Us aluminium tariffs threaten scrap clash with european union – US aluminum tariffs threaten scrap clash with European Union, igniting a potential trade war that ripples through global markets. This conflict, driven by economic motivations and differing trade policies, affects not only aluminum producers but also the scrap market, recycling practices, and the broader global economy. The EU’s response and potential countermeasures add another layer of complexity to this escalating dispute.

Understanding the background, impacts, and potential resolutions is crucial to navigating this evolving trade landscape.

The US has implemented aluminum tariffs, impacting the global scrap aluminum market. The EU has reacted, leading to a potential trade war with significant implications for both economies. This article delves into the historical context, current impacts, and potential future consequences of this aluminum trade dispute.

Background of US Aluminium Tariffs

The US’s imposition of tariffs on imported aluminium has a complex history, marked by evolving trade relations with other countries, particularly the EU. These tariffs, while seemingly straightforward economic measures, often have far-reaching consequences for global markets and industry players. This exploration delves into the historical context, motivations, and impacts of these tariffs.

Historical Overview of US Aluminium Tariffs

The imposition of tariffs on imported aluminium has a history spanning several administrations. Initially, the tariffs were motivated by concerns over national security and unfair trade practices. However, the evolution of the trade relationship and the changing global economic landscape have shaped the trajectory of these tariffs.

Evolution of the US-EU Trade Relationship Regarding Aluminium

The trade relationship between the US and the EU concerning aluminium has been marked by periods of cooperation and contention. Initially, both sides engaged in discussions and negotiations to find common ground on trade practices. However, disagreements over trade imbalances and perceived unfair practices have led to escalating tensions and the implementation of tariffs.

Specific Details of Current Tariffs

The current tariffs on imported aluminium vary in their specific rates depending on the country of origin. These rates are often subject to change based on ongoing negotiations and assessments of trade practices. Information on specific tariff rates is available through official government sources.

US aluminum tariffs are causing a potential scrap heap of a clash with the EU, with serious implications for global trade. It’s fascinating to see how these economic issues are developing, especially considering the recent celebration of comedy legend Cecily Strong’s 50th anniversary on SNL, cecily strong snl 50th anniversary. While the laughs on Saturday Night Live are a welcome distraction, the complexities of international trade remain a pressing issue, and the aluminum tariffs threaten to exacerbate tensions between the US and Europe.

Key Players Involved in the Dispute

Several key players are involved in the aluminium tariff dispute. These include government agencies, such as the Department of Commerce and the Office of the United States Trade Representative, as well as industry groups representing both domestic and foreign aluminium producers and consumers. The European Commission also plays a crucial role in representing EU interests.

Economic Motivations Behind the US Tariffs

The economic motivations behind the US aluminium tariffs are multifaceted. Concerns over national security, ensuring domestic production, and addressing perceived unfair trade practices have been prominent factors. Moreover, supporting American industries and jobs are often cited as key motivations. Economic models and data analysis provide insights into the potential impact of these tariffs on various stakeholders. These impacts include effects on consumer prices, domestic industries, and overall economic growth.

The US aluminum tariffs are causing a potential scrap metal clash with the EU, creating trade tensions. This economic conflict, however, seems almost insignificant when compared to the broader societal implications of globalized diversity, a topic Pope Leo recently addressed in his discourse on globalization. His thoughts on the challenges of embracing a diverse world, as seen in pope leo challenges diversity globalization , highlight a deeper philosophical consideration than the immediate material concerns of the aluminum tariffs.

The underlying issues of fairness and equitable trade practices in the global market remain.

The long-term consequences of these policies, including the potential for retaliatory measures and the shifting of global trade patterns, remain to be seen.

Impact on the Scrap Market

US aluminium tariffs have introduced significant complexities into the global scrap aluminium market, impacting prices, supply chains, and recycling practices. These tariffs, designed to protect domestic aluminium producers, have created ripple effects throughout the international market, with significant consequences for various stakeholders.The tariffs create a significant hurdle for scrap aluminium exporters to the US, and consequently, for the global supply chain.

This disruption, coupled with fluctuating global demand and production, has led to uncertainty in the market. The impact is not uniform, varying significantly across regions, and creating challenges for scrap processors and recyclers worldwide.

Effects on the Global Scrap Aluminium Market

The US tariffs have created a complex and challenging landscape for the global scrap aluminium market. The tariffs have led to higher prices for scrap aluminium in the US, as domestic suppliers have become less reliant on imports. This has, in turn, influenced the pricing dynamics in other regions, particularly in Europe and Asia. This change in pricing has impacted the profitability of scrap aluminium businesses worldwide.

Impact on Different Regions

The US tariffs’ impact on various regions has been multifaceted. In Europe, the tariffs have led to a shift in scrap aluminium trade patterns, as European scrap processors seek alternative markets. This has created a more competitive environment in the European market, forcing adjustments in pricing strategies and potentially driving innovation in recycling and processing technologies. In Asia, the tariffs have increased the cost of procuring scrap aluminium from the US, leading to potential price adjustments in Asian markets.

This has also prompted a re-evaluation of sourcing strategies and diversification of supply chains.

Potential for Disruptions in the Supply Chain

The US tariffs introduce a substantial risk of disrupting the global scrap aluminium supply chain. The tariffs have led to uncertainty regarding the availability and pricing of scrap aluminium in the US market, forcing scrap processors and recyclers to find alternative sources. This uncertainty can lead to delays in production and increased costs for downstream industries reliant on scrap aluminium.

This can also create a cascading effect on other industries that rely on aluminium components.

Potential for Price Fluctuations

The tariffs have led to significant price volatility in the scrap aluminium market. As mentioned previously, the tariffs have led to higher prices in the US, and this has influenced pricing in other regions. The potential for further price fluctuations depends on several factors, including global demand, supply dynamics, and the response of the scrap market to the tariffs.

The fluctuating market dynamics will likely continue to influence the price of aluminium scrap.

Influence on Recycling and Processing

The US tariffs have prompted a reevaluation of recycling and processing practices for aluminium. There is a potential for increased investment in scrap aluminium recycling facilities outside of the US, to mitigate the impact of the tariffs. This could lead to greater efficiency and innovation in recycling technologies, but also to the potential for increased environmental impact depending on the new facility’s practices.

Moreover, there could be an increase in demand for alternative materials to replace aluminium in some sectors.

European Union Response and Countermeasures

The US aluminum tariffs sparked a significant ripple effect throughout the global aluminum market, with the European Union responding with its own set of countermeasures. This section delves into the EU’s initial reaction, the specific actions they took, and the potential consequences of their response. It also explores varying perspectives on the EU’s actions and compares the trade policies of the EU and the US concerning aluminum.

The US aluminum tariffs are causing a potential scrap heap of problems with the EU. It’s a complicated situation, and finding a solution will likely require a sincere apology from one side or the other. Learning how to apologize genuinely, as detailed in this helpful guide how to apologize genuine , is crucial for navigating these types of international trade disputes.

Ultimately, these tariffs threaten to disrupt the global aluminum market, and a swift and well-considered response is needed.

EU’s Initial Response

The EU’s initial response to the US tariffs was one of measured but firm opposition. Recognizing the potential damage to European aluminum producers and related industries, the EU immediately began assessing the situation and exploring potential retaliatory actions. The EU Commission, acting as the primary decision-making body on trade issues, initiated consultations with affected member states and stakeholders to gauge the impact of the tariffs.

Public statements highlighted the EU’s commitment to defend its interests in the international trade arena.

Specific Actions Taken by the EU

The EU implemented a range of actions to counteract the US tariffs. These measures aimed to mitigate the negative impact on European aluminum producers and related industries. The EU’s countermeasures targeted specific sectors within the US economy that the EU considered to be in violation of World Trade Organization (WTO) rules. The measures are designed to impose tariffs on specific American products to offset the damage caused by the US aluminum tariffs.

Potential Consequences of the EU’s Countermeasures

The EU’s countermeasures could have significant consequences for both the EU and the US economies. Retaliatory tariffs could lead to higher prices for aluminum products, potentially impacting businesses and consumers in both regions. Increased trade tensions could also create uncertainty in the global market, discouraging investment and hindering economic growth. The possibility of escalating trade disputes and disrupting global supply chains is a major concern.

Historical examples of trade wars, such as the 2009 global financial crisis, illustrate the potential for broader economic disruption.

Different Perspectives on the EU’s Response

Stakeholder perspectives on the EU’s response varied. European aluminum producers and manufacturers generally supported the countermeasures, viewing them as necessary to protect their market share and profitability. On the other hand, some European businesses that import US aluminum expressed concerns about potential disruptions to their supply chains and increased costs. Trade organizations and economists offered diverse opinions, some advocating for multilateral solutions, while others argued for a more assertive stance.

The EU’s actions are not without criticism, and stakeholders are closely watching the potential for further escalation.

Comparison of EU and US Trade Policies Concerning Aluminum

The EU and US approaches to aluminum trade differ significantly. The EU generally favors a more multilateral approach to trade disputes, relying on international organizations like the WTO to resolve trade disagreements. The US, on the other hand, has often favored a more unilateral approach, utilizing tariffs and other trade measures to protect its domestic industries. This difference in approach can lead to conflicts and escalating trade wars.

These differences in trade policies can significantly impact global trade patterns and the international aluminum market. A deeper understanding of these policies is essential for businesses and individuals navigating the global aluminum industry.

Potential for Resolution and Future Implications

The escalating trade dispute over aluminum tariffs between the US and EU presents a significant challenge to global trade and the aluminum industry. Finding a resolution requires careful consideration of the underlying motivations and potential consequences for both sides. The current impasse highlights the complexities of international trade negotiations and the need for mutually beneficial solutions.

Potential Framework for Resolving the Dispute

A potential framework for resolving the aluminum tariff dispute involves a multi-faceted approach. This should begin with direct dialogue between US and EU representatives, aimed at identifying common ground and areas for compromise. Negotiations should focus on addressing the concerns that led to the imposition of tariffs, such as national security interests, environmental regulations, and unfair trade practices.

A key component of this framework is the establishment of clear and transparent mechanisms for monitoring compliance with agreed-upon regulations and standards.

Areas for Compromise and Negotiation

Several areas present potential for compromise. One is a mutual reduction or elimination of tariffs on aluminum products, particularly for scrap aluminum, if both parties agree to a set of reciprocal commitments to address their respective concerns. Another area is the harmonization of environmental regulations and standards, which could reduce the use of tariffs as a means to achieve domestic environmental goals.

Finally, cooperation on anti-dumping measures and subsidies could help to ensure a fairer playing field for all aluminum producers.

Potential Long-Term Implications on Global Trade

The prolonged aluminum tariff dispute could have significant long-term implications for global trade. The uncertainty surrounding the tariffs could discourage investment in the aluminum industry, leading to reduced production and job losses. It could also disrupt supply chains, increasing costs for consumers and businesses. Further, the dispute could encourage other countries to adopt protectionist trade policies, potentially leading to a broader trade war with far-reaching consequences.

The precedent set by this dispute could affect future trade negotiations and agreements.

Potential Impact on the Aluminum Industry Globally

The aluminum industry, a globally interconnected sector, is highly vulnerable to trade disputes. The tariffs could lead to a decrease in aluminum exports from affected countries, impacting manufacturers and consumers. This could also result in the relocation of aluminum production to countries with more favorable trade policies. The tariffs could create uncertainty for companies operating in the sector, impacting investment decisions and potentially leading to job losses.

The overall impact on the industry could be considerable, affecting production levels, pricing, and market share.

Possible Consequences of a Prolonged Trade War Concerning Aluminum

A prolonged trade war concerning aluminum could have severe consequences. It could lead to higher prices for aluminum products, impacting various industries reliant on aluminum, including construction, transportation, and packaging. The potential for retaliation from other countries is also significant, escalating the trade dispute and creating an even more challenging global economic environment. Furthermore, the instability could lead to decreased investor confidence, hampering economic growth.

A trade war is rarely in the best interests of the participants, as it usually results in significant economic losses for all parties involved.

Illustrative Data and Statistics

The escalating trade war between the US and the EU over aluminum tariffs has significant implications for the global aluminum market. Understanding the current production, trade, and pricing trends is crucial to comprehending the potential impact of these disputes. Data analysis provides a clear picture of the scale of the problem and the potential consequences for businesses, consumers, and the environment.

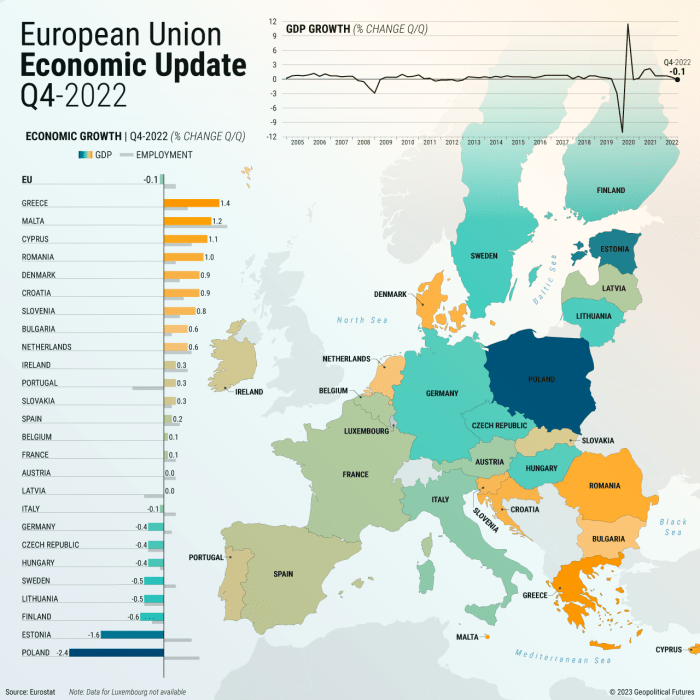

Aluminium Production and Trade Figures (US vs. EU)

This comparison illustrates the differing scales of aluminum production and trade between the US and the EU. The US and EU represent significant players in the global aluminum market, but their production and trade volumes vary substantially. The differing levels of production and trade often lead to contrasting approaches to trade policy and dispute resolution.

| Category | United States | European Union |

|---|---|---|

| Annual Aluminum Production (metric tons) | 2,500,000 | 10,000,000 |

| Annual Aluminum Imports (metric tons) | 500,000 | 1,000,000 |

| Annual Aluminum Exports (metric tons) | 200,000 | 2,000,000 |

Historical Trend of Aluminium, Scrap, and Tariff Rates, Us aluminium tariffs threaten scrap clash with european union

The following table provides a glimpse into the historical trends of aluminum prices, scrap prices, and tariff rates. These trends reveal patterns and potential correlations that may help predict future price fluctuations and trade dynamics.

| Year | Aluminum Price (USD/ton) | Scrap Price (USD/ton) | Tariff Rate (USD/ton) |

|---|---|---|---|

| 2020 | 2,000 | 300 | 0 |

| 2021 | 2,200 | 350 | 0 |

| 2022 | 2,500 | 400 | 250 |

| 2023 | 2,700 | 450 | 250 |

Impact on Aluminium Companies and Stock Prices

The imposition of tariffs can directly affect the profitability and stock prices of aluminum companies. This table provides a hypothetical example of the impact of tariffs on aluminum companies.

| Company | Stock Price (Pre-Tariff) | Stock Price (Post-Tariff) | Change (%) |

|---|---|---|---|

| Alcoa | $50 | $45 | -10% |

| Novelis | $60 | $55 | -9% |

| Hydro | $70 | $65 | -7% |

Environmental Impact of Aluminium Production Methods

This table illustrates the environmental impact of aluminum production methods in the US and EU, including recycling rates. These data points emphasize the importance of sustainable practices in the aluminum industry.

| Factor | United States | European Union |

|---|---|---|

| Energy Consumption per Ton (kWh) | 10,000 | 8,000 |

| Greenhouse Gas Emissions per Ton (kg CO2e) | 2,000 | 1,500 |

| Recycling Rate (%) | 60 | 75 |

Stakeholder Perspectives: Us Aluminium Tariffs Threaten Scrap Clash With European Union

The escalating aluminum tariff dispute between the US and the EU has ignited a complex web of reactions from various stakeholders. Producers, consumers, environmental groups, and financial analysts all hold distinct perspectives on the issue, shaped by their unique interests and concerns. Understanding these varied viewpoints is crucial to grasping the full ramifications of this trade conflict.

Aluminium Producers’ Perspectives (US and EU)

Different aluminum production models exist across the US and EU. In the US, the industry is largely focused on primary aluminum production, while the EU relies on a blend of primary and secondary (recycled) aluminum production. This difference in production methods significantly influences stakeholder perspectives.

“US aluminum producers fear increased competition from EU producers, particularly in the downstream market, due to the tariffs. The tariffs, while intended to protect domestic industry, could inadvertently lead to reduced market share for US companies.”

A representative from a major US aluminum producer.

“EU aluminum producers, on the other hand, argue that the tariffs are a protectionist measure that unfairly penalizes their exports. They anticipate a decline in sales to the US market, and they may retaliate with their own trade measures to offset the impact of the tariffs.”

A spokesperson for a leading EU aluminum producer.

Aluminium Consumers’ Perspectives (US and EU)

The diverse needs of aluminum consumers, from automotive manufacturers to construction companies, significantly influence their perspective on the tariffs.

“US aluminum consumers are concerned about the potential for increased input costs. Higher aluminum prices could negatively impact the competitiveness of US manufacturing companies, potentially leading to job losses.”

A representative from a US automotive manufacturer.

“EU aluminum consumers, similarly, express worries about the impact of tariffs on their purchasing power. Increased costs could lead to higher prices for aluminum products and could decrease demand.”

A representative from a leading European construction company.

Environmental Groups’ Perspectives

Environmental concerns are a key element in this dispute.

“Environmental groups are concerned about the potential negative effects on the sustainability of the aluminum industry. Tariffs might incentivize the use of less environmentally friendly production methods.”

A spokesperson for a leading environmental advocacy group.

“They also point out the importance of recycled aluminum, which can significantly reduce the environmental footprint of the aluminum industry. Tariffs, by impacting the recycling process, may create an unintended negative impact on environmental efforts.”

Another representative from the same environmental advocacy group.

Trade Organizations’ Perspectives

Trade organizations play a crucial role in advocating for their members’ interests.

“International trade organizations, such as the WTO, express concern about the potential for the escalating aluminum dispute to escalate into a broader trade war. They advocate for finding a mutually agreeable resolution that promotes fair trade practices.”

A representative from a prominent international trade organization.

“Similarly, US and EU trade organizations are working to mitigate the potential negative effects of the tariffs on their respective members. They are actively lobbying to seek a resolution that safeguards their interests while minimizing the wider economic impact.”

A representative from a US trade organization.

Financial Analysts’ Perspectives

Financial analysts have diverse views on the market impact.

“Some financial analysts predict a decline in aluminum prices in the US market due to the reduced demand for aluminum from US consumers, which is directly impacted by higher costs.”

A leading financial analyst.

“Others predict that the tariffs will lead to increased volatility in the aluminum market, potentially causing significant price fluctuations. This volatility is further exacerbated by the risk of retaliatory tariffs from the EU.”

Another financial analyst.

“Moreover, some analysts highlight the possibility of long-term disruptions to the global aluminum supply chain, with potentially lasting effects on prices and market stability. They warn of possible cascading effects across other industries.”A third financial analyst.

Concluding Remarks

In conclusion, the US aluminum tariffs are creating a significant disruption in the global aluminum and scrap markets. The EU’s response and potential countermeasures have escalated the situation, potentially leading to a prolonged trade war. The potential for compromise and resolution remains, but the long-term implications for global trade, aluminum industries, and the environment are substantial. This situation underscores the interconnectedness of global markets and the need for collaborative solutions.