When policymakers ignore economists warnings – When policymakers ignore economists’ warnings, they’re playing a dangerous game. This article delves into the historical missteps of governments that disregarded economic advice, examining the potential reasons behind this disregard, and exploring the significant consequences that often follow. From the impact on vulnerable populations to the long-term economic instability created, the ramifications can be far-reaching and deeply troubling.

Throughout history, countless examples highlight how ignoring expert economic advice has led to disastrous outcomes. This exploration will examine a range of historical cases, from economic crises to political pressures that have influenced policymakers’ decisions. We’ll analyze the role of special interests and media influence in potentially distorting the conversation and ultimately contributing to poor policy choices.

Historical Examples of Policy Failures

Ignoring economic warnings often leads to painful and avoidable consequences. Governments, driven by short-term pressures or ideological convictions, sometimes fail to heed the advice of economists, resulting in economic downturns, social unrest, and long-term damage. Understanding these historical instances allows us to learn from past mistakes and potentially avoid repeating them. Analyzing these failures helps illuminate the importance of listening to diverse perspectives and considering the long-term implications of policy decisions.Policymakers frequently face complex economic challenges, often requiring nuanced solutions.

Sometimes, the pressure to respond quickly or the desire to prioritize immediate gains overshadows the need for careful consideration of long-term economic effects. A deeper understanding of these situations, coupled with historical analysis, can equip policymakers with valuable tools to make more informed and sustainable decisions.

Examples of Policy Failures in the 20th Century

Policymakers, at times, have been slow to react to or outright ignored economic warnings. This often results in adverse effects.

- The Great Depression (1929-1939): Many economists warned of the dangers of excessive speculation in the stock market and the unsustainable levels of debt. However, the policies implemented in the United States, like high tariffs and reduced government spending, exacerbated the crisis. Other countries, like the UK, initially took a more laissez-faire approach, which also contributed to the severity of the downturn.

The US implemented policies, such as the Smoot-Hawley Tariff Act, aimed at protecting domestic industries, but these policies inadvertently reduced international trade and deepened the global economic crisis. Contrastingly, some countries, like the Scandinavian nations, implemented more active government intervention, including public works programs, which helped mitigate the severity of the crisis. The differing approaches to the crisis highlighted the significant impact of government intervention and the importance of international cooperation in economic recovery.

- The 1970s Oil Crisis: Economists warned of the potential for oil price shocks and their impact on inflation and economic growth. However, the response of many governments was slow and ineffective. A significant portion of the 1970s was marked by stagflation, a combination of high inflation and high unemployment. This was a period of economic uncertainty.

Different nations responded differently. Some countries prioritized energy conservation and diversification, while others relied on price controls or increased government spending, which sometimes further fueled inflation. The varying outcomes underscored the importance of proactive policies and international cooperation in addressing global economic shocks.

Forecasting Accuracy and Policy Disregard

Accurate economic forecasts, when ignored, can have profound consequences.

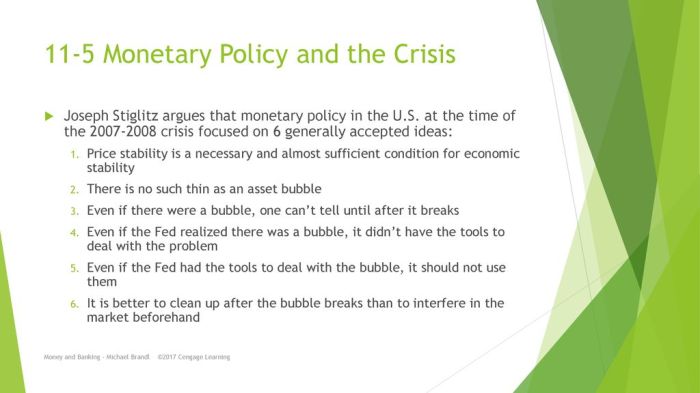

- Housing Bubble of 2008: Numerous economists predicted the housing market bubble, highlighting the unsustainable rise in home prices and the risks of subprime mortgages. Despite these warnings, policymakers and regulators failed to implement sufficient measures to prevent the crisis. The result was a severe economic downturn, widespread financial instability, and a global recession.

Historical Policy Failures Table

This table provides a concise overview of historical events, warnings, and consequences.

| Country | Time Period | Nature of Policy | Economic Warning | Impact |

|---|---|---|---|---|

| United States | 1929-1939 | High tariffs, reduced government spending | Excessive speculation, unsustainable debt | Severe economic depression, high unemployment |

| Various Countries | 1970s | Slow response to oil price shocks | Impact on inflation and economic growth | Stagflation, economic uncertainty |

| United States | 2000s | Insufficient regulation of housing market | Unsustainable rise in home prices, subprime mortgages | Severe economic downturn, global recession |

Underlying Reasons for Ignoring Warnings

Policymakers, faced with complex economic challenges, sometimes disregard expert advice. This can stem from a multitude of factors, often intertwined and interacting in unpredictable ways. The pressures of the political arena, ideological convictions, and the allure of short-term gains can all contribute to a situation where economic realities are overshadowed by other considerations. Understanding these underlying reasons is crucial for fostering a more informed and responsive policymaking process.The path to sound economic policy is rarely straightforward.

Political pressures, special interest groups, and a perceived need for immediate results can all influence decisions, potentially leading to policies that conflict with sound economic principles. The consequences of ignoring expert warnings can range from suboptimal outcomes to outright economic disasters. Examining these reasons and their interplay is essential for understanding the dynamics of policymaking and improving future outcomes.

Political Pressures and Ideological Biases

Political expediency often takes precedence over long-term economic considerations. Policymakers may prioritize short-term gains, such as job creation in a specific region, even if broader economic models suggest negative consequences. Ideological biases can also lead to policies that are not supported by economic evidence. For example, a strong belief in a particular economic theory, regardless of empirical evidence, may result in the adoption of policies that are detrimental to overall economic well-being.

Such biases can hinder the ability to objectively evaluate and consider alternative approaches.

The Role of Special Interest Groups

Special interest groups can exert significant influence on policy decisions. Lobbyists and advocacy groups may advocate for policies that benefit their constituents, even if those policies are not in the best interest of the broader economy. For instance, agricultural subsidies, while supporting farmers, can distort market prices and create inefficiencies in the long run. The pursuit of short-term advantages for specific groups can overshadow the potential for broader economic gains.

Trust and Credibility

The credibility of economists and economic models plays a crucial role in shaping policy decisions. When policymakers distrust or misunderstand the methodologies used by economists, they may be less likely to consider their warnings. A history of inaccurate predictions or conflicting advice can erode the trust between economists and policymakers, leading to a disregard for expert input. Strengthening the communication and relationship between these two groups is critical for fostering a more informed policymaking process.

Policymakers often disregard economic warnings, leading to unforeseen consequences. A recent example of this, sadly, is the case of Mahrang Baloch, arrested in Balochistan, Pakistan. This situation highlights how ignoring expert advice can have severe and long-lasting repercussions, as seen in the ongoing plight of Balochistan’s people and the potentially negative economic impacts that follow such actions. Ignoring the voices of economists can have far-reaching and potentially devastating effects on a population, as exemplified by the circumstances surrounding mahrang baloch arrest balochistan pakistan.

The disregard for expert counsel ultimately hurts the very people it purports to serve.

Perceived Urgency and Short-Term Gains

Policymakers often face immense pressure to address urgent political issues, such as rising unemployment or economic downturns. In such circumstances, the perceived urgency can override the importance of long-term economic considerations. Focusing on immediate relief measures, rather than comprehensive and sustainable solutions, can lead to policies that have unintended and potentially damaging long-term consequences. The pursuit of short-term gains can often come at the expense of long-term economic stability.

Table: Factors Contributing to Policymakers Ignoring Warnings

| Factor | Description | Example |

|---|---|---|

| Political Motivations | Prioritizing short-term political gains over long-term economic stability. | Passing tax cuts that are projected to increase the national debt, but are popular with voters. |

| Special Interest Groups | Influence from groups seeking to advance their specific interests, even if detrimental to the overall economy. | Supporting agricultural subsidies that inflate food prices. |

| Media Influence | Public perception and media framing of economic issues can lead to policies based on public sentiment rather than expert advice. | Focusing on immediate economic crises and ignoring long-term solutions. |

Consequences of Ignoring Economic Warnings: When Policymakers Ignore Economists Warnings

Ignoring economic warnings often leads to a cascade of negative consequences, impacting not only the economy as a whole but also vulnerable segments of society. Short-sighted policies, fueled by a disregard for expert advice, can trigger detrimental cycles of instability and hardship. The potential for recessions, inflation, and social unrest underscores the critical importance of heeding economic forecasts and adjusting policies accordingly.Economic warnings, when ignored, can have far-reaching and long-lasting effects.

These consequences aren’t confined to the immediate present; they frequently ripple through the economy, creating problems that take years to resolve and impacting generations to come. The long-term ramifications of ignoring short-term gains can result in diminished economic growth and a decline in overall standards of living. Ignoring these warnings can lead to a cycle of economic vulnerability, hindering the nation’s ability to adapt to future challenges.

Recessions and Economic Instability

Ignoring economic warnings often results in unexpected recessions or economic instability. These crises can be triggered by a variety of factors, from unsustainable government spending to financial bubbles. A lack of foresight and preventative measures can exacerbate the impact of these crises, leading to job losses, business failures, and a decline in consumer confidence. For example, the 2008 financial crisis was partly triggered by a lack of regulatory oversight and the accumulation of unsustainable levels of debt.

Inflationary Pressures

Ignoring warnings about rising inflation can lead to a rapid increase in the general price level of goods and services. This erosion of purchasing power can disproportionately affect low-income households, as essential goods and services become more expensive. When inflation spirals out of control, it erodes savings, discourages investment, and can lead to significant social unrest. Examples include the hyperinflation experienced in some countries in the 20th century.

Social Unrest and Political Instability

Economic hardship often contributes to social unrest and political instability. When people lose faith in the economic system or feel marginalized, they may resort to protests, demonstrations, or other forms of civil disobedience. This instability can disrupt economic activity, deter investment, and ultimately lead to a decline in living standards. The Arab Spring uprisings, partly fueled by economic grievances, serve as a stark reminder of the potential for social unrest when economic warnings are ignored.

Unsustainable Debt Burdens

Ignoring warnings about rising government debt can result in a crippling debt burden that restricts future economic growth and development. Excessive borrowing can lead to higher interest rates, reduced government spending on essential services, and a decline in investor confidence. Countries that have accumulated unsustainable levels of debt have often experienced reduced economic growth and decreased living standards.

Impact on Vulnerable Populations

The consequences of ignoring economic warnings disproportionately affect vulnerable populations, such as low-income families and marginalized communities. Recessions, inflation, and economic instability can lead to job losses, reduced access to essential services, and an increase in poverty. These groups often lack the resources to cushion the blow of economic hardship, making them more susceptible to the negative effects of ignored warnings.

Policymakers sometimes ignore economic warnings, leading to unforeseen consequences. A prime example is South Korea’s declining birth rate, particularly concerning nonmarital childbirth, which has been explored in depth in this explainer on South Korea’s nonmarital childbirth out of wedlock fertility rate. Ignoring expert advice on this demographic shift highlights the potential pitfalls of neglecting economic forecasts and their implications for future societal well-being.

Table: Types of Economic Problems from Ignored Warnings

| Type of Economic Problem | Frequency | Severity |

|---|---|---|

| Recessions | Periodic | High |

| Inflation | Occasional to chronic | High, especially for low-income households |

| Social Unrest | Potentially high, depending on the context | Variable, can be severe |

| Unsustainable Debt | Increasingly common | High, impacting long-term growth |

Potential Solutions and Mitigation Strategies

Ignoring economic warnings by policymakers often leads to disastrous consequences, as demonstrated by historical examples. Effective strategies are crucial to prevent such failures in the future. These strategies must involve a multifaceted approach, encompassing improved communication, independent oversight, and a commitment to diverse perspectives. By proactively addressing the potential for misjudgment, we can enhance policy effectiveness and safeguard economic well-being.

Independent Economic Advisory Bodies

Independent economic advisory bodies play a vital role in providing objective assessments and unbiased recommendations to policymakers. These bodies, composed of experts with diverse backgrounds and experiences, can offer a broader perspective than those within the immediate political sphere. Their independence ensures that recommendations are based on rigorous analysis and sound economic principles, not political expediency. The presence of such bodies can act as a crucial check on potential biases and provide an alternative source of information.

A robust advisory body can effectively counter potential political pressures, ensuring that policies are grounded in evidence-based insights. Their recommendations can provide a more comprehensive understanding of economic realities, helping policymakers make informed decisions.

Policymakers often ignore economic warnings, leading to unforeseen consequences. A prime example is Governor Newsom’s recent speech, warning the nation about potential fallout from recent events , highlighting how ignoring expert advice can have serious repercussions. This ultimately underscores the importance of listening to economic forecasts to avoid similar pitfalls in the future.

Improved Communication and Collaboration

Effective communication and collaboration between policymakers and economists are essential for bridging the gap between theoretical insights and practical application. Regular dialogue and information sharing can foster a deeper understanding of economic issues. This dialogue should include workshops, seminars, and joint research projects, allowing for a reciprocal exchange of ideas and perspectives. Establishing clear communication channels for feedback and suggestions is also crucial.

This enables economists to effectively convey their concerns and policymakers to engage with these concerns, promoting a more holistic understanding of economic challenges.

Methods for Incorporating Diverse Perspectives

Policymaking processes should actively seek out and incorporate diverse perspectives, recognizing that various backgrounds and experiences contribute to a richer understanding of complex economic issues. This includes actively engaging with marginalized communities, understanding their needs and concerns, and considering their unique experiences in the policy formulation process. This inclusive approach helps ensure that policies are not only effective but also equitable and inclusive, ensuring a more just and sustainable future.

Table of Solutions for Reducing the Likelihood of Ignoring Economic Warnings

| Solution | Description |

|---|---|

| Establishment of Independent Economic Advisory Councils | Creation of bodies composed of leading economists and experts from various fields. These councils provide objective assessments and recommendations, independent of political pressures. |

| Enhanced Communication Channels | Regular meetings, seminars, and workshops between policymakers and economists. These platforms facilitate information sharing and feedback mechanisms, promoting a more collaborative approach to policymaking. |

| Strengthening Data Transparency and Accessibility | Making economic data and research readily available to policymakers, researchers, and the public. Increased transparency allows for a more thorough examination of policy implications. |

| Promoting Interdisciplinary Collaboration | Encouraging interaction between economists and other relevant disciplines (e.g., sociology, political science) to develop a more comprehensive understanding of complex social and economic issues. |

| Incentivizing Dissent and Open Debate | Creating a culture where dissenting opinions and critical analyses are valued and encouraged. Open debate can reveal blind spots and lead to more robust and effective policies. |

The Role of Media and Public Opinion

The media plays a crucial role in shaping public perception of economic issues, often influencing how policymakers respond to economic warnings. News outlets, through their reporting and framing of economic data, can either amplify or diminish the perceived urgency and importance of warnings from economists. This influence can significantly impact the public’s understanding and acceptance of economic advice, ultimately affecting policy decisions.

The media’s ability to present complex economic concepts in an accessible and engaging manner can be a powerful force for good, or a significant impediment to informed decision-making.The media’s power stems from its ability to translate complex economic theories and data into narratives that resonate with the public. Effective communication of economic warnings requires a nuanced understanding of public concerns and a presentation that avoids overly technical language.

Conversely, inaccurate or sensationalized reporting can misrepresent the nuances of economic realities, potentially leading to misinformed public opinion and misguided policy choices. This is particularly true in situations where media outlets prioritize attracting viewership over providing accurate and balanced analyses.

Media’s Influence on Public Opinion

The media wields considerable influence in shaping public opinion regarding economic issues. This influence stems from the media’s ability to frame economic events and trends, often creating a narrative that affects public understanding and response. News stories, editorials, and analysis can highlight specific aspects of an economic issue, either amplifying or downplaying its potential impact. The choice of which economic experts to interview, and the prominence given to their viewpoints, further shapes public perception.

Examples of Media Misrepresentation

Certain media outlets have been criticized for misrepresenting or downplaying economic warnings in the past. For instance, during the lead-up to the 2008 financial crisis, some news organizations focused on positive economic indicators while neglecting warnings from economists about rising housing prices and unsustainable lending practices. This selective reporting may have contributed to a false sense of economic stability and hindered public awareness of the looming crisis.

Similarly, during periods of high inflation, media coverage may focus on consumer complaints rather than the underlying economic factors driving price increases.

Media Outlets’ Coverage of Economic Warnings, When policymakers ignore economists warnings

| Media Outlet | Coverage Style | Potential Impact on Public Perception |

|---|---|---|

| News Network A | Often highlights positive economic data while downplaying warnings about potential risks. Relies heavily on short-term market indicators. | May create a false sense of economic security and delay necessary policy adjustments. |

| News Network B | Focuses on expert opinions from a range of perspectives, presenting both positive and negative forecasts. Provides in-depth analysis of underlying economic factors. | More likely to foster a balanced understanding of the situation, prompting more informed public discourse and potential policy responses. |

| Financial News Channel C | Overemphasizes the volatility of the stock market and presents economic news as solely driven by speculation. | Can create undue fear and uncertainty, potentially discouraging investment and economic growth. |

This table provides a simplified comparison. The actual impact of media coverage on public perception is complex and influenced by various factors beyond the outlet’s style. Further analysis would require a more comprehensive examination of individual articles, editorials, and reporting styles.

Economic Models and Their Applicability

Economic models are simplified representations of complex economic systems, used to forecast trends, analyze policies, and understand economic phenomena. While these tools can be powerful analytical instruments, their application in policymaking often faces inherent limitations. Understanding these limitations is crucial to interpreting the results and acknowledging the inherent uncertainty in economic predictions.Economic models, despite their usefulness, are not perfect mirrors of reality.

They often rely on simplifying assumptions to make the system tractable. These assumptions, while necessary for mathematical analysis, can sometimes distort the representation of real-world complexities, leading to inaccurate predictions. Furthermore, models often lack the ability to capture the full spectrum of human behavior, unexpected events, or external shocks that can dramatically alter economic outcomes.

Different Economic Models

Various economic models are employed to understand and forecast economic trends. Key examples include macroeconomic models like the IS-LM model, which depicts the interaction between the goods and money markets, and the Aggregate Demand-Aggregate Supply (AD-AS) model, illustrating the relationship between overall output and the price level. Microeconomic models, on the other hand, examine individual consumer and firm behavior, often utilizing concepts like supply and demand curves.

More sophisticated models, such as dynamic stochastic general equilibrium (DSGE) models, attempt to capture a wider range of economic interactions and are often used for forecasting.

Limitations of Economic Models

Economic models, despite their sophistication, are inherently limited in their ability to predict real-world outcomes. One crucial limitation is the inherent uncertainty in the data used to build and calibrate the models. Errors in data collection and measurement can significantly affect the accuracy of the forecasts. Another limitation is the assumption of rationality and stability in the models, which may not hold true in complex and volatile economic environments.

Unforeseen shocks or events, such as natural disasters, political upheavals, or technological breakthroughs, can disrupt the underlying assumptions of the models, leading to inaccurate predictions. Furthermore, the inherent complexity of the real world, with its multitude of interconnected factors, often exceeds the capacity of any model to capture fully.

Accuracy and Relevance Factors

The accuracy and relevance of economic models can be influenced by a multitude of factors. Data quality, as previously mentioned, is paramount. The assumptions underlying the model, including those regarding market behavior, government policies, and technological advancements, significantly affect the model’s predictive power. The model’s structure and the complexity of the economic environment being modeled also play a crucial role.

More sophisticated models can capture more nuanced interactions, but they often require more data and are more challenging to interpret. The time horizon of the forecast also influences the model’s accuracy. Short-term forecasts are generally more reliable than long-term ones, given the increased potential for unforeseen events.

Examples of Model Application

One notable example of an economic model used in policymaking is the use of macroeconomic models to assess the impact of fiscal stimulus packages. For example, the IS-LM model can help predict how changes in government spending or taxation might affect aggregate demand and output. Likewise, AD-AS models can be used to predict the impact of monetary policy changes on inflation and economic growth.

Comparison of Economic Models

| Model | Strengths | Weaknesses |

|---|---|---|

| IS-LM | Simple, intuitive, good for understanding short-run interactions between goods and money markets. | Doesn’t capture long-run dynamics, ignores expectations and uncertainty. |

| AD-AS | Illustrates the relationship between aggregate output and price level, helpful for understanding inflation and output fluctuations. | Simplified view of the economy, may not fully account for all factors influencing aggregate supply. |

| DSGE | Sophisticated, captures long-run dynamics and expectations, better at handling complex interactions. | Requires substantial data, complex to interpret, may not capture unforeseen shocks. |

Last Recap

In conclusion, the tendency for policymakers to overlook economists’ warnings is a complex issue with serious consequences. The analysis of historical failures, underlying motivations, and potential solutions provides valuable insights. Ultimately, fostering greater trust and open communication between policymakers and economists, alongside the use of robust and transparent economic models, is crucial to avoid repeating past mistakes. A more proactive and collaborative approach is essential to mitigate the risks of future economic crises.