reputable Financial News Sources

Reliable financial news sources often publish analyses that include multiple perspectives. Examples include The Wall Street Journal, Bloomberg, and Reuters. These publications generally have established reputations for accuracy and in-depth reporting. Their articles often cite multiple sources to strengthen their arguments.

Recognizing Potential Biases in Financial News

Financial news articles can exhibit bias in several ways. Look for statements that express strong opinions or favor a specific viewpoint without providing supporting data. Excessive use of hyperbole, emotionally charged language, or a focus on specific outcomes can also indicate potential bias. Articles relying heavily on anecdotal evidence rather than statistical data should also raise a red flag.

Potential Future Scenarios

The appointment of Selway to the Tapped Run Secs Trading Markets Division presents a unique opportunity, but also introduces significant uncertainties. Predicting the future trajectory of this division requires careful consideration of various market conditions and strategic choices. This analysis explores potential future scenarios, considering the implications for the division and its stakeholders.Understanding the potential outcomes necessitates an assessment of market dynamics, the effectiveness of Selway’s leadership, and the division’s adaptability to changing circumstances.

This evaluation considers a range of possibilities, from successful growth to significant challenges.

Potential Market Conditions and Strategic Decisions

Several key factors will influence the future performance of the Selway Tapped Run Secs Trading Markets Division. These factors include overall market trends, regulatory changes, and competitive pressures. Strategic decisions made by the division, such as investment strategies and resource allocation, will also play a critical role in shaping the outcome.

Potential Outcomes Table

| Market Condition | Strategic Decision | Potential Outcome | Implications for Stakeholders |

|---|---|---|---|

| Strong Bull Market | Aggressive Trading Strategies | High Profitability, Increased Market Share | Increased profitability for investors, potentially higher salaries for employees. |

| Strong Bull Market | Conservative Trading Strategies | Moderate Profitability, Stable Market Position | Lower risk for investors, potentially lower salaries for employees. |

| Bear Market | Hedging Strategies | Mitigation of Losses, Preservation of Capital | Lower losses for investors, potentially job security for employees. |

| Bear Market | Aggressive Trading Strategies | High Risk of Losses, Potential Capital Erosion | Significant losses for investors, potential job losses for employees. |

| Volatile Market | Adaptive Trading Strategies | Balance of Profitability and Risk Management | Profitability dependent on effective risk management, potentially moderate salaries for employees. |

Illustrative Examples from the Past

The 2008 financial crisis provides a relevant example of a bear market scenario. Investment banks that relied heavily on leveraged trading strategies suffered significant losses. Conversely, firms with robust hedging strategies were better positioned to weather the storm. The 2020 COVID-19 market crash offers another example, illustrating the need for adaptability and risk management during volatile periods.

Many investors saw substantial losses, yet companies with diversified portfolios and contingency plans fared better. These historical precedents highlight the importance of developing contingency plans and risk mitigation strategies to address potential challenges.

Contingency Plans and Risk Mitigation Strategies

To navigate potential future scenarios effectively, the division should implement contingency plans and risk mitigation strategies. These strategies might include:

- Diversification of Trading Strategies: Developing a portfolio of trading strategies that address various market conditions. This strategy reduces reliance on a single approach and mitigates risk during periods of market volatility.

- Hedging Instruments: Utilizing hedging instruments to mitigate potential losses in declining markets. Examples include options, futures, and swaps.

- Robust Risk Management Systems: Implementing sophisticated risk management systems to monitor and control market exposures. This includes stress testing, scenario analysis, and daily position limits.

- Capital Reserves: Maintaining adequate capital reserves to absorb potential losses and fund future opportunities.

- Adaptable Workforce: Cultivating a workforce with adaptable skills to respond effectively to changing market conditions and strategic shifts.

Illustrative Examples and Visualizations: Selway Tapped Run Secs Trading Markets Division Sources Say

Diving deeper into the Selway Tapped Run Secs Trading Markets Division, visualizing performance and potential scenarios is crucial. Illustrative examples using market charts and graphs, historical data, and potential scenarios provide a tangible understanding of the division’s past performance and possible future trajectories. These visualizations will help us assess the impact of market indicators on the division’s success.

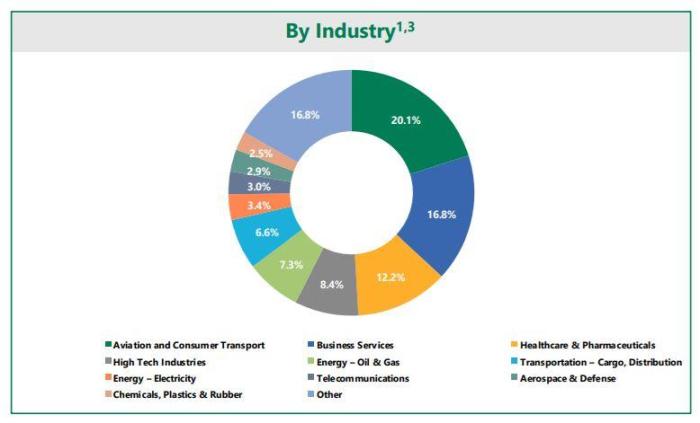

Market Chart Examples of Similar Trading Divisions, Selway tapped run secs trading markets division sources say

Understanding the performance of comparable trading divisions offers valuable context. Analyzing their historical data allows for informed comparisons and potential projections for the Selway division. Charts showcasing trading volume, profit margins, and key market indicator correlations will be presented. For instance, a chart displaying the volume of trades executed daily alongside the movement of the Dow Jones Industrial Average would be illustrative.

Historical Market Data Related to Trading Activities

Historical data provides insights into past performance trends and patterns. Examining the division’s trading activities over time helps understand market response to various events. A comprehensive table showcasing monthly trading volume, average daily returns, and market indices during specific periods is beneficial. This historical data can be correlated with key economic events to observe the impact on trading activity.

For example, the table could display data for Q1 2022 and Q1 2023, comparing trading performance against prevailing market conditions, including interest rate changes.

Potential Scenarios Visualized

Visualizing potential scenarios allows for proactive planning and preparedness. Diagrams and graphs representing different market conditions (e.g., bull, bear, or sideways markets) can demonstrate how the division might perform under various scenarios. This allows for the development of contingency plans to mitigate potential risks. For instance, a graph illustrating the division’s potential profit under a bear market scenario, compared to a bull market scenario, would be illustrative.

The visualization should be accompanied by an analysis of the underlying assumptions and variables.

Impact of Key Market Indicators on Trading Division Performance

Key market indicators significantly affect a trading division’s performance. Understanding these relationships is vital for accurate prediction and strategic decision-making. Visualizations can illustrate the correlation between key indicators like the S&P 500 index and the division’s daily trading volume. For example, a scatter plot showing the relationship between interest rate changes and the trading division’s profitability would be insightful.

Division Structure and Reporting Lines

This diagram illustrates the organizational structure and reporting lines within the Selway Tapped Run Secs Trading Markets Division. The structure highlights key roles and responsibilities, enabling a clear understanding of how decisions are made and implemented. The diagram should be a simplified organizational chart, showing reporting lines from junior traders to senior managers, with a clear representation of the division’s leadership team.

Final Review

In conclusion, the appointment of Selway to the Run Secs Trading Markets Division presents a complex scenario with both promising opportunities and potential risks. The division’s future performance hinges on several factors, including market conditions, strategic decisions, and the execution of contingency plans. Understanding the historical context, the concept of “Tapped Run Secs,” and the evolving market landscape is crucial for assessing the likely outcomes.

Further analysis and monitoring are warranted as the division navigates this pivotal period.