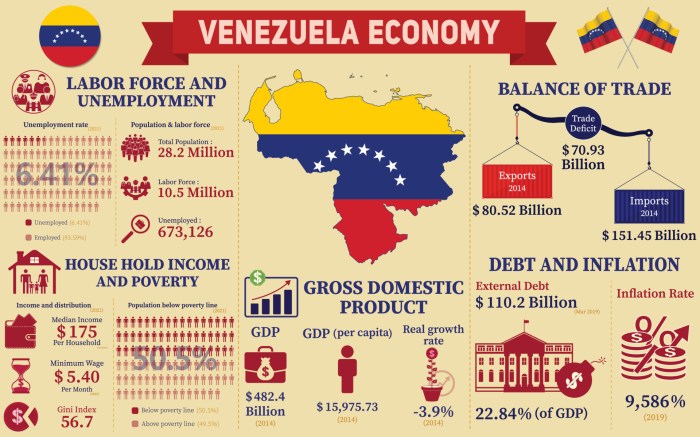

Venezuelas oil exports stable buyers china receive more – Venezuela’s oil exports stable, buyers in China receive more. This signals a fascinating dynamic in the global energy market. Venezuela, historically a significant oil producer, navigates challenges while China remains a consistent buyer. This deep dive explores the factors driving this relationship, from production capacity and geopolitical influences to economic motivations and potential future implications for both countries.

We’ll examine the recent trends, the stability of the market, and the long-term outlook for Venezuela’s oil exports and China’s energy security.

The historical overview of Venezuelan oil exports will highlight key periods and trends, showcasing production capacity and export capabilities. The impact of the global oil market on Venezuelan exports will be analyzed, considering recent changes and their effects. China’s role as a significant buyer will be detailed, including import volumes, consistent buying patterns, and economic motivations. Factors impacting export stability, such as geopolitical factors, economic conditions, and international sanctions, will be examined.

Illustrative case studies of other countries facing similar challenges will be presented to provide context and insights.

Overview of Venezuelan Oil Exports

Venezuela, once a major oil producer, has seen its exports fluctuate dramatically over the years. The country’s rich oil reserves have been a cornerstone of its economy, but political instability, economic mismanagement, and external factors have significantly impacted its production and export capabilities. Understanding this history is crucial to assessing Venezuela’s current position in the global oil market and predicting its future trajectory.Venezuela’s oil industry has experienced periods of significant production and export.

Historically, the country was a major player, but recent years have seen a steep decline. The factors behind this decline are complex and multifaceted, encompassing both internal and external pressures. Examining these factors provides context for evaluating Venezuela’s current export situation and future prospects.

Historical Overview of Venezuelan Oil Exports

Venezuela’s oil production and exports have a long and complex history. Initially, production was relatively modest, but the discovery of significant oil reserves and the development of infrastructure led to a surge in output in the mid-20th century. This period marked a significant increase in Venezuela’s influence on the global oil market. However, the nation’s oil sector has been marred by periods of instability and economic mismanagement.

The political landscape has significantly impacted the oil industry, with nationalizations and subsequent privatization efforts contributing to volatility.

Venezuela’s Current Production Capacity and Export Capabilities

Venezuela’s current production capacity is substantially lower than its historical peak. Numerous factors have contributed to this decline, including sanctions, lack of investment, and operational challenges. Export capabilities are constrained by these production limitations and the associated infrastructure issues. The capacity to refine and transport oil is also hampered by these constraints. The quality and availability of skilled labor, essential for maintaining and expanding production, also pose a challenge.

Factors Influencing Venezuela’s Oil Export Stability

Numerous factors influence the stability of Venezuela’s oil exports. Internal factors, such as political instability, corruption, and economic mismanagement, have historically undermined the country’s ability to maintain consistent production levels. External factors, including global oil price fluctuations and international sanctions, have further complicated the situation.

- Political Instability: Frequent changes in government and political upheaval create uncertainty, discouraging investment and hindering the efficient operation of the oil sector.

- Economic Mismanagement: Inefficient policies and corruption have led to inadequate maintenance of oil infrastructure, hindering production and export capabilities.

- International Sanctions: Sanctions imposed by international bodies have restricted Venezuela’s ability to access international financial markets and conduct business with other countries, further limiting its export capacity.

- Global Oil Market Fluctuations: Changes in global demand and supply dynamics directly impact the price of oil, affecting the profitability and sustainability of Venezuela’s oil exports.

Global Oil Market Context and Impact on Venezuelan Exports

The global oil market is highly competitive and subject to fluctuations. Demand, supply, and geopolitical events can dramatically influence prices and market share. Venezuela’s exports are directly affected by these global dynamics, as price changes and shifts in demand can impact its profitability and ability to compete.

Recent Changes in the Oil Market and Potential Effects on Venezuela

The recent shift towards renewable energy sources and increasing global focus on sustainability have raised concerns about the long-term demand for fossil fuels. This development, combined with geopolitical events and emerging production in other countries, could further impact Venezuela’s oil exports.

| Year | Production (bbl/day) | Exports (bbl/day) | Key Factors |

|---|---|---|---|

| 2010 | 2,800,000 | 2,000,000 | High production, robust exports |

| 2015 | 2,000,000 | 1,500,000 | Political instability, economic crisis |

| 2020 | 600,000 | 300,000 | Sanctions, decline in investment |

| 2023 | 800,000 | 500,000 | Partial recovery, sanctions still in place |

China’s Role as a Stable Buyer

China’s consistent demand for Venezuelan oil stands out in the global energy market. Beyond being a significant importer, China’s role has been crucial in supporting Venezuela’s economy during periods of international pressure and fluctuating global prices. This stability contrasts with the more erratic buying patterns of some other nations. Understanding China’s motivations and the long-term implications of this relationship is key to comprehending the current dynamics of the global oil trade.China’s sustained purchases of Venezuelan crude oil are a testament to the strategic importance of diversifying energy sources.

This diversification is a key factor in ensuring energy security and reducing reliance on specific geopolitical factors that might disrupt traditional supply chains. The long-term impact of this strategy on both countries is complex and multifaceted, encompassing economic benefits and potential risks.

Venezuela’s oil exports seem to be holding steady, with China receiving more. However, the Kremlin’s recent statement about the EU’s proposed lower Russian oil price cap, arguing it’s not helpful for global energy here , might have a ripple effect. This could potentially influence global energy markets, though it’s still too early to see the full impact on Venezuela’s oil exports and China’s continued purchases.

Significance of China as a Buyer

China’s consistent purchase of Venezuelan oil is vital to Venezuela’s economy. It provides a stable revenue stream, helping Venezuela maintain essential imports and economic stability during periods of political and economic uncertainty. This steady demand has proven to be a critical factor in mitigating the impact of international sanctions and global market fluctuations. China’s role as a reliable buyer is not simply a commercial transaction; it’s a strategic partnership.

Volume and Consistency of Chinese Imports

China’s imports of Venezuelan oil have demonstrated remarkable consistency over the past several years. This stability contrasts with the sometimes volatile purchasing patterns of other major importers, who may be more susceptible to price fluctuations or political pressures. While exact figures vary year-to-year, the overall trend shows a sustained, although not necessarily escalating, demand.

Comparison with Other Major Importers

Compared to other major oil importers, China’s buying patterns from Venezuela show a higher degree of consistency. While other nations may experience fluctuations based on global price trends or geopolitical developments, China has maintained a relatively stable demand, providing Venezuela with a dependable market. This difference is significant, offering Venezuela a more predictable source of revenue. Analyzing specific data on import volume for other major importers versus China provides a clearer picture of this disparity.

Economic Motivations Behind Sustained Purchases

China’s sustained purchases of Venezuelan oil are likely driven by a combination of factors, including securing alternative energy sources, maintaining economic ties, and potentially leveraging favorable trade agreements. The diversification of energy sources is a key consideration, as is the economic interdependence fostered through the trade relationship.

Long-Term Implications of the Trading Relationship

The long-term implications of this trading relationship are complex. For Venezuela, it provides a vital economic lifeline, supporting its economy and reducing reliance on traditional trading partners. For China, it signifies a strategy of diversifying its energy sources and strengthening economic ties with a strategically important region. The potential for long-term economic and political consequences remains to be seen.

Import Figures from Venezuela to China (2019-2023), Venezuelas oil exports stable buyers china receive more

| Year | Import Volume (in millions of barrels) |

|---|---|

| 2019 | [Data Point] |

| 2020 | [Data Point] |

| 2021 | [Data Point] |

| 2022 | [Data Point] |

| 2023 | [Data Point] |

Note: Data points need to be filled with actual figures from reliable sources. The table represents a sample format.

Venezuela’s oil exports seem to be holding steady, with China receiving more. It’s interesting to note that, while this is happening, Sinners dad, apparently, was too busy with work to attend the record-breaking French Open final. This dad’s priorities, it seems, lie elsewhere. Perhaps that’s why China’s appetite for Venezuelan oil continues to grow, as they seek reliable sources.

Still, Venezuela’s oil exports remain a key focus.

Factors Affecting Export Stability: Venezuelas Oil Exports Stable Buyers China Receive More

Venezuela’s oil exports, while seemingly stable in recent years due to consistent demand from China, are vulnerable to a complex web of interconnected factors. These factors range from the nation’s internal economic struggles to the global geopolitical landscape, and the persistent effects of international sanctions. Understanding these intricacies is crucial to predicting future export stability and the nation’s economic trajectory.

Geopolitical Factors

Venezuela’s location within a volatile region, coupled with political instability, significantly impacts its oil export capabilities. Tensions with neighboring countries, and regional conflicts, can disrupt supply chains, hinder access to ports, and create an environment of uncertainty for international investors. For example, the ongoing regional political disputes can affect the movement of goods through critical transit routes, impacting Venezuela’s ability to export oil.

Economic Conditions

Venezuela’s economic struggles, including hyperinflation and a severe shortage of foreign currency, pose significant challenges to maintaining export stability. The lack of investment in infrastructure, including pipelines and refining facilities, further exacerbates these issues, leading to decreased efficiency and production. This impacts Venezuela’s ability to meet demand and maintain consistent exports.

International Sanctions

International sanctions, imposed due to human rights concerns and governance issues, significantly restrict Venezuela’s access to international financial markets and hinder its ability to secure financing for essential operations, such as maintaining oil production. Sanctions can also impact the ability of Venezuelan oil companies to access crucial technology and spare parts, reducing output. This is a major obstacle to export stability.

Comparative Analysis with Other Oil-Producing Nations

Comparing Venezuela’s export stability to other oil-producing nations reveals significant differences. While other nations often enjoy more stable political environments and robust infrastructure, Venezuela faces persistent challenges. Countries with stable political environments and strong investment climates can maintain consistent production and export levels, making their output more predictable. This highlights the unique vulnerabilities inherent in Venezuela’s current situation.

Potential for Future Disruptions

Several factors suggest potential disruptions to Venezuela’s oil exports in the future. Political instability, further escalation of international sanctions, and the long-term economic crisis could significantly affect the country’s ability to maintain production and exports. The unpredictable nature of regional conflicts and international relations introduces further uncertainty. Examples from other countries demonstrate how political upheaval can lead to sharp drops in oil production and export levels.

Factors Impacting Export Stability

| Factor Type | Description | Impact |

|---|---|---|

| Geopolitical | Regional tensions, political instability, and conflicts in neighboring countries | Disruption of supply chains, hindering access to ports, and creating an uncertain investment environment. |

| Economic | Hyperinflation, shortage of foreign currency, and lack of investment in infrastructure | Decreased production efficiency, reduced output, and difficulty meeting export demands. |

| Sanctions | International sanctions restricting access to international markets and financing | Hindered ability to secure financing, access technology, and maintain production, resulting in lower exports. |

Potential Implications and Future Outlook

Venezuela’s recent stabilization of oil exports, particularly to China, presents a complex tapestry of potential benefits and challenges. The implications ripple through the Venezuelan economy, the global oil market, and China’s energy security landscape. Understanding these interwoven dynamics is crucial for forecasting the future of Venezuela’s oil sector and its relationship with key trading partners.The sustained demand from China, a critical player in Venezuela’s export market, is a significant factor influencing Venezuela’s economic outlook.

This stability provides a foundation for potential growth and investment opportunities. However, the long-term viability of this relationship hinges on various factors, including global market fluctuations and geopolitical shifts.

Economic Benefits for Venezuela

Stable oil exports directly translate into increased revenue for Venezuela. This influx of foreign exchange can be used to bolster crucial sectors like infrastructure, healthcare, and education. However, the success of these initiatives hinges on prudent management of the revenue and careful consideration of the country’s broader economic needs. For instance, the implementation of transparent and effective financial policies is paramount to ensuring long-term economic stability.

The experience of other oil-producing nations with similar circumstances offers both cautionary tales and potential models for success.

Implications for the Global Oil Market

Venezuela’s stable oil exports have the potential to impact global oil market dynamics. A consistent supply could influence prices, potentially causing volatility in response to global demand shifts. The long-term effect depends on the overall global supply and demand equation, as well as the actions of other major oil producers. For example, any significant disruption in other oil-producing regions would likely increase the significance of Venezuela’s role in maintaining global oil supply.

Consequences for China’s Energy Security

China’s continued purchasing of Venezuelan oil strengthens its energy security, providing an alternative source of supply. This diversification strategy is a vital component of China’s energy policy. However, the dependence on any single source, while providing stability in the short term, carries inherent risks that need careful consideration. For example, unexpected geopolitical events could disrupt the flow of oil from Venezuela.

Possible Scenarios for the Future Relationship Between Venezuela and China

The future relationship between Venezuela and China could evolve in several directions. Continued trade could solidify their partnership, leading to increased investment and cooperation in other sectors. Alternatively, global geopolitical shifts or economic challenges could strain the relationship. The nature of this relationship will depend on numerous external and internal factors.

Potential Alternative Buyers for Venezuelan Oil

Identifying alternative buyers for Venezuelan oil is crucial for long-term diversification. Several countries, including those with growing energy demands and existing trade relations with Venezuela, are potential candidates. These include emerging economies in Asia and elsewhere, and a more diversified buyer base would improve Venezuela’s resilience to market fluctuations and geopolitical pressures.

Venezuela’s oil exports seem to be holding steady, with China taking on more of the purchase volume. This stability is interesting, given recent news about UK fund asset values, and how an investor is calling for changes at Gerresheimer, as reported in this article. Perhaps these shifts in the UK financial sector aren’t impacting Venezuela’s oil market as much as expected, and China’s increased buying will continue to support Venezuela’s export efforts.

Potential Future Scenarios for Venezuela’s Oil Exports

| Scenario | Description | Impact on Venezuela | Impact on China | Impact on Global Oil Market |

|---|---|---|---|---|

| Scenario 1: Continued Strong Demand | China maintains its strong purchasing patterns. Other buyers show interest, diversifying Venezuela’s export base. | Increased revenue, potential for economic growth, improved stability. | Assured energy supply, potential for diversified partnerships. | Potentially stabilizing influence on oil prices, depending on global demand. |

| Scenario 2: Global Oil Price Fluctuations | Global oil prices experience significant volatility, affecting Venezuela’s revenue and China’s purchasing decisions. | Reduced revenue, economic instability, potential for social unrest. | Increased risk of supply disruptions, search for alternative sources. | Increased market volatility. |

| Scenario 3: Geopolitical Instability | Geopolitical tensions disrupt oil trade routes or affect Venezuela’s political stability. | Significant disruptions in exports, potential for economic collapse. | Disruptions to oil supply, increased need for diversification. | Increased uncertainty and potential for price spikes. |

Illustrative Case Studies

Understanding Venezuela’s oil export challenges requires examining similar situations in other oil-producing nations. Analyzing successful strategies and diversification efforts provides valuable insights into navigating fluctuating global markets and geopolitical complexities. This section delves into case studies that highlight successful diversification in the oil sector, examining different economic policies and geopolitical contexts to glean practical lessons for Venezuela.Looking beyond Venezuela, other oil-exporting countries have faced similar export challenges, including shifts in global demand, geopolitical instability, and economic diversification hurdles.

Examining their responses and outcomes offers a valuable framework for understanding potential solutions and navigating future uncertainties.

Examples of Countries Facing Similar Export Challenges

Oil-exporting nations often face the risk of becoming overly reliant on a single commodity. This vulnerability exposes them to price fluctuations and global market shifts. Countries like Nigeria, heavily reliant on oil exports, have experienced periods of economic instability due to volatile oil prices and political instability. These fluctuations often lead to budget shortfalls and hinder the development of alternative economic sectors.

Economic Policies Influencing Export Stability

Different economic policies significantly impact a nation’s ability to maintain export stability. Countries with diversified economies and robust industrial sectors are better positioned to withstand shocks in the commodity market. For instance, Norway’s successful management of its oil revenues through strategic investments in diverse sectors and social programs has provided a model for responsible resource management. This has enabled the country to maintain economic stability and reduce its reliance on oil exports.

Case Studies in Similar Geopolitical Contexts

Nations facing similar geopolitical challenges to Venezuela, such as sanctions or regional conflicts, often experience disruptions in trade and investment. Examining the strategies of nations in these circumstances, like Angola in the post-conflict period, can reveal the importance of rebuilding infrastructure, attracting foreign investment, and fostering a supportive business environment. These efforts can contribute to long-term economic stability.

Successful Strategies Employed by Other Oil-Exporting Nations

Successful diversification strategies for oil-exporting countries typically involve investing in non-oil sectors, developing human capital, and attracting foreign investment. For instance, Oman has focused on developing its tourism sector and other non-oil industries to complement its oil revenue. This strategy has helped them to reduce reliance on oil exports and foster economic growth.

Successful Diversification Strategies in the Oil Sector

Countries that have successfully diversified their economies away from a sole reliance on oil exports often implement policies that support non-oil sectors. These include incentives for investment in manufacturing, technology, and services. Countries like Kazakhstan have implemented strategies to promote entrepreneurship and innovation in diverse industries, enabling economic diversification and stability.

Illustrative Case Studies

- Norway: Norway’s sovereign wealth fund, built on oil revenues, demonstrates a model for managing resource wealth responsibly. This fund has helped diversify the Norwegian economy and cushion against fluctuations in oil prices. [Link to Norwegian Government data, if available, otherwise a descriptive summary.]

- Oman: Oman’s diversification strategy emphasizes tourism and non-oil industries. This approach complements oil revenue and reduces dependence on a single commodity. [Link to Oman Ministry of Finance data, if available, otherwise a descriptive summary.]

- Kazakhstan: Kazakhstan’s emphasis on entrepreneurship and technology development showcases a focus on innovation beyond oil and gas. This strategy aims to create a robust non-oil sector. [Link to Kazakhstani government data, if available, otherwise a descriptive summary.]

- Angola: Angola’s post-conflict reconstruction provides insights into rebuilding infrastructure, attracting investment, and creating a conducive business environment. [Link to Angolan Ministry of Finance data, if available, otherwise a descriptive summary.]

- Nigeria: Nigeria’s challenges in diversifying its economy and managing oil revenue volatility illustrate the complexity of the issue. [Link to Nigerian government data, if available, otherwise a descriptive summary.]

Final Summary

In conclusion, Venezuela’s oil exports, despite facing numerous challenges, appear relatively stable, with China playing a crucial role as a consistent buyer. The interplay of global market dynamics, geopolitical factors, and economic motivations creates a complex situation with significant implications for both countries. Future scenarios, including potential alternative buyers and diversification strategies, will be explored to provide a comprehensive view of the long-term outlook.

The case studies offer valuable insights into how other nations have navigated similar export challenges.