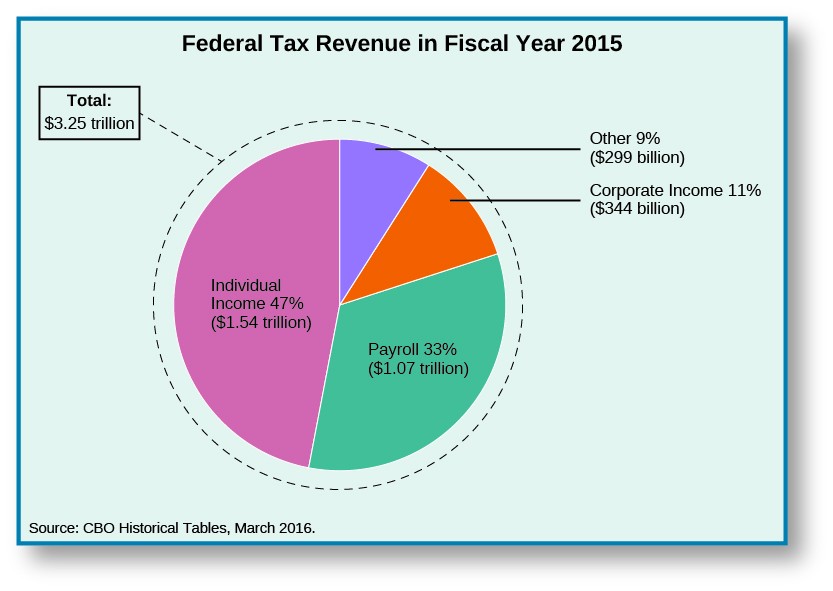

Tax bill contains sledgehammer trump retaliate against foreign digital taxes, potentially sparking a global trade war. This bill proposes a significant US response to foreign digital tax policies, aiming to level the playing field for American companies. The legislation details specific retaliatory measures against various types of digital taxes imposed by other countries. Understanding the bill’s provisions, its historical context, potential economic impacts, and Trump’s likely reactions is crucial for comprehending the potential ramifications of this complex issue.

The bill Artikels provisions targeting specific foreign digital taxes, from the details of the retaliatory actions to the potential economic impact on both US businesses and international trade. The document also includes historical context, analyzing past efforts at international cooperation and conflict related to digital taxation. A crucial aspect of the analysis examines the potential economic repercussions on US businesses, consumers, and international trade relations, comparing potential benefits and drawbacks of the proposed measures.

Understanding the Tax Bill’s Provisions

The recently introduced tax bill aims to counteract foreign digital services taxes (DSTs) by implementing retaliatory measures. This response to global tax policies reflects a broader trend of nations seeking to protect their domestic tax bases in an increasingly digitalized world. The bill’s provisions are designed to level the playing field for U.S. businesses operating internationally, and to mitigate the impact of these foreign taxes on American companies and consumers.

Summary of Proposed Retaliatory Measures

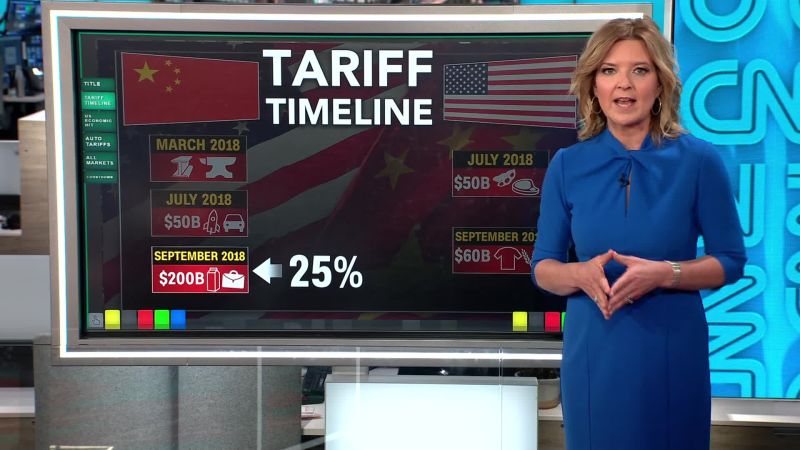

The tax bill proposes a series of retaliatory actions against countries imposing DSTs. These actions are intended to offset the tax burden placed on U.S. companies and their customers by foreign digital tax regimes. The specific mechanisms range from matching tax rates on foreign digital services to implementing tariffs or import restrictions on goods and services from the offending nation.

The overarching goal is to discourage the imposition of DSTs and create a fairer global tax environment.

Mechanisms for Retaliation

The bill utilizes several mechanisms to address foreign digital taxes. One key approach is to impose equivalent taxes on foreign digital services utilized by American consumers. Another method is to levy tariffs or import restrictions on goods or services from countries imposing DSTs. The retaliatory measures are designed to be proportional to the foreign tax imposed and to minimize any negative effects on U.S.

consumers. The specific approach used will vary based on the type of DST and the nature of the foreign tax regime.

Types of Foreign Digital Taxes Targeted

The tax bill targets various types of foreign digital taxes, primarily focusing on those impacting American companies and their customers. These include taxes on revenue generated by digital services, value-added taxes (VATs) on digital transactions, and taxes on the profits of digital businesses. Understanding the different types of DSTs and their specific provisions is crucial for evaluating the bill’s impact on businesses and the global economy.

Specific Provisions Addressing Foreign Digital Taxes

| Tax Type | Description | Retaliatory Measure | Impact on US Businesses |

|---|---|---|---|

| Digital Services Tax (DST) | A tax levied on the revenue generated by digital services provided by foreign companies to users within a specific jurisdiction. | The U.S. imposes a corresponding tax on digital services offered by companies from the taxing nation to U.S. users. | U.S. companies offering digital services to customers in countries with DSTs may face an increase in their tax burden, offset by the imposition of the same tax on foreign companies. |

| Value-Added Tax (VAT) on Digital Transactions | VATs are applied to digital transactions, such as online sales, and typically collected by the retailer in the country where the customer resides. | The U.S. may impose a reciprocal VAT on digital transactions involving foreign companies and U.S. customers. | US companies selling digital products or services to customers in countries with such VATs may face an additional tax burden, mirroring the same tax for foreign companies operating in the U.S. market. |

| Tax on Profits of Digital Businesses | Some countries tax the profits of digital businesses operating within their borders, regardless of the business’s physical location. | The U.S. may implement a tax on the profits of foreign digital businesses operating in the U.S. market. | US companies operating in foreign markets with these taxes may see an increase in their tax liability, but U.S. companies with international operations will also be affected in their domestic operations. |

Historical Context of Foreign Digital Taxes

The global digital economy has spurred a complex and evolving debate about how to tax multinational corporations operating across borders. Traditional tax systems, designed for a more tangible and localized economy, struggle to keep pace with the fluidity and international reach of today’s digital giants. This has led to a series of attempts at international cooperation and, sometimes, conflict over how to fairly tax these companies.The current tax bill, a retaliatory measure, is the culmination of a history of international efforts to address this challenge.

Understanding this history provides context for the present and potential future developments in the realm of digital taxation.

International Efforts to Tax Digital Companies

Early attempts at regulating digital taxation were largely reactive to specific cases of perceived tax avoidance. For example, concerns over the lack of clear rules for taxing revenue generated by digital platforms, like Google and Facebook, in specific countries, were a major catalyst. These initial efforts often lacked widespread international consensus and faced resistance from countries concerned about their sovereignty and potential loss of tax revenue.

Previous Attempts at International Cooperation

Numerous international organizations, including the OECD, have been involved in crafting guidelines and frameworks for addressing digital taxation. However, reaching a global consensus has been challenging, with differing opinions on how to allocate taxing rights among nations. These efforts, while laudable, haven’t yielded a comprehensive and globally accepted solution, highlighting the inherent complexities of the issue.

Previous Attempts at International Conflict

In certain cases, disputes have arisen between countries and digital corporations regarding the appropriate jurisdiction for taxation. These conflicts often centered around the location of the company’s servers, the users’ location, or the actual economic activity taking place. The lack of clear international rules led to uneven and sometimes conflicting approaches. For instance, France’s digital services tax, targeted at large tech companies, sparked a debate about the fairness and effectiveness of such unilateral measures.

Comparison of Current Tax Bill with Past Approaches

The current retaliatory tax bill differs from past approaches in its explicit use of countermeasures. Previous attempts often relied on negotiation and international agreements. The current bill demonstrates a more confrontational approach, driven by a perceived need to protect national interests and address perceived unfair practices.

Specific Events Triggering the Retaliatory Measure

The specific events that directly prompted the tax bill are rooted in the perceived unfairness of foreign digital taxes. Concerns about the economic impact of these measures on domestic businesses and the potential for revenue loss played a significant role in the decision-making process. A particular country’s digital services tax is often cited as a direct trigger.

Political Landscape Surrounding the Legislation

The political landscape surrounding the legislation is highly charged. The bill is likely to face opposition from companies and countries that are affected by the measures. Domestic political considerations, including the need to support domestic businesses and maintain a competitive tax environment, are also key elements influencing the debate. This bill has clearly divided the political spectrum.

Potential Economic Impacts

This tax bill, aiming to counter foreign digital taxes, promises a complex interplay of economic forces. The bill’s potential impact on US businesses, international trade, and consumers is multifaceted and warrants careful consideration. Its success will depend on a variety of factors, including the global response and the adaptability of businesses and markets.

Potential Impacts on US Companies

The bill’s provisions regarding foreign digital taxes could significantly affect US companies, particularly those with significant international operations. Some companies might face increased costs due to the complexities of navigating the new tax regulations. Conversely, some companies may benefit from the level playing field it creates, potentially boosting their competitiveness in international markets. The bill’s impact will also vary depending on the company’s size, industry, and specific operations.

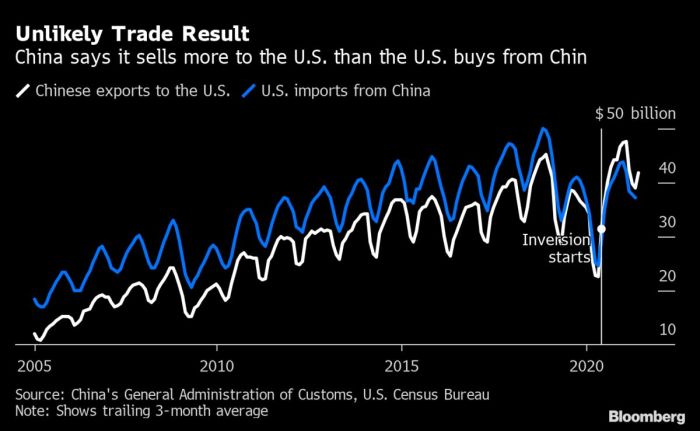

Potential Impacts on International Trade Relations

The bill’s implications for international trade relations are significant. Retaliatory measures from other countries could lead to trade wars, impacting global supply chains and market access. The bill could also affect foreign investment in the US, potentially discouraging international companies from expanding or investing in the American market. Ultimately, international cooperation and negotiation will be key to mitigating these risks.

Potential Impacts on Consumers

The bill’s impact on consumers is a crucial consideration. While the intention is to protect American businesses, higher costs for US companies could translate to higher prices for consumers. Conversely, increased competitiveness in international markets could lead to lower prices for certain goods and services. The net effect on consumers will depend on the extent to which businesses can absorb increased costs and the ability of consumers to adapt to changes in the market.

Potential Impacts on the Global Economy

The bill’s effects on the global economy could be far-reaching. Retaliatory measures from other countries could trigger a domino effect, impacting global trade and investment. The potential for trade wars and economic instability could ripple through various sectors and affect economies worldwide.

Comparison of Benefits and Drawbacks

The bill presents a complex trade-off between potential benefits and drawbacks. The primary benefit is to level the playing field for US businesses operating internationally. However, potential drawbacks include the risk of retaliatory measures, trade wars, and economic instability. The success of the bill hinges on its ability to achieve its goals without triggering a negative international response.

Trump’s tax bill, a sledgehammer aimed at foreign digital taxes, is definitely a hot topic. Meanwhile, Volkswagen is reportedly facing significant job cuts, with over 20,000 employees potentially agreeing to early redundancy, according to Bild reports. This economic downturn seems to be affecting businesses worldwide, even as the US government tries to assert its influence on international digital tax policies.

Potential Scenarios and Outcomes

| Scenario | Impact on US Businesses | Impact on International Trade | Impact on Consumers |

|---|---|---|---|

| Scenario 1: Global Cooperation | US companies maintain competitiveness; some cost increases possible but manageable. | International trade relations remain stable; minimal disruption to global supply chains. | Consumer prices may experience slight increases, but overall affordability remains stable. |

| Scenario 2: Retaliatory Measures | Increased costs for US companies; potential for reduced market access abroad. | Trade wars; significant disruption to global supply chains; reduced international investment. | Higher consumer prices; potential for reduced availability of goods and services. |

| Scenario 3: Partial Success | Mixed results; some US companies benefit, others face challenges. | Limited disruption to international trade; some retaliatory measures may be implemented. | Consumer prices may experience moderate increases depending on the industries affected. |

Trump’s Stance and Possible Reactions

President Trump’s stance on foreign digital taxes has been consistently protectionist, focusing on perceived unfair treatment of American companies. He has frequently criticized such taxes as harmful to US businesses and a form of unfair competition. This stance, coupled with his often-stated desire to retaliate against perceived trade imbalances, suggests a potential for aggressive action.His past actions and statements regarding international trade disputes, including tariffs and trade wars, provide context for anticipating potential responses to foreign digital taxes.

The current administration’s approach is likely to be driven by the belief that US companies deserve preferential treatment and that foreign digital taxes represent an unfair tax burden.

Trump’s Past Statements and Actions

President Trump has repeatedly expressed opposition to foreign digital taxes, viewing them as discriminatory against US companies and a barrier to their global expansion. His administration has actively sought ways to challenge these measures, emphasizing the need for a level playing field for American companies. Past actions, like imposing tariffs on imported goods, demonstrate a willingness to use retaliatory measures in trade disputes.

The new tax bill is apparently a sledgehammer, designed by Trump to retaliate against foreign digital taxes. This comes at a time when Chad has suspended visa issuance for US citizens due to a travel ban, a move that’s definitely raising some eyebrows. It’s all part of a complex web of international political tensions, which likely impacts the ultimate outcome of the tax bill, reflecting a larger strategy of retaliation against perceived unfair foreign digital tax policies.

chad suspends visa issuance us citizens over travel ban is a fascinating example of the ripple effects of these global conflicts. This whole situation just highlights the complicated nature of international relations and the potential for unintended consequences, potentially impacting the tax bill’s ultimate effectiveness.

Potential Reactions of Foreign Governments

Foreign governments may react to a Trump administration’s retaliatory measures in several ways. They could respond in kind with their own tariffs or taxes on US digital companies, mirroring the tit-for-tat approach often seen in trade disputes. Alternatively, some might seek to find common ground and negotiate an international solution to the digital tax issue. The reaction will depend on the specific nature of the retaliatory measures, the political climate in each country, and the perceived fairness of the US actions.

The European Union, for example, has already expressed its intention to enforce the digital services tax, potentially escalating the situation.

Potential Reactions of Digital Companies

Digital companies operating globally will likely experience significant uncertainty and disruption. They will need to adjust their tax strategies, potentially shifting operations or investment plans to mitigate the impact of retaliatory measures. Companies with substantial international operations may be forced to confront the increased complexities of navigating a multifaceted and potentially volatile global tax landscape.

Possible Escalation or De-escalation of Tensions

The potential for escalation depends on the severity of the retaliatory measures and the willingness of both sides to find a diplomatic solution. The outcome will be influenced by the level of political will and the degree of cooperation among involved parties. If the retaliatory measures are limited and accompanied by a commitment to negotiation, there’s a chance for de-escalation.

Conversely, escalating trade conflicts could create significant economic instability and disrupt global trade flows. Historical examples of trade wars illustrate the potential for unpredictable outcomes.

Potential Counter-Measures from Foreign Governments

- Imposing tariffs on US digital services or products.

- Implementing similar digital taxes on US companies operating in their jurisdictions.

- Seeking international cooperation to develop a common approach to taxing digital companies.

- Filing complaints with international organizations like the WTO, alleging unfair trade practices.

These counter-measures highlight the potential for a reciprocal response, with foreign governments mirroring the actions of the US administration. This reciprocal action could lead to a full-blown trade war, impacting not only the digital sector but the global economy as a whole.

Possible Roles of International Organizations in Mediating the Situation, Tax bill contains sledgehammer trump retaliate against foreign digital taxes

International organizations like the WTO can play a crucial role in facilitating negotiations and resolving disputes. Their established framework for international trade disputes could provide a platform for dialogue and potential compromises. The WTO’s role in mediating trade disputes is well-documented, and their intervention could potentially help de-escalate the situation. Successful mediation would require the cooperation of all parties involved.

Alternative Solutions and Perspectives: Tax Bill Contains Sledgehammer Trump Retaliate Against Foreign Digital Taxes

The looming threat of retaliatory tariffs from the US, in response to foreign digital taxes, presents a complex challenge. Instead of escalating tensions, exploring alternative solutions can foster a more collaborative approach to address the issues of digital taxation fairly and equitably. These solutions must consider the diverse perspectives of businesses, consumers, and governments worldwide.International cooperation and harmonization of tax rules are crucial to mitigating the negative effects of conflicting tax policies.

This can involve establishing international standards for taxing digital services, which will create a more predictable and stable business environment. The need for such a unified approach is particularly important in a globalized economy where digital businesses operate across multiple jurisdictions.

Alternative Approaches to Foreign Digital Taxes

Several alternative approaches to handling foreign digital taxes exist beyond retaliatory measures. These include:

- International Tax Treaties and Agreements: A crucial approach involves the negotiation of international tax treaties that address the taxation of digital services. These treaties would specify the jurisdiction responsible for taxing particular transactions and would ensure that there are no double taxation issues. For example, the OECD has been working on a global agreement for taxing digital services and is actively seeking to establish standards.

This collaborative effort can avoid the potential negative impacts of conflicting tax policies.

- Joint Taxation Mechanisms: Developing a joint taxation mechanism could provide a shared platform for assessing and collecting taxes on digital services. This mechanism would require cooperation between multiple countries, potentially using a multilateral framework. An example of a similar system could be seen in the international approach to taxing multinational corporations. This can ensure a consistent approach to taxation for digital services, regardless of the location of the business.

A possible drawback might be the complexity of coordinating efforts between nations with different tax systems.

- Multilateral Tax Treaties and Harmonization: Establishing a multilateral agreement on the taxation of digital services could create a consistent global approach. Such a framework would reduce the risk of double taxation and encourage cross-border investments in the digital economy. This could benefit both businesses and consumers by providing clarity and predictability in the global tax landscape. A possible drawback might be the protracted negotiation process and the need for compromise among diverse interests.

The latest tax bill seems like a sledgehammer approach by Trump to retaliate against foreign digital taxes. It’s interesting to see how this plays out, especially considering recent news about rally cars, like the thrilling rally in Sardinia where Ogier edges Tanak claim fifth Sardinia crown Toyota charge into title fight here. While the rally scene is exciting, the tax bill’s potential impact on global economies remains a significant concern.

Stakeholder Perspectives and Impacts

The implications of alternative solutions vary based on the perspective of different stakeholders.

| Stakeholder | Perspective | Impact |

|---|---|---|

| Businesses | Businesses favor clarity and predictability in tax rules. They need consistent global rules to reduce compliance costs and ensure fair taxation. | Clearer and consistent tax rules minimize compliance costs and create a more stable environment for businesses, which can encourage investment and economic growth. |

| Consumers | Consumers benefit from clear and consistent tax policies. This ensures that digital services are fairly taxed and that prices reflect the costs associated with this taxation. | Fair taxation of digital services can lead to transparency in pricing and avoid potential exploitation by businesses. |

| Governments | Governments seek to ensure fair taxation of digital services while maintaining economic competitiveness. | Consistent global standards ensure fair tax collection and avoid revenue losses. |

Potential Outcomes of Each Alternative

The potential outcomes of each alternative solution depend on the level of international cooperation and the willingness of different countries to compromise. Harmonized taxation can lead to increased tax revenues for governments, reduce compliance burdens for businesses, and ensure fairer pricing for consumers. However, the implementation of such solutions may face significant challenges in terms of negotiation, implementation, and potential resistance from certain stakeholders.

The OECD’s work on a global framework provides a positive example of a collaborative approach to address this complex issue.

Illustrative Case Studies

Navigating the complex world of international taxation can feel like navigating a maze. Foreign digital taxes, particularly those targeting large tech companies, introduce a new layer of intricacy. Understanding how these taxes impact businesses and nations requires examining real-world examples. This section dives into specific case studies to illuminate the potential ramifications of the proposed tax bill and similar policies.

A Case Study: Google and the EU’s Digital Services Tax

The European Union’s Digital Services Tax (DST) provides a compelling case study. Google, a multinational tech giant, faced potential tax liabilities under the DST due to its significant revenue generated from EU users. The DST targeted companies with a market capitalization exceeding a certain threshold and significant revenue from EU users.

- Google’s revenue from advertising and other services in the EU was substantial, making them a target for the tax.

- The implementation of the DST raised concerns about the fairness and practicality of taxing digital revenue streams across borders.

- Google, along with other large tech companies, engaged in lobbying and legal challenges to the DST, arguing that it unfairly burdened companies with substantial international operations.

- The DST’s impact on Google and other companies involved complex calculations and assessments of how to apportion revenue to the EU, and how to comply with the tax regulations.

Impact on Google Under a Similar US Tax Bill

The proposed US tax bill, if similar to the EU DST, would likely require Google to recalculate its tax liabilities in the United States. This would involve complex calculations to determine the appropriate tax burden on US-sourced revenue and how that aligns with the revenue generated from US-based users.

- The bill’s specific provisions would dictate how much revenue Google would need to report and tax in the US, potentially impacting its financial statements.

- The bill’s impact on Google would likely be felt in the form of higher tax payments and a need to restructure its global tax strategies to comply with US regulations.

- The potential for legal challenges and disputes with the IRS would be substantial, potentially delaying the implementation and compliance process.

- It would likely require Google to establish or strengthen its tax compliance infrastructure, leading to increased administrative costs.

France’s Experience with a Digital Services Tax

France enacted a digital services tax in 2020. This provides another case study for examining the practical implications of such taxes.

- France’s tax implementation involved significant administrative challenges, including the need to develop new systems and procedures for collecting and auditing the tax.

- The French government faced pushback from multinational corporations, leading to legal challenges and disputes.

- The experience in France demonstrated that implementing and enforcing such a tax requires significant resources and careful planning to ensure compliance and avoid legal conflicts.

- Furthermore, the French experience highlights the potential for international disputes over taxation, particularly in the context of digital economies.

Lessons Learned

The case studies of Google under the EU’s DST and France’s implementation of a digital services tax highlight the following key lessons:

- Foreign digital taxes can significantly impact multinational corporations, particularly those with significant international operations.

- The implementation and enforcement of such taxes require careful planning, considerable resources, and a robust compliance infrastructure.

- International disputes and legal challenges are inevitable, underscoring the need for clear and unambiguous legal frameworks.

- The economic impacts of these taxes can ripple through global markets, affecting both companies and consumers.

Ending Remarks

In conclusion, the tax bill’s sledgehammer approach to foreign digital taxes presents a complex web of potential consequences. From the bill’s potential impact on US businesses and international trade to Trump’s potential reactions and alternative solutions, the discussion highlights the multifaceted nature of this issue. Ultimately, the bill’s success depends on a delicate balance between protecting US interests and avoiding a damaging global trade war.

The provided case studies and alternative perspectives provide further insight into the intricacies of this debate.