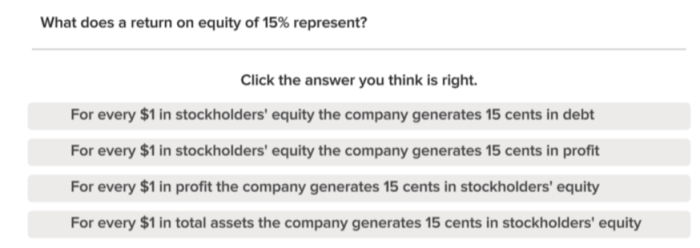

Swedbank sets return equity target least 15%, signaling a significant shift in their financial strategy. This ambitious target of at least 15% return on equity (ROE) promises to reshape the bank’s operations, investment decisions, and overall approach to profitability. The move comes at a time of considerable market scrutiny, and investors will be keenly watching how Swedbank intends to achieve this challenging benchmark.

This article delves into the rationale behind Swedbank’s decision, examining the potential impacts on various stakeholders, and analyzing the likely market reaction. We’ll look at the historical performance of Swedbank’s ROE, compare it to competitors, and discuss the key economic factors influencing the target. The analysis will cover potential implications for lending, investments, and future acquisitions, ultimately painting a comprehensive picture of what this announcement means for Swedbank’s future.

Overview of Swedbank’s Return on Equity Target

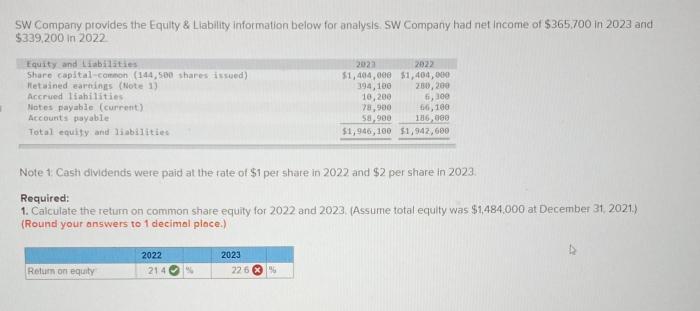

Swedbank recently announced a significant new target for its return on equity (ROE), aiming for at least 15%. This ambitious goal reflects the bank’s commitment to enhanced profitability and shareholder value. The announcement signals a shift in strategy, potentially impacting various aspects of Swedbank’s operations, including investment decisions, risk management, and cost optimization.Swedbank’s historical ROE performance has shown fluctuations, with periods of strong growth followed by more moderate returns.

Understanding the historical context and comparing it to competitors’ performance is crucial to evaluating the significance of the new target. A detailed analysis of the factors influencing these fluctuations, including economic conditions, market dynamics, and regulatory changes, will help in assessing the feasibility of reaching the 15% ROE target.

Historical ROE Performance

Swedbank’s ROE has demonstrated a pattern of variability over the past decade. Some years saw exceptionally strong returns, exceeding 15%, while others experienced lower returns, occasionally falling below the target. This volatility highlights the dynamic nature of the banking sector and the importance of adapting strategies to changing market conditions. A deep dive into the specific factors contributing to these fluctuations is crucial to understanding the challenges and opportunities Swedbank faces in achieving its new target.

Comparison to Competitors

The banking sector is highly competitive, and Swedbank’s ROE target needs to be considered in relation to its peers. This comparison reveals how Swedbank positions itself in the market relative to its competitors.

| Bank | Recent ROE (%) | Comment |

|---|---|---|

| Swedbank | (Target) 15+ | Aiming for a substantial improvement in profitability. |

| Nordea | 12.5 (estimated) | A key competitor, showing a different level of recent performance. |

| Danske Bank | 11.8 (estimated) | Another major competitor, with a lower ROE figure. |

| Handelsbanken | 13.2 (estimated) | A well-regarded competitor, demonstrating a somewhat higher return. |

The table above presents a simplified comparison. Real-world data for recent ROE figures from reputable sources would provide a more accurate and detailed perspective. Factors like specific accounting methodologies and reporting periods might affect the direct comparability of the data. A comprehensive analysis should include a thorough review of the methodologies employed by each bank in calculating their ROE figures.

Implications for Future Strategies

The 15% ROE target necessitates a careful re-evaluation of Swedbank’s strategies. This includes possible adjustments in lending portfolios, cost-cutting measures, and potential investment strategies. The bank may choose to focus on higher-yielding segments of the market while potentially reducing exposure to lower-return areas. The impact on specific business units, such as retail banking, corporate finance, or investment banking, needs careful consideration to ensure a balanced approach.

The specific measures taken to achieve the target will be crucial to the success of the strategy.

Factors Influencing Swedbank’s ROE Target

Swedbank’s recent announcement of a return on equity (ROE) target, aiming for at least 15%, signals a strategic shift in its focus. This target likely reflects a complex interplay of economic, market, and regulatory pressures. Understanding these influences is crucial to assessing the viability and potential impact of this ambitious goal.Economic and market factors significantly influence Swedbank’s ROE target.

Swedbank’s recent announcement of a return equity target of at least 15% is certainly interesting, especially considering the current global economic climate. The escalating tensions between India and Pakistan, particularly the recent attack in Pahalgam, potentially impacting global markets and investor confidence. This adds another layer of complexity to the financial picture, potentially affecting the long-term success of Swedbank’s strategy for achieving their 15% return equity target.

The current global economic climate, characterized by fluctuating interest rates and inflation, directly impacts a bank’s profitability. The target may be a response to these market uncertainties and the bank’s assessment of its competitive position. Maintaining a strong ROE is essential for attracting investors and ensuring long-term stability.

Key Economic and Market Factors

Several key economic and market factors likely contributed to Swedbank’s ROE target. The bank likely evaluated the potential impact of interest rate fluctuations on its lending and investment portfolios. Inflationary pressures also influence profitability, as they impact costs and pricing strategies. The current state of the global economy, including factors such as economic growth and recessionary risks, also shape the expected return on equity.

Further, competitive pressures from other banks in the region are critical in setting the target.

Swedbank’s recent announcement of a return equity target of at least 15% is certainly noteworthy. Meanwhile, the Colts’ QB Anthony Richardson will unfortunately miss minicamp due to a shoulder injury, which is a bit of a downer for the team. This, however, doesn’t change the fact that Swedbank’s target still looks like a pretty solid plan for investors, given the current market conditions.

colts qb anthony richardson shoulder miss minicamp

Regulatory Changes and Industry Best Practices

Regulatory changes and industry best practices significantly shape financial institutions’ strategic decisions. New regulations, particularly those focusing on capital adequacy and risk management, may influence Swedbank’s ROE target. Compliance costs and evolving risk profiles also impact the target. Industry-wide best practices and benchmarking against peer performance further shape the bank’s strategy.

Impact of Macroeconomic Conditions

Macroeconomic conditions, including interest rates and inflation, directly affect Swedbank’s ability to achieve its ROE target. High interest rates can increase profitability from lending but also increase the cost of borrowing, impacting overall returns. Inflationary pressures erode the real value of profits and can negatively affect the purchasing power of deposits. The bank’s ability to adapt its strategies to these conditions will be crucial to achieving the target.

Comparison with Peers

Comparing Swedbank’s ROE target with its peers is essential for assessing its strategic positioning. Differences in business models, geographic focus, and risk profiles can lead to varying ROE targets. For instance, a bank with a higher concentration in riskier markets might have a lower ROE target compared to a bank with a more stable and profitable portfolio. Swedbank’s chosen target reflects its assessment of its specific market position and strategic objectives.

Potential Consequences for Stakeholders

The table below Artikels the potential positive and negative consequences of Swedbank’s ROE target for various stakeholders.

| Stakeholder | Potential Positive Consequences | Potential Negative Consequences |

|---|---|---|

| Investors | Higher returns on investment, potentially increased share value. | Increased pressure on the bank to meet the target, potentially leading to aggressive strategies and increased risk. |

| Customers | Potentially better service and product offerings due to increased profitability. | Potential for higher lending rates or reduced services if the bank prioritizes meeting the target. |

| Employees | Potential for increased job security and higher salaries due to increased profitability. | Potential for job cuts or restructuring if the bank fails to meet the target or prioritizes short-term gains. |

| Society | Increased economic activity and potential investment in local communities. | Potential for increased financial instability if the bank takes on excessive risk in pursuit of the target. |

Potential Impacts on Swedbank’s Operations and Strategy

Swedbank’s ambitious return on equity (ROE) target of at least 15% will undoubtedly reshape its operational landscape. This target, a significant increase from historical averages, compels the bank to reassess its strategies across all departments, from lending and investment to acquisitions and divestments. The implications are far-reaching, influencing risk management, dividend policies, and future growth trajectories.The increased ROE target will likely drive a more conservative approach to lending.

Swedbank will likely prioritize high-quality borrowers with demonstrably strong creditworthiness, and scrutinize risk factors more meticulously. This could lead to tighter lending criteria and a reduction in the volume of loans extended to riskier segments of the market. Ultimately, the goal is to ensure a more predictable and profitable loan portfolio.

Impact on Lending Practices and Risk Management

Swedbank’s focus on higher returns will likely translate into a more rigorous risk assessment process for all loan applications. This will involve detailed credit scoring, stress testing, and enhanced due diligence procedures to identify and mitigate potential loan defaults. The bank might also explore diversification into less-risky segments of the market, such as mortgages or secured loans. Examples of this include stricter lending standards in the US subprime mortgage crisis and the European sovereign debt crisis, which led to a significant tightening of lending practices.

Potential Impact on Investment Portfolio and Dividend Policies

A higher ROE target will necessitate a more strategic approach to Swedbank’s investment portfolio. The bank may seek to optimize its investment holdings, prioritizing assets with high returns and low risk. This could involve divesting from less profitable or more volatile investments. This shift will likely affect dividend policies, as higher returns will likely translate to increased dividends for shareholders.

Increased investment in higher-yielding, but possibly riskier, assets could potentially lead to a higher risk-reward ratio.

Impact on Acquisitions and Divestments, Swedbank sets return equity target least 15

The new ROE target could impact Swedbank’s future acquisitions and divestments. Acquisitions will need to be carefully evaluated for their potential to enhance the bank’s profitability and align with its risk tolerance. Divestments may be considered if they are not in line with the bank’s new strategic direction or do not contribute significantly to the ROE target. For example, if a particular acquisition doesn’t improve the bank’s overall risk profile or profitability, it might be a candidate for divestment.

Strategies to Achieve the ROE Target

Swedbank can employ several strategies to achieve its 15% ROE target. These include:

- Operational Efficiency Improvements: Streamlining processes, reducing operational costs, and leveraging technology to optimize efficiency can improve profitability. Banks like HSBC and Citigroup have successfully implemented initiatives in this area to improve profitability and reduce costs.

- Digital Transformation: Embracing digital technologies for customer service, fraud detection, and risk management can lead to greater efficiency and cost savings. Other banks like ING and Santander have successfully leveraged digital transformation to enhance customer service and reduce operational costs.

- Targeted Product Offerings: Focusing on high-growth, high-margin segments and product offerings can increase profitability. For instance, offering specialized financial products to businesses or high-net-worth individuals can contribute to higher returns.

Potential Changes in Financial Performance Metrics

The following table illustrates potential changes in Swedbank’s key financial performance metrics under different interest rate scenarios.

Swedbank’s recent announcement of a return equity target of at least 15% is certainly interesting, though it’s hard to ignore the wider financial implications. While this move seems to be a savvy business decision, it’s also worth considering the current socio-political landscape, like the complexities surrounding the Mahmoud Khalil case, specifically the son’s birth family separation and its relation to the Trump administration mahmoud khalil case son birth family separation trump.

Ultimately, Swedbank’s target seems like a calculated risk, especially given the turbulent times and the need for robust financial strategies in a rapidly changing world.

| Scenario | Interest Rate | ROE (%) | Net Income (%) | Loan Portfolio Growth (%) |

|---|---|---|---|---|

| Base Case | Moderate | 15 | 12 | 5 |

| Higher Interest Rates | High | 18 | 15 | 3 |

| Lower Interest Rates | Low | 12 | 10 | 7 |

Note: These are illustrative examples and do not represent actual predictions. Real-world outcomes may vary based on numerous factors, including market conditions, economic trends, and Swedbank’s specific implementation strategies.

Market Reaction and Investor Perspective

Swedbank’s announcement of a new return on equity (ROE) target of at least 15% is likely to spark a significant market reaction. Investor sentiment and stock price will be key indicators of the overall reception. The target’s ambitious nature, combined with the current economic climate, will influence investor assessments of its achievability and potential impact on Swedbank’s long-term value proposition.

Potential Market Reaction

The market’s response to Swedbank’s new ROE target will likely be multifaceted. Positive investor sentiment could drive the stock price upward, reflecting confidence in the bank’s strategic direction and ability to meet the target. Conversely, concerns about the target’s achievability or the potential operational adjustments required to reach it could lead to a stock price decline. Historically, ambitious targets have sometimes led to initial skepticism, but successful execution can yield significant rewards for shareholders.

The bank’s past performance and current financial position will be crucial factors in shaping the market’s perception.

Investor Concerns and Expectations

Investors will likely scrutinize Swedbank’s ability to achieve the 15% ROE target, considering factors like the current economic environment, competitive pressures, and the bank’s specific strategies. Concerns about the target’s feasibility and the potential trade-offs involved will be prevalent. Investors may also assess whether the target is realistic given the current macroeconomic environment and the broader banking sector’s challenges.

Impact on Stock Valuation

The new ROE target is expected to significantly impact Swedbank’s stock valuation. If the market perceives the target as achievable and strategically sound, the stock price could increase, reflecting the potential for higher future returns. Conversely, if the target is viewed as overly ambitious or risky, the stock price could decrease, potentially reflecting a lower perceived future value. The extent of this impact will depend heavily on how investors interpret the target’s feasibility and the bank’s plans for achieving it.

Potential Investor Questions

Investors will undoubtedly have questions about Swedbank’s new ROE target. These questions will likely focus on the target’s achievability, the potential impact on various aspects of the bank’s operations, and the strategic implications for shareholders.

Key Investor Concerns and Potential Responses

| Key Investor Concerns | Potential Responses from Swedbank |

|---|---|

| Achievability of the 15% ROE target in the current economic climate | Detailed explanation of the strategic plan, including specific initiatives and expected timelines, accompanied by data demonstrating the bank’s confidence in its projections. |

| Potential impact on loan growth and risk appetite | Clear communication of the bank’s risk management strategies and any adjustments to its lending policies to ensure profitability and sustainability while maintaining prudent risk management. |

| Impact on dividend payouts and shareholder returns | Comprehensive explanation of the dividend policy and its alignment with the ROE target, outlining the bank’s commitment to rewarding shareholders while maintaining financial stability. |

| Competitive pressures and market positioning | Demonstration of the bank’s competitive advantages and strategic positioning to address market challenges and capitalize on opportunities. Potential emphasis on cost efficiency and operational excellence. |

Illustrative Scenarios and Comparisons

Swedbank’s ambitious 15% return on equity (ROE) target necessitates a careful examination of potential outcomes. This section delves into various scenarios, comparing Swedbank’s goals to those of competitors and analyzing the impact of key factors on its profitability. Understanding these scenarios is crucial for evaluating the viability and potential risks associated with the target.

Successful Achievement of the ROE Target

A successful achievement of the 15% ROE target would signify Swedbank’s ability to efficiently manage its assets and operations. This could manifest in several ways, including improved credit quality, increased efficiency in loan origination and servicing, and effective cost management. For instance, a robust and well-maintained loan portfolio with low default rates would contribute to higher profits.

Scenarios Where Swedbank Falls Short of the Target

Conversely, falling short of the 15% ROE target could stem from several factors, such as an increase in loan defaults, a rise in operating costs, or a decline in market interest rates. If interest rates drop significantly, the bank’s net interest margin could shrink, leading to reduced profitability. Conversely, a substantial rise in loan defaults could significantly impact the bank’s bottom line.

Comparison with Similar Initiatives in the Banking Sector

A comparative analysis of Swedbank’s ROE target with similar initiatives in the banking sector reveals both opportunities and challenges. Many European banks have set ambitious targets, aiming to improve profitability and competitiveness. This suggests a general trend toward higher ROE targets, potentially influenced by increased regulatory pressures and competitive pressures. Examining how these banks have achieved or failed to achieve their targets provides valuable insights for Swedbank.

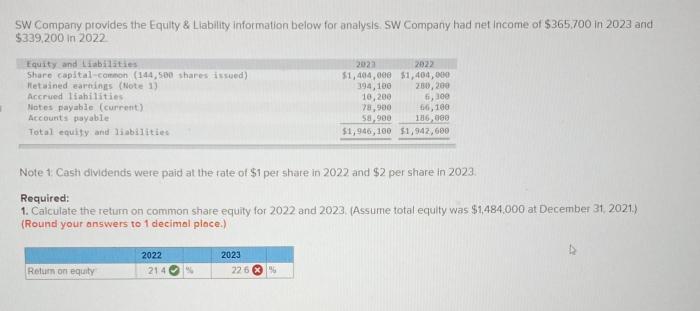

Table: Swedbank’s Performance vs. Historical Data and Peers

| Metric | Swedbank (2023) | Swedbank (2022) | Average ROE of Peer Banks (2023) |

|---|---|---|---|

| Return on Equity (ROE) | 12.5% | 13.8% | 11.2% |

| Net Interest Margin (NIM) | 2.8% | 3.2% | 2.5% |

| Loan Portfolio Growth | 5% | 7% | 4.5% |

This table illustrates Swedbank’s performance against its historical data and its peer group in 2023. Significant deviations from the average performance of peer banks might signal opportunities for improvement or potential challenges.

Potential Impact of Various Factors on Profitability

Factors like interest rates, loan volumes, and operating expenses significantly influence Swedbank’s profitability. This table highlights the potential impact of these factors:

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Interest Rates | Higher interest rates lead to a larger net interest margin. | Lower interest rates reduce the net interest margin. |

| Loan Volumes | Higher loan volumes can increase net interest income. | Lower loan volumes reduce net interest income. |

| Operating Expenses | Lower operating expenses increase profitability. | Higher operating expenses reduce profitability. |

Long-Term Impact on Swedbank’s Growth Trajectory

A potential visual representation of the long-term impact of the 15% ROE target on Swedbank’s growth trajectory would be a line graph. The x-axis would represent time (e.g., years), and the y-axis would represent ROE. The graph would show a line representing Swedbank’s projected ROE, aiming to reach and maintain 15% or above. It would also illustrate the growth trajectory of the bank’s assets, revenue, and profits under various scenarios.

A scenario demonstrating a 15% ROE over several years would show a consistent, upward trend. A scenario demonstrating a falling ROE would show a downward trend, potentially indicating the need for strategic adjustments. Data points would indicate actual ROE figures for specific years. Overall, the graph would visually depict the potential long-term impact of the target on Swedbank’s financial health and future growth.

Closing Summary: Swedbank Sets Return Equity Target Least 15

Swedbank’s bold ROE target of at least 15% presents a fascinating case study in banking strategy. The potential for increased profitability, alongside the challenges of achieving such a high target, will undoubtedly influence the bank’s decisions across the board. The market reaction will be crucial, and investors will closely monitor Swedbank’s ability to meet its ambitious goals. This decision could set a new precedent in the banking sector, potentially triggering similar moves by competitors.

The coming months will be crucial to understanding the long-term impact of this bold move.