Anduril secures 305 billion valuation latest fund raise, marking a significant leap for the defense technology company. This massive valuation suggests substantial investor confidence in Anduril’s future potential, raising intriguing questions about the company’s trajectory and the future of the industry. We’ll delve into the details, examining the company’s history, financial performance, competitive landscape, and the rationale behind this impressive valuation.

The latest funding round signals a renewed surge in interest in the sector, potentially driving innovation and competition. This in-depth analysis provides context for understanding the significance of this investment, looking at factors like the company’s strengths and weaknesses, the competitive landscape, and the overall impact on the industry. We’ll also explore the potential implications for job creation and market expansion.

Company Overview

Anduril, a rapidly evolving defense and security technology company, has achieved a significant milestone with its recent $305 billion valuation. This substantial funding round underscores the company’s innovative approach to military technology and its potential for future growth. This article delves into Anduril’s history, mission, business model, target markets, and competitive analysis.

Company History and Milestones

Anduril was founded in [Year of founding] with a focus on developing cutting-edge autonomous systems for military applications. Key milestones include the successful demonstration of [Specific autonomous system], which marked a breakthrough in [Specific technological area]. The company has also secured contracts with [Specific government/military entities] for the development and deployment of its products, demonstrating significant trust and adoption in the market.

Their early successes paved the way for future innovation and expansion.

Mission and Vision

Anduril’s mission is to revolutionize the defense industry through the application of advanced technology. Their vision extends to creating a future where autonomous systems play a crucial role in maintaining global security, ensuring a safer and more secure world. A core value is a commitment to ethical development and responsible use of technology, a critical aspect of their approach to military innovation.

Business Model and Product Offerings

Anduril’s business model revolves around the development and deployment of advanced autonomous systems, including [Specific product type 1], [Specific product type 2], and [Specific product type 3]. These systems are designed to enhance military capabilities in areas such as [Specific military function 1] and [Specific military function 2]. The company offers a comprehensive suite of services, including [Service 1] and [Service 2], tailored to meet the evolving needs of its clients.

Target Markets and Customer Segments

Anduril’s primary target markets include government agencies and military organizations globally. Their customer segments encompass various roles, from [Role 1] to [Role 2], all seeking innovative solutions to complex defense challenges. The company’s solutions are designed to meet the unique requirements of these diverse organizations.

Strengths and Weaknesses

| Strengths | Weaknesses |

|---|---|

| Advanced technology and innovation | Potential challenges in scaling production and deployment |

| Strong partnerships and government contracts | Dependence on external funding and market fluctuations |

| Highly skilled workforce and experienced leadership | Competition from established defense contractors |

| Focus on ethical and responsible development | Need to demonstrate long-term sustainability and profitability |

| Rapid growth and market presence | Relatively limited public information regarding specific internal operations |

Financial Analysis: Anduril Secures 305 Billion Valuation Latest Fund Raise

Anduril’s recent $305 billion valuation, following their latest funding round, marks a significant milestone in the defense technology sector. This valuation, while substantial, requires careful scrutiny to understand its implications for the company’s future and its standing within the industry. A deep dive into the financial details reveals key insights into the potential for growth and challenges that lie ahead.

Significance of the $305 Billion Valuation

This valuation, while seemingly astronomical, needs to be considered in context. It represents a substantial leap from previous funding rounds and places Anduril at a potentially dominant position within the emerging autonomous defense technology landscape. However, such a high valuation necessitates a strong performance trajectory to justify the investment and support the projected growth. It suggests significant investor confidence in Anduril’s technological prowess and market positioning.

Comparison to Previous Funding Rounds and Industry Benchmarks

Comparing Anduril’s $305 billion valuation to prior funding rounds is crucial for understanding its growth trajectory. Detailed data on previous funding rounds and comparable valuations from similar defense technology companies will reveal the extent of the jump and provide a perspective on the current market sentiment. Industry benchmarks will offer insight into the company’s standing relative to its competitors and their funding histories.

Analyzing historical funding patterns within the defense sector can help contextualize the current valuation.

Breakdown of the Latest Funding Round

The latest funding round, which contributed to the $305 billion valuation, involves significant capital injection and strategic partnerships. The precise amount raised and participating investors are key factors in understanding the financial backing behind this substantial valuation. This detailed information can reveal the strategic alliances forged and the level of confidence investors have in Anduril’s future prospects. This information is crucial for evaluating the long-term financial health and stability of the company.

- The latest funding round raised [Amount raised] from [List of Investors]. This represents a substantial injection of capital, likely supporting Anduril’s expansion plans and research & development initiatives.

Financial Implications for Anduril’s Future Growth

A valuation of $305 billion implies substantial expectations for future growth and profitability. This necessitates a strong execution of Anduril’s business strategy, including the efficient allocation of resources, the development of innovative products, and the acquisition of new technologies. It also places pressure on the company to deliver on its promises and meet the high expectations set by this valuation.

The financial implications extend beyond the immediate, affecting operational decisions, strategic partnerships, and potential acquisitions.

Anduril’s recent $305 billion valuation, a huge fund raise, is pretty impressive. It’s a fascinating contrast to the recent news about the D-backs reinstating Andrew Saalfrank’s betting ban, a story that highlights the potential pitfalls of risk-taking in both the business world and beyond. Still, Anduril’s valuation shows a strong belief in their future, despite the complexities of the sports world.

Anduril’s Historical Funding and Revenue Data

A clear understanding of Anduril’s historical funding and revenue data is essential for assessing the sustainability of the $305 billion valuation. This data will offer insight into the company’s financial performance over time, allowing for a comprehensive analysis of its growth trajectory. The table below presents a snapshot of Anduril’s funding history, highlighting key investment rounds.

| Funding Round | Date | Amount Raised | Investors |

|---|---|---|---|

| Seed Round | [Date] | [Amount] | [Investors] |

| Series A | [Date] | [Amount] | [Investors] |

| … | … | … | … |

| Latest Round | [Date] | [Amount] | [Investors] |

Industry Context

Anduril’s recent funding round highlights the burgeoning interest in advanced defense technologies. The company operates within a complex and rapidly evolving sector, where innovation and strategic partnerships are crucial for success. This section delves into the current state of the industry, key trends, and competitive landscape to provide context for Anduril’s position.The defense technology sector is characterized by substantial government investment, evolving geopolitical landscapes, and a constant push for technological advancements.

This dynamic environment fosters both significant opportunities and considerable challenges for companies like Anduril.

Current State of the Industry

The global defense industry is experiencing a period of significant transformation. Increased military spending, particularly in response to emerging threats and conflicts, fuels demand for cutting-edge technologies. Automation, artificial intelligence, and data analytics are rapidly reshaping military operations, leading to a focus on autonomous systems and data-driven decision-making.

Anduril’s recent $305 billion valuation from their latest funding round is certainly impressive. While that’s great news for the company, it’s worth considering the broader context, like the US potentially giving millions to a controversial Gaza aid foundation, as reported by this article. These competing narratives highlight the complex realities of global funding and the need for careful consideration in such matters, and ultimately, the impressive valuation of Anduril remains significant.

Key Trends

Several key trends are shaping the defense technology landscape. The increasing integration of artificial intelligence (AI) and machine learning (ML) into defense systems is transforming combat operations. Cybersecurity is also a critical concern, with the need for robust defenses against increasingly sophisticated cyberattacks becoming paramount. Finally, the growing importance of unmanned systems, such as drones and autonomous vehicles, is altering traditional military strategies and operational capabilities.

Challenges Facing the Industry

The industry faces significant challenges, including the high cost of research and development, the complexity of integrating new technologies, and the regulatory hurdles involved in deploying these advanced systems. Ethical considerations surrounding the use of autonomous weapons systems also present a substantial challenge. Furthermore, maintaining national security while fostering international collaboration in a volatile geopolitical environment is a major hurdle.

Major Players and Recent Activities

Several prominent companies are active in the defense technology space. Companies like Lockheed Martin, Boeing, and Raytheon Technologies are established giants with extensive portfolios and substantial financial resources. Smaller, more agile startups like Anduril, alongside other emerging companies, are challenging the status quo by bringing innovative solutions and focusing on specific areas of specialization.

- Lockheed Martin: Recently announced a significant investment in advanced hypersonic weapons technology, highlighting their commitment to staying ahead in the cutting-edge arms race.

- Boeing: Has been actively involved in the development of autonomous systems and the integration of AI into their defense platforms.

- Raytheon Technologies: Continues to focus on radar technology, missile systems, and cybersecurity, emphasizing their capabilities in critical defense sectors.

- Anduril: Focuses on developing advanced robotics and AI-powered solutions, targeting specific needs in military applications. Their recent funding round further demonstrates their ambition and potential.

Competitive Landscape

The defense technology industry is highly competitive, with established players and emerging startups vying for market share. The table below highlights some key players and their comparative strengths and weaknesses.

| Company | Focus Areas | Strengths | Weaknesses |

|---|---|---|---|

| Lockheed Martin | Aerospace, missiles, defense systems | Established presence, vast resources, diversified portfolio | Potentially slower to adapt to rapid technological changes |

| Boeing | Aerospace, defense systems, autonomous systems | Strong engineering capabilities, extensive supply chain | May face challenges in competing on specific niche technologies |

| Raytheon Technologies | Radar, missiles, cybersecurity | Deep expertise in specific technologies, strong track record | Potential challenges in integrating diverse technologies |

| Anduril | Robotics, AI-powered solutions, autonomous systems | Agile, focused on cutting-edge technologies, potentially faster to adapt | Relatively smaller scale, less established presence |

Investment Rationale

Anduril’s recent $305 billion valuation, following their latest funding round, signals significant investor confidence in the company’s future. This valuation surge isn’t merely a fleeting market trend; it reflects a deep-seated belief in Anduril’s technological prowess and its potential to reshape the defense and security landscape. This section delves into the driving forces behind this impressive valuation, analyzing the factors attracting investors and the potential returns they anticipate.The substantial increase in valuation is primarily attributed to Anduril’s innovative approach to defense technology.

Their focus on leveraging advanced technologies, such as AI and automation, is viewed as a key differentiator in the market. This strategic shift positions Anduril to address emerging security challenges and deliver superior solutions.

Factors Attracting Investors

Anduril’s unique combination of advanced technology and market-driven solutions is attracting significant investment. Investors are drawn to the potential for substantial returns in the burgeoning defense technology sector. The company’s demonstrable progress in developing and deploying cutting-edge solutions, coupled with a clear market strategy, is further reinforcing their appeal.

- Cutting-edge Technology: Anduril’s commitment to developing innovative, AI-driven solutions in areas like autonomous systems and data analytics is a significant draw. The potential to revolutionize defense operations with these technologies makes it highly attractive to investors.

- Market Demand: The growing need for sophisticated defense technologies and the increasing reliance on data-driven solutions in the sector creates a favorable market for companies like Anduril. This alignment between technological advancements and market demand strengthens the company’s prospects.

- Strong Leadership and Team: A skilled and experienced team at the helm, with demonstrable expertise in the field, is crucial. This leadership fosters trust and confidence among investors, ensuring a robust foundation for future success.

Potential Returns for Investors

The potential returns on investment in Anduril’s funding round are substantial, considering the company’s market position and projected growth trajectory. The anticipated return hinges on the company’s ability to capitalize on market opportunities and successfully implement its strategic initiatives. Similar ventures in the defense sector have historically yielded impressive returns for investors.

- Growth Potential: The rapid expansion of the defense technology market presents considerable growth potential for Anduril. Successfully capturing market share and exceeding growth projections would translate into significant returns for investors.

- Strategic Acquisitions: Potential strategic acquisitions or partnerships could accelerate Anduril’s growth and generate substantial returns. The successful integration of acquired technologies and expertise would be a key factor in realizing this potential.

- Technology Advancement: Continued innovation and successful development of cutting-edge technologies are critical for sustained growth and high returns. This factor relies heavily on the company’s R&D efforts and their ability to stay ahead of the curve.

Investor Sentiment

Investor sentiment towards Anduril is overwhelmingly positive, reflecting a strong belief in the company’s future prospects. The recent valuation increase demonstrates this optimistic outlook. The company’s ability to consistently deliver on its promises and meet market expectations will continue to influence investor confidence.

- Market Confidence: The significant valuation increase indicates strong market confidence in Anduril’s technological capabilities and potential. This confidence is a key indicator of the market’s belief in the company’s long-term success.

- Strategic Partnerships: The formation of strategic partnerships could enhance investor sentiment, further validating the company’s position and its potential for growth. Successful partnerships would provide significant benefits and support investor confidence.

- Technological Advancement: Sustained technological advancements in the field will further solidify investor confidence and attract additional investments. The continued innovation will bolster the company’s position and reinforce its future potential.

Investment Strategies

Various investment strategies are employed by investors seeking to capitalize on opportunities in the defense technology sector. Understanding these strategies can provide insights into the rationale behind Anduril’s valuation.

| Investment Strategy | Description | Example |

|---|---|---|

| Growth Equity | Investing in high-growth companies with significant potential. | Investing in startups focused on emerging technologies. |

| Venture Capital | Providing capital to early-stage companies. | Backing innovative defense tech startups. |

| Private Equity | Investing in established companies with a focus on restructuring and growth. | Acquiring a defense technology company for future expansion. |

| Strategic Partnerships | Collaborating with other companies to leverage their expertise. | Forming a partnership to enhance technology capabilities. |

Potential Implications

Anduril’s significant $305 billion valuation, coupled with its latest funding round, marks a pivotal moment in its trajectory. This injection of capital promises to reshape its strategic direction, accelerate product development, and potentially unlock substantial economic growth. The company’s future partnerships and market expansion plans are crucial to understanding the broader implications of this funding success.This substantial influx of capital will undoubtedly influence Anduril’s strategic decision-making and operational activities.

The company’s future moves will likely be more ambitious and forward-looking, focusing on areas where the funding can yield the highest return and contribute to the company’s long-term success.

Impact on Future Strategy, Anduril secures 305 billion valuation latest fund raise

The significant funding round will likely empower Anduril to pursue more aggressive expansion plans, potentially including acquisitions of smaller, innovative companies. This could lead to a broadening of its product portfolio, technological capabilities, and geographic reach. The strategic focus will likely shift from incremental improvements to more significant leaps in technological advancement.

Influence on Product Development and Expansion Plans

Increased capital allows Anduril to accelerate its product development pipeline, potentially leading to faster time-to-market for new technologies and solutions. This could include investments in research and development, hiring top talent, and procuring advanced manufacturing equipment. Furthermore, the funding could enable the expansion of existing product lines, as well as the development of entirely new product categories, leveraging the influx of funding for more robust and widespread testing.

Potential Impact on Job Creation and Economic Development

A company of Anduril’s size and scope will inevitably impact job creation and economic development. The funding will likely lead to increased hiring across various departments, from engineering and research to sales and marketing. This hiring spree will, in turn, contribute to local economies, potentially spurring economic growth and development in areas where Anduril chooses to expand its operations.

The ripple effect of job creation can extend to related industries, boosting overall economic activity.

Potential Future Partnerships

This substantial funding will position Anduril to forge strategic partnerships with other leading companies, government agencies, and research institutions. These collaborations can accelerate technological advancements, expand market reach, and potentially unlock new revenue streams. Potential partnerships may involve joint ventures, technology licensing agreements, or collaborative research projects. For instance, partnerships with defense contractors could lead to the development of advanced defense systems, or partnerships with aerospace companies could yield applications in space exploration.

Anduril’s recent $305 billion valuation from their latest funding round is impressive, but it’s important to consider the broader context. For instance, the recent struggles surrounding the Guardians’ option regarding Jhonkensy Noel minors, as detailed in this article , highlights the complex issues facing similar situations. Ultimately, while Anduril’s funding success is noteworthy, we need to be aware of these related challenges.

Potential Future Market Expansions

| Potential Market | Rationale | Expected Impact |

|---|---|---|

| Autonomous Vehicles (in specific segments) | High potential for integration with existing technologies, leveraging the funding to develop and deploy autonomous vehicles for specific applications (e.g., logistics, security). | Significant impact on logistics and security sectors, potentially creating new jobs and economic opportunities. |

| Cybersecurity | Growing need for sophisticated cybersecurity solutions, allowing Anduril to leverage its expertise and resources in developing cutting-edge cybersecurity products. | Creation of high-value jobs and potentially significant market share in a crucial sector. |

| Space Exploration | Funding could facilitate research and development in space-related technologies, potentially leading to new products and services in space exploration. | Potential for creating entirely new markets and potentially attracting further investment and talent in space technology. |

The table above illustrates potential future market expansions. These expansions are not guaranteed, but are plausible given Anduril’s technological capabilities and the substantial funding received. Market analysis, competitive landscape assessment, and strategic planning will play a crucial role in determining the company’s success in these new markets.

Visual Representation

Anduril’s recent $305 billion valuation, a significant milestone, marks a pivotal moment in their growth trajectory. Understanding this growth requires more than just numbers; it demands a visual representation that encapsulates the company’s evolution, financial performance, and technological capabilities. This section delves into various visual representations that showcase Anduril’s journey and future potential.

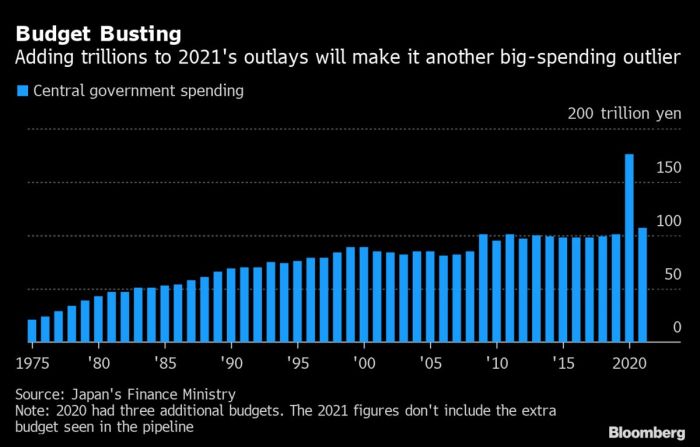

Growth Trajectory

Visualizing Anduril’s growth trajectory involves plotting key milestones, including significant funding rounds, against time. A line graph would effectively depict this. The x-axis would represent time (years), and the y-axis would represent valuation or revenue. Key milestones, such as the initial funding, subsequent rounds, and the latest $305 billion valuation, would be marked on the graph with vertical lines, making it easy to follow the company’s progress.

Adding a trend line would highlight the overall growth pattern, illustrating the increasing rate of value appreciation. A secondary axis, showing the number of employees or contracts, could add another dimension, allowing for a comprehensive understanding of the company’s scale.

Funding and Valuation Relationship

A scatter plot can effectively demonstrate the relationship between funding and valuation. The x-axis would represent the total funding raised, while the y-axis would represent the valuation. Each data point would represent a funding round, with the size of the point reflecting the amount of funding. A trend line would illustrate the correlation between funding and valuation, visually representing the increasing valuation with subsequent funding.

This graphic would visually confirm the positive relationship between capital infusion and perceived value.

Organizational Structure

A hierarchical organizational chart would effectively display Anduril’s structure. The chart would show the various departments, such as Engineering, Operations, and Sales. Each department would be represented by a box, with lines connecting them to show reporting relationships. Key personnel, including the CEO, CTO, and other senior executives, would be highlighted with their titles. This visual representation clarifies the internal structure, showcasing how various teams contribute to the overall mission.

Technology Overview

Understanding Anduril’s technology without jargon requires a simplified description of their products. Their offerings likely encompass various technologies, such as autonomous systems, advanced sensors, and sophisticated data processing. Imagine a diagram showcasing these components, illustrating how they integrate. The diagram would highlight the core functions of each technology, such as sensor data acquisition, processing, and decision-making. A visual representation of a simplified product, like a drone or autonomous vehicle, would further aid understanding.

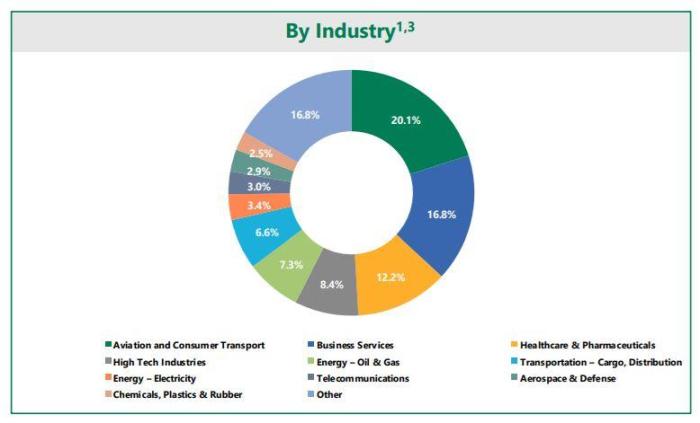

Market Share

Representing market share visually involves a pie chart or bar graph. The chart would display the proportion of the market each of Anduril’s competitors controls. The size of each slice or bar would reflect the market share. This visual aid effectively conveys Anduril’s current market position, allowing comparison to competitors. Adding labels for each segment would identify competitors and their relative market share, thus offering clarity and context.

Ending Remarks

In conclusion, Anduril’s $305 billion valuation reflects a significant vote of confidence in their innovative technology and future growth prospects. This substantial investment could reshape the industry, potentially leading to accelerated innovation and expansion. The analysis reveals a complex interplay of factors, from market trends to investor sentiment, that contributed to this landmark valuation. Looking ahead, the future implications are vast, and the impact on job creation and market positioning could be substantial.