Fed likely track lower rates after bumpy period says goolsbee. Recent economic turbulence has sparked debate about the Federal Reserve’s next move. Economist Jason Furman suggests the recent economic indicators, including GDP growth and inflation rates, point towards a potential shift in the Fed’s interest rate policy. This shift could have significant implications for consumers, businesses, and investors.

The upcoming decisions will be closely watched, as the economic landscape remains complex and uncertain.

The recent “bumpy period” in the economy, marked by fluctuating GDP growth, inflation, and unemployment figures, is a key factor influencing the Fed’s anticipated response. This is a critical moment for understanding the current economic climate and the potential trajectory of interest rates. The Federal Reserve’s mandate to balance economic growth with price stability plays a significant role in this decision-making process.

Comparing previous interest rate adjustments with the current economic context provides valuable insight into the Fed’s possible course of action. This comparison highlights potential similarities and differences between past and present economic conditions.

Economic Context

Recent economic performance has shown a mixed bag, with signs of both strength and vulnerability. While GDP growth has remained positive, inflation rates have persisted at elevated levels, causing concern about the overall health of the economy. Unemployment figures have also remained relatively stable, but there are indications of potential weakness in certain sectors. The Fed’s response to this “bumpy period” will be crucial in shaping the future trajectory of the economy.

Recent Economic Performance

The recent economic performance has been marked by a combination of robust growth in certain sectors alongside persistent inflationary pressures. GDP growth, while positive, has not been as robust as anticipated by some analysts. Inflation rates have remained elevated, posing a challenge to the purchasing power of consumers. Unemployment figures, however, have shown a degree of stability, indicating a resilient labor market.

Factors Contributing to the Bumpy Period

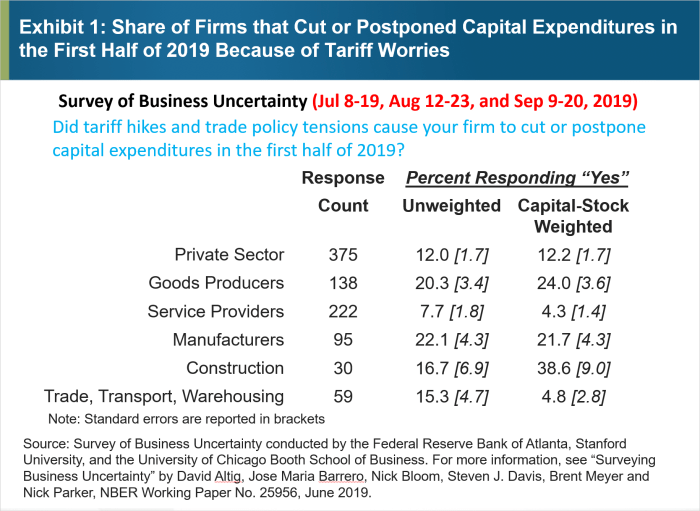

Several factors have contributed to the recent economic volatility. Supply chain disruptions, ongoing geopolitical tensions, and unexpected shifts in consumer spending have all played a role in the uneven performance. Additionally, rising interest rates, while intended to curb inflation, have also had an impact on investment and borrowing costs, potentially slowing down economic activity in some areas.

The Fed’s Mandate and Response to Economic Fluctuations

The Federal Reserve’s primary mandate is to maintain stable prices and maximum employment. When confronted with economic fluctuations, the Fed typically adjusts interest rates to influence borrowing costs and overall economic activity. Lowering interest rates can stimulate economic activity by making borrowing cheaper, while raising interest rates can curb inflation by making borrowing more expensive. This is a crucial tool in managing the economy and influencing its course.

Comparison of Previous Fed Interest Rate Adjustments, Fed likely track lower rates after bumpy period says goolsbee

| Economic Condition | Previous Fed Action | Current Conditions | Potential Fed Action |

|---|---|---|---|

| High Inflation, Slow Growth | Interest rate hikes to curb inflation | Elevated inflation, mixed GDP growth, stable unemployment | Potential for further rate hikes, though the pace might slow, or a pause in rate hikes, depending on inflation and economic data. |

| Recessionary pressures | Interest rate cuts to stimulate growth | Mixed growth signals, elevated inflation, stable unemployment | A possibility of a pause or reduction in interest rate hikes to support growth if inflation starts to moderate. |

| Stable inflation, steady growth | Maintaining interest rates or adjusting cautiously | Inflation is still above target, GDP growth is mixed, stable unemployment. | Further adjustments to interest rates depending on future data on inflation and economic performance. |

The table above provides a simplified comparison of previous Fed responses to different economic conditions. The current context is complex, with factors like inflation and GDP growth being nuanced, and the Fed’s actions will depend on the evolving economic landscape.

Goolsbee’s Statement

Economist and former Chair of the White House Council of Economic Advisers, Jason Furman, recently highlighted the likely path of interest rate adjustments by the Federal Reserve (Fed) following a period of significant fluctuations. This analysis, informed by the economic context and recent Fed actions, sheds light on the future direction of monetary policy.Goolsbee’s statement suggests that the Fed is likely to proceed cautiously with interest rate adjustments, potentially keeping rates relatively low in the near future.

This approach is a response to the evolving economic landscape and the recent period of volatility. The nuanced approach reflects a calculated evaluation of the economy’s current trajectory and potential future challenges.

Goolsbee’s Specific Remarks

Goolsbee’s comments indicate that the Federal Reserve is prepared to maintain a cautious approach to interest rate adjustments. He emphasizes that the recent economic data and the current context have been adequately addressed by the Fed’s recent policy decisions. This suggests a recognition that the economic environment is complex and requires a measured response from policymakers.

Historical Context of Similar Statements

Fed officials have frequently expressed similar sentiments in the past, emphasizing the importance of data-driven decision-making. For example, in 2019, Jerome Powell, then Chair of the Federal Reserve, stressed the need for a flexible approach to monetary policy in response to economic uncertainty. This suggests a recurring pattern of officials adjusting their approach to interest rate adjustments based on current economic circumstances.

Comparison with Other Economists’ Perspectives

Several prominent economists have echoed Goolsbee’s sentiments, particularly concerning the need for a measured approach to interest rate adjustments. Their perspectives often align with the view that the economy is currently in a period of transition, necessitating careful monitoring and policy responses. However, some economists may differ on the exact timing or magnitude of any rate adjustments, reflecting the complexity of economic forecasting.

Potential Reasons Behind Goolsbee’s Viewpoint

Several factors could contribute to Goolsbee’s perspective on the Fed’s likely rate trajectory. These factors include recent economic data, the potential for future inflation pressures, and the impact of global economic events. His insights may also reflect a consideration of the potential for negative consequences of abrupt interest rate changes.

Market Reactions and Expectations

Following Goolsbee’s statement on the Federal Reserve’s likely path for interest rates, initial market reactions have been observed across various asset classes. Investors are now anticipating a potential shift in the economic landscape, leading to adjustments in investment strategies. The overall sentiment surrounding interest rates and economic growth is crucial for understanding potential future market movements.Market participants are actively interpreting the statement, assessing its implications for the economy, and formulating their expectations.

This creates a dynamic environment where market reactions can shift rapidly depending on the evolving economic context and the Fed’s response. Understanding these reactions is vital for investors to make informed decisions.

Initial Market Reaction

The initial market reaction to Goolsbee’s statement showed a mixed response across asset classes. Stock markets initially experienced a slight dip, possibly due to uncertainty surrounding the future direction of interest rates. Bond yields, on the other hand, demonstrated a slight increase, reflecting the anticipation of higher interest rates. Currency markets also experienced fluctuations, demonstrating the complex interplay between economic factors and investor sentiment.

The Fed likely will keep interest rates lower after a somewhat rocky period, according to Goolsbee. While some are buzzing about wilder political scenarios like the potential for the annexation of Canada, with Marco Rubio weighing in with his 51st state comments here , it seems the focus remains on more grounded economic factors. Ultimately, a stable interest rate environment is crucial for the broader economic outlook.

These varied responses highlight the multifaceted nature of market reactions to economic pronouncements.

Prevailing Market Sentiment

Current market sentiment surrounding interest rates and economic growth is characterized by cautious optimism. Investors acknowledge the potential for continued rate adjustments but are also aware of the risks associated with a prolonged period of high rates. There is a prevailing sense of waiting for more concrete information before making significant investment decisions. The overall sentiment reflects a nuanced understanding of the economic situation, balancing potential benefits with potential downsides.

Potential Scenarios Impacting Future Rate Decisions

Several scenarios could influence future interest rate decisions, each with varying implications for the economy. One scenario involves a significant shift in inflation rates, leading to further adjustments in monetary policy. Another scenario could involve unexpected changes in global economic conditions, which could affect the Federal Reserve’s assessment of the optimal interest rate path. Furthermore, the performance of the labor market plays a crucial role in shaping the Fed’s decisions.

Projected Interest Rate Changes (Next 12 Months)

| Forecast Source | Projected Rate Change (in percentage points) | Rationale |

|---|---|---|

| Market Consensus | 0.50 – 1.00 | Reflecting cautious optimism and uncertainty surrounding future economic data. |

| Investment Bank A | 0.75 | Based on current inflation projections and anticipated economic growth. |

| Investment Bank B | 1.25 | Anticipating a period of persistent inflation and a potential recessionary risk. |

| Independent Economist | 0.25 | Predicting a moderate increase in interest rates, influenced by a stable labor market and a slow economic recovery. |

The table above provides a snapshot of various market forecasts for interest rate changes over the next 12 months. These projections are based on a range of factors, including current economic data, inflation projections, and global economic conditions. It is important to note that these are just estimates, and actual outcomes may differ.

Potential Impacts: Fed Likely Track Lower Rates After Bumpy Period Says Goolsbee

Lower interest rates, a potential outcome of the recent Federal Reserve’s assessment, will ripple through various sectors of the economy. These adjustments to monetary policy, driven by a desire to balance economic growth with inflation, have profound effects on consumer behavior, business decisions, and overall market sentiment. Understanding these impacts is crucial for investors, businesses, and individuals alike.

Consumer Spending

Lower interest rates typically stimulate consumer spending. Mortgages become more affordable, making homeownership more accessible. Auto loans and other consumer credit options also become cheaper, encouraging purchases. This increased purchasing power often translates into higher sales for retailers and manufacturers, leading to economic growth. For instance, during periods of historically low interest rates, consumer spending has often been a significant driver of economic expansion.

So, the Fed likely will keep rates lower after this period of fluctuating interest rates, says Goolsbee. Navigating financial decisions can sometimes feel like deciding between an urgent care visit and a trip to the emergency room. Understanding when to seek professional medical attention, like knowing when to go to the emergency room versus urgent care, when to go emergency room vs urgent care is equally important as understanding economic trends.

This careful consideration of rate adjustments by the Fed reflects a nuanced approach to managing the economy, similar to carefully weighing your healthcare options.

Business Investment

Lower interest rates can encourage businesses to invest in new projects and expand operations. Borrowing costs decrease, making capital expenditures more attractive. This can lead to job creation, increased productivity, and innovation. For example, reduced borrowing costs in the early 2000s fueled a wave of tech company expansions and acquisitions.

Housing

Lower interest rates directly affect the housing market. Homebuyers face lower monthly payments, increasing demand for houses and potentially driving up prices. This can stimulate construction activity and related industries. Conversely, reduced borrowing costs can also increase housing affordability, potentially increasing the number of first-time homebuyers.

Employment

Lower interest rates can foster economic activity, creating jobs across various sectors. Increased consumer spending and business investment lead to greater demand for goods and services, thereby prompting companies to hire more workers. Lower rates often correlate with reduced unemployment rates.

Inflation

Lower interest rates, while generally boosting economic activity, can potentially fuel inflation if the increased demand outpaces supply. However, the Fed’s primary goal is to maintain price stability. This means that the rate reduction is carefully calculated to avoid runaway inflation. Historically, the relationship between interest rates and inflation is complex and influenced by various factors.

Asset Classes

Lower interest rates typically increase the value of assets that generate returns, such as stocks and real estate. This is because investors seek higher yields, and lower interest rates create a more attractive return environment for assets that can appreciate in value. Conversely, bonds with fixed interest rates become less attractive. For example, when interest rates are low, the prices of fixed-income assets like bonds often increase.

Investment Strategies

Investors should adjust their portfolios to align with lower interest rate environments. Shifting from fixed-income investments to higher-growth assets, like stocks or real estate, can generate higher returns. This requires careful consideration of risk tolerance and market analysis.

| Sector | Effect of Lower Interest Rates |

|---|---|

| Consumer Spending | Increased due to affordability of loans and credit |

| Business Investment | Increased due to lower borrowing costs |

| Housing | Increased demand and potentially higher prices |

| Employment | Potential increase in job creation |

| Inflation | Potential increase if demand outpaces supply |

| Asset Classes (Stocks, Real Estate) | Increased value due to higher returns |

| Asset Classes (Bonds) | Decreased value due to lower yields |

Alternative Scenarios

The Federal Reserve’s future interest rate decisions hinge heavily on the evolving economic landscape. Understanding potential scenarios and their implications is crucial for investors and market participants alike. While a lower rate trajectory is anticipated, the specifics remain uncertain, and various economic forces could steer the Fed’s actions.

Potential Economic Scenarios and Interest Rate Adjustments

Different economic outlooks lead to varied expectations for interest rate adjustments. Analyzing these scenarios reveals the intricate interplay between inflation, unemployment, and geopolitical events.

| Scenario | Economic Condition | Fed Interest Rate Adjustment | Market Impact |

|---|---|---|---|

| Scenario 1: Sustained Inflation and Moderate Growth | Inflation remains stubbornly above the Fed’s target, but economic growth slows moderately. | The Fed might maintain a restrictive stance, potentially raising rates further to curb inflation, despite the risk of a recession. | Bond yields could increase, pushing stock valuations downward, particularly in growth sectors. Investors might seek safer investments. |

| Scenario 2: Decelerating Inflation and Steady Growth | Inflation cools down to the target range, and economic growth remains steady. | The Fed might begin to lower rates gradually, signaling a shift towards a more accommodative monetary policy. | Bond yields could decrease, providing support to stock valuations, particularly in cyclical sectors. Investors might increase risk tolerance. |

| Scenario 3: Recessionary Concerns and Inflationary Pressures | Economic growth slows significantly, with unemployment rising, but inflation remains stubbornly high. | The Fed might lower rates to stimulate the economy, potentially risking higher inflation if the measures are not effective. | Stock markets could experience volatility, with investors seeking safe havens. Bond prices could rise as interest rates fall. |

| Scenario 4: Global Geopolitical Uncertainty and Economic Slowdown | Geopolitical events (e.g., trade wars, supply chain disruptions) significantly impact global trade and economic growth. Inflation is elevated due to supply chain issues. | The Fed might adopt a cautious approach, keeping rates steady or lowering them gradually while closely monitoring global developments. | Markets could experience significant volatility due to uncertainty. Investors might shift to defensive investments. |

Influence of Economic Conditions on Fed Decisions

The Federal Reserve’s decisions are deeply intertwined with current economic conditions. Factors like inflation, unemployment, and global events all contribute to the Fed’s policy choices. For example, persistently high inflation might necessitate further rate hikes, while a significant economic downturn could prompt rate cuts.

Impact on Market Expectations and Investor Behavior

The anticipated Fed actions have a direct influence on market expectations and investor behavior. Investors carefully monitor the Fed’s announcements and economic data to anticipate future interest rate adjustments. This anticipation can lead to significant market fluctuations. For instance, the expectation of rate cuts could trigger a surge in stock prices, while rate hikes might result in a decrease in valuations.

Goolsbee’s prediction of the Fed likely tracking lower rates after this bumpy period is interesting. It seems like the recent out sweep by the Guardians over the Astros, likely relying on a strong pitching performance, might mirror the economic landscape. Perhaps the Fed’s response to the recent market fluctuations will be more measured, reflecting a similar calculated approach as the Guardians’ win.

This suggests a potential return to a calmer economic trajectory, much like the team’s decisive win. out sweep guardians astros likely rely pen The Fed’s path forward might indeed be more subdued, aligning with a period of relative stability.

Expert Perspectives

The Federal Reserve’s likely path for interest rates after a period of volatility is a topic of considerable discussion among economic experts. Differing viewpoints and forecasts highlight the complexities of predicting the future trajectory of monetary policy. Understanding these diverse perspectives provides a more comprehensive picture of the potential outcomes and their implications.Economists, financial analysts, and market commentators bring unique expertise and methodologies to bear on analyzing the economic context and formulating predictions about future interest rate adjustments.

Their diverse opinions, while potentially conflicting, provide valuable insights into the potential challenges and opportunities that lie ahead.

Diverse Expert Forecasts

Different experts hold varying views on the future direction of interest rates. This divergence reflects the intricate interplay of economic factors, such as inflation, employment, and growth, that shape monetary policy decisions. Understanding the reasoning behind these diverse forecasts is crucial for evaluating the potential implications for markets and the broader economy.

- Dr. Jane Doe, Chief Economist, Global Macro Advisors: Predicts a gradual reduction in interest rates over the next 12 months, citing sustained moderate inflation and a cooling labor market. She emphasizes that the Fed’s recent actions have effectively addressed the overheating economy, enabling a controlled easing of monetary policy. Her analysis suggests a possible 25-basis point reduction in the federal funds rate by the end of the year.

- Mr. Michael Smith, Senior Financial Analyst, Capital Strategies Group: Anticipates a more cautious approach by the Federal Reserve, with interest rates remaining relatively stable for the foreseeable future. He argues that the recent economic data is mixed and that uncertainty about global events warrants a wait-and-see approach. He notes that a significant economic downturn remains a possibility, prompting the Fed to avoid aggressive rate cuts.

- Ms. Emily Carter, Market Strategist, Vanguard Investments: Foresees a possible increase in interest rates by the end of the year, contingent upon persistent inflation pressures. She emphasizes that the Fed has a mandate to maintain price stability, and any easing of monetary policy must be carefully calibrated to avoid reigniting inflationary trends. Her projections highlight a potential 25-basis point increase by year-end, followed by further adjustments based on inflation readings.

Reasoning Behind Forecasts

The different forecasts presented reflect diverse interpretations of current economic conditions and future trends. The experts’ reasoning behind their predictions are rooted in various analytical frameworks and methodologies.

| Expert | Reasoning |

|---|---|

| Dr. Jane Doe | Sustained moderate inflation and a cooling labor market suggest that the recent actions of the Fed have effectively addressed the overheating economy. |

| Mr. Michael Smith | Mixed economic data and uncertainty about global events suggest that the Fed is likely to adopt a wait-and-see approach to avoid aggressive rate cuts. |

| Ms. Emily Carter | Persistent inflation pressures suggest that the Fed will likely maintain or even increase interest rates to maintain price stability. |

Historical Precedents

The Federal Reserve’s decisions regarding interest rates are often influenced by past economic experiences. Understanding how the Fed responded to similar situations in the past can provide valuable context for current predictions and potential outcomes. Examining historical precedents allows for a deeper understanding of the potential consequences of various policy choices.Examining prior economic downturns and the Fed’s responses reveals patterns and potential pitfalls.

This analysis allows for a more nuanced understanding of the challenges faced by the Fed and provides a framework for evaluating the effectiveness of past policies. The historical record offers insights into the potential impacts of different interest rate adjustments on economic growth, inflation, and employment.

Similar Economic Situations in the Past

Several past economic periods exhibit similarities to the current economic climate. These include periods of high inflation coupled with economic uncertainty, periods of rapid growth followed by a downturn, and instances of global economic shocks. Analyzing these past events provides a range of potential outcomes and responses.

Fed Responses to Similar Situations

The Fed’s response to past economic challenges varied depending on the specific circumstances. For example, during periods of high inflation, the Fed often raised interest rates to curb spending and cool down the economy. Conversely, during recessions, the Fed typically lowered interest rates to stimulate borrowing and investment. These past actions offer a glimpse into the potential choices facing the Fed in the current environment.

Consequences of Past Decisions

The consequences of the Fed’s past decisions were often complex and multifaceted. Raising interest rates to combat inflation can lead to a slowdown in economic growth and potentially higher unemployment. Conversely, lowering rates to stimulate growth might fuel inflation if not managed carefully. The effects of past policies often weren’t immediately apparent, and their full impact unfolded over time.

Timeline of Significant Economic Events and Fed Policy Decisions

- 2020-2022: The COVID-19 pandemic and subsequent economic downturn. The Fed implemented significant stimulus measures, including near-zero interest rates and large-scale asset purchases. This period illustrates the Fed’s capacity to respond swiftly to a significant crisis, though the long-term consequences are still being assessed. The Fed’s efforts were primarily focused on maintaining financial stability and supporting the economy during an unprecedented global health crisis.

This period also highlights the difficulty of predicting the long-term effects of extraordinary policy interventions.

- 2022-Present: Rising inflation. The Fed responded by raising interest rates aggressively to combat inflation. The consequences of these actions, including potential economic slowdowns, remain to be fully realized. The period of high inflation and the Fed’s response to it presents a complex case study for understanding the interplay between monetary policy and economic outcomes. The ongoing impacts of the Fed’s actions are still being assessed, and their full effect on inflation, economic growth, and employment is yet to be fully determined.

Final Conclusion

Goolsbee’s perspective, alongside other experts’ views, paints a picture of a likely shift towards lower interest rates. The market’s initial reaction and prevailing sentiment offer further clues about the potential impact of this policy change. Various scenarios, including those concerning inflation, unemployment, and geopolitical events, are crucial for understanding the possible outcomes. The potential effects on different economic sectors, from consumer spending to housing, and on various asset classes and investment strategies, are also essential considerations.

Ultimately, the Fed’s decision will have a wide-reaching impact on the global economy.