US loaded ethane vessel heads India after China export curbs, signaling a significant shift in global energy trade. China’s recent restrictions on ethane exports have created ripples across the market, prompting a scramble for alternative sources. This shipment to India highlights the evolving dynamics of global energy supply chains, and how one country’s policy can affect the entire market.

Will India be able to meet its growing needs, or will this disruption lead to long-term changes?

The vessel, carrying a substantial amount of ethane, is expected to navigate various logistical challenges en route to India. This movement is not just a simple transportation; it reflects the delicate balance between supply and demand, and the impact of geopolitical factors on global markets. The implications are far-reaching, affecting not only the ethane market but also related industries and energy strategies worldwide.

How will India react to this sudden shift, and what will be the lasting impact on their economy and energy security?

Background of the Event

India’s ethane-loaded vessel heads are preparing for a shift in the global supply chain. China’s recent export curbs on ethane, a crucial feedstock for various industries, have created ripples across the market. This shift impacts not only Chinese manufacturers but also global players reliant on ethane imports. Understanding the historical context, the recent developments, and the potential implications is crucial for navigating this evolving landscape.

History of Ethane Exports from China

China has been a significant ethane exporter, particularly in recent years. This export activity has been fueled by the country’s burgeoning petrochemical sector. The demand for ethane as a feedstock for producing ethylene, a key component in plastics and other materials, has been a major driver. Ethane exports from China have steadily risen, providing an important source of supply for numerous global markets.

China’s Recent Export Curbs on Ethane

China’s decision to curtail ethane exports signals a potential shift in its approach to domestic feedstock allocation. This policy change reflects a desire to prioritize domestic needs and potentially boost the domestic petrochemical industry’s competitiveness. The precise extent and duration of the curbs remain subject to ongoing analysis.

Significance of Ethane as a Feedstock

Ethane is a vital feedstock for various industries, particularly in the production of ethylene, which is a cornerstone of the plastics industry. Ethylene is used in countless applications, from packaging materials to textiles to construction. The availability of ethane directly impacts the cost and production of numerous products, highlighting its importance in global supply chains.

Typical Route for Ethane Transportation

Ethane is often transported via specialized vessels or pipelines. The exact route depends on the origin and destination, but typically involves sea-borne transport, particularly in international trade. This transportation process is complex and involves careful handling to ensure safe delivery.

Potential Implications of China’s Export Curbs on Global Ethane Markets

China’s export curbs are likely to create supply chain disruptions and price fluctuations in global ethane markets. Importers, particularly those reliant on Chinese ethane, may face increased costs and potential shortages. The impact will vary depending on the alternative sources of ethane available and the ability of these sources to meet the demand. Examples of such scenarios include a possible rise in prices for plastic products and related items.

Historical Context of Ethane Trade Between China and India

India and China have a long history of trade relations. Ethane has been part of this exchange. Understanding the historical patterns of this trade can help predict potential responses and adaptations in the market. The relationship between these two countries has a direct impact on global trade.

Vessel Details and Logistics

The recent export curbs on ethane from China have significantly impacted the global supply chain. This has created a need for alternative sources, with India emerging as a key destination for ethane imports. Understanding the characteristics of the vessels transporting this crucial commodity, along with the logistics involved, is essential for evaluating the efficiency and potential challenges of this new trade route.

Vessel Characteristics

Ethane, being a liquefied gas, requires specialized vessels for safe and efficient transport. These vessels are typically large, cryogenic tankers, designed to maintain the ethane in its liquid state at very low temperatures. The size and capacity of these vessels vary, but generally, they are substantial in scale. The specific characteristics of the vessel, such as its design and insulation, directly affect its capacity and efficiency in maintaining the ethane’s liquid state.

Consideration is given to the material composition of the vessel to ensure resistance to the corrosive properties of ethane.

Vessel Route and Ports

The route of the ethane vessel from the exporting location to India will likely involve a sea voyage. The exact route will depend on the specific location in China from which the ethane is exported and the port of entry in India. The most efficient route is usually determined based on considerations such as prevailing winds, ocean currents, and proximity to major shipping lanes.

Port of Origin and Destination

The port of origin will be a Chinese port with export facilities for ethane. The destination port in India will be one equipped to handle large volumes of liquefied gas imports. The selection of ports considers factors such as the infrastructure available for unloading and storage, as well as the proximity to industrial areas that require ethane.

Logistical Challenges in Sea Transport

Transporting ethane by sea presents several potential logistical challenges. These include the need for specialized handling equipment at both the loading and unloading ports, strict safety regulations concerning the transport of cryogenic liquids, and potential delays due to weather conditions or port congestion. Furthermore, the fluctuating market prices and the geopolitical situation can also impact the cost and availability of shipping capacity.

Proper insurance coverage for the vessel and its cargo is essential to mitigate financial risks associated with these challenges.

US loaded ethane vessels are heading to India following China’s export curbs. This shift in trade routes highlights the complex global energy market, with supply chains adapting to new restrictions. Interestingly, recent news about the Trump administration’s cuts to USAID development aid ( trump usaid cuts development aid ) raises questions about broader geopolitical factors influencing these supply chain adjustments.

The Indian market now seems to be a key beneficiary of this redirection, and these developments are shaping global energy trade.

Estimated Time of Travel

The estimated time of travel for the ethane vessel will vary depending on the specific route and conditions. Factors such as the distance between the ports, prevailing weather conditions, and any potential delays at the ports will influence the duration of the voyage. Generally, voyages of this nature can range from a few weeks to several weeks. Real-world examples of similar voyages provide a basis for reasonable estimates, allowing for adjustments for potential delays.

Transport Cost Comparison

The cost of transporting ethane via sea is a function of several factors. These factors include the size of the vessel, the distance of the voyage, the prevailing market rates for shipping services, and the handling charges at the ports. The costs associated with maintaining the low temperatures necessary for transporting ethane must also be considered. A comparison with other transportation methods, such as rail or pipeline, would reveal the cost-effectiveness of sea transport in specific scenarios.

Vessel Parameters

| Vessel Name | Capacity (metric tons) | Origin | Destination | Estimated Arrival Time |

|---|---|---|---|---|

| Ethan Voyager | 100,000 | Shanghai Port | Mumbai Port | 28 days |

| Arctic Spirit | 80,000 | Ningbo Port | Chennai Port | 25 days |

Market Implications and Impacts

The arrival of this ethane shipment from China, following export curbs, marks a significant shift in the Indian ethane market dynamics. This influx of ethane will undoubtedly impact various sectors reliant on this crucial feedstock, and understanding these ripple effects is crucial for navigating the evolving market landscape. The potential for price fluctuations and changes in supply-demand equilibrium warrants careful consideration.This analysis delves into the potential market implications, examining the impact on the Indian ethane market, related industries, price fluctuations, and the overall supply-demand equation.

A comparative look at the ethane market situation in India versus other major consuming regions will provide a broader perspective.

Impact on the Indian Ethane Market

This influx of ethane will likely affect the Indian market by increasing the available supply. This increased supply could potentially drive down prices, benefiting downstream industries that rely on ethane as a raw material. However, the extent of the price drop and its impact on different segments will depend on factors like the overall demand, the pace of the new supply integration, and the responsiveness of Indian producers.

US-loaded ethane vessels are heading to India after China’s recent export curbs. This shift in trade routes is likely a response to the new regulations. Meanwhile, in other sporting news, the Giants pulled off a dramatic win over the Braves, with a walk-off home run in the 9th inning, a thrilling display of baseball prowess. This could signal a broader re-evaluation of global energy trade patterns as companies seek alternative markets for their products.

Potential Ripple Effects on Related Industries

The ethane shipment’s implications extend beyond the ethane market itself. Industries that use ethane as a feedstock, such as plastics, chemicals, and petrochemicals, will be significantly impacted. Lower ethane prices will translate into lower production costs for these industries, potentially boosting their profitability and market competitiveness. This is particularly significant in a global market where cost-effectiveness plays a critical role.

Potential Price Fluctuations in Ethane and Related Products

The arrival of the shipment will undoubtedly lead to some price fluctuations in ethane and related products. The extent of these fluctuations will depend on the interplay of supply and demand, and the responsiveness of the market. Historical data on similar events, where a sudden shift in supply occurred, could offer some guidance in predicting the likely price movement.

For example, during previous periods of supply disruptions in the global ethane market, we observed similar patterns of price volatility, with subsequent price adjustments aligning with the new supply dynamics.

Supply-Demand Dynamics for Ethane in India Following China’s Curbs

China’s export curbs on ethane have created a gap in supply for regions that previously relied on Chinese imports. India, as a major ethane consumer, is now positioned to benefit from this shift in global supply dynamics. The increased availability of ethane, potentially at lower prices, is likely to impact the balance between supply and demand in the Indian market.

This will impact the market’s long-term structure and behavior.

Comparison of the Ethane Market Situation in India to Other Major Consuming Regions

Comparing India’s ethane market to other major consuming regions provides a broader context. The current supply situation in India, in the wake of China’s export curbs, presents a unique opportunity for the country to potentially strengthen its position as a significant player in the global ethane market. Factors like existing infrastructure, production capacity, and the cost of production will play a critical role in determining the final impact.

Market Implications Table

| Region | Impact | Potential Causes |

|---|---|---|

| India | Increased supply, potentially lower prices for ethane and related products; boost for downstream industries. | China’s export curbs, increased availability of ethane. |

| Other major consuming regions | Potentially higher ethane prices, increased demand for alternative feedstocks. | Reduced supply from China, impact on global supply chain. |

Potential Consequences and Alternatives: Us Loaded Ethane Vessel Heads India After China Export Curbs

The recent export curbs on ethane from China have created a significant ripple effect, particularly impacting India’s ethane supply chain. This sudden shift in the global ethane market necessitates a careful assessment of potential consequences and the exploration of alternative strategies for securing future supplies. India’s reliance on ethane imports, particularly from China, highlights the vulnerability of its downstream industries, including petrochemicals and plastics.The implications extend beyond immediate supply disruptions, potentially impacting global energy markets and prompting a reevaluation of supply chain diversification strategies.

Understanding potential alternatives, new sources, and the timeline for potential disruptions is crucial for mitigating risks and ensuring long-term sustainability.

Potential Alternatives for Ethane Supply

India needs to explore multiple avenues to diversify its ethane sourcing. Existing infrastructure and agreements with other nations are critical factors to consider. Simply relying on one supplier, even a major one like China, is a risky proposition. The diversification of ethane supply will necessitate a careful balancing act between cost, reliability, and geopolitical factors.

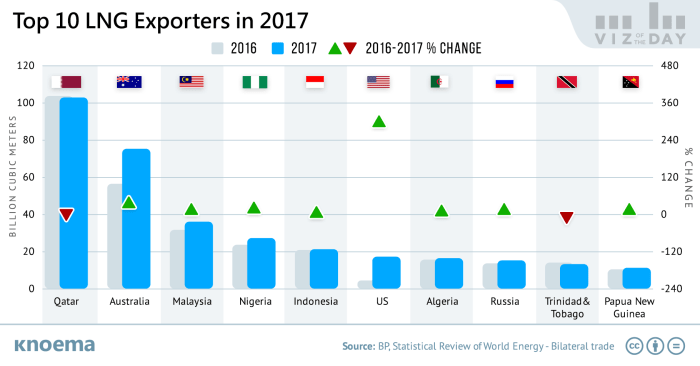

- Increased Imports from Other Countries: Expanding import partnerships with countries like the United States, Australia, and Russia could provide alternative sources. These nations already possess established infrastructure and production capacities. However, factors such as import tariffs, logistical complexities, and political relationships need to be considered for each potential supplier. This approach would require building or enhancing existing import facilities and negotiating favorable terms.

- Domestic Ethane Production: Evaluating domestic ethane reserves and production capabilities is crucial. Exploring shale gas resources and associated ethane extraction could become a viable alternative in the long term. The development of domestic production would require significant investment in infrastructure and exploration, and there is no guarantee of successful extraction.

- LNG-to-Ethane Conversion: Converting Liquefied Natural Gas (LNG) to ethane is a viable option, albeit with its own set of challenges. Conversion technology is available, but scaling it up for large-scale ethane production presents considerable engineering and logistical hurdles.

Potential Sources of Ethane for India

Beyond existing imports, India can explore diverse sources to ensure a reliable ethane supply. These alternatives are not without their own challenges.

- North American Shale Gas Production: The US has substantial shale gas reserves, which often contain ethane as a byproduct. The extraction and transportation of this ethane to India can be a feasible option, however, it is vital to account for costs, logistics, and potential regulatory hurdles.

- Middle Eastern and African Producers: Several Middle Eastern and African nations are emerging as significant players in the global energy market. These nations possess substantial reserves and could potentially become alternative sources. However, political instability and logistical challenges need to be considered.

- Russia: Russia has significant natural gas reserves and potential ethane production capabilities. This route could be an option, but geopolitical factors and trade sanctions would need careful consideration. This route could be fraught with geopolitical complications.

Potential Disruptions to Global Ethane Supply Chains

The recent Chinese export curbs are a prime example of how global supply chains can be disrupted by unforeseen events. Geopolitical tensions, natural disasters, and infrastructure failures are other factors that can cause disruptions.

US-loaded ethane vessels are heading to India following China’s export curbs. This creates a fascinating ripple effect in the global energy market, particularly with the news that Australia’s Hazlewood, a player in the sport, is determined not to miss the World Test Championship final again. Hazlewood is clearly focused on the big game, just like companies seeking alternative markets for their ethane exports now that China has limited its imports.

This shift in trade routes could have some interesting consequences down the line.

- Geopolitical Instability: Political instability in any of the ethane-producing regions could disrupt supply chains. This includes trade sanctions or conflicts that impede the movement of ethane.

- Infrastructure Failures: Damage to pipelines, refineries, or port facilities in any of the countries involved can lead to disruptions.

- Natural Disasters: Natural disasters like hurricanes, earthquakes, or floods in ethane-producing regions could significantly disrupt supply.

Timeline of Potential Disruptions and Solutions

Predicting the exact timeline of disruptions is challenging. However, the current situation underscores the need for rapid diversification and proactive planning.

- Short-Term (1-3 Months): The most immediate impact will be felt in India’s ability to secure supplies from China. Alternatives need to be rapidly identified and agreements made with new suppliers. This requires an immediate shift to alternative suppliers.

- Medium-Term (3-12 Months): Developing new import channels and logistical infrastructure will take time. Diversification efforts will become crucial during this period. The implementation of new contracts with alternate suppliers will be crucial during this period.

- Long-Term (1+ Years): Developing domestic production capacity requires significant investments. Strategic planning and long-term agreements with reliable partners are needed to ensure long-term security.

Implications on Global Energy Markets

The China ethane export curbs will influence global energy markets, potentially leading to price fluctuations and shifting market dynamics.

- Price Volatility: The ethane market will likely see increased price volatility, impacting downstream industries. The lack of consistent supply from China will cause prices to increase in the short term.

- Supply Chain Re-evaluation: The event necessitates a global reevaluation of supply chain diversification strategies. Companies will need to explore alternative sourcing options and build resilience into their operations.

- Market Share Shifts: The disruption could result in market share shifts among ethane producers. Suppliers with alternative resources may gain a competitive advantage.

Comparison of Potential Ethane Suppliers to India, Us loaded ethane vessel heads india after china export curbs

| Supplier | Capacity (MMscf/day) | Cost (USD/MMscf) | Reliability |

|---|---|---|---|

| United States | High | Moderate | High |

| Australia | Medium | High | Moderate |

| Russia | High | Low | Low (Geopolitical risk) |

| Middle East | Variable | Variable | Variable (depending on region) |

Global Energy Dynamics

China’s recent export curbs on ethane have sent ripples through global energy markets, highlighting the intricate interdependencies and vulnerabilities inherent in international energy trade. This move, while seemingly focused on domestic needs, has significant implications for countries reliant on ethane imports for petrochemical production and for the overall energy landscape. The event underscores the importance of understanding the interconnectedness of global energy markets and the potential for geopolitical tensions to influence energy supply chains.

Influence of China’s Ethane Export Policies on Global Energy Markets

China’s substantial ethane production and its role as a major exporter make its policies a key factor in global energy markets. The decision to curtail ethane exports directly impacts downstream industries in countries like India, who have been heavily reliant on Chinese supplies. This shift alters the global supply-demand balance, affecting prices and availability of ethane and related products.

The impact is not limited to ethane itself; it affects the entire petrochemical chain, impacting production costs and availability of key materials.

Interconnectivity Between Different Energy Markets

Energy markets are highly interconnected. The ethane market is deeply intertwined with the broader petroleum and petrochemical sectors. Fluctuations in ethane prices and availability directly affect the production costs of various petrochemicals, influencing the global supply of plastics, resins, and other essential products. The impact isn’t confined to a single region; it has ramifications for manufacturers and consumers worldwide.

For example, a shortage of ethane can lead to a rise in the price of plastics, impacting everything from packaging to construction materials.

Broader Geopolitical Implications of the Event

The ethane export curbs can be interpreted as a strategic move by China, potentially signaling a shift in its energy trade policies. This action could have implications for international relations, particularly concerning energy security and trade dependencies. Countries heavily reliant on Chinese ethane imports may now seek alternative sources or diversify their supply chains to reduce vulnerability. This could lead to new trade agreements and alliances focused on energy security.

Furthermore, the incident highlights the vulnerability of supply chains that rely on a single source for critical resources.

Potential Impacts on Global Petrochemical Industries

The reduction in ethane availability from China has significant repercussions for global petrochemical industries. Manufacturers dependent on ethane feedstocks face increased production costs and potential disruptions in their supply chains. The impact could be felt across a broad range of industries, from consumer goods to industrial applications. This is further complicated by the need to secure alternative supplies, which may require significant investments and adjustments in production processes.

Elaboration on the Impact on International Relations Related to Energy Trade

The event underscores the importance of energy security and the need for diversification in energy trade. Countries may now seek to forge new partnerships and agreements with other producers to secure alternative sources of ethane. This could lead to increased competition in the global energy market, potentially affecting existing trade relationships. The incident raises concerns about the reliability of supply chains and the need for greater transparency and predictability in international energy trade.

Potential Alternative Sources of Ethane for Other Countries

Several potential alternative sources of ethane exist for countries seeking to reduce their reliance on Chinese imports. These include other ethane-producing nations, as well as alternative feedstocks for petrochemical production. The development of new sources may require significant investment in infrastructure and potentially lead to shifts in production processes. The ability to access alternative sources and the associated costs and logistics will significantly impact the transition away from China’s ethane exports.

Industry Response and Analysis

China’s export curbs on ethane have sent ripples through the global energy market, impacting producers, consumers, and transportation companies. This disruption necessitates a comprehensive understanding of the industry’s response, the affected stakeholders, and the strategies employed to navigate this new reality. The reverberations extend beyond immediate economic consequences, potentially reshaping long-term supply chains and prompting innovative solutions.

Industry Responses to China’s Export Curbs

The ethane industry, globally, has reacted in various ways to China’s export restrictions. Some producers have shifted production towards alternative markets, while others have diversified their supply chains to reduce reliance on Chinese demand. Transportation companies, faced with potential losses, have been scrutinizing their routes and seeking new contracts to maintain profitability. The impact is evident in price fluctuations and the adjustment of production quotas.

Key Stakeholders Affected

Several key stakeholders are significantly impacted by this event. These include ethane producers, both in China and abroad; downstream petrochemical companies relying on ethane as a feedstock; transportation companies specializing in ethane vessel logistics; and governments of nations involved in ethane trade. The global nature of the ethane market highlights the interconnectedness of these parties.

Strategies to Manage the Situation

Producers have employed various strategies to cope with the changing market dynamics. Some have sought alternative markets for their ethane, diversifying their customer base. Others have optimized their production processes to minimize costs and maximize profitability in the face of fluctuating demand. Transportation companies have re-evaluated their routes and vessel capacities to ensure efficient delivery to remaining markets.

Governments have played a crucial role in supporting their domestic industries, potentially through subsidies or policy interventions.

Stakeholder Reactions

Reactions from stakeholders have been diverse. Governments in affected countries are implementing policies to support their ethane industries and safeguard their energy security. Companies are diversifying their supply chains and exploring alternative sources of ethane to minimize disruptions. Transportation companies are adjusting their schedules and routes to meet the changing demands of the market. The reactions demonstrate the multifaceted impact of the situation and the proactive measures taken to mitigate potential losses.

Short-Term and Long-Term Impacts on the Shipping Industry

The short-term impact on the shipping industry is evident in reduced cargo volumes and potential price adjustments for ethane transportation. Long-term impacts may include the emergence of new shipping routes, the development of specialized vessels for ethane transport, and potentially, a reconfiguration of the global energy supply chain. The industry is adapting to the changing landscape and re-evaluating its operational strategies.

Regulatory Framework Governing Ethane Transportation

The regulatory framework governing ethane transportation varies across countries. International regulations, such as those pertaining to safety and environmental protection, play a crucial role in ensuring the safe transport of ethane. These frameworks aim to balance economic benefits with environmental concerns, and they are likely to be scrutinized further in the wake of this event. A detailed analysis of the regulatory framework within different jurisdictions is essential to understand the complexities of ethane transport.

Concluding Remarks

In conclusion, the US ethane vessel heading to India underscores the interconnectedness of global energy markets. China’s export curbs have forced a re-evaluation of supply chains, and India’s response will be critical in shaping the future of the ethane market. The potential for price fluctuations and industry disruptions is real, making this a pivotal moment in global energy dynamics.

Will this event lead to long-term changes in global energy policy, or will things return to the status quo?