The making of the American fiscal state is a captivating journey through the nation’s history, revealing how policies have evolved from the founding fathers to the present day. From the early taxation strategies to the complex challenges of the 21st century, this exploration unveils the intricate interplay of economic theories, political ideologies, and social movements that have shaped the American fiscal landscape.

We’ll delve into the constitutional framework, examining the powers granted to Congress and the executive branch, while also contrasting these with state and local authorities. This deep dive will also cover the impact of significant events like wars and depressions, and how these crises have influenced the development of the American fiscal system.

This comprehensive look at the American fiscal state examines the interplay of historical context, economic theories, and social influences. Understanding the complexities of this system is crucial for comprehending how the nation has navigated economic prosperity and hardship. Through detailed analysis of key events, tax policies, and economic indicators, this blog post aims to illuminate the factors that have shaped America’s fiscal trajectory.

Historical Context

The American fiscal state, a complex tapestry woven from economic realities and political decisions, has evolved significantly since the nation’s founding. From the initial struggles to establish a stable financial system to the modern challenges of balancing budgets and managing debt, the journey reflects the nation’s growth, its periods of prosperity and crisis, and the shifting priorities of its citizens.

Understanding this evolution provides crucial insight into the current state of the American economy and the future of its fiscal policy.The formative years of the American fiscal state were marked by experimentation and challenges. The newly formed nation inherited a patchwork of colonial tax systems and a need to establish a unified financial framework. This era saw the rise of debates about the role of government in the economy, the appropriate level of taxation, and the distribution of fiscal resources.

Early Republic (1789-1860)

The early republic saw the establishment of the federal government’s fiscal infrastructure. The first Congress implemented tariffs and excise taxes to fund the government’s operations. Early taxation policies focused primarily on tariffs, and internal revenue taxes were often used as a last resort during periods of crisis. The impact of the Louisiana Purchase and the War of 1812 on the national debt and subsequent fiscal strategies are significant aspects of this period.

Tracing the evolution of the American fiscal state is fascinating, highlighting the complex interplay of economic policies and societal shifts. The recent exit interview with Mastercard’s Chief People Officer, a fascinating read, an exit interview with mastercards chief people officer , provides a glimpse into the modern financial landscape, though it doesn’t directly connect to the historical creation of the fiscal state.

Ultimately, understanding these historical forces is crucial for appreciating the intricate workings of our current financial systems.

The early republic saw experimentation with different approaches to taxation and revenue generation, and these experiments laid the groundwork for future developments.

Civil War and Reconstruction (1861-1877)

The Civil War dramatically reshaped the American fiscal state. The need to fund a massive military effort led to significant increases in taxation, including the introduction of the first federal income tax. The wartime fiscal measures had a profound impact on the national debt, the growth of the federal bureaucracy, and the relationship between the federal government and the economy.

The era also saw the rise of industrialization, which brought about new sources of revenue and further shaped the fiscal state.

Progressive Era and World War I (1890-1920)

The Progressive Era brought about significant changes in taxation policies, driven by the growing concerns about wealth inequality and the need for social reform. The implementation of the 16th Amendment, authorizing the federal income tax, was a landmark event. This period also witnessed the rise of corporate taxation. These changes, along with the massive spending associated with World War I, further expanded the role of the federal government in the economy.

The Great Depression and World War II (1930-1945)

The Great Depression forced a dramatic re-evaluation of fiscal policy. The government’s role in stimulating the economy and providing social safety nets expanded substantially. New Deal programs and policies focused on stabilizing the economy and alleviating poverty. World War II further expanded the role of the government, and wartime spending created a significant increase in the national debt, which impacted fiscal strategies for decades to come.

Post-War Boom and Stagflation (1945-1980)

The post-war period saw a sustained period of economic growth, which led to increased tax revenues and a reduction in the national debt. The focus shifted to maintaining economic stability and managing the increasing complexities of the modern economy. The 1970s, however, witnessed stagflation, a period of high inflation and slow economic growth, which presented new challenges for fiscal policy.

The Modern Era (1980-Present)

The modern era has been characterized by fluctuating economic conditions and evolving fiscal strategies. Tax cuts, deregulation, and increased government spending have all played a role in shaping the American fiscal state. The rise of globalization, technological advancements, and the increasing complexity of international finance have further influenced the landscape.

Table: Major Tax Laws and Their Effects

| Tax Law | Year | Key Provisions | Impact on Socioeconomic Groups |

|---|---|---|---|

| Revenue Act of 1913 | 1913 | Established the federal income tax. | Increased tax burden on higher-income earners. |

| Revenue Act of 1942 | 1942 | Increased income tax rates significantly to fund World War II. | Led to higher taxes for all income levels. |

| Tax Reform Act of 1986 | 1986 | Reduced tax rates for corporations and individuals. | Reduced tax burden for higher-income earners, potentially stimulated economic growth. |

| Tax Cuts and Jobs Act of 2017 | 2017 | Substantial tax cuts for corporations and high-income earners. | Reduced tax burden for corporations and high-income earners, potential impact on economic growth and inequality remains debated. |

Constitutional Framework

The US Constitution lays the foundation for the nation’s fiscal system, outlining the powers and limitations of the federal government, states, and localities in raising revenue and spending. Understanding these provisions is crucial to comprehending the evolution of the American fiscal state. The document’s framers sought to balance centralized authority with the need to protect individual liberties and state autonomy.

Taxation Powers

The Constitution explicitly grants Congress the power to “lay and collect Taxes, Duties, Imposts and Excises” (Article I, Section 8). This power is fundamental to funding the federal government. However, the Constitution also places limitations on this power. These limitations, along with the specific types of taxes Congress can impose, shape the structure of the American fiscal system.

The “uniformity clause” of the Constitution mandates that “duties, imposts, and excises” must be the same across all states, preventing discrimination.

Spending Powers

The Constitution’s grant of spending power to Congress is implicit, arising from its enumerated powers. For example, the power to “regulate Commerce” (Article I, Section 8) allows for federal spending on infrastructure projects and other initiatives deemed necessary for commerce. The Necessary and Proper Clause (Article I, Section 8, Clause 18) further expands Congress’s power to enact laws “necessary and proper” for carrying out its enumerated powers, providing flexibility in the fiscal realm.

This allows for spending on a wide range of activities that support the country’s interests, even if not explicitly mentioned elsewhere in the Constitution.

Executive Branch Role

The executive branch, primarily the President, plays a significant role in the budgetary process. The President submits an annual budget to Congress, outlining the federal government’s spending priorities and revenue projections. This budget document acts as a crucial guide for Congress in shaping the appropriations process. The President also has the power to veto legislation, including appropriations bills, which can influence the final form of the budget.

The power of the President in this regard is crucial in balancing the legislative and executive powers within the fiscal system.

Federal-State-Local Fiscal Relations

The Constitution establishes a system of shared sovereignty between the federal government and the states. This system impacts how fiscal policy is developed and implemented at each level. The Tenth Amendment reserves powers not explicitly delegated to the federal government to the states or the people. This division of power affects the fiscal authority of each level of government, creating a complex interplay of responsibilities.

The balance between federal and state spending, particularly in areas like education and infrastructure, often reflects the political landscape and priorities of the time.

Constitutional Limitations on Spending and Taxation

| Limitation | Description |

|---|---|

| Taxation | Congress cannot impose taxes on exports. The Constitution also mandates that direct taxes must be apportioned among the states based on population. |

| Spending | Government spending must be for “common Defence and general Welfare.” This clause serves as a crucial limit on the scope of federal spending. |

| Due Process and Equal Protection | Taxation and spending measures must comply with the Due Process Clause and the Equal Protection Clause of the Fourteenth Amendment. These clauses ensure that government actions are not arbitrary or discriminatory. |

| Bill of Rights | Constitutional rights, as Artikeld in the Bill of Rights, can limit the government’s power to tax and spend. For instance, the First Amendment may restrict the government’s ability to tax certain forms of speech or expression. |

“The power to tax is the power to destroy.”

John Marshall

This quote highlights the significant impact that taxation has on individuals and businesses, underscoring the need for careful consideration of any tax policy.

Digging into the intricate history of the American fiscal state is fascinating, isn’t it? While pondering the complexities of government spending and revenue, I stumbled across a fascinating list of the top 10 best sneakers of all time according to AI the top 10 best sneakers of all time according to ai. It got me thinking about how different aspects of American culture, even seemingly trivial ones like footwear trends, can reflect broader economic and social shifts, ultimately shaping the very fabric of the American fiscal state.

Economic Theories and Policies

The American fiscal state has been shaped by a complex interplay of economic theories and policies, evolving significantly over time. From the early emphasis on laissez-faire principles to the interventionist approaches of the 20th and 21st centuries, understanding these shifts is crucial to comprehending the current state of the American economy and its future trajectory. Different economic philosophies have influenced the design and implementation of fiscal policies, leading to diverse outcomes and ongoing debates.Keynesian economics, supply-side economics, and classical principles have all played pivotal roles in shaping the American fiscal landscape.

The interplay between these theories and practical application has resulted in varying degrees of government intervention in the economy, leading to fluctuations in economic performance and public debt levels. Analyzing the specific impacts of these theories and their application during periods of inflation and recession provides valuable insight into the complexities of fiscal policy.

Major Economic Theories Influencing the American Fiscal State

Several key economic theories have significantly influenced the development and implementation of fiscal policy in the United States. Classical economics, emphasizing free markets and limited government intervention, provided the foundation for early fiscal policies. This framework emphasized the self-regulating nature of the economy and the belief that market forces would naturally steer the economy towards equilibrium.

Role of Keynesian and Classical Economic Principles in Shaping Fiscal Policy

Keynesian economics, developed by John Maynard Keynes, advocated for government intervention during economic downturns. It emphasized the role of aggregate demand in driving economic activity and argued that government spending and tax cuts could stimulate demand during recessions. Classical economics, in contrast, stressed the importance of balanced budgets and minimal government involvement in the economy. This approach believed that market forces would efficiently allocate resources and that government intervention could hinder economic growth.

Impact of Supply-Side Economics on the Fiscal System

Supply-side economics, gaining prominence in the 1980s, focused on incentivizing production and investment to stimulate economic growth. Proponents argued that tax cuts and deregulation would encourage businesses to invest, expand production, and create jobs. This approach aimed to increase the supply of goods and services in the market, leading to lower prices and higher overall economic output. However, the practical effects of supply-side policies have been debated, with some studies suggesting limited long-term impact on economic growth.

Approaches to Fiscal Policy in Response to Inflation and Recession

Different approaches to fiscal policy are employed in response to inflation and recession. During periods of inflation, contractionary fiscal policies, such as tax increases and reduced government spending, aim to curb aggregate demand and cool down the economy. Conversely, during recessions, expansionary fiscal policies, such as tax cuts and increased government spending, aim to stimulate aggregate demand and boost economic activity.

The effectiveness of these policies depends on various factors, including the severity of the economic downturn, the state of the economy, and the overall economic environment.

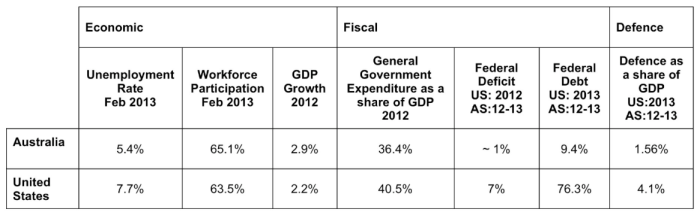

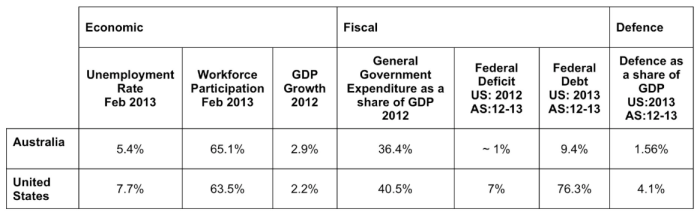

Summary of Key Economic Indicators and their Relation to Fiscal Policy

| Economic Indicator | Description | Relation to Fiscal Policy |

|---|---|---|

| Gross Domestic Product (GDP) | Measures the total value of goods and services produced within a country. | A key indicator of economic performance; fiscal policy often aims to stimulate GDP growth during recessions and moderate it during periods of overheating. |

| Inflation Rate | Measures the rate at which prices for goods and services are increasing. | High inflation necessitates contractionary fiscal policies to cool down the economy. |

| Unemployment Rate | Measures the percentage of the labor force that is unemployed. | High unemployment often necessitates expansionary fiscal policies to create jobs and boost economic activity. |

| Government Debt | Represents the total amount of money owed by the government. | Fiscal policy decisions impact the level of government debt; expansionary policies often increase it, while contractionary policies can reduce it. |

Social and Political Influences: The Making Of The American Fiscal State

The American fiscal state has been profoundly shaped by the interplay of social movements, political ideologies, and the influence of interest groups. Understanding these forces is crucial to comprehending the evolution of tax policies, spending priorities, and the overall trajectory of the nation’s economic well-being. From the progressive era to the modern day, social and political pressures have constantly reshaped the parameters of the American fiscal system.Social movements, often driven by evolving moral values and societal needs, have exerted a powerful influence on the development of the fiscal state.

The Civil Rights Movement, for example, directly led to demands for more equitable resource allocation, impacting areas like education and housing, forcing a reevaluation of existing fiscal policies.

Impact of Social Movements

Social movements have been instrumental in driving change within the American fiscal state. The push for civil rights, the women’s rights movement, and the environmental movement, among others, have all had significant impacts on fiscal priorities. These movements have prompted the government to address social inequalities and environmental concerns, often through new legislation and increased spending in relevant sectors.

For example, the Civil Rights Act of 1964, spurred by the Civil Rights Movement, led to increased federal funding for education and job training programs aimed at addressing racial disparities. The environmental movement, with its focus on pollution and conservation, has resulted in the creation of agencies like the Environmental Protection Agency (EPA) and the implementation of policies aimed at reducing environmental damage, often requiring substantial government investment.

Role of Political Ideologies

Political ideologies significantly shape fiscal priorities. Liberals, for example, generally advocate for greater government intervention in the economy, including progressive taxation and social safety nets. Conversely, conservatives often favor lower taxes, reduced government spending, and free market principles. These differing perspectives have consistently influenced the debate over taxation, social welfare programs, and government spending. Historical examples include the New Deal policies of the 1930s, championed by Franklin D.

Roosevelt and the Democratic Party, which expanded the role of government in providing social welfare programs.

The intricate dance of creating the American fiscal state is a fascinating study in itself, highlighting the constant push and pull between competing interests. Recent advancements in gene editing, like the first CRISPR treatment in a baby, first crispr treatment baby , spark some parallel thoughts about the potential for unforeseen consequences of rapid technological advancements. Ultimately, the delicate balancing act of progress and responsibility in the realm of public finance remains the core of the American fiscal state’s ongoing evolution.

Influence of Interest Groups and Lobbying

Interest groups and lobbying efforts play a crucial role in shaping fiscal policies. Organizations representing various industries, professions, and special interests often actively advocate for policies that benefit their members. This influence can manifest in support for tax breaks, subsidies, and regulations that favor specific sectors. For example, the agricultural lobby has historically exerted significant influence on farm subsidies, while the pharmaceutical industry heavily advocates for policies that maintain high drug prices.

These efforts can significantly affect spending priorities and tax burdens on different segments of society.

Comparison of Fiscal Policies Across Political Parties

Different political parties often hold contrasting views on fiscal policy. Democrats, generally, support a larger role for the government in regulating the economy and providing social services, frequently advocating for higher taxes on higher earners and increased spending on social programs. Republicans, on the other hand, typically favor lower taxes, reduced government spending, and deregulation, often promoting tax cuts for businesses and individuals.

This difference in philosophy frequently leads to heated debates over the appropriate level of government intervention in the economy. The Reagan administration, for example, enacted significant tax cuts, while the Obama administration responded to the 2008 financial crisis with substantial government spending and stimulus packages.

Historical Correlation Between Social Conditions and Fiscal Spending Priorities

| Historical Period | Social Conditions | Fiscal Spending Priorities |

|---|---|---|

| Progressive Era (late 19th – early 20th century) | Rapid industrialization, urbanization, and social inequality | Increased regulation of businesses, expansion of public education, and social welfare programs. |

| Great Depression (1930s) | Widespread unemployment and economic hardship | Massive government spending on public works projects and social security. |

| Civil Rights Movement (1950s-1960s) | Racial segregation and discrimination | Increased spending on civil rights programs, education, and job training. |

| Environmental Movement (1970s-present) | Growing environmental concerns | Increased spending on environmental protection, research, and conservation. |

Modern Challenges and Trends

The American fiscal state, a complex and evolving entity, faces a multitude of contemporary challenges. Globalization’s impact on trade and investment patterns, coupled with the rapid advancements in technology, has reshaped the economic landscape, creating both opportunities and novel fiscal complexities. These challenges, alongside the ongoing burden of debt and deficits, require careful consideration and innovative solutions to maintain the nation’s fiscal health and stability.The modern fiscal state grapples with the implications of a rapidly changing global economy.

Technological advancements have spurred innovation and economic growth, but they’ve also altered the tax base and the ways in which governments collect and spend revenue. This necessitates a constant re-evaluation of existing tax policies and spending priorities to ensure their continued relevance and effectiveness. The need to adapt to these shifts is critical for long-term fiscal sustainability.

Key Challenges Facing the American Fiscal State, The making of the american fiscal state

The American fiscal state faces several key challenges in the 21st century, demanding innovative solutions. These challenges include managing the increasing national debt, adapting to evolving economic structures, and ensuring equitable distribution of fiscal resources.

- Managing the national debt, a significant concern, necessitates strategies that promote economic growth and responsible spending. Historical examples of countries that have effectively managed their debt include those that implemented rigorous fiscal discipline and structural reforms to improve their fiscal position.

- Adapting to evolving economic structures, particularly those influenced by globalization and technological advancement, is critical. This requires a flexible and forward-looking approach to taxation, recognizing the changing nature of employment and income generation. For instance, the rise of the gig economy demands new ways of taxing independent contractors.

- Ensuring equitable distribution of fiscal resources is essential to address socioeconomic disparities and maintain social cohesion. Policies promoting income equality, such as progressive taxation and targeted social programs, can mitigate the widening gap between the rich and the poor.

Impact of Globalization and Technological Advancements

Globalization and technological advancements have profoundly altered the fiscal landscape. These forces have led to shifts in the tax base, increased global competition, and the need for new fiscal instruments to manage international transactions.

- Globalization has broadened the scope of the tax base, complicating the task of collecting revenue from multinational corporations and individuals operating across borders. International tax treaties and agreements are crucial in this evolving context.

- Technological advancements have automated many tasks, altering the nature of work and potentially reducing the tax base. Adapting tax policies to account for these changes is crucial to maintain revenue collection.

- Increased global competition necessitates strategic fiscal policies to attract investment and maintain economic competitiveness. For example, incentives for research and development, or investments in infrastructure, can support economic growth.

Role of Debt and Deficits

National debt and deficits have significant implications for the fiscal state. Understanding their impact on the economy is crucial for formulating effective fiscal policies.

- High levels of debt can stifle economic growth by increasing interest payments and reducing government spending on essential services. Examples include the impact of high national debt on interest rates and subsequent economic growth in countries experiencing similar fiscal pressures.

- Deficits, the difference between government spending and revenue, can lead to accumulating debt and potential economic instability. Managing deficits requires careful consideration of government spending and revenue generation strategies.

Approaches to Managing the National Debt

Various approaches exist for managing the national debt, each with its own set of benefits and drawbacks. These approaches range from austerity measures to economic growth strategies.

- Austerity measures, focusing on reducing government spending, can lead to short-term fiscal stability but may negatively impact economic growth. This strategy has been implemented in various countries, often with mixed results.

- Promoting economic growth is a long-term approach that can increase tax revenue and reduce the debt-to-GDP ratio. Investing in education, infrastructure, and research and development are often part of such strategies.

Projected Fiscal Trends and Potential Impacts

Understanding projected fiscal trends is crucial for anticipating and mitigating potential challenges. The following table Artikels some projected trends and their possible consequences.

| Fiscal Trend | Potential Impact |

|---|---|

| Increasing national debt | Higher interest payments, reduced government spending on social programs, potential economic instability. |

| Decreasing tax revenue | Reduced government funding for essential services, potential increase in public debt. |

| Rise in healthcare costs | Increased strain on the fiscal system, potentially leading to reduced government spending in other areas. |

| Demographic shifts | Changes in the workforce and the need for adjustments in social security and retirement programs. |

The Future of the American Fiscal State

The American fiscal state, a complex interplay of taxation, spending, and economic policy, faces a future laden with both opportunities and challenges. Understanding potential scenarios, emerging trends, and their implications is crucial for navigating the evolving landscape and ensuring long-term fiscal stability. The interplay between demographic shifts, technological advancements, and global economic forces will shape the future trajectory of the American fiscal state.The future of the American fiscal state will be defined by the interaction of these factors, creating a dynamic and unpredictable environment.

Navigating this landscape requires a forward-looking approach that balances short-term needs with long-term sustainability. Adaptability and a willingness to consider innovative solutions will be paramount.

Potential Future Scenarios

The future of the American fiscal state is not predetermined. Several potential scenarios exist, each with its own set of economic, social, and political implications. These scenarios will be shaped by the choices made today.The fiscal state could face a scenario where technological advancements lead to significant changes in labor markets, requiring adjustments in social safety nets and tax policies.

Alternatively, a period of sustained economic growth could provide the opportunity to reduce national debt and invest in infrastructure. A global recession could create significant fiscal challenges, forcing governments to make difficult choices between spending on social programs and maintaining national security.

Emerging Trends in Taxation and Spending

Significant shifts are occurring in both taxation and spending patterns. These trends are often interconnected and reflect broader societal changes.

- Progressive Tax Reform: Advocates for progressive tax reform aim to address income inequality by increasing taxes on higher earners. This approach is aimed at generating more revenue for social programs, but could also face opposition due to concerns about economic impact. The potential for increased government revenue could be used to fund infrastructure improvements, enhance social security programs, or to stimulate the economy through public investments.

- Sustainability in Social Security and Medicare: The growing aging population is putting a strain on social security and Medicare systems. Addressing this challenge requires a multifaceted approach including increasing contribution rates, adjusting benefit levels, or exploring alternative financing mechanisms. The potential for increased longevity and healthcare costs necessitates comprehensive solutions to ensure the long-term viability of these programs. Failure to address these challenges could lead to significant disruptions in social security and Medicare benefits for future generations.

- Infrastructure Investment: Investing in infrastructure is crucial for long-term economic growth. Modernizing transportation networks, energy grids, and communication systems can improve productivity and create jobs. However, the cost of these projects can be substantial, and the return on investment must be carefully considered. The potential for increased productivity and economic growth could lead to significant returns on infrastructure investments, driving economic activity and generating new job opportunities.

Potential Impacts of Emerging Trends

The emerging trends in taxation and spending have significant implications for various segments of society.

- Impact on different income groups: Progressive tax reforms, for example, can lead to increased tax burdens for higher-income earners but potentially benefit lower-income individuals through enhanced social programs. This impact varies based on the specific tax policies and their implementation.

- Impact on economic growth: Significant infrastructure investment can stimulate economic activity, create jobs, and improve productivity. However, the potential for increased government spending could also lead to inflation or reduced private investment, impacting long-term economic growth.

Possible Strategies to Address Future Challenges

A comprehensive approach is required to address the challenges of the future fiscal state. This requires a willingness to engage in thoughtful debate and to consider a variety of options.

- Enhancing revenue collection efficiency: Improving tax compliance and reducing tax loopholes can increase government revenue without increasing the tax burden on individuals. This could involve technological improvements in tax collection systems, stronger enforcement mechanisms, or comprehensive tax reform.

- Prioritizing spending efficiency: Focusing on programs with demonstrable positive impacts and reducing waste and inefficiency in government spending can maximize the impact of allocated resources. This could involve conducting cost-benefit analyses of government programs and using data-driven insights to guide spending decisions.

- Encouraging long-term investment: Policies that incentivize savings, investment, and entrepreneurship can help foster a healthy economy and generate revenue for the fiscal state in the long run. This could involve providing tax breaks for investments, simplifying regulatory environments, and fostering innovation.

Policy Options and Implications for Different Demographics

The following table illustrates potential policy options and their potential implications for different demographic groups.

| Policy Option | Impact on Low-Income Households | Impact on Middle-Income Households | Impact on High-Income Households |

|---|---|---|---|

| Progressive Tax Reform | Potentially increased benefits from social programs | Potential for increased tax burden | Potential for significantly increased tax burden |

| Infrastructure Investment | Potential for job creation and improved infrastructure access | Potential for job creation and improved infrastructure access | Potential for job creation and improved infrastructure access |

| Social Security and Medicare Reform | Potential for adjustments to benefits and contributions | Potential for adjustments to benefits and contributions | Potential for adjustments to benefits and contributions |

Last Recap

In conclusion, the making of the American fiscal state is a dynamic and multifaceted story. From the nation’s origins to the current challenges, the evolution of fiscal policy reflects the nation’s social, political, and economic landscape. The interplay of constitutional frameworks, economic theories, and social movements has created a complex system that continues to adapt to a rapidly changing world.

Understanding this history is essential for comprehending the challenges and opportunities that lie ahead.