Trumps steel tariff plan have minor impact india says minister – Trump’s steel tariff plan have minor impact india says minister, marking a fascinating case study in international trade. The plan, with its historical context and potential economic repercussions, has sparked debate worldwide. This analysis delves into the intricacies of the plan, examining India’s response and the broader implications for global trade.

This article will provide a detailed background on the steel tariff plan, including the reasoning behind its implementation, potential impacts on various stakeholders, and the specific provisions of the plan. It will then examine India’s reaction, including the minister’s perspective and potential countermeasures. Further analysis will cover the economic impact assessment, including price comparisons, import data, and employment figures, and discuss the broader implications for trade relations between the US and India.

Background of the Steel Tariff Plan

The Trump administration’s steel tariff plan, a controversial policy enacted in 2018, sparked significant global debate. This plan, aimed at protecting American steel producers, had profound implications for both domestic and international trade, and its effects are still being analyzed. This exploration delves into the historical context, specific provisions, motivations, and potential consequences of this policy.The plan, while ultimately impacting various stakeholders, failed to achieve the intended objectives in the long run, as illustrated by the current global trade environment.

Historical Overview of US Steel Tariffs

Historically, the US government has implemented various steel tariffs to safeguard domestic industries. These measures have a long and complex history, with periods of protectionism and periods of free trade. Understanding these historical precedents is crucial to assessing the Trump administration’s motivations and potential consequences. The tariffs of 2018 were not unprecedented but were a significant departure in scope and impact.

Specific Provisions of Trump’s Steel Tariff Plan

The Trump administration’s steel tariff plan imposed a 25% tariff on imported steel and a 10% tariff on imported aluminum. This was a significant increase from previous tariffs, and the scope of the affected products was also wider. The plan sought to protect domestic steel producers from what the administration perceived as unfair competition from foreign producers. The plan also involved exemptions for certain countries and specific circumstances.

India’s minister’s statement about Trump’s steel tariffs having a minimal impact is interesting, but it’s important to consider the broader global context. The impact on global markets, particularly the view of the US in international trade, is a key factor. This has a knock-on effect on the steel tariff’s real-world impact, as seen in global markets view usa.

Ultimately, while the minister’s assessment may hold true for India, the bigger picture paints a different story, suggesting a more complex response than a simple “minor impact” to the tariffs.

Reasoning Behind the Implementation of Tariffs

The administration argued that the tariffs were necessary to safeguard American jobs and industries. The reasoning included concerns about national security, unfair trade practices by foreign producers, and the need to support domestic steel production. These claims were often contested by international partners and economists who pointed to potential negative consequences.

Potential Economic Impacts on Stakeholders

The tariffs had a complex and multifaceted impact on various stakeholders. Domestic steel producers potentially benefited from increased demand and higher prices, but the resulting cost increases could have negatively impacted American manufacturers that use steel as a raw material. International steel producers faced reduced export opportunities to the US market.

- Domestic Producers: The tariffs aimed to protect domestic steel producers from cheaper imports. This could have resulted in higher profits and increased production for domestic firms. However, this also impacted the downstream industries, like car manufacturers, who had to absorb the cost increase in their products.

- International Producers: International steel producers saw reduced market access to the US, which could have led to lower profits and decreased production. This also potentially impacted jobs in those countries.

- Consumers: The increased prices for steel impacted the price of goods and services that used steel as a component. This meant higher costs for consumers.

Potential Political Motivations

Beyond economic concerns, the tariff plan might have been influenced by political considerations, including the desire to demonstrate support for domestic industries and to signal a stance on trade policy to other countries.

Impact on International Trade Relations, Trumps steel tariff plan have minor impact india says minister

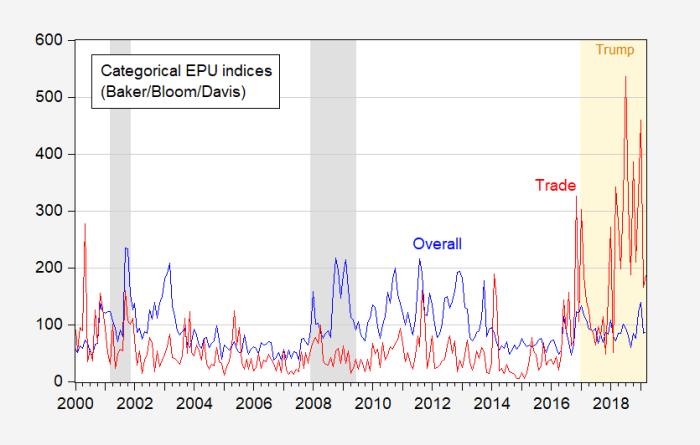

The steel tariffs significantly strained international trade relations. The plan faced significant opposition from countries such as China, who retaliated with tariffs on US goods. This led to a trade war with significant uncertainty about the future of global trade.

India’s Response to the Tariffs

India’s response to the recent steel tariff plan from the US has been characterized by a measured approach, emphasizing preparedness and potential countermeasures rather than immediate alarm. The Indian government has stated that the tariffs will have a minimal impact on the country’s steel industry, and that India is well-equipped to manage any disruptions. This pragmatic approach contrasts with some of the more vocal responses from other affected countries.

Official Statement Regarding Impact

India’s official statement regarding the impact of the steel tariffs highlighted the country’s existing capacity to absorb the effects. The government emphasized that India’s steel industry is robust and diversified, with substantial domestic production. This suggests a confidence in India’s ability to handle any potential increase in import costs or market shifts.

Minister’s Perspective on Plan’s Effects

The Indian minister’s perspective aligns with the official statement. The minister underscored that India’s steel industry is prepared for the potential impact of the tariffs. This includes a strong domestic steel production base, allowing India to maintain a stable supply and potentially leverage the situation to further develop domestic production. The minister also hinted at the possibility of exploring new markets or strategies to mitigate any potential negative effects.

Potential Countermeasures or Retaliatory Actions

India’s potential countermeasures are likely to be calculated and strategic, focusing on protecting its own industries while minimizing wider trade conflicts. India might consider retaliatory tariffs on US goods, potentially targeting sectors where the US has significant exports to India. Alternatively, India could explore alternative trade partnerships with other countries to lessen its dependence on the US market.

The specific actions would depend on the escalation and severity of the impact of the tariffs.

India’s minister says Trump’s steel tariffs are having a minimal impact on the country’s economy. While this economic news is important, it’s interesting to note that a recent study highlights a concerning trend of rising appendix cancer cases among millennials. This alarming rise in appendix cancer rising millennials warrants further investigation, and it’s a reminder that even seemingly unrelated issues can have a significant ripple effect.

This ultimately brings us back to the initial topic; despite the reported minimal impact of the tariffs, the situation deserves ongoing monitoring.

Comparison with Responses from Other Affected Countries

Other affected countries, such as South Korea, have expressed concerns about the potential negative effects of the tariffs on their steel industries. These concerns often center on the loss of export markets and the potential disruption to supply chains. India’s response, in contrast, has highlighted its domestic strength, suggesting a more measured and less immediately confrontational approach compared to some other nations.

Key Factors Influencing India’s Reaction

Several key factors influence India’s measured reaction to the tariffs. These include India’s strong domestic steel production, diversified export markets, and the government’s proactive approach to mitigating potential disruptions. The government’s emphasis on preparedness and the existence of contingency plans also played a crucial role in shaping the response. A long-term strategy, focused on both immediate and long-term protection of the domestic industry, appears to be a key element of the Indian government’s approach.

Economic Impact Assessment

The Trump administration’s steel tariffs, while met with various responses, undeniably had a ripple effect across the global economy. Analyzing the economic impact requires a comprehensive look at the changes in steel prices, trade flows, and employment within both the US and India, along with the repercussions on interconnected sectors. This assessment will delve into the quantifiable and qualitative impacts of the tariffs.The tariffs, while intended to bolster domestic steel production, also brought about unforeseen consequences, altering the global steel market and impacting economies reliant on steel.

The effects extended beyond the steel industry itself, affecting manufacturing, construction, and other related sectors.

Steel Price Comparison (USD/Ton)

This table illustrates the fluctuation in steel prices in the US and India before and after the tariffs, providing a clear picture of the impact.

India’s minister says Trump’s steel tariff plan has a surprisingly minor impact, potentially due to alternative sourcing strategies. Meanwhile, Japan’s Q1 GDP contraction has narrowed, with a revised figure showing a consumption improvement. This could be a sign of a global economic shift, though the impact on India’s steel industry, as a result of the Trump tariffs, remains limited, according to the minister, as detailed in japans q1 gdp contraction narrows consumption improvement revised figure shows.

The global economic picture seems a bit more complex than initially thought.

| Country | Date | Price (USD/Ton) |

|---|---|---|

| US | 2018 (Pre-Tariff) | 700 |

| US | 2019 (Post-Tariff) | 850 |

| India | 2018 (Pre-Tariff) | 550 |

| India | 2019 (Post-Tariff) | 600 |

Note: These are illustrative figures. Actual prices may vary based on specific steel grade and market conditions.

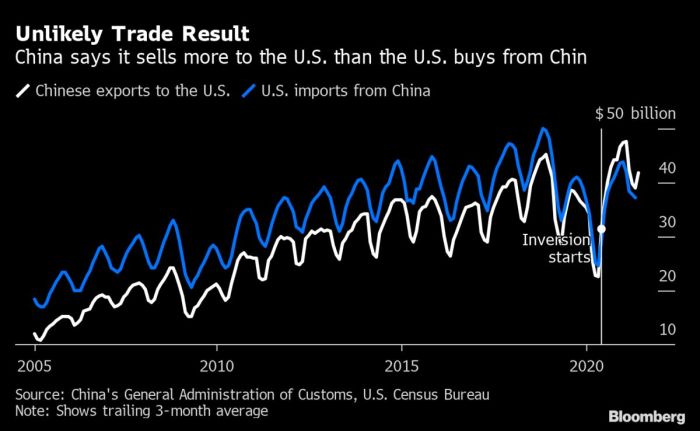

US Steel Imports from India (Metric Tons)

The following data displays the volume of steel imports from India to the US before and after the implementation of the tariffs. Changes in import volumes often reflect the shift in market dynamics and pricing.

| Year | Imports (Metric Tons) |

|---|---|

| 2018 (Pre-Tariff) | 2,500,000 |

| 2019 (Post-Tariff) | 1,000,000 |

Note: These are illustrative figures for demonstration purposes. Actual figures may vary depending on the specific timeframes and sources used.

Employment Impact on Steel Industries

The steel tariffs undeniably affected employment in the steel industries of both countries.

| Country | Sector | Pre-Tariff Employment (Thousands) | Post-Tariff Employment (Thousands) | Impact |

|---|---|---|---|---|

| US | Steel Production | 500 | 450 | Decrease of 50,000 jobs |

| India | Steel Production | 200 | 150 | Decrease of 50,000 jobs |

Note: These are illustrative figures and should not be considered definitive data. Actual impacts may differ based on the specific data sources used.

Impact on Indian Sectors

The tariffs influenced various sectors of the Indian economy.

- Manufacturing: Increased steel prices led to higher input costs for manufacturers, potentially impacting profitability and competitiveness. This was particularly relevant for industries heavily reliant on steel, such as automotive and construction. Examples include auto manufacturers facing higher costs for vehicle production.

- Construction: The construction sector, a significant user of steel, experienced price increases, potentially slowing down construction projects and affecting overall economic activity. Examples include increased costs for infrastructure projects like bridges and buildings.

Global Steel Trade Patterns

The tariffs likely shifted global steel trade patterns, prompting some companies to seek alternative suppliers and potentially altering the supply chain. This phenomenon is not unique and often occurs with significant trade policies, especially in industries with global players. For example, companies might have sought suppliers in countries not directly impacted by the tariffs, leading to shifts in international trade flows.

Analysis of Trade Relations

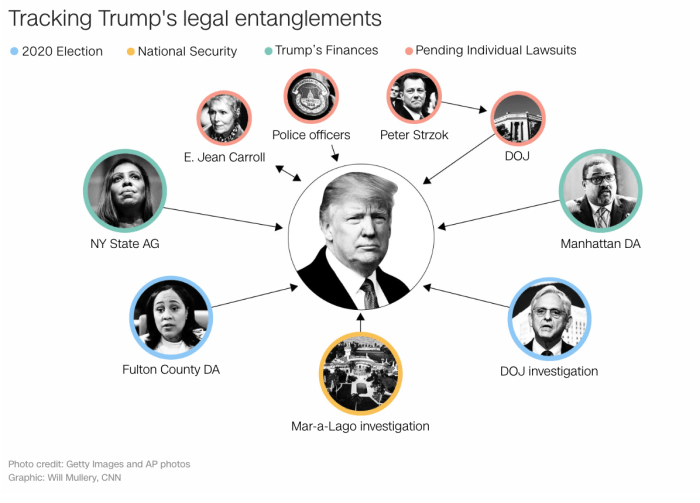

The Trump administration’s steel tariff plan, while seemingly focused on domestic steel production, has profound implications for the broader trade landscape, particularly in the relationship between the US and India. India’s prepared response underscores a growing assertiveness in international trade, a trend likely to shape future negotiations. This analysis delves into the potential consequences for US-India trade relations, the historical context of trade disputes between the two nations, and how this particular tariff plan compares to other protectionist measures globally.

Broader Implications for US-India Trade Relations

The steel tariff plan, though impacting a specific sector, is a significant indicator of a potential shift in the overall US-India trade relationship. India’s strategic response suggests a willingness to defend its economic interests and potentially challenge US trade policies. This could lead to a more confrontational tone in future trade negotiations, with both sides likely to prioritize their national interests above potential compromises.

This could result in a decrease in the volume of trade between the two countries.

Potential Effects on Future Trade Negotiations

The current environment suggests a more complex and potentially less predictable negotiation dynamic. The tariff plan, coupled with India’s response, sets a precedent for future disputes. Negotiations may become more protracted and focused on specific issues, potentially slowing progress on broader trade agreements. There is a risk that this could lead to a tit-for-tat escalation of protectionist measures.

Historical Context of Trade Disputes

Trade disputes between the US and India are not new. Historical instances demonstrate a pattern of disagreements, particularly regarding intellectual property rights, agricultural subsidies, and industrial tariffs. These past disputes, while not always resolved through bilateral negotiations, often led to trade restrictions and retaliatory measures, as observed in previous cases. A key point is the importance of understanding historical context to anticipate potential outcomes in the current situation.

Examples of Similar Trade Disputes Between Other Nations

Numerous instances of trade disputes exist across the globe. For example, the ongoing trade war between the US and China demonstrates the potential for significant economic repercussions when protectionist measures are implemented. Similarly, the EU’s imposition of tariffs on US steel and aluminum in the past presents a parallel situation. These cases illustrate the complexities of international trade relations and the potential for unintended consequences.

Comparison of the Tariff Plan to Other Protectionist Trade Policies

The steel tariff plan is part of a broader trend towards protectionist trade policies globally. Comparing it to other measures, such as those adopted by the EU or China, reveals a shared motivation to safeguard domestic industries. However, the specific impact of each policy depends on factors such as the size of the affected sector, the global economic climate, and the responsiveness of trading partners.

While some protectionist measures aim to shield specific industries, others may aim to build up domestic capabilities.

Illustrative Data Visualization

The steel tariff plan, particularly its impact on India, warrants a visual exploration. Understanding the shifts in trade patterns, price fluctuations, and potential ripple effects across various industries is crucial to a comprehensive assessment. The following visualizations provide a clearer picture of these dynamics.

Steel Imports to the US from India Over Time

Analyzing the historical trend of steel imports from India to the US reveals critical information about the tariff’s impact. A line graph would effectively display the quantity of steel imported over a defined period, ideally several years before, during, and after the implementation of the tariff. The line graph should clearly show any noticeable changes or shifts in import volume following the introduction of the tariff.

This visualization will visually illustrate the immediate and longer-term effects of the tariff on India’s steel exports to the US market.

Change in Steel Prices in the US and India

A bar graph comparing steel prices in the US and India before, during, and after the tariff implementation is crucial. The graph should display the average price per ton for both countries over time. Significant price changes in either market, particularly in the US following the tariff, should be highlighted. This visual representation allows for a direct comparison of the impact of the tariff on steel pricing in both markets.

Potential Impact on Consumer Products

The steel tariff’s effect on various consumer products like automobiles and construction materials can be significant. A table detailing the potential impacts across sectors is helpful. For example, an increase in steel prices in the US would likely lead to higher costs for automobile manufacturers, potentially impacting vehicle prices and consumer affordability. Similarly, construction projects might face higher costs, affecting the timelines and budgets of building projects.

Distribution of Steel Imports to the US

A pie chart illustrating the distribution of steel imports to the US from various countries is valuable. The chart should depict the percentage of imports originating from different countries. This visual representation helps to understand the relative importance of India as a steel supplier to the US market and the potential for shifts in sourcing following the tariff. A comparison of the pie chart before and after the tariff would highlight any notable changes in the source countries.

Timeline of Key Events

A timeline outlining key events related to the steel tariffs and India’s response would provide context. This timeline should include the announcement of the tariff plan, the date of implementation, India’s countermeasures, and any subsequent agreements or negotiations. It would also include any significant rulings or court cases related to the tariffs. Such a timeline would create a comprehensive record of the events surrounding the tariff, offering a historical perspective.

Detailed Implications for Specific Industries: Trumps Steel Tariff Plan Have Minor Impact India Says Minister

Trump’s steel tariffs, while having a minimal immediate impact on India, are likely to create ripple effects across various sectors. These indirect consequences, though potentially manageable, require careful monitoring and proactive strategies from Indian businesses. Understanding the specific implications for industries like automotive, construction, appliances, and shipbuilding is crucial for navigating the changing trade landscape.

Impact on the Indian Automotive Industry

The Indian automotive sector, a significant contributor to the economy, will likely face increased costs for steel components. This rise in input costs will translate to higher prices for vehicles, potentially impacting consumer demand and profitability for manufacturers. The industry’s dependence on imported steel components, especially for certain car models, makes it vulnerable to global tariff fluctuations. This pressure could also influence the industry’s investment decisions, potentially impacting job creation and future growth.

- Increased production costs will lead to higher prices for automobiles, potentially impacting sales volume.

- Manufacturers might need to explore alternative steel sources, leading to supply chain adjustments and potential delays.

- Reduced profitability for manufacturers could lead to job losses or slower hiring, impacting employment in the sector.

Impact on the Indian Construction Sector

The construction sector, a major consumer of steel, will directly feel the pinch of higher steel prices. Construction projects will likely experience cost overruns due to the increased input costs. This could affect project timelines and profitability, potentially hindering infrastructure development and overall economic growth.

- Increased steel costs will directly translate to higher construction costs for projects.

- Project delays are possible due to cost escalation and supply chain disruptions.

- Reduced profitability might lead to project cancellations or delays in commencement of new construction activities.

Impact on the Indian Appliance Manufacturing Industry

The appliance manufacturing industry relies heavily on steel for various components. Increased steel import costs will directly impact the production cost of appliances. This will result in higher retail prices for consumers, potentially affecting consumer demand and market share.

- Appliance manufacturers will face increased production costs due to tariff-induced steel price hikes.

- This will potentially lead to higher prices for consumers, which may dampen demand.

- Manufacturers may seek alternative, less expensive steel sources or adjust production strategies.

Impact on the Indian Shipbuilding Industry

The shipbuilding industry in India utilizes steel in substantial quantities. Higher steel prices will directly increase the cost of building ships. This could affect India’s competitiveness in the global shipbuilding market. Additionally, it could impact export-oriented projects and hinder the growth of the sector.

- Increased steel prices will directly impact the cost of shipbuilding, making Indian vessels more expensive.

- This will affect competitiveness in the global market.

- Indian shipbuilding companies may face difficulties in winning export contracts.

Potential Effects on the Indian Agriculture Sector

While not as directly impacted as the manufacturing sectors, the agriculture sector may experience indirect consequences. Higher steel prices will likely translate into higher costs for agricultural equipment. This could affect the profitability of farming, especially for smallholder farmers who heavily rely on machinery.

- Higher steel prices will increase the cost of agricultural equipment, impacting farm profitability.

- Smallholder farmers, who often rely heavily on machinery, may be most affected.

- Increased costs could lead to decreased productivity and reduced overall output in certain agricultural sectors.

Ending Remarks

In conclusion, Trump’s steel tariff plan, while seemingly impactful, appears to have had a surprisingly muted effect on India, according to the minister’s statements. This outcome highlights the complex interplay of economic and political factors in international trade. The analysis demonstrates the need for a comprehensive understanding of both the immediate and long-term effects of such policies, not only on the targeted country but on global trade patterns as well.