Americas oil pops dollar drops – America’s oil pops, dollar drops. Rising oil prices in the Americas are creating ripples across the global economy. This fluctuation isn’t just a short-term blip; it’s a complex interplay of market forces, global demand, and geopolitical factors. We’ll delve into the historical context, explore the intricate relationship between oil and the US dollar, and examine the potential economic impacts on various sectors.

From the energy transition to the possible responses of governments, we’ll paint a comprehensive picture of this dynamic situation.

The recent surge in American oil prices has sparked a noticeable drop in the value of the US dollar. This inverse relationship has historical precedent, but the current context presents unique challenges and opportunities. Understanding the underlying factors is crucial to predicting future trends and mitigating potential risks. This article provides a comprehensive overview, examining various facets of this economic phenomenon.

Oil Market Fluctuations

The global oil market is a dynamic and complex system, with prices constantly fluctuating due to a multitude of interconnected factors. Understanding these fluctuations is crucial for businesses, governments, and individuals alike, as oil prices directly impact energy costs, inflation, and global economic stability. This analysis will delve into the historical trends, influencing factors, and potential future implications of oil market volatility in the Americas.

Historical Overview of Oil Price Volatility in the Americas

Oil prices in the Americas have exhibited significant volatility throughout history. Early fluctuations were largely driven by supply and demand imbalances within the region. The discovery and exploitation of new oil fields, coupled with changes in refining capacity, have dramatically affected prices. The 1970s oil crises, triggered by geopolitical events and supply disruptions, are prime examples of how sudden and dramatic price increases can occur.

More recent periods, marked by technological advancements in energy production and global economic cycles, have also witnessed periods of price volatility.

Factors Influencing Oil Prices in the Americas

Several factors contribute to oil price fluctuations in the Americas. These include global supply and demand, geopolitical events, economic growth, technological advancements, and government policies. Changes in global economic activity significantly impact oil demand, as increased industrial output typically leads to higher consumption. Geopolitical instability, such as conflicts or sanctions, can disrupt supply chains and lead to price spikes.

Technological advancements in oil extraction and refining can alter supply dynamics, while government policies, such as subsidies or regulations, can impact production costs and market access.

Impact of Recent Events on Oil Prices in the Americas

Recent events, including the COVID-19 pandemic and the ongoing geopolitical situation, have had a profound impact on oil prices in the Americas. The pandemic-induced lockdowns led to a sharp decline in global demand, causing prices to plummet. The subsequent recovery, however, has been uneven, with price fluctuations continuing. The geopolitical situation has also introduced uncertainty, as disruptions to supply chains and sanctions can significantly affect availability and prices.

Role of Global Demand and Supply in Shaping Oil Market Trends

Global demand and supply dynamics play a critical role in shaping oil market trends. When global demand outstrips supply, prices tend to rise. Conversely, a surplus of supply relative to demand typically leads to price declines. The interaction between these two forces is complex, influenced by factors such as economic growth, technological advancements, and geopolitical events. The balance between supply and demand often determines the overall price trajectory.

Potential Catalysts for Future Oil Price Changes

Several potential catalysts could trigger future oil price changes. These include changes in global economic activity, geopolitical tensions, technological breakthroughs, and government policies. A surge in global economic growth could lead to increased oil demand, pushing prices higher. Conversely, a global recession could lead to lower demand and decreased prices. Technological innovations in renewable energy could potentially alter the demand dynamics, potentially affecting oil prices in the long term.

Correlation Between Oil Prices and the US Dollar

The US dollar’s value has a strong correlation with oil prices. A stronger US dollar generally leads to lower oil prices, as it makes oil more expensive for buyers using other currencies. Conversely, a weaker US dollar can lead to higher oil prices.

| US Dollar Index | Oil Price (USD/barrel) |

|---|---|

| Strong | Low |

| Weak | High |

Short-Term and Long-Term Implications of Price Changes

Short-term price changes can significantly impact businesses, consumers, and governments. For example, high oil prices increase transportation costs, leading to higher prices for goods and services. Long-term trends, such as the transition to renewable energy sources, can reshape the oil market landscape and alter the role of oil in the global economy.

Comparison of Oil Prices in the Americas

| Type of Oil | Price (USD/barrel) |

|---|---|

| West Texas Intermediate (WTI) | [Variable, depends on the date] |

| Brent Crude | [Variable, depends on the date] |

| Other regional grades | [Variable, depends on the date and location] |

Note: Prices are highly variable and should be verified with reliable sources for accurate information.

Dollar’s Response to Oil Price Shifts

The relationship between oil prices and the US dollar is complex and multifaceted, often exhibiting inverse correlations. Fluctuations in oil prices can significantly impact the dollar’s value, and understanding these dynamics is crucial for investors and policymakers. This interplay is driven by a variety of factors, including global economic conditions and the interplay of supply and demand in the energy market.The US dollar’s value often moves inversely to the price of oil.

When oil prices rise, the dollar often weakens, and vice versa. This is partly because oil is priced in US dollars, making it an important factor in international trade and finance. Increased oil prices can lead to higher import costs for countries, which can affect their balance of payments and, in turn, influence their demand for the US dollar.

Factors Influencing Dollar Movement

Several factors influence the US dollar’s response to oil price changes. Stronger demand for oil can boost the prices, which can lead to a weaker dollar as it affects the balance of payments. Furthermore, central bank policies, such as interest rate adjustments, play a significant role in the dollar’s movements. Changes in inflation expectations and global economic growth can also influence the demand for the US dollar, impacting its value relative to other currencies.

Historical Patterns

Historically, there have been periods where oil prices and the dollar’s value have moved in opposite directions. This inverse relationship is not always consistent, and other global economic factors often play a crucial role. For example, during periods of global economic uncertainty, the dollar may strengthen even as oil prices rise. The interconnectedness of the global economy and the complexity of economic forces makes predicting the precise relationship challenging.

Impact of Global Economic Conditions

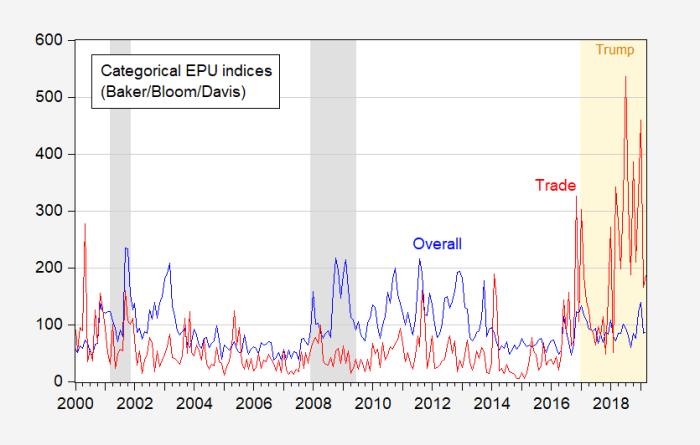

Global economic conditions significantly affect the dollar’s response to oil price changes. Strong global growth often leads to higher demand for oil, which could, in turn, lead to a weaker dollar. Conversely, periods of economic recession can decrease oil demand and potentially strengthen the dollar. Factors such as geopolitical events, trade tensions, and investor sentiment can further complicate the relationship between oil prices and the dollar’s value.

Potential Scenarios

Several scenarios can lead to a strengthening or weakening of the dollar in response to oil price shifts. A sudden and sharp increase in oil prices could cause a significant weakening of the dollar, especially if global economic conditions are already fragile. Conversely, a sustained period of low oil prices, combined with a strong US economy, could strengthen the dollar.

The relationship between the two is not always linear, and unforeseen events can significantly influence the outcome.

Correlation Table

The following table presents a simplified representation of the correlation between oil prices and the dollar’s value. This is a general overview and should not be used for precise predictions.

| Oil Price Trend | Likely Dollar Trend | Explanation |

|---|---|---|

| Rising | Weakening | Increased import costs and reduced competitiveness for US exports |

| Falling | Strengthening | Decreased import costs and increased competitiveness for US exports |

Historical Examples

Numerous historical instances demonstrate the complex interplay between oil prices and the dollar’s value. For example, during the 2008 financial crisis, while oil prices were relatively high, the dollar experienced a period of significant weakening due to global economic uncertainty. Similarly, periods of strong US economic growth, even with rising oil prices, can lead to a stronger dollar. These historical examples highlight the interconnected nature of global economic factors and the complexity of predicting the precise outcome of oil price shifts on the dollar’s value.

Economic Impacts of Price Changes

Oil prices are a critical factor in the global economy, influencing everything from energy costs to consumer spending. Fluctuations in these prices ripple through various sectors, impacting industries and individuals alike. Understanding these impacts is crucial for assessing the overall health and stability of the economy.The fluctuating cost of oil directly impacts American industries that heavily rely on it as a primary input.

These include transportation, manufacturing, and energy production. The prices directly influence costs of production, leading to adjustments in pricing strategies and potentially impacting employment and investment decisions. This ripple effect extends beyond these industries, affecting consumer spending and inflation, and potentially leading to shifts in global trade patterns.

Effects on American Industries Dependent on Oil

American industries heavily reliant on oil face significant challenges when prices surge. Transportation costs increase, impacting trucking, shipping, and airlines. Higher fuel prices translate to higher costs for consumers, potentially leading to decreased demand and impacting profits for these companies. The manufacturing sector also experiences cost increases as raw materials become more expensive. The energy sector itself is vulnerable to fluctuating oil prices, facing either reduced profitability or increased demand for alternative sources.

Influence on Consumer Spending and Inflation

Higher oil prices often lead to higher consumer costs. This is because oil is a key component in many products, from gasoline to plastics. Increased costs can decrease consumer purchasing power, impacting spending across various sectors. Inflation, driven by rising input costs, can erode the value of money and reduce consumer confidence. Historically, periods of high oil prices have coincided with higher inflation rates, as seen in the early 2000s and 2008.

Examples of Impact on Different Sectors

The airline industry provides a clear example. Increased fuel costs directly translate into higher ticket prices, potentially impacting travel demand. Similarly, the trucking industry faces increased operating expenses, potentially leading to higher shipping costs for goods, impacting businesses across the supply chain. The construction sector also faces increased costs, influencing the prices of building materials and affecting construction projects.

Potential Ripple Effects Across Global Markets

Fluctuating oil prices aren’t confined to the US. They have global implications, impacting international trade and investment. For example, a sharp increase in oil prices could negatively affect emerging economies that heavily rely on oil imports. The global interconnectedness of markets means that economic shocks, like those caused by oil price fluctuations, can have significant consequences for other parts of the world.

American oil prices are surging, causing the dollar to dip. This volatility is interesting, given that the US and Mexico are reportedly close to a deal that would slash steel tariffs, as reported by Bloomberg here. This could potentially stabilize the market and, in turn, influence the dollar’s movement. It’ll be fascinating to see how these interconnected factors play out.

Hopefully, the oil market will see some stabilization soon.

Summary of Economic Effects on Various Industries

| Industry | Impact of Higher Oil Prices |

|---|---|

| Transportation (Trucking, Shipping, Airlines) | Increased operating costs, higher prices for consumers, potential decrease in demand |

| Manufacturing | Increased input costs, higher production costs, potential decrease in profits |

| Energy | Reduced profitability or increased demand for alternative sources |

| Construction | Increased costs for building materials, potentially impacting project timelines and costs |

| Agriculture | Increased costs for fertilizer and transportation, impacting food prices |

Impact on Import/Export Activities

Fluctuations in oil prices can significantly impact import/export activities. Higher oil prices can increase transportation costs for imported goods, leading to higher prices for consumers. This can also impact export activities, making goods produced in the affected region more expensive on the global market. This often results in trade imbalances and shifts in global supply chains.

America’s oil prices are surging, causing the dollar to plummet. This economic volatility, however, seems almost insignificant compared to the significant shifts occurring within the Catholic Church, as seen in the current conclave, and the debates surrounding its future. This internal struggle within the Church, as explored in the article ” conclave catholicism at a crossroads “, might just be a microcosm of the broader global economic uncertainties, highlighting the interconnectedness of faith and finance.

The fluctuations in oil prices and the dollar are, therefore, more than just economic indicators; they reflect a broader uncertainty in the world.

Impact on Transportation Costs

Transportation costs are a direct reflection of oil prices. Higher oil prices mean higher fuel costs for trucks, ships, and airplanes, ultimately leading to increased transportation expenses for goods. This cost increase is passed down to consumers, affecting the final price of products.

Government Responses to Price Changes

Governments may implement various measures to mitigate the negative impacts of oil price fluctuations. These might include subsidies for transportation, investments in renewable energy, or tax incentives to encourage energy efficiency. These responses aim to buffer the effects of price shocks and maintain economic stability. Government policies can significantly influence how these price changes are handled and their consequences managed.

Geopolitical Influences

The global oil market is intricately intertwined with international relations, political stability, and geopolitical tensions. These factors exert significant influence on oil production, transportation, and ultimately, the price consumers pay. Understanding these dynamics is crucial for analyzing the fluctuations in oil prices and anticipating future trends.Geopolitical factors, from trade disputes to regional conflicts, can disrupt supply chains and lead to sudden price spikes.

This volatility is a key component of the market’s complexity and often makes predicting future price movements challenging. The interplay of these factors is crucial to comprehending the market’s behavior.

Impact of International Relations

International relations play a critical role in shaping oil market dynamics. Agreements and alliances between countries regarding oil production and trade can significantly impact prices. For example, OPEC’s influence on global oil production and pricing is well-documented. Similarly, political relations between major oil-producing and consuming nations can influence the flow of oil and consequently affect global prices.

Influence of Major Oil-Producing and Consuming Countries

The actions and policies of major oil-producing and consuming nations significantly affect the global oil market. Countries like the United States, Saudi Arabia, and Russia are major players. Their production levels, investment strategies, and political decisions often directly impact the global supply and demand equilibrium. For instance, Saudi Arabia’s decision to increase or decrease production can dramatically shift the global oil market.

Similarly, the US’s import/export policies and energy independence initiatives can have ripple effects on oil prices.

Political Instability and Oil Markets

Political instability in oil-producing regions can lead to significant disruptions in oil production and supply. Conflicts or unrest can disrupt operations, damage infrastructure, and reduce output, driving up prices. For example, the Arab Spring uprisings impacted oil production in some regions, and the conflict in Ukraine has influenced global oil prices.

Government Approaches to Oil Price Regulation

Governments employ various strategies to regulate oil prices, often balancing the need for affordable energy with the potential for market manipulation. Some governments intervene directly through price controls, while others rely on market mechanisms. Different approaches have varying consequences, some leading to price stability but potentially limiting market efficiency, while others allow market forces to dictate prices but may result in greater volatility.

The efficacy and appropriateness of different approaches are often debated and depend on specific geopolitical contexts.

America’s oil prices are surging, causing the dollar to plummet. This economic ripple effect has significant implications, especially when considering the vital role of organizations like the David J. Johns National Black Justice Collective david j johns national black justice collective in advocating for economic justice within the Black community. Ultimately, these fluctuating markets highlight the complex interplay of factors affecting everyday life and the need for robust support systems.

Influence of International Relations on Oil Prices: A Summary

| International Relation | Potential Impact on Oil Prices |

|---|---|

| Trade disputes between major oil producers and consumers | Increased uncertainty, potentially leading to price spikes |

| Regional conflicts or political instability in oil-producing regions | Disruptions in supply, resulting in price increases |

| OPEC production quotas | Significant influence on global supply and prices |

| International sanctions on oil producers | Reduced supply, leading to price increases |

| Agreements between oil-producing and consuming countries | Potential for price stability or manipulation |

Energy Transition Considerations

The global energy landscape is undergoing a significant transformation, driven by growing concerns about climate change and the need for cleaner, sustainable energy alternatives. This shift towards a more sustainable future is impacting the oil market in profound ways, creating both challenges and opportunities for the industry. Understanding the dynamics of this transition is crucial for navigating the complexities of the energy sector in the coming decades.The transition to alternative energy sources is rapidly reshaping the global energy mix.

This transformation is not just about replacing fossil fuels; it’s about reimagining the entire energy system, from generation to consumption. The implications for oil prices, demand, and the long-term viability of the oil industry are multifaceted and deserve careful consideration.

Impact on Oil Prices, Americas oil pops dollar drops

The rise of renewable energy sources is expected to gradually reduce the demand for oil, impacting its market price. Government policies, technological advancements, and consumer choices are all factors in the transition’s pace. Increased renewable energy adoption and the rising cost of fossil fuels will contribute to the changing dynamics of the oil market.

Influence of Renewable Energy Investments

Investments in renewable energy sources, such as solar and wind power, are increasing substantially globally. This influx of capital is driving innovation and efficiency improvements in renewable technologies, making them more competitive with traditional energy sources. The growing popularity of solar panels and wind turbines is directly correlated with a decrease in the cost of these technologies.

Long-Term Implications for the Oil Industry

The energy transition presents both challenges and opportunities for the oil industry. Companies that adapt and diversify their portfolios into renewable energy technologies are better positioned to navigate the changing market landscape. A significant shift towards sustainable alternatives could lead to a decrease in demand for oil, requiring oil companies to find new markets and adapt their business models.

Potential Challenges and Opportunities for the Energy Sector

The transition presents significant challenges for the energy sector. Companies must adapt to new technologies, regulatory frameworks, and evolving consumer preferences. Opportunities arise in the form of developing renewable energy infrastructure, investing in energy storage solutions, and creating new business models in the energy sector. The energy sector will likely experience both major changes and unexpected innovations.

Examples of How Other Countries Are Addressing the Transition

Several countries have already implemented policies and initiatives to accelerate the energy transition. For instance, Germany has invested heavily in solar and wind power, while China has set ambitious targets for renewable energy development. These examples demonstrate the varying approaches countries take to achieve sustainable energy goals.

Projected Growth of Renewable Energy in the Americas

| Year | Projected Renewable Energy Growth (%) |

|---|---|

| 2024 | 5.2% |

| 2025 | 6.1% |

| 2026 | 7.0% |

| 2027 | 7.8% |

| 2028 | 8.7% |

These figures represent projections, and actual growth rates may vary depending on factors such as government policies, technological advancements, and economic conditions. The projected growth rates in the table highlight the increasing importance of renewable energy in the Americas.

Impact of the Shift to Electric Vehicles on Oil Demand

The growing adoption of electric vehicles (EVs) is a key driver of the energy transition. As EV adoption increases, oil demand for transportation is expected to decrease, putting pressure on traditional oil markets. The transition to electric vehicles will likely decrease oil demand, potentially leading to a decline in the use of petroleum-based fuels in the transportation sector.

Ending Remarks: Americas Oil Pops Dollar Drops

In conclusion, the interplay between America’s oil prices and the US dollar’s value is a multifaceted issue with significant economic and geopolitical implications. We’ve explored the historical patterns, the role of global demand and supply, and the potential for future volatility. The energy transition adds another layer of complexity, as the shift towards renewable energy sources may fundamentally alter the dynamics of the oil market.

The coming months will be critical in understanding how this interplay will shape the global economy.