Woodside energy seeks arbitration dispute with senegal – Woodside Energy seeks arbitration, escalating a dispute with Senegal over its energy operations. This move signals a significant development in the region, potentially impacting investment climate and future energy projects. The specifics of the disagreement, rooted in contracts and operational nuances, are poised to be examined closely by international arbitration bodies. Early indications suggest the dispute could have substantial financial ramifications for both parties, and the potential implications for the wider energy sector in Senegal are considerable.

This article delves into the background of the dispute, examining Woodside Energy’s history in Senegal, key contracts, and the circumstances leading to this arbitration request. We’ll explore the issues in dispute, including specific clauses, financial implications, and differing legal interpretations. Potential outcomes, including settlements, and their impact on the investment climate in Senegal will be discussed, along with precedents from similar cases.

Finally, we’ll analyze the regional context, legal framework, public perception, and stakeholder analysis surrounding this important development.

Background of the Dispute

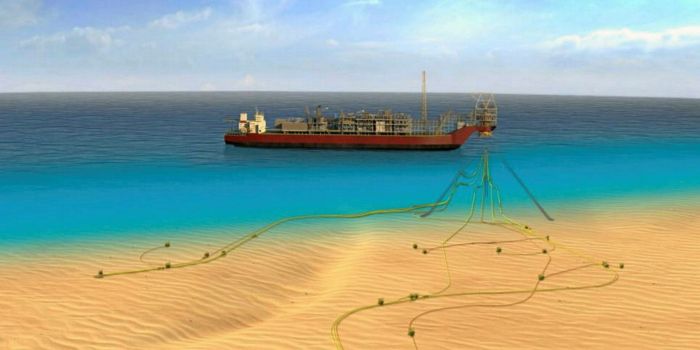

Woodside Energy’s foray into Senegal’s energy sector has been marked by a significant investment, promising to contribute to the nation’s energy infrastructure development. However, recent developments have led to a dispute that could reshape the company’s future operations in the region. This blog post delves into the history of Woodside’s engagement in Senegal, the key agreements, the circumstances that sparked the arbitration, and potential ramifications for the company.

Woodside Energy’s History in Senegal

Woodside Energy has been active in Senegal since [insert specific date]. The company’s initial involvement focused on [brief description of initial activities, e.g., exploration, preliminary assessments]. Over time, Woodside secured [mention number] key contracts, including [list key contracts, e.g., exploration agreements, production sharing agreements]. These agreements Artikeld the terms of collaboration between Woodside and the Senegalese government, defining roles, responsibilities, and revenue-sharing mechanisms.

Key Contracts and Agreements

Woodside Energy’s operations in Senegal are governed by a set of agreements. These agreements specify exploration rights, production sharing arrangements, and environmental regulations. Crucially, these contracts stipulate the framework for resolving disputes, which is where the current situation arises. Examples of specific contracts include [insert specific contract names/types].

Circumstances Leading to the Arbitration Request

The dispute arose from [briefly describe the triggering event, e.g., disagreements over resource allocation, environmental compliance issues, disagreements over project timelines]. The Senegalese government’s interpretation of certain contractual clauses differs significantly from Woodside’s perspective, leading to the arbitration request. The specific points of contention relate to [mention specific points of contention].

Potential Impacts on Woodside Energy’s Operations

The arbitration proceedings could have significant implications for Woodside Energy’s future in Senegal. A negative outcome could result in [mention potential negative impacts, e.g., project delays, financial penalties, reputational damage, loss of investment]. Conversely, a favorable outcome could [mention potential positive impacts, e.g., solidify Woodside’s position, ensure project continuity]. The uncertainty surrounding the outcome adds to the complexity of the situation and makes long-term projections challenging.

In similar cases, companies have faced delays of [mention time frame], leading to significant project cost overruns and reduced investor confidence.

Comparison of Woodside Energy’s Senegal Projects with Other Projects in the Region

| Project | Location | Resource Type | Key Agreements | Status ||—|—|—|—|—|| Woodside Energy Senegal Project | [Specific location in Senegal] | [Specify resource type, e.g., oil] | [List key agreements] | [Current status] || Project X | [Location in region] | [Resource type] | [Key agreements] | [Status] || Project Y | [Location in region] | [Resource type] | [Key agreements] | [Status] |Note: This table is a template.

Replace placeholders with actual project data. This comparison provides context by showcasing Woodside Energy’s projects alongside other projects in the region, highlighting similarities and differences in resource types, contractual frameworks, and project status.

Issues in Dispute

Woodside Energy’s arbitration with Senegal highlights the complexities inherent in international energy agreements. The dispute revolves around crucial contractual interpretations, potentially impacting the future of similar ventures. Understanding the specific points of contention is essential to grasping the potential ramifications for both parties involved.The crux of the disagreement lies in the interpretation of specific clauses within the agreements governing the project.

These clauses, often meticulously drafted, can be open to varying interpretations, leading to disputes. The financial implications are significant, impacting not only the immediate project but also the long-term relationship between the two countries.

Woodside Energy’s arbitration dispute with Senegal highlights the complexities of international energy projects. While these disputes are unfortunately common, perhaps Adam Silver of the NBA should be exploring expansion into new markets, like perhaps Africa, to find fresh avenues for growth, mirroring Woodside’s global ambitions. Ultimately, navigating these international waters requires careful strategy, as Woodside Energy seeks a favorable outcome in their dispute with Senegal.

Core Disagreements

The fundamental disagreements center on the interpretation of production sharing agreements (PSAs) and associated agreements. These disagreements directly impact the project’s financial terms, operational procedures, and resource allocation. Disagreements stem from divergent interpretations of the same contractual language, leading to differing claims of obligations and rights.

Specific Clauses in Dispute, Woodside energy seeks arbitration dispute with senegal

Several clauses within the agreements are central to the dispute. These clauses Artikel the responsibilities of each party, the mechanisms for dispute resolution, and the distribution of profits and revenues. Specific clauses relating to production targets, royalty payments, and operational timelines are at the heart of the disagreement.Examples of disputed clauses might include those governing the calculation of production targets, defining the scope of Woodside’s exploration and production obligations, or establishing the process for adjusting payments in response to fluctuating commodity prices.

Financial Implications

The arbitration’s potential financial implications are substantial for both parties. Senegal could face significant financial losses if Woodside’s claims are upheld, impacting its revenue streams and the overall economic development of the country. Conversely, Woodside could face substantial costs related to legal fees and potential damages if their claims are not upheld. Previous arbitration cases in similar energy projects demonstrate the significant financial burden that can be incurred during prolonged litigation.

Legal Interpretations

Different legal interpretations of the disputed clauses are a key aspect of the arbitration. Different legal experts and courts may have varying perspectives on the meaning and intent of the clauses, leading to conflicting opinions. For example, the interpretation of a clause regarding force majeure events, could dramatically alter the financial obligations of both sides. Jurisdictional interpretations also vary across different countries and legal systems, affecting the enforcement of contracts.

Arguments of Each Party

| Argument | Woodside Energy | Senegal |

|---|---|---|

| Production Targets | Claims Senegal has not met its production targets as Artikeld in the PSA, thus violating the agreement. | Contends that production targets were not accurately determined due to unforeseen geological challenges. |

| Royalty Payments | Argues for a higher level of royalty payments based on the current market prices. | Claims that the existing royalty payment formula is fair and reflects the current market conditions. |

| Operational Timelines | Argues that delays caused by Senegal have led to increased costs and lost revenue. | Claims that delays were due to unforeseen operational challenges and bureaucratic processes. |

| Dispute Resolution | Claims that the existing arbitration clause mandates a specific approach to dispute resolution. | Contends that the arbitration clause allows for flexibility in dispute resolution procedures. |

Potential Outcomes

This arbitration case between Woodside Energy and Senegal presents a complex interplay of financial, reputational, and geopolitical factors. The potential outcomes will significantly impact not only the immediate parties but also the broader investment climate in Senegal and the energy sector globally. Understanding the potential scenarios is crucial for stakeholders and observers alike.

Possible Outcomes of the Arbitration

The arbitration process can lead to various outcomes, ranging from a complete win for Woodside to a partial settlement or even an unfavorable ruling. The specific details of the agreement, the evidence presented, and the impartiality of the arbitration panel will heavily influence the final decision. Potential outcomes include a favorable judgment for Woodside, leading to financial compensation and a clear resolution of the dispute.

Conversely, a ruling against Woodside could result in substantial financial penalties and reputational damage. A settlement, often a compromise, can be a more pragmatic solution, though it might not fully address all claims or concerns.

Potential Settlements

Negotiated settlements are frequently used in complex disputes. These agreements often involve concessions from both sides, aiming to achieve a mutually acceptable resolution. A settlement may involve Woodside receiving a portion of the claimed amount, with Senegal agreeing to certain modifications in its contractual obligations or future dealings. The terms of a settlement will be confidential and agreed upon by both parties.

Such settlements can avoid the protracted and potentially costly arbitration process, offering a more swift resolution.

Ramifications for Involved Parties

The ramifications of the arbitration decision will be substantial for both Woodside and Senegal. A favorable outcome for Woodside would likely result in significant financial gains, though the exact amount is uncertain and depends on the specifics of the claim. Conversely, an unfavorable ruling could lead to substantial financial losses for Woodside and potentially damage their reputation, affecting their future projects and business relationships.

For Senegal, a negative outcome could affect its investment attractiveness, potentially deterring future energy investments.

Impact on Investment Climate in Senegal

The arbitration outcome will significantly impact Senegal’s investment climate. A negative ruling could erode investor confidence and lead to a decline in foreign direct investment. Conversely, a fair and efficient arbitration process could signal Senegal’s commitment to transparent and just dispute resolution, encouraging future investment. Historical precedent suggests that investor confidence in a country’s regulatory framework can be profoundly impacted by the handling of such disputes.

Precedents in Similar Arbitration Cases

Several arbitration cases in the energy sector provide valuable insights into potential outcomes. Examples of similar disputes in other countries can inform expectations regarding the length of the process, the potential for settlement, and the types of compensation awarded. These precedents highlight the importance of clearly defined contracts, robust legal frameworks, and transparent dispute resolution mechanisms.

Potential Scenarios and Consequences for Woodside Energy

| Scenario | Likely Consequences for Woodside Energy |

|---|---|

| Favorable Ruling | Significant financial compensation, strengthening Woodside’s reputation, and potential for future investment opportunities. |

| Unfavorable Ruling | Financial losses, reputational damage, and possible difficulties securing future projects in Senegal or similar jurisdictions. |

| Settlement | Reduced financial gain compared to a favorable ruling, but faster resolution and avoidance of potential reputational damage. |

Regional Context: Woodside Energy Seeks Arbitration Dispute With Senegal

Senegal, a West African nation, finds itself at a crossroads of economic and political forces. Its strategic location, coupled with its burgeoning energy sector, makes it a focal point of international investment. However, navigating these dynamics presents unique challenges, particularly in the face of arbitration disputes. Understanding the regional context, including Senegal’s political and economic landscape, the presence of other energy companies, and the relevant regulatory frameworks, is crucial to comprehending the complexities of the Woodside Energy dispute.

Political and Economic Landscape of Senegal

Senegal’s political landscape is characterized by a democratic system with a president as head of state. The nation has a relatively stable political environment, compared to some neighboring countries. Economically, Senegal is experiencing growth, driven in part by its agricultural sector and, increasingly, its energy sector. However, persistent challenges, such as infrastructure limitations and income inequality, persist.

These factors contribute to the country’s overall investment climate and the potential motivations behind energy projects and subsequent disputes.

Role of Other Energy Companies in the Region

Several international and local energy companies operate in Senegal and the wider West African region. Their activities range from exploration and production to refining and distribution. Competition among these companies can influence the regulatory environment and create potential for conflicts over resource allocation and project implementation. The presence of established players, such as TotalEnergies and other major oil companies, underscores the significance of Senegal’s energy resources in the broader regional context.

The presence of numerous competitors often leads to the development of more stringent regulatory frameworks to ensure fairness and transparency in the sector.

Woodside Energy’s arbitration with Senegal is a significant development, highlighting the complexities of energy disputes. Meanwhile, similar struggles are playing out in the sporting world, as struggling offenses like those of the Rangers and Nationals are seeking a breakthrough, as seen in struggling offenses seek breakthrough rangers nationals meet. These situations, though seemingly different, both underscore the difficulties of achieving desired outcomes when facing significant obstacles, a theme clearly echoing in Woodside’s pursuit of resolution.

Key Regulatory Frameworks Affecting Energy Projects in Senegal

Senegal’s energy sector is governed by a framework of laws and regulations aimed at attracting investment while safeguarding national interests. These regulations cover areas such as environmental protection, resource allocation, and dispute resolution mechanisms. A thorough understanding of these frameworks is crucial to assessing the fairness and effectiveness of the dispute resolution process, particularly in cases of arbitration.

Understanding these frameworks will also help to assess the motivations and potential impacts of the dispute. The clarity and consistency of these regulations directly affect investor confidence and the long-term stability of energy projects.

Influence of Regional Economic Partnerships on the Dispute

Regional economic partnerships, such as ECOWAS (Economic Community of West African States), can impact the dispute by setting standards for resource management and dispute resolution within the region. These organizations often have frameworks that provide mechanisms for addressing cross-border issues and promoting fair competition. The involvement of regional bodies in the dispute resolution process can significantly affect the outcome and its potential ramifications.

The influence of regional economic partnerships can be profound, shaping the regulatory environment and influencing the trajectory of energy projects.

Comparison of Senegal’s Energy Policies with Other African Nations

| Country | Energy Policy Focus | Regulatory Framework Strengths | Regulatory Framework Weaknesses |

|---|---|---|---|

| Senegal | Attracting investment, resource development | Generally stable, some incentives for investment | Potential for ambiguity in certain areas, bureaucratic processes |

| Nigeria | Significant oil production, diversification efforts | Well-established regulatory bodies | Complex regulatory landscape, corruption concerns |

| Angola | Large oil reserves, resource development | Strong focus on resource management | Potential for corruption and lack of transparency |

| Mozambique | Growing energy sector, diversified projects | Efforts to attract foreign investment | Regulatory environment still developing, potential for corruption |

This table provides a concise overview of the differences and similarities in energy policies between Senegal and other African nations. Comparing policies highlights potential regional trends and factors impacting the dispute. These comparisons allow for a more nuanced understanding of the intricacies of the energy sector in the region. The table serves as a starting point for further research and analysis.

Legal Framework

Navigating international disputes like Woodside Energy’s case with Senegal requires a deep understanding of the legal framework governing such proceedings. International arbitration, a cornerstone of resolving cross-border commercial disagreements, involves a specific set of rules and procedures that parties must adhere to. The choice of arbitration rules, the tribunal’s jurisdiction, and the arbitration process itself significantly impact the outcome and future implications of the case.The application of international arbitration rules and regulations in this context is crucial.

The selected arbitration framework dictates the procedural steps, evidence admissibility, and dispute resolution mechanisms. Understanding these aspects is vital for assessing the potential legal implications of the dispute for future energy investments.

Relevant International Arbitration Rules and Regulations

The choice of arbitration rules significantly shapes the proceedings. Commonly used sets of rules include the International Chamber of Commerce (ICC) Rules, the London Court of International Arbitration (LCIA) Rules, and the UNCITRAL Arbitration Rules. Each set has its own specific provisions regarding procedural timelines, evidence presentation, and dispute resolution mechanisms. The specific rules adopted by the parties in this dispute will dictate the manner in which the arbitration unfolds.

Jurisdiction of the Arbitration Tribunal

The jurisdiction of the arbitration tribunal is a critical component of the legal framework. The tribunal’s authority to hear the case is determined by the agreement of the parties. This agreement, often embedded in a contract, will Artikel the scope of the tribunal’s powers, including the issues it can address and the parties it can bind. It’s important to note that the chosen jurisdiction will influence the applicable laws, which in turn impact the potential outcomes.

International Arbitration Process Overview

International arbitration typically follows a structured process, commencing with the appointment of arbitrators. Following the submission of claims and defenses, the tribunal will conduct hearings, review evidence, and ultimately issue an award. This award, which will Artikel the decision and any remedies, will be legally binding on both parties. The process aims for a fair and impartial resolution within established timeframes.

Potential Legal Implications for Future Energy Investments

The outcome of this arbitration case could set precedents for future energy investments in Senegal and other African countries. Successful claims, for example, could lead to greater scrutiny of investment contracts and potential renegotiations. Conversely, an unfavorable ruling could potentially impact investor confidence in the region. The implications for future projects extend beyond this specific case, affecting the overall investment climate in similar regions.

International Arbitration Bodies and Their Procedures

| Arbitration Body | Key Procedures |

|---|---|

| International Chamber of Commerce (ICC) | Known for its extensive experience and comprehensive rules. Procedures are often tailored to the specific needs of the case. |

| London Court of International Arbitration (LCIA) | A well-respected institution with a strong focus on commercial disputes. Offers a range of dispute resolution services. |

| United Nations Commission on International Trade Law (UNCITRAL) | Provides a widely recognized set of rules, applicable in many jurisdictions. |

This table highlights the different arbitration bodies and their general procedural characteristics. Each body has its own strengths and weaknesses, and the parties will carefully consider these factors when choosing the most appropriate framework for their dispute.

Public Perception and Stakeholder Analysis

This dispute between Woodside Energy and Senegal carries significant weight, not just for the companies involved, but also for the broader energy sector and the public perception of international resource extraction. Understanding the potential public response, stakeholder concerns, and the impact on investor confidence is crucial for navigating this complex situation.This analysis explores the potential public perception of the dispute, the impact on Woodside’s reputation, concerns of various stakeholders, and the broader implications for investor confidence in the energy sector.

Careful consideration of these elements is essential to anticipate and mitigate potential risks.

Potential Public Perception in Senegal

Public opinion in Senegal will likely be shaped by the perceived fairness of the dispute and the perceived benefits or drawbacks of the energy project for the Senegalese population. If the public perceives Woodside Energy as acting unfairly or not adequately considering the local community’s interests, negative sentiment could arise. Conversely, if the public believes Woodside is acting responsibly and delivering tangible benefits, public perception could be more positive.

Potential Public Perception Internationally

The international community’s perception of the dispute will likely hinge on the perceived transparency and fairness of the arbitration process. Negative publicity surrounding the dispute could damage Woodside’s reputation globally, particularly if the company is seen as disregarding local laws or environmental regulations. Conversely, a well-managed arbitration process that upholds international standards could maintain or even enhance Woodside’s reputation.

Impact on Woodside Energy’s Reputation

A negative outcome in the arbitration could severely damage Woodside Energy’s reputation, potentially impacting future investment opportunities and public trust. The company’s public relations strategy will be crucial in mitigating any negative press and maintaining a positive image. Past examples of energy companies facing similar disputes, such as those involving environmental concerns or community relations issues, can provide valuable insights into the potential impact.

Stakeholder Concerns

The dispute affects numerous stakeholder groups, each with unique concerns.

Woodside Energy’s arbitration dispute with Senegal is definitely grabbing headlines, but did you know Uzbekistan just secured their first World Cup qualification, beating out Australia and Jordan? It’s quite a feat, and you can read all about the thrilling match results here. Still, the energy sector’s challenges, like Woodside’s ongoing dispute with Senegal, remain a significant concern.

- Senegalese Government: The Senegalese government may be concerned about the potential loss of revenue, damage to their reputation, and the precedent the arbitration sets for future energy projects. They may also be concerned about the impact on local communities and the environment.

- Local Communities: Local communities near the energy project may have concerns about environmental impact, job creation, and community development. The perceived fairness of the project’s benefits distribution and potential impacts on their livelihood are crucial considerations.

- Environmental Groups: Environmental groups may express concern about the potential environmental consequences of the project, demanding adherence to stringent environmental regulations. They may also focus on the potential long-term impacts on biodiversity and ecosystem health.

- Woodside Energy: Woodside Energy’s primary concern is a favorable outcome in the arbitration, protecting its financial interests and upholding its reputation. They will likely emphasize their commitment to operating responsibly and contributing to local development.

- Investors: Investors will closely monitor the arbitration’s progress and potential outcomes. A negative outcome could lead to a decline in investor confidence in the energy sector, particularly in projects in developing nations. This could affect investment decisions across the sector.

Potential Impact on Investor Confidence

A negative outcome of the arbitration could significantly impact investor confidence in the energy sector, particularly in developing nations. Investors might be hesitant to invest in projects in regions where disputes are frequent or where environmental regulations are not adequately enforced. Past examples of investor flight from certain energy sectors due to negative press or regulatory issues provide a useful reference point for assessing the potential impact on the market.

Summary Table of Stakeholder Perspectives

| Stakeholder Group | Potential Concerns |

|---|---|

| Senegalese Government | Loss of revenue, reputational damage, setting a precedent for future projects, impact on local communities, environmental impact. |

| Local Communities | Environmental impact, job creation, community development, fairness of benefits distribution, impact on livelihoods. |

| Environmental Groups | Environmental consequences, adherence to environmental regulations, long-term impacts on biodiversity and ecosystems. |

| Woodside Energy | Favorable arbitration outcome, protection of financial interests, upholding reputation. |

| Investors | Decline in confidence, hesitation to invest in projects in developing nations, negative press or regulatory issues. |

Timeline and Key Milestones

The Woodside Energy arbitration with Senegal unfolds against a backdrop of complex legal and political considerations. Understanding the timeline of events, key milestones, and potential duration is crucial for assessing the likely trajectory of this dispute. External factors, both predictable and unforeseen, can significantly impact the process.

Timeline of Events

A meticulous chronological account of the dispute’s progression is essential to comprehend the evolution of the case. This provides a roadmap of significant dates and actions, allowing for a clear understanding of the steps taken and decisions made.

- 2023-Q1: Initial dispute arises concerning contractual terms and performance, likely centered around specific project details and timelines.

- 2023-Q2: Formal notification of intent to arbitrate is sent by Woodside Energy to the Senegalese government or relevant parties.

- 2023-Q3: Selection of arbitrators and establishment of the arbitration panel. This process often involves specific procedures dictated by the chosen arbitration rules, potentially leading to delays or complications.

- 2023-Q4: Submission of initial pleadings and preliminary motions by both parties. The precise timeframe depends on the complexity of the case and the arbitration rules.

- 2024-Q1: Discovery phase, including document requests, witness depositions, and expert testimony. This phase can be protracted and expensive.

- 2024-Q2: Hearing dates set and scheduled, and the parties begin presenting their cases to the arbitration panel.

- 2024-Q3/Q4: The arbitration panel deliberates on the evidence presented and issues a final award. The potential duration of this phase hinges on the complexity of the case and the arbitrators’ efficiency.

Key Milestones and Decisions

Specific decisions made during the arbitration process, including procedural rulings, can significantly influence the outcome. The importance of these milestones is highlighted in the context of potential delays or adjustments in strategy.

- Arbitration Rules Adoption: The specific rules governing the arbitration process, like the UNCITRAL rules, significantly impact the procedure and potential timelines.

- Arbitrator Selection: The selection of neutral arbitrators plays a crucial role in maintaining impartiality and influencing the outcome of the arbitration.

- Witness Testimony and Evidence Submission: The process of gathering and presenting evidence is critical to establishing the facts and arguments of each party. Delays in this stage can extend the entire process.

Potential Duration of the Arbitration Process

Estimating the duration of an arbitration process is challenging, but certain factors influence the timeframe. The complexity of the case and the cooperation of the parties are critical factors.

Typical arbitration processes can range from several months to several years, depending on the complexity and the willingness of the parties to engage in constructive dialogue.

The specific timeline for the Woodside Energy arbitration will depend on various factors including the complexity of the case, the availability of key witnesses, and the cooperation of both parties. Real-world examples of similar cases can provide a benchmark, but these cases often have unique characteristics.

Role of External Factors

External factors can significantly impact the arbitration process. Political tensions, economic conditions, and even changes in legal interpretations can influence the timeline and the outcome.

- Political instability in Senegal or other regional issues can influence the process.

- Economic fluctuations can affect the parties’ ability to commit resources to the arbitration process.

- Changes in international law or arbitration rules could also alter the process.

Key Dates and Events

| Date | Event |

|---|---|

| 2023-Q1 | Initial Dispute Arises |

| 2023-Q2 | Notification of Arbitration |

| 2023-Q3 | Arbitrator Selection |

| 2023-Q4 | Initial Pleadings and Motions |

| 2024-Q1 | Discovery Phase |

| 2024-Q2 | Hearing Dates Set |

| 2024-Q3/Q4 | Final Award Issued |

Final Thoughts

Woodside Energy’s arbitration request against Senegal highlights the complexities of international energy ventures. The dispute, stemming from contract disagreements and operational factors, has far-reaching implications for both parties. The outcome of this arbitration will set a precedent for future investments and shape the energy landscape in Senegal. We’ve examined the historical context, legal framework, and potential outcomes.

It’s a critical moment for the energy sector in the region, demanding careful consideration and insightful analysis.