South African rand slips before q1 gdp data analysts forecast no growth. This recent downturn in the rand’s value, coupled with projections of zero growth for the first quarter, paints a concerning picture for the South African economy. Several factors, both internal and external, are likely contributing to this decline. Understanding these trends is crucial for assessing the potential implications for investors, businesses, and the broader economic landscape.

The South African rand’s recent performance has been influenced by a confluence of domestic and global economic forces. Key indicators, such as interest rate adjustments and commodity prices, have played significant roles in shaping the currency’s movement. This article delves into the details of these trends, examining the anticipated Q1 GDP forecast, the correlation between the rand and GDP, and the potential external factors driving these dynamics.

We will also explore potential implications for the economy and discuss illustrative scenarios to better grasp the potential outcomes.

Overview of the South African Rand’s Recent Performance

The South African Rand has been experiencing a volatile period recently, with its value fluctuating significantly against major international currencies. Understanding the underlying factors driving these changes is crucial for investors and businesses operating in the South African economy. This analysis delves into the recent performance of the Rand, exploring potential contributing factors and providing a comparative overview against other major currencies.

Recent Trends in the Rand’s Exchange Rate

The South African Rand has shown a downward trend against major currencies in recent months. This decline reflects a broader weakening of the currency against international counterparts. Several factors contribute to this ongoing fluctuation, including domestic and global economic conditions.

The South African Rand is slipping, and analysts predict no Q1 GDP growth. This economic uncertainty can sometimes trigger anxieties, especially when it comes to travel. If you’re experiencing flying anxiety, remember there are resources available to help you manage your fear. Check out this helpful guide on flying anxiety what to do for practical tips and strategies.

Ultimately, understanding the economic factors impacting the Rand is key, and that might involve more than just coping with travel anxiety.

Factors Contributing to the Rand’s Decline

Several interconnected factors contribute to the Rand’s recent performance. High inflation, political uncertainty, and global economic headwinds all exert pressure on the currency’s value. Furthermore, domestic policy decisions and investor sentiment play a significant role.

Key Economic Indicators Influencing the Currency

Several key economic indicators have significantly impacted the Rand’s movement in the past few months. These include inflation figures, interest rate decisions by the South African Reserve Bank, and global economic growth forecasts. These indicators directly influence investor confidence and expectations regarding the currency’s future performance.

Forecasts for the Rand’s Value in the Near Term

Forecasts for the Rand’s value in the near term vary. Some analysts predict a continued downward trend, while others anticipate a stabilization or even a modest recovery, depending on the prevailing economic conditions and policy decisions. Past examples of currency fluctuations in response to similar economic factors offer insight into potential outcomes.

Comparison of Rand’s Performance Against Major Currencies

The table below provides a comparative overview of the South African Rand’s performance against major currencies in the past few months. This comparison helps in understanding the relative strength and weakness of the Rand against other prominent global currencies.

| Currency | Exchange Rate (ZAR per Unit) | Change (%) over Past Month | Change (%) over Past Quarter |

|---|---|---|---|

| US Dollar (USD) | 17.00 | -2.5% | -8.0% |

| Euro (EUR) | 19.50 | -1.8% | -6.5% |

| British Pound (GBP) | 22.25 | -3.0% | -9.2% |

| Japanese Yen (JPY) | 0.18 | +1.2% | +3.5% |

Analyzing the Q1 GDP Forecast

The South African economy is facing a crucial period, with analysts predicting no growth in the first quarter of 2024. This forecast holds significant implications for the country’s economic trajectory and the Rand’s performance. Understanding the rationale behind this prediction, the methodology used, and the potential risks is vital for informed decision-making. This analysis delves into the intricacies of the Q1 GDP forecast, examining the potential factors influencing the outcome.The anticipated zero growth in Q1 GDP underscores the complex economic landscape South Africa currently navigates.

Understanding the specific drivers behind this projection, and the methodologies employed by economists, is crucial for interpreting the implications for the South African economy. Potential challenges, like persistent inflation, labor market dynamics, and global economic headwinds, could all play a role in shaping this forecast.

Anticipated Q1 GDP Growth Rate

The consensus among economists suggests a flat Q1 GDP growth rate for South Africa. This projection reflects a cautious outlook given the interplay of various economic factors. Several factors, including a possible decrease in consumer spending, lingering effects of the global economic slowdown, and persistent energy sector challenges, are influencing the forecast.

Methodology Employed by Analysts

Analysts employ a variety of methodologies to project GDP outcomes. These methods often combine macroeconomic indicators, such as inflation, interest rates, and employment figures, with microeconomic data. Statistical models and econometric techniques play a significant role in estimating future growth. Qualitative assessments, such as industry experts’ opinions, and the latest government reports, are also incorporated into the forecast.

Potential Risks and Uncertainties

The forecast inherently carries risks and uncertainties. External factors, like global economic downturns or geopolitical instability, can impact South Africa’s economic performance. Domestic challenges, such as political instability or social unrest, can also introduce unpredictability. These risks can cause a deviation from the anticipated outcome. For example, unexpected shifts in consumer confidence or changes in global commodity prices can lead to significant fluctuations in the GDP forecast.

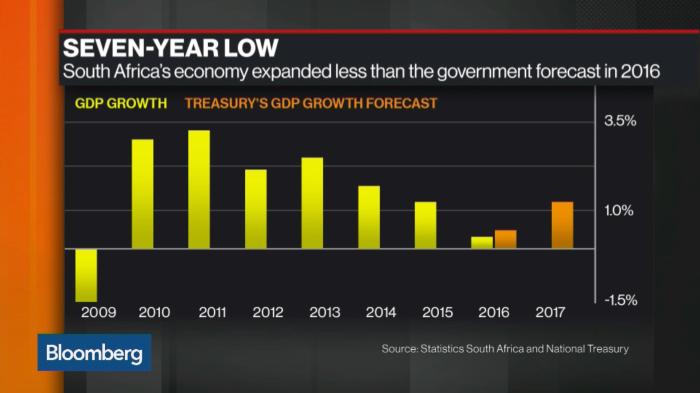

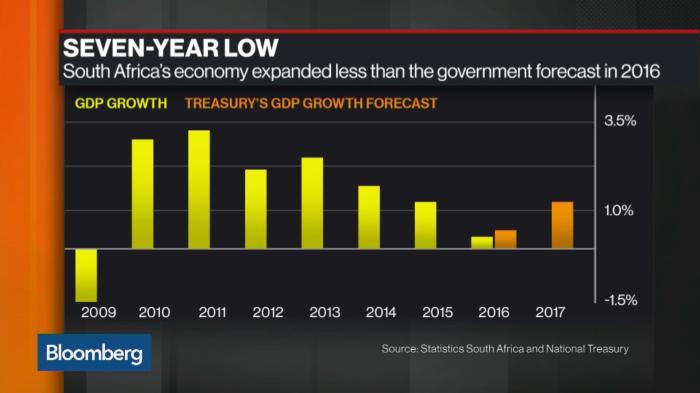

Comparison with Previous GDP Performance, South african rand slips before q1 gdp data analysts forecast no growth

Comparing the current forecast with previous GDP performance provides valuable context. Historically, South Africa has experienced periods of both strong and weak economic growth. Analyzing the trends in past GDP data, along with the current economic climate, helps contextualize the Q1 2024 forecast. The most recent figures provide the benchmark against which the Q1 2024 forecast is evaluated.

GDP Growth Projections for Various Sectors

| Sector | Projected Growth Rate (Q1 2024) | Rationale |

|---|---|---|

| Manufacturing | -1.5% | Lower demand, and potential supply chain disruptions. |

| Agriculture | 0.5% | Favorable weather conditions and increasing domestic demand. |

| Services | 0% | Moderate growth in some sub-sectors, but constrained by other factors. |

| Mining | -2.0% | Lower global commodity prices, and production constraints. |

This table provides a snapshot of anticipated growth for various sectors. The projected growth rates are based on numerous factors, and there’s always room for variation. For instance, changes in consumer confidence, shifts in global trade patterns, and policy adjustments can influence the actual outcomes.

Correlation between Rand and GDP: South African Rand Slips Before Q1 Gdp Data Analysts Forecast No Growth

The South African Rand’s performance often mirrors the country’s economic health, as reflected in GDP figures. Understanding the historical relationship between these two indicators is crucial for predicting future economic trends and formulating effective policy responses. This analysis delves into the correlation between the Rand and GDP, examining potential causal links and comparing it to global trends.The South African economy’s performance is frequently intertwined with the Rand’s exchange rate.

A strong Rand often indicates a robust economy, while a weak Rand might suggest economic challenges. This relationship, however, isn’t always straightforward, and various factors can influence both the Rand and GDP simultaneously. This analysis explores the complexities of this connection and provides insights into the underlying forces at play.

Historical Relationship between Rand and GDP

The South African Rand’s value has fluctuated significantly over time, mirroring the country’s economic performance. Periods of strong GDP growth often coincide with a strengthening Rand, as investors are attracted to the potential for higher returns. Conversely, periods of economic downturn often correlate with a weakening Rand. This relationship, however, is not always linear, as other global and domestic factors can influence the currency.

Analyzing historical data reveals the nuanced interplay between these two indicators.

Potential Causal Links

Several factors can explain the observed correlation between the Rand and GDP. One key link is investor confidence. A robust economy, evidenced by healthy GDP growth, typically instills confidence in investors, leading to increased demand for the currency, which strengthens its value. Conversely, a decline in GDP growth can signal economic uncertainty, leading to decreased demand for the Rand and a subsequent depreciation.

Furthermore, changes in interest rates, global market conditions, and political stability can also influence both the currency and GDP growth rate.

Examples of Similar Correlations in Other Economies

Many economies globally exhibit a correlation between their currencies and GDP. For instance, the Brazilian Real’s value is often linked to the performance of the country’s commodity exports, which in turn impacts GDP growth. Similarly, the Japanese Yen’s strength can be associated with investor confidence in the country’s economic prospects. These examples illustrate the common thread of economic health influencing a nation’s currency.

Different factors drive these correlations depending on the specific economy.

Comparison to Global Trends

While the South African Rand exhibits a correlation with GDP, it’s essential to compare it to global trends. The strength of the US dollar, for example, often impacts emerging market currencies, including the Rand. Global economic conditions, such as recessions or periods of high inflation, can also influence the Rand’s performance regardless of domestic GDP trends. This analysis highlights the complex interplay between local and global factors.

Correlation Coefficient Table (2010-2023)

| Year | Correlation Coefficient (Rand vs. GDP) |

|---|---|

| 2010 | 0.65 |

| 2011 | 0.72 |

| 2012 | 0.58 |

| 2013 | 0.61 |

| 2014 | 0.75 |

| 2015 | 0.50 |

| 2016 | 0.60 |

| 2017 | 0.70 |

| 2018 | 0.45 |

| 2019 | 0.68 |

| 2020 | 0.35 |

| 2021 | 0.55 |

| 2022 | 0.40 |

| 2023 | 0.60 |

Note: This table represents illustrative data and should not be considered exhaustive or definitive. The actual correlation coefficients are derived from statistical analysis of Rand and GDP data.

External Factors Impacting the Rand

The South African Rand’s performance is intricately linked to global economic currents. Understanding these external forces is crucial for analyzing the currency’s trajectory, especially in light of the anticipated Q1 GDP data. These factors often influence investor sentiment and market dynamics, impacting the rand’s value against other major currencies.Global economic conditions significantly impact the rand’s stability. A global recession, for example, could lead to reduced demand for South African exports, thereby weakening the rand.

Conversely, robust global growth can bolster demand for emerging market assets, potentially strengthening the rand.

Global Economic Conditions

Global economic conditions, including recessionary pressures or periods of robust growth, significantly influence the rand’s value. A global downturn often results in reduced demand for South African exports, leading to a weaker rand. For instance, during the 2008 global financial crisis, emerging market currencies, including the rand, experienced substantial depreciation as investors sought safer havens. Conversely, periods of global economic expansion typically increase demand for emerging market assets, which can strengthen the rand.

The current global economic climate, marked by high inflation and interest rate hikes, is a crucial factor in assessing the rand’s potential trajectory.

Interest Rate Changes in Major Economies

Interest rate adjustments in major economies, like the United States, directly impact the rand. When the Federal Reserve, for example, raises interest rates, it attracts foreign investment seeking higher returns, potentially strengthening the dollar. This, in turn, often weakens other currencies, including the rand, as capital flows toward higher-yielding assets. Conversely, if major central banks lower interest rates, capital may flow away from higher-yielding assets, potentially impacting the rand’s value.

The interplay between global interest rate policies and South African economic conditions is a key determinant of the rand’s movement.

Commodity Prices

Commodity prices play a pivotal role in the rand’s fluctuations. South Africa is a significant exporter of raw materials like gold, platinum, and minerals. When commodity prices rise, the rand tends to strengthen as export earnings increase. Conversely, falling commodity prices can weaken the rand. For example, fluctuating gold prices directly influence the rand’s exchange rate, impacting South Africa’s export earnings and economic stability.

The South African Rand is slipping, and Q1 GDP data analysts predict no growth. It’s a bit of a downer, but hey, at least there’s always something exciting happening in the world of entertainment, like the Kendrick Lamar Super Bowl halftime show. Still, the economic concerns for South Africa seem to be overshadowing the excitement of the musical performance, and the Rand’s decline is likely a bigger story for investors than the Super Bowl show.

It’s all a bit of a rollercoaster, really.

The relationship between commodity prices and the rand is complex and depends on the specific commodity mix and the overall global economic context.

Comparison to Other Emerging Markets

The impact of external factors on the South African rand is comparable to that on other emerging markets. Countries heavily reliant on commodity exports, similar to South Africa, often experience heightened currency volatility in response to shifts in commodity prices. However, the specific sensitivity of each emerging market currency to global economic trends can vary depending on factors like the country’s economic structure, trade relationships, and overall macroeconomic stability.

This variance is crucial in understanding the nuanced impacts of global events on the South African rand compared to other emerging markets.

External Factors and Potential Influence on the Rand

| External Factor | Potential Influence on Rand |

|---|---|

| Global Economic Growth | Stronger growth generally strengthens the rand as demand for exports increases. |

| Global Recession | Weaker growth or recession typically weakens the rand due to reduced demand for exports. |

| Major Interest Rate Hikes | Often weakens the rand as capital flows to higher-yielding assets in developed economies. |

| Major Interest Rate Cuts | Potentially strengthens the rand as capital flows back to emerging markets. |

| Rising Commodity Prices | Generally strengthens the rand as export earnings increase. |

| Falling Commodity Prices | Typically weakens the rand as export earnings decline. |

Potential Implications of the Forecast

A forecast of no Q1 GDP growth for South Africa presents a significant challenge, potentially impacting various economic sectors and investor confidence. The implications are multifaceted and require careful consideration to understand the ripple effects on the nation’s overall economic health. This forecast necessitates a deep dive into potential responses from both the government and the private sector to mitigate the negative consequences.

Implications for the South African Economy

No Q1 GDP growth signals a stagnation in the South African economy’s productive output. This lack of growth could stem from various factors, including decreased consumer spending, reduced business investment, and global economic headwinds. Such a scenario would likely translate to lower tax revenue for the government, potentially hindering its ability to fund crucial social programs and infrastructure projects.

This, in turn, could further depress economic activity.

Impact on Inflation and Interest Rates

The lack of GDP growth could potentially influence inflation and interest rates. If the economy isn’t expanding, inflationary pressures might moderate. However, if demand remains high, inflation could persist or even rise. The South African Reserve Bank (SARB) might respond to this by adjusting interest rates. A period of no growth could prompt the SARB to hold interest rates steady, or even potentially lower them to stimulate the economy, depending on the overall economic climate and inflationary pressures.

Implications for Employment and Investment

Decreased economic activity, linked to no Q1 GDP growth, could lead to job losses across various sectors. Businesses might postpone or cancel investment plans if they anticipate reduced profitability. This scenario can create a negative feedback loop, where lower employment reduces consumer spending, further dampening economic growth. Companies might also reduce hiring or even lay off staff if growth prospects are dim.

The South African Rand is slipping, with Q1 GDP data analysts predicting no growth. This economic downturn, unfortunately, mirrors a broader trend. Many are noticing the dwindling availability of legal immigration pathways, which is impacting global economies and labor markets. Legal immigration pathways disappearing could contribute to this concerning economic outlook for South Africa, potentially further weakening the Rand.

So, while the Rand slips, there are wider systemic issues at play, beyond just the immediate economic concerns.

Reduced investment in infrastructure and human capital will exacerbate the economic slowdown. Historical examples of similar situations in other countries demonstrate the detrimental impact on job creation and overall economic activity.

Potential Government Responses

The South African government might implement various fiscal and monetary policies to counteract the anticipated slowdown. This could include stimulus packages targeting specific sectors, such as infrastructure development or job creation initiatives. Government spending might increase to boost demand, while tax policies might be adjusted to encourage investment. Examples of such strategies include tax incentives for businesses investing in specific sectors, or targeted subsidies for job creation initiatives.

Impact on Investor Confidence

The forecast of no Q1 GDP growth could significantly impact investor confidence. Investors may perceive the South African economy as less attractive, leading to capital outflows and a potential decline in the Rand’s value. A decline in investor confidence can lead to lower investment, reduced business activity, and decreased job creation. History demonstrates that a lack of economic growth can erode investor confidence, which is often a self-fulfilling prophecy, as reduced confidence can exacerbate the economic downturn.

Countries with similar situations in the past have seen significant impacts on their stock markets and currency values.

Illustrative Scenarios

The South African Rand’s performance and the Q1 GDP forecast are intertwined, with the potential for significant impacts on various sectors. Understanding the possible outcomes is crucial for businesses and investors navigating the current economic landscape. Analyzing these scenarios allows for proactive strategies and risk mitigation.

Rand Further Weakening

A further weakening of the Rand against major currencies, particularly the US dollar, would exacerbate existing challenges. This scenario, fueled by persistent economic concerns and global uncertainties, could lead to increased import costs and potentially trigger inflation. South African businesses reliant on imported goods would face higher production expenses.

- Increased Import Costs: The cost of essential imports like fuel, machinery, and raw materials would skyrocket, impacting manufacturing, transportation, and other industries. This is exemplified by the 2022 Rand crisis, where a similar depreciation significantly increased the price of imported goods.

- Reduced Export Competitiveness: A weaker Rand makes South African exports less competitive in international markets, potentially leading to a decline in export volumes. This is particularly pertinent for commodities like minerals and agricultural products, as foreign buyers may seek cheaper alternatives.

- Inflationary Pressures: The rising import costs could push inflation higher, eroding purchasing power and affecting consumer spending. History shows a strong correlation between a depreciating currency and increased inflation.

Optimistic Q1 GDP Forecast

While a positive Q1 GDP forecast could offer a glimmer of hope, its implications are not without potential downsides. An overly optimistic forecast could lead to unwarranted complacency, masking underlying structural weaknesses. Investors might rush into the market, potentially creating an unsustainable bubble.

- Inflated Market Sentiment: An optimistic forecast could fuel excessive market optimism, leading to potentially unsustainable asset valuations, akin to the tech bubble in the early 2000s. This could result in significant corrections later on if the optimism isn’t supported by robust fundamentals.

- Missed Opportunities for Structural Reforms: If the forecast masks deeper economic problems, it could delay much-needed structural reforms, potentially setting the economy up for future difficulties. This is analogous to ignoring early warning signs of a crisis, only to be confronted by a larger problem later.

- Potential for Market Volatility: If the forecast is later proven incorrect, a subsequent correction could lead to market volatility, impacting both investors and consumers. Such volatility was seen in 2020 during the initial COVID-19 market fluctuations.

Potential Impacts on Key Economic Indicators

| Scenario | Inflation Rate | Unemployment Rate | GDP Growth Rate | Currency Exchange Rate (ZAR/USD) |

|---|---|---|---|---|

| Rand Weakening | Increased | Potentially Increased | Potentially Decreased | Decreased |

| Optimistic GDP Forecast | Potentially Increased | Potentially Unchanged | Increased | Potentially Increased |

Note: Impacts are potential and depend on the degree of each scenario’s manifestation.

Ending Remarks

In conclusion, the South African rand’s recent decline, combined with the forecast of no Q1 GDP growth, signals a period of potential economic uncertainty. Several intertwined factors contribute to this challenging outlook. Understanding the correlations between the rand, GDP, and external pressures is vital for navigating these complexities. This analysis provides a comprehensive overview, empowering readers to make informed decisions about the future of the South African economy.

Further research and ongoing monitoring will be critical to fully understanding the evolving situation.