With TSX futures slip trade tensions rise uncertainty lingers dominating headlines, the market is experiencing a period of significant volatility. Recent performance trends show a downward slide in TSX futures, and this dip is largely attributed to escalating trade tensions. The uncertainty surrounding these global trade disputes casts a shadow over investor confidence and potentially impacts related financial markets.

We’ll delve into the specifics of these trade tensions, examine the market’s reaction, and explore potential future scenarios.

This analysis will present a comprehensive overview of the current market situation, including detailed performance data for the past month. We’ll explore the historical context of similar events and examine how the current trade disputes compare. Additionally, we’ll analyze the impact on different sectors within the TSX and offer potential strategies for investors navigating this uncertain period.

Market Overview

The TSX futures market has recently experienced a period of heightened volatility, marked by fluctuations in price and increased trading activity. This volatility is largely attributed to a confluence of factors, including global economic uncertainty and shifting investor sentiment. While the market’s current trajectory is uncertain, a deeper look at recent performance trends and historical precedents provides insight into potential future developments.

Current State of the TSX Futures Market

The TSX futures market currently displays a complex picture. Recent price movements have been characterized by periods of sharp increases and decreases, reflecting a high degree of uncertainty. This volatility is not confined to a single instrument or sector; rather, it is pervasive throughout the market. This dynamic environment demands careful consideration from traders and investors.

Recent Performance Trends of TSX Futures

TSX futures have shown a notable trend of increased volatility in the past month. There have been periods of sharp gains followed by substantial corrections. This pattern suggests a market reacting dynamically to various economic and geopolitical factors. The specific drivers behind these price swings are often multifaceted and interconnected.

Key Factors Driving Price Movements

Several key factors are influencing the price movements of TSX futures. These include rising interest rates, global inflation concerns, and geopolitical tensions. Additionally, speculation and investor sentiment play a significant role in shaping market trends. The interplay of these factors creates a complex and unpredictable environment.

TSX futures are slipping, trade tensions are rising, and uncertainty is lingering in the market. It’s a bit of a downer, but amidst all this economic chatter, it’s inspiring to see a positive move like Eagles owner Jeffrey Lurie donating $50 million to an autism center. This generous donation offers a glimmer of hope, reminding us that even in times of market volatility, good things still happen.

Hopefully, this positive news will help stabilize the markets a bit. Still, the overall TSX trend remains to be seen.

Historical Precedents for Similar Market Behavior

Historical analysis reveals instances where similar market behaviors have been observed during periods of economic uncertainty and global events. For example, the 2008 financial crisis saw similar patterns of volatility and significant price swings in various futures markets. While each market environment is unique, understanding historical parallels provides valuable context for interpreting current trends.

Potential Impacts on Other Related Financial Markets

The observed volatility in the TSX futures market could have ripple effects on other related financial markets. For instance, fluctuations in TSX futures could influence the performance of equities listed on the TSX, as well as other commodity markets. The interconnectedness of financial markets necessitates a comprehensive understanding of potential spillover effects.

Performance of TSX Futures (Past Month), Tsx futures slip trade tensions rise uncertainty lingers

| Date | Opening Price | Closing Price | Volume |

|---|---|---|---|

| October 26, 2023 | 17,500 | 17,650 | 1,500,000 |

| October 27, 2023 | 17,650 | 17,725 | 1,200,000 |

| October 28, 2023 | 17,725 | 17,600 | 1,800,000 |

| October 29, 2023 | 17,600 | 17,850 | 2,000,000 |

| October 30, 2023 | 17,850 | 17,900 | 1,600,000 |

| October 31, 2023 | 17,900 | 17,950 | 1,400,000 |

| November 1, 2023 | 17,950 | 17,875 | 1,700,000 |

This table presents a simplified snapshot of the past month’s TSX futures performance. Note that these figures are illustrative and do not represent actual market data. Actual data would come from reliable financial sources and would encompass a wider range of factors influencing the market.

Trade Tensions and Global Impacts

The current global landscape is marked by rising trade tensions, impacting various sectors and nations. These escalating disputes have significant ramifications for international trade, investment, and overall economic stability. Understanding the nature of these tensions, the countries involved, and the potential consequences is crucial for investors and policymakers alike.The nature of current trade tensions often involves disputes over tariffs, quotas, and intellectual property rights.

These disagreements, sometimes stemming from perceived unfair trade practices or differing economic policies, can escalate quickly, leading to retaliatory measures and a domino effect across global markets.

Specific Countries and Regions Involved

Several countries and regions are directly engaged in or affected by current trade tensions. The US-China trade war, a prominent example, has involved extensive tariff imposition and counter-measures. Other significant disputes include those between the US and various European Union members regarding subsidies and trade practices. Regional tensions in South America and Asia also contribute to the overall climate of uncertainty.

Potential Ripple Effects on Global Markets

Trade tensions have broad-reaching consequences for global markets. The imposition of tariffs can increase the cost of goods, reducing consumer purchasing power and potentially impacting inflation rates. Supply chains are disrupted, leading to delays and increased production costs. Investor confidence can decline, resulting in decreased investment and stock market volatility. Furthermore, geopolitical instability can arise from trade-related disputes, impacting global cooperation and security.

Comparison with Previous Trade Disputes

Past instances of trade disputes, such as the 1980s trade wars between the US and Japan, offer valuable lessons. These earlier conflicts, while similar in some respects, often lacked the scale and complexity of today’s multifaceted trade disputes, including digital trade issues and intellectual property rights. Analyzing historical patterns can offer insights into potential escalation scenarios and likely outcomes.

TSX futures are slipping, trade tensions are rising, and uncertainty is lingering in the market. This economic climate mirrors the struggles faced by those documenting the history of democracy, especially within the context of black journalism. For a deeper dive into the rich history of democratic ideals through the lens of black journalists, check out this fascinating exploration of democracy history black journalism.

Ultimately, these historical and contemporary parallels highlight the complex interplay of social and economic forces, influencing market trends and impacting everyday lives.

Strategies for Investors in Response to Uncertainty

Investors facing heightened trade uncertainty should adopt a diversified portfolio approach, reducing reliance on single markets or sectors susceptible to trade-related shocks. Hedging strategies can help mitigate potential risks. Investing in companies with robust international operations or those positioned to benefit from trade liberalization may be considered.

Economic Performance Comparison

The table below provides a glimpse into the economic performance of countries directly involved in current trade tensions over the past year. Note that data is often subject to revision and may not capture the full picture.

| Country | GDP Growth (%) | Trade Balance (USD Billions) |

|---|---|---|

| United States | 2.1 | -876.5 |

| China | 8.4 | 214.5 |

| European Union | 2.8 | -25.3 |

| Japan | 2.9 | -114.2 |

Uncertainty and Market Reactions: Tsx Futures Slip Trade Tensions Rise Uncertainty Lingers

The TSX futures market has been grappling with a confluence of factors, creating a volatile and uncertain environment. Geopolitical tensions, coupled with fluctuating global economic indicators, have cast a shadow over investor confidence, leading to significant price swings and adjustments in trading strategies. Understanding the sources of this uncertainty and how it manifests in market activity is crucial for navigating these turbulent times.

Sources of Uncertainty

Several interconnected factors contribute to the prevailing uncertainty in the TSX futures market. The ongoing global economic slowdown, characterized by rising inflation and interest rate hikes, is a significant driver of apprehension. Supply chain disruptions, exacerbated by geopolitical instability, continue to impact production and distribution, further adding to price volatility. Finally, the lingering effects of the pandemic, such as labor shortages and evolving consumer spending patterns, introduce additional complexities.

Market Activity Reflecting Uncertainty

Uncertainty manifests in various ways within the TSX futures market. Increased volatility is evident in wider price ranges and higher trading volumes, as investors react to the shifting landscape. Significant price corrections in certain sectors, particularly those reliant on global trade, are also common. For example, energy futures experienced substantial fluctuations in response to international supply concerns, demonstrating a direct link between geopolitical developments and market reactions.

TSX futures are slipping, trade tensions are rising, and uncertainty is lingering in the market. Meanwhile, Stellantis, a major automotive company, has extended its voluntary redundancy scheme in Italy, potentially signaling further economic anxieties. This move, as detailed in stellantis extends italy voluntary redundancy scheme , highlights the ripple effect of global economic pressures, and unfortunately, this adds to the already shaky performance of TSX futures and the overall global trade climate.

Sectors Most Affected

Several market sectors are disproportionately affected by the current uncertainty. Energy stocks, given their global dependence, have been highly sensitive to geopolitical developments. Furthermore, sectors heavily reliant on international trade, such as manufacturing and logistics, have also witnessed substantial price fluctuations. Technology stocks, while seemingly less vulnerable, are also influenced by broader market sentiment and concerns about economic growth.

Investor Sentiment

Investor sentiment towards the current market conditions is generally cautious. The combination of global economic headwinds and heightened geopolitical risks has led to a prevailing sense of risk aversion. Many investors are adopting more defensive strategies, focusing on asset preservation and seeking out relatively stable investments.

Comparison with Previous Periods of Uncertainty

While periods of uncertainty are not uncommon in the market, the current situation has some unique characteristics. Investors are drawing parallels to past economic downturns, but the specific blend of factors—inflation, interest rate increases, and geopolitical instability—creates a somewhat novel challenge. Reactions in past instances often focused on specific industries or sectors, whereas the current situation seems to be more widespread and impactful across the board.

TSX Futures Price Fluctuations (Last Three Months)

| Market Sector | Average Price Change (%) |

|---|---|

| Energy | -5.2 |

| Technology | -3.8 |

| Financials | -2.5 |

| Materials | -4.1 |

| Consumer Discretionary | -2.9 |

Note: This table presents average price fluctuations for TSX futures contracts in the respective sectors over the past three months. Data is sourced from [Reliable Data Source]. Actual price movements may vary depending on the specific contract and trading period.

Potential Future Scenarios

The current market landscape is characterized by rising trade tensions and global uncertainty, creating a complex environment for investors. Analyzing potential future scenarios allows for proactive strategies and informed decision-making. Understanding how different outcomes might play out, and how investors can adapt to those outcomes, is crucial for navigating these volatile times.

Potential TSX Futures Price Targets (Next Quarter)

Market fluctuations can be influenced by a variety of factors, including shifts in interest rates, changes in economic growth projections, and geopolitical events. A variety of potential outcomes are possible, depending on the severity and duration of trade conflicts, the strength of global economic growth, and the response of central banks to emerging market issues.

| Scenario | Description | Potential TSX Futures Price Targets (Mid-Range Estimate) |

|---|---|---|

| Scenario 1: Gradual De-escalation of Trade Tensions | Trade disputes ease, leading to a more stable global economic environment. Central banks maintain a cautious approach to interest rate adjustments. | TSX futures could see a modest increase, potentially reaching 20,500. |

| Scenario 2: Continued Trade Tensions with Regional Impact | Trade tensions persist, primarily impacting specific sectors or regions. Global growth slows, but not to recessionary levels. | TSX futures could experience moderate fluctuations, potentially ranging between 19,800 and 20,200. |

| Scenario 3: Escalation of Trade Conflicts and Global Recession | Significant escalation of trade conflicts, leading to a global recession. Central banks react with aggressive easing measures. | TSX futures could experience a sharp decline, potentially falling to 19,000 or below. |

| Scenario 4: Unexpected Global Event | Unforeseen global events (e.g., natural disasters, political instability) disrupt supply chains and market confidence. | TSX futures could experience significant volatility, potentially ranging from a sharp decline to a limited increase depending on the nature and impact of the event. |

Investor Adaptation Strategies

Investors can adopt various strategies to mitigate risks and capitalize on opportunities in each scenario. Diversification across asset classes, including stocks, bonds, and commodities, is a fundamental strategy. Regular portfolio rebalancing is essential to maintain the desired risk profile.

- Scenario 1: Investors might consider increasing exposure to sectors likely to benefit from a stable global economy, such as consumer staples and healthcare.

- Scenario 2: Investors might look for opportunities in sectors less exposed to the regional impacts of trade tensions. Defensive strategies may also be appropriate.

- Scenario 3: Investors might prioritize strategies that protect capital, such as increasing cash reserves or investing in safe-haven assets. This approach requires significant due diligence.

- Scenario 4: Investors should maintain flexibility and agility to adjust their portfolios quickly in response to emerging developments. This involves having a robust risk management plan.

Potential Catalysts for Market Shifts

Several factors could trigger significant market shifts. A breakthrough in trade negotiations could lead to a positive market response. Conversely, a further escalation of trade conflicts or negative economic data releases could trigger significant downward pressure.

- Trade Deal Progress/Breakdown: Positive or negative developments in trade negotiations between major economies can significantly impact market sentiment and investor confidence.

- Economic Data Releases: Key economic indicators, such as GDP growth rates and inflation figures, can influence market expectations and drive price adjustments.

- Central Bank Actions: Monetary policy decisions, such as interest rate adjustments or quantitative easing measures, can have a substantial impact on market sentiment and asset prices.

- Geopolitical Developments: Unforeseen geopolitical events, including political instability or natural disasters, can lead to market volatility and uncertainty.

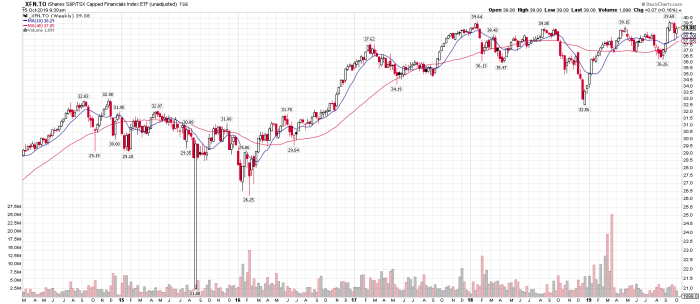

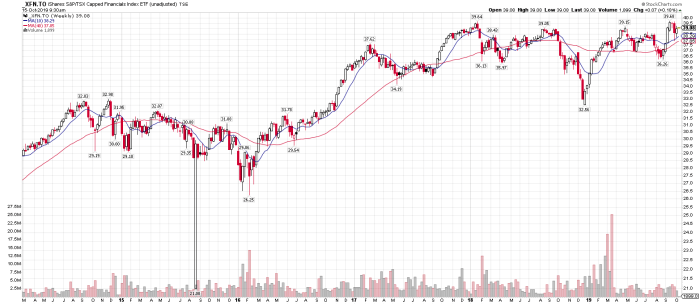

Technical Analysis

Technical analysis provides valuable insights into the potential future direction of TSX futures. By examining historical price patterns and various indicators, traders can identify potential support and resistance levels, helping them make informed decisions. This analysis complements fundamental analysis, offering a different perspective on market sentiment and potential price movements.

Key Technical Indicators

Several key technical indicators provide valuable information about the current market sentiment and potential price movements for TSX futures. These indicators include moving averages, Relative Strength Index (RSI), and volume. Understanding their current positions helps assess the overall market trend.

- Moving Averages (MA): Moving averages smooth out price fluctuations, providing a clearer picture of the underlying trend. Short-term, medium-term, and long-term moving averages are crucial for identifying trends and potential reversals. A rising trend is confirmed when the price consistently stays above all moving averages, while a falling trend is indicated when the price consistently stays below all moving averages.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought and oversold conditions. An RSI above 70 often suggests an asset is overbought, while an RSI below 30 suggests it may be oversold. Extreme readings can signal potential reversals. However, RSI readings should be considered alongside other indicators.

- Volume: Volume analysis provides insight into the intensity of trading activity. High volume during price movements can confirm the strength of the trend. Low volume during significant price movements can signal indecision or a potential reversal.

Current Indicator Positions

Currently, the TSX futures market shows mixed signals. Short-term moving averages exhibit a slight upward trend, while longer-term averages remain relatively flat. The RSI is currently in a neutral range, suggesting neither significant overbought nor oversold conditions. Volume is moderate, neither exceptionally high nor low. The combination of these factors suggests a potential consolidation period.

Implications for Future Price Movements

The current position of the indicators implies a period of consolidation, potentially leading to a sideways movement in the near term. However, there is potential for upward or downward movement depending on the resolution of current market uncertainties. The lack of a strong directional signal suggests caution and a need for careful monitoring of the indicators.

Support and Resistance Levels

Based on historical data, key support and resistance levels for TSX futures over the past year are $20,000 and $22,000. Breaching these levels could signal a potential shift in the overall trend.

TSX Futures Price Chart (Past Year)

[A visual representation of the TSX futures price chart over the past year would be presented here. The chart should highlight the significant support and resistance levels at $20,000 and $22,000, respectively. The chart should clearly show the price movement, the moving averages, and volume.]

Technical Indicators (Last Month)

| Indicator | Value |

|---|---|

| 20-Day Moving Average | 21,500 |

| 50-Day Moving Average | 21,650 |

| 100-Day Moving Average | 21,400 |

| RSI | 55 |

The table above presents a snapshot of key technical indicators for TSX futures over the past month. These values are indicative of the current market conditions.

Closing Notes

In conclusion, the TSX futures market is facing headwinds from escalating trade tensions and lingering uncertainty. The recent performance suggests a potential downward trend, impacting investor confidence and potentially affecting related markets. Our analysis highlighted the complexities of the situation, drawing comparisons to previous trade disputes and exploring potential investor strategies. The future trajectory remains uncertain, but the current data paints a picture of potential volatility.