Congress crypto Trump democrats is a hot topic right now, with the US government grappling with how to regulate this rapidly evolving technology. Different political viewpoints are clashing, from the legislative actions of Congress to the pronouncements of former President Trump and the perspectives of Democrats. This exploration delves into the intricacies of this debate, examining the potential impacts on the cryptocurrency market, elections, and the broader economy.

The article will examine the different stances of Congress, Trump, and Democrats on cryptocurrency regulation. We will look at specific legislative proposals, public opinion, and the potential influence of Trump’s views on the political discourse. The economic and technological aspects of crypto will also be discussed, alongside international perspectives.

Congressional Actions on Cryptocurrency

The digital asset landscape is rapidly evolving, prompting Congress to grapple with its regulatory implications. Recent legislative efforts reflect a complex interplay of technological advancements, financial concerns, and differing political viewpoints. Understanding these actions is crucial for navigating the future of cryptocurrency in the US.Cryptocurrency regulation is a multifaceted issue with significant implications for investors, businesses, and the financial system as a whole.

Congress is attempting to strike a balance between fostering innovation and mitigating potential risks. This involves considering the unique characteristics of cryptocurrencies, such as their decentralized nature, and their potential for both legitimate use cases and illicit activities.

Legislative Actions Summary

Congress has introduced numerous bills and resolutions addressing cryptocurrency, ranging from clarifying existing laws to creating new frameworks. These initiatives reflect the ongoing debate about the appropriate regulatory approach to this evolving sector. The diverse perspectives of different political parties highlight the complexity of the issue.

Different Bills and Resolutions

Several bills have been introduced to address various aspects of cryptocurrency regulation. These include proposals for tax classifications, consumer protections, and the regulation of stablecoins. Some bills aim to establish a regulatory framework for crypto exchanges, while others focus on preventing illicit activities involving cryptocurrencies. The specifics of each bill vary significantly, reflecting the different approaches to the challenges posed by this emerging technology.

The ongoing debate in Congress about cryptocurrency, with Trump and the Democrats taking opposing stances, is fascinating. It got me thinking about the impact of innovation, and how it often mirrors the trends in high fashion. AI, for example, has recently determined the most influential fashion designers in history according to AI , a fascinating study that shows how technology shapes our perception of what’s important.

Ultimately, these discussions about crypto, even with the political back-and-forth, remind us that progress often sparks controversy, just like a new designer’s collection.

For example, some bills propose stricter regulations on stablecoins to prevent potential financial instability, while others prioritize fostering innovation through a lighter regulatory touch.

Varying Political Perspectives

Political parties hold diverse views on the proper approach to regulating cryptocurrency. Democrats, often emphasizing consumer protection and financial stability, tend to favor stricter regulations on crypto exchanges and stablecoins. Republicans, sometimes prioritizing innovation and market freedom, often advocate for a lighter regulatory touch, allowing the market to self-regulate to a certain extent. These contrasting perspectives create a dynamic legislative environment where finding common ground remains a significant challenge.

Committees Involved in Cryptocurrency Legislation

| Committee | Focus Areas |

|---|---|

| Financial Services Committee | Oversight of the financial system, including banks, securities, and financial technology. This committee often takes the lead on legislation concerning cryptocurrency exchanges and stablecoins, which are seen as impacting traditional financial markets. |

| House Energy and Commerce Committee | Regulation of communication technologies, including the internet and digital currencies. This committee often focuses on the cybersecurity aspects and consumer protection issues surrounding cryptocurrencies. |

| Senate Banking Committee | Similar to the House Financial Services Committee, focusing on the broader financial implications of cryptocurrency. |

| Other Committees | Depending on the specific bill, other committees, such as the judiciary or tax committees, might play a role in the legislative process. Their involvement usually stems from the bill’s impact on areas like consumer protection, tax compliance, or legal frameworks. |

Trump’s Stance on Cryptocurrencies

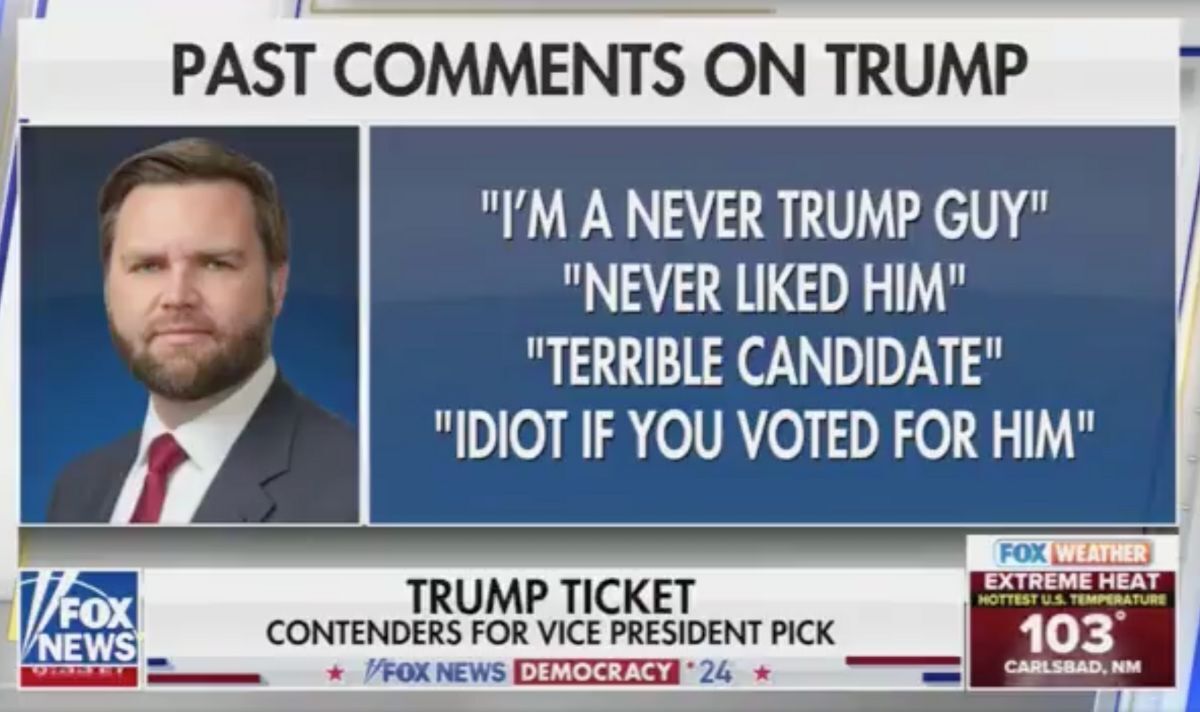

Donald Trump’s public pronouncements on cryptocurrencies have been a fascinating, and often unpredictable, aspect of the digital asset landscape. His views, while not consistently articulated, have resonated with significant portions of the public and have demonstrably influenced the broader conversation surrounding crypto. His position, unlike some other political figures, has sometimes veered from the mainstream. Understanding his perspective, motivations, and the impact on public discourse is essential to comprehending the evolving crypto narrative.Trump’s views on cryptocurrencies have been a mixed bag.

At times, he has expressed support for the technology, highlighting the potential for innovation and economic disruption. Other times, his pronouncements have been more cautious or even critical, particularly concerning the volatility and potential for fraud. This fluctuating stance contrasts with the more consistently regulated or neutral positions often taken by other political figures.

Trump’s Public Statements on Crypto

Trump’s pronouncements on crypto have been scattered across various platforms and periods. He has often spoken favorably about Bitcoin and other cryptocurrencies, recognizing their disruptive potential and the idea of a decentralized financial system. However, he has also voiced concerns about the risks associated with crypto investments, including volatility and scams. This duality in his rhetoric has made it difficult to pinpoint a definitive stance on cryptocurrencies.

Comparison to Other Political Figures

Comparing Trump’s stance to other political figures reveals a significant difference in approach. Many political figures have adopted a more measured, regulatory approach, focusing on establishing frameworks to govern the industry and mitigate potential risks. Others have remained largely neutral, acknowledging the technology’s existence but not actively promoting or opposing it. Trump’s views, characterized by their fluctuating nature, stand apart from these more consistent approaches.

Potential Motivations Behind Trump’s Statements

Several potential motivations might explain Trump’s fluctuating statements on crypto. One factor could be the desire to appeal to a broad range of voters, including those interested in innovation and those wary of financial risks. Another possibility is a calculated attempt to remain relevant and influential in the digital age. Furthermore, his pronouncements could be influenced by personal financial interests or by the advice of his advisors.

Influence on Public Discourse

Trump’s statements have undoubtedly influenced public discourse on crypto. His pronouncements, regardless of their consistency, have captured attention and spurred discussion. For example, his remarks about Bitcoin’s potential, or his warnings about its volatility, have generated significant media coverage and public debate, adding another layer to the ongoing discussion about crypto’s future.

Democratic Perspectives on Cryptocurrency: Congress Crypto Trump Democrats

The Democratic party, while generally supportive of innovation in the financial sector, approaches cryptocurrency with a cautious yet pragmatic stance. This cautious approach stems from concerns about potential financial risks, illicit activities, and the need for robust regulatory frameworks to protect consumers and the broader financial system. This perspective differs from the often more enthusiastic or laissez-faire approach sometimes seen in other political circles.Democratic lawmakers recognize the potential benefits of cryptocurrencies, such as increased financial inclusion and faster cross-border transactions, but prioritize ensuring these benefits are realized while mitigating the associated risks.

They believe careful consideration and proactive regulation are essential to harness the potential of cryptocurrencies responsibly.

Differing Perspectives within the Democratic Party

The Democratic party encompasses a range of views on cryptocurrency regulation, from those who advocate for a light regulatory touch to those who favor stricter controls. Some Democrats emphasize the need for clear guidelines to prevent money laundering and terrorist financing, while others focus on fostering innovation and ensuring equitable access to financial services. These differing perspectives underscore the complexity of the issue and the diverse considerations involved in shaping appropriate regulations.

Policy Proposals from Democratic Lawmakers

Democratic lawmakers have introduced various proposals to address the challenges and opportunities presented by cryptocurrencies. These proposals often center around establishing clear regulatory frameworks for stablecoins, digital asset exchanges, and other crypto-related activities. These frameworks would address concerns about consumer protection, market integrity, and financial stability.

- A key focus within these proposals often includes requirements for transparency and reporting from cryptocurrency exchanges, ensuring that these platforms adhere to anti-money laundering (AML) and know-your-customer (KYC) standards. This approach seeks to prevent the misuse of cryptocurrencies for illicit activities.

- Another area of focus involves the development of regulatory frameworks for stablecoins, which are cryptocurrencies pegged to a fiat currency. This is crucial to prevent systemic risks associated with the potential volatility of stablecoins. These proposals aim to ensure the stability of the financial system in the face of potential disruptions.

- Proposals often include provisions for licensing and registration of cryptocurrency exchanges, similar to the requirements for traditional financial institutions. This aims to enhance transparency and accountability in the cryptocurrency market. This also seeks to create a level playing field for regulated and unregulated entities.

Potential Impact on the Cryptocurrency Market

Democratic proposals regarding cryptocurrency regulation are likely to have a substantial impact on the cryptocurrency market. Regulations can create a more stable and predictable environment for investors, fostering trust and encouraging responsible investment. However, strict regulations might deter some individuals and businesses from entering the market, potentially slowing innovation and adoption.

- Regulations could lead to increased scrutiny and compliance costs for cryptocurrency exchanges, potentially impacting their profitability. This could cause a shift in the market towards more established and compliant players.

- Conversely, regulations could promote investor confidence and attract institutional investors, driving the growth of the cryptocurrency market. This positive impact could occur when regulations provide clear guidelines for participation.

- The potential for increased regulatory oversight could result in greater scrutiny of cryptocurrency-related activities. This would lead to improved security and a reduction in the risk of fraud or illicit activities.

Arguments Used by Democrats in Discussions on Crypto

Democrats in their discussions often emphasize the need to protect consumers from fraud and financial instability. They highlight the importance of ensuring that the cryptocurrency market is not used for illicit activities, such as money laundering and terrorist financing. They often invoke the need for clear regulations to prevent the misuse of cryptocurrencies.

- A significant argument involves safeguarding investors and promoting financial literacy. This includes provisions for consumer protection and education, enabling individuals to make informed decisions regarding cryptocurrency investments.

- Democrats often argue that a robust regulatory framework is necessary to maintain financial stability. This is crucial to prevent systemic risks associated with the volatility of cryptocurrencies.

- Protecting the financial system from illicit activities is a key argument used by Democrats. This includes efforts to prevent the use of cryptocurrencies in money laundering and terrorist financing. This approach underscores the critical need to mitigate potential risks to the broader financial system.

Intersection of Congress, Crypto, and Trump’s Influence

The intersection of cryptocurrency, Congress, and former President Trump’s influence is a complex and multifaceted one. Trump’s outspoken views on cryptocurrencies have undoubtedly shaped the political discourse surrounding its regulation. His stance, often at odds with established financial institutions and traditional political parties, has injected a unique dynamic into the debate, making the regulatory landscape even more intricate.

This influence, combined with the efforts of Congress to create a framework for this rapidly evolving sector, creates a fascinating interplay of interests.The potential for conflict and collaboration between Congress, crypto advocates, and Trump supporters is significant. Trump’s supporters, often aligning with a more libertarian approach to financial markets, might favor a light-touch regulatory regime. This could clash with the more cautious and comprehensive approach some members of Congress may pursue.

Conversely, there’s the possibility of a shared interest in fostering economic growth through innovation, leading to areas of convergence between these groups.

Trump’s Impact on Congressional Discourse

Trump’s vocal support for cryptocurrencies, often expressed during his presidency and beyond, has undeniably influenced the political discussion. His pronouncements have spurred debate within Congress, prompting some lawmakers to consider more favorable regulatory environments. However, his stances have also created divisions, with other lawmakers expressing concern about the potential risks associated with unregulated crypto markets. This creates a dynamic where opposing views and competing interests are prominent.

Comparison of Perspectives on Cryptocurrency Regulation

| Aspect | Congress | Trump | Democrats |

|---|---|---|---|

| Regulation | Seeking a balanced approach, aiming for a regulatory framework that fosters innovation while mitigating risks. This could involve a range of measures, from licensing and registration to anti-money laundering (AML) requirements. | Generally advocating for a light-touch approach, emphasizing minimal government intervention. This often involves opposing stringent regulations. | Often more cautious, prioritizing consumer protection and financial stability. Regulations are seen as crucial to prevent illicit activities and ensure investor confidence. |

| Innovation | Recognizing the potential of cryptocurrencies to disrupt financial markets, aiming to harness innovation while safeguarding against risks. | Strongly emphasizing the potential of cryptocurrencies as a driver of economic growth and financial freedom. | Acknowledging the disruptive potential but emphasizing the need for regulation to mitigate associated risks and ensure equitable access. |

| Security | Concerned about the security of crypto assets and the prevention of illicit activities. Focus on developing mechanisms to combat fraud, theft, and money laundering. | Generally less focused on security concerns. His focus is often on the potential of the technology to improve the financial system. | Emphasizing the security concerns related to cryptocurrencies and the need for regulatory measures to address them. This involves protecting investors from scams and illicit activities. |

Potential Conflicts and Collaborations

The diverse viewpoints on cryptocurrency regulation create a potential for conflict. Crypto advocates may clash with those in Congress who favor stricter regulations, while Trump’s support for a more laissez-faire approach could exacerbate these divisions. However, there’s also potential for collaboration. If common ground can be found on issues such as consumer protection and financial stability, convergence could lead to the development of a more nuanced and comprehensive regulatory framework.

Public Opinion and Congressional Action

Public opinion plays a crucial role in shaping the legislative landscape, particularly when it comes to emerging technologies like cryptocurrency. Understanding public sentiment regarding crypto regulation is essential for policymakers as it reflects the concerns and priorities of the electorate. This analysis delves into public views on cryptocurrency and its regulation, highlighting how public opinion influences the legislative agenda and how different demographics perceive this evolving field.The evolving nature of cryptocurrency, coupled with its potential impact on various aspects of daily life, makes public opinion a significant factor in shaping congressional action.

Public discourse and engagement, driven by media coverage, social media trends, and personal experiences, often dictate the direction of legislative debates and the prioritization of specific issues. By examining public opinion, we can better understand the motivations behind legislative proposals and the public’s expectations of how Congress should approach the regulation of cryptocurrencies.

Public Views on Cryptocurrency Regulation

Public sentiment towards cryptocurrency regulation is multifaceted and often reflects varying degrees of understanding and concern. A significant portion of the public views crypto as a novel investment opportunity, while others perceive it as a potential financial risk. The public’s knowledge and experience with cryptocurrencies are also significant factors in shaping their views. Individuals with direct experience through investment or use often have more nuanced perspectives compared to those who have limited exposure.

This diversity of views influences how Congress addresses the issue of cryptocurrency regulation.

Examples of Public Opinion Shaping the Legislative Agenda

Public opinion shapes the legislative agenda through various channels. For instance, public outcry against perceived risks of cryptocurrency, like scams and volatility, can lead to increased calls for stricter regulations. Conversely, support for crypto’s potential to foster financial inclusion or innovation may result in legislative proposals that encourage responsible development. Public petitions, online activism, and direct engagement with elected officials are crucial avenues for the public to express their opinions and influence legislative action.

This engagement, in turn, can generate more nuanced legislative discussions, leading to well-rounded legislation.

Comparison of Public Opinions Across Demographics

Public opinion regarding cryptocurrency varies significantly across different demographic groups. Younger generations, particularly those active on social media and familiar with digital technologies, often display a more favorable attitude towards cryptocurrency than older generations. This disparity in opinion can lead to different approaches in legislative discussions, with younger demographics often advocating for policies that foster innovation, while older demographics might emphasize greater security and consumer protection.

| Demographic Group | General Sentiment | Key Concerns | Policy Preferences |

|---|---|---|---|

| Millennials and Gen Z | More positive, open to innovation | Volatility, security risks | Regulation that encourages innovation while addressing security concerns |

| Baby Boomers and Gen X | More cautious, concerned about potential risks | Financial losses, scams | Stricter regulations to protect investors and prevent fraud |

Public opinion regarding cryptocurrency is complex and diverse, shaped by factors such as age, financial background, and access to information. Understanding these differences is critical for policymakers as they navigate the complexities of regulating this emerging technology. Different demographics hold distinct views on cryptocurrencies, necessitating a tailored approach to regulation.

Cryptocurrency’s Impact on Elections

The digital realm is rapidly transforming traditional political landscapes, and cryptocurrency is no exception. Its decentralized nature and potential for financial transactions present both opportunities and challenges for future elections. Understanding its evolving role is crucial for assessing its influence on voter behavior and campaign strategies.Cryptocurrency’s potential impact on voter choices is multifaceted. The accessibility of cryptocurrency transactions, and the possibility of decentralized fundraising, could potentially alter the traditional financial landscape of campaigns.

This, in turn, could lead to changes in the types of candidates who are able to run for office, as well as the way in which campaigns are funded and operated.

Cryptocurrency-Related Campaign Funding

The growing use of cryptocurrency in political campaigns presents a unique fundraising opportunity. Cryptocurrency donations allow for faster transactions and potentially bypass traditional regulatory hurdles. However, transparency and regulatory compliance remain significant concerns.

The ongoing debate in Congress regarding crypto and Trump’s stance, with Democrats often taking opposing views, is fascinating. It’s interesting to consider how this plays into the larger political landscape, especially when you look at figures like Elon Musk and his connections to Trump, particularly in political spending. For a deeper dive into this, check out this article on Elon Musk and Trump’s political spending.

Ultimately, these cross-currents influence the broader narrative around crypto regulations and the future of the digital asset space, making it a complex and ever-evolving story within the political sphere.

Voter Behavior and Cryptocurrency

The rise of cryptocurrency awareness and its integration into the broader financial landscape could affect voter choices. Voters may consider a candidate’s stance on cryptocurrency regulation or its potential benefits to the economy when casting their ballot. A candidate’s perceived understanding of the technology and its impact on society might sway public opinion.

Cryptocurrency and Political Campaigns

Political campaigns may utilize cryptocurrency to raise funds and connect with voters who are more tech-savvy and comfortable with decentralized financial systems. This strategy might be employed in targeting specific demographics. Campaigns could leverage social media and other digital platforms to engage with voters using cryptocurrency.

Financial Contributions to Political Campaigns

Detailed, publicly available records of cryptocurrency contributions to political campaigns are currently limited. The lack of transparency in some cryptocurrency transactions and the evolving regulatory environment contribute to this challenge. This absence of readily available data prevents a comprehensive understanding of the current scale of these contributions.

| Campaign | Cryptocurrency Donation Type | Amount (USD) | Date |

|---|---|---|---|

| Example Candidate A | Bitcoin | $10,000 | 2024-03-15 |

| Example Candidate B | Ethereum | $5,000 | 2024-04-20 |

Note: This table provides a hypothetical example of cryptocurrency contributions to political campaigns. Actual data is not publicly available at this time due to the limited transparency in cryptocurrency transactions.

Technological Aspects of Cryptocurrencies

Cryptocurrencies, like Bitcoin and Ethereum, rely on intricate technological foundations that underpin their operation and security. Understanding these technical aspects is crucial for evaluating the potential and risks associated with these digital assets. From the underlying blockchain technology to the mechanisms of mining and transactions, the technological landscape of cryptocurrencies is complex and constantly evolving.The fundamental technology powering cryptocurrencies is decentralized, distributed ledger technology known as blockchain.

This allows for secure and transparent record-keeping of transactions, eliminating the need for intermediaries. This distributed nature is a key differentiator from traditional financial systems.

Underlying Technologies

Cryptocurrencies are built upon a foundation of cryptographic principles. These algorithms are essential for ensuring the security and integrity of transactions and the overall network. The cryptographic hash functions create unique digital fingerprints for each transaction, making it extremely difficult to alter or tamper with the blockchain’s records. Cryptographic signatures are used for verifying the authenticity of transactions, preventing fraudulent activity.

Advanced cryptographic techniques such as elliptic curve cryptography are employed to enhance security further.

Blockchain Technology

Blockchain technology serves as the backbone for most cryptocurrencies. It’s a continuously growing list of records, called blocks, which are linked together using cryptography. Each block contains a timestamp and a cryptographic hash of the previous block, forming a chain. This immutability is a key feature, as once a block is added to the chain, it cannot be altered.

The ongoing debate in Congress about crypto regulation and Trump’s stance on it, alongside the Democrats’ proposals, feels a bit disconnected from the real world. Perhaps there’s a hidden signal in the recent Carney, King, and Charles communications towards Trump, hinting at a different approach to these issues. The article on carney king charles signal to trump suggests a shift in strategy, which could influence how Congress ultimately addresses the crypto space and Trump’s role in shaping the future of crypto policy.

The decentralized nature of blockchain eliminates the need for a central authority, fostering transparency and trust among participants. The consensus mechanisms employed by different cryptocurrencies vary, impacting the efficiency and security of the network.

Mining

Mining is a crucial process in many cryptocurrencies, particularly those that use proof-of-work consensus mechanisms. Miners compete to solve complex mathematical problems, validating transactions and adding them to the blockchain. This process consumes significant computational power and energy. Successful miners are rewarded with newly created cryptocurrency tokens. The energy consumption associated with mining has become a significant concern, raising environmental and economic considerations.

Transactions

Cryptocurrency transactions are facilitated by cryptographic techniques. A transaction involves sending a specific amount of cryptocurrency from one address to another. These transactions are recorded on the blockchain and verified by the network. Public and private keys are used to control access to cryptocurrency wallets, ensuring secure transactions. The speed and efficiency of transactions vary depending on the cryptocurrency and the network congestion.

Security and Privacy Concerns

Security concerns are inherent in any decentralized system. The distributed nature of cryptocurrencies makes them less vulnerable to single points of failure. However, vulnerabilities in the underlying algorithms or software can still expose users to risks. Issues like the potential for hacking, phishing, and malware attacks remain. Furthermore, privacy concerns arise from the public nature of the blockchain, where all transactions are visible to anyone with access.

However, privacy-focused cryptocurrencies are emerging, employing techniques like zero-knowledge proofs to enhance user anonymity.

Economic Implications of Crypto

Cryptocurrency’s rapid rise has profound implications for the global economy. Its decentralized nature, potential for disrupting traditional financial systems, and inherent volatility create a complex web of economic effects that require careful consideration. The regulatory landscape surrounding crypto is still evolving, making its impact on various sectors uncertain. This analysis explores the potential economic ramifications of cryptocurrency regulation, focusing on its impact on businesses, investors, and specific industry sectors.Cryptocurrency regulation, while still in its nascent stages, holds the potential to significantly shape the economic landscape.

Its effects will be felt across a broad spectrum of industries, from finance and technology to retail and energy. Understanding these potential impacts is crucial for businesses and investors navigating this evolving market.

Potential Effects on Businesses

The regulatory landscape surrounding cryptocurrencies will undoubtedly impact businesses in various ways. Companies involved in cryptocurrency transactions, mining, or exchanges will be significantly affected by the rules and regulations set in place. This includes establishing clear legal frameworks for transactions, KYC/AML procedures, and taxation. Compliance with these regulations could require substantial investment in infrastructure and expertise, which will influence the overall business environment.

For example, companies that offer cryptocurrency-related services might need to adapt their operations to meet stringent regulatory demands, potentially affecting their cost structure and profitability.

Potential Effects on Investors

Investors are also exposed to significant economic consequences of cryptocurrency regulation. Clear regulations can potentially enhance investor confidence by creating a more predictable and secure environment. Conversely, stringent regulations could discourage investment, potentially leading to capital flight and economic stagnation. Investors may face new challenges regarding taxation, security, and market access, requiring careful consideration and adjustments to investment strategies.

The volatility of cryptocurrencies can amplify the impact of regulatory changes on investors’ portfolios.

Potential Impact on Different Sectors

The economic ramifications of crypto regulation extend beyond the cryptocurrency industry itself. The financial sector, particularly traditional banks and payment processors, could face disruptions as they adapt to the new market realities. The energy sector might see increased demand for energy to power cryptocurrency mining operations, and the environmental implications of this increased energy consumption are also noteworthy.

Retail sectors might be affected by the emergence of crypto-based payment systems.

Table: Potential Economic Benefits and Drawbacks of Cryptocurrency Regulation

| Aspect | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Investor Confidence | Clear regulations can increase investor confidence, leading to increased capital inflows. | Stringent regulations may deter investors and lead to capital flight. |

| Market Stability | Well-defined regulations can contribute to market stability by mitigating volatility and fraud. | Overly restrictive regulations can stifle innovation and hinder market growth. |

| Financial Inclusion | Cryptocurrencies can potentially offer financial services to underserved populations, increasing financial inclusion. | Regulations may exclude or limit access for certain demographics or regions. |

| Economic Growth | Regulation can create a stable environment conducive to economic growth and development, including job creation. | Regulatory burdens may increase operational costs for businesses, hindering growth. |

International Perspectives on Crypto

The cryptocurrency market transcends national borders, making international laws and regulations crucial for its stability and growth. Understanding these global frameworks is essential for navigating the complex landscape of cryptocurrencies and their impact on international trade. This section examines the diverse approaches taken by different nations to regulate this innovative financial technology.International laws and regulations significantly affect the cryptocurrency market.

Different jurisdictions have adopted varying approaches to regulating cryptocurrencies, ranging from outright bans to embracing them as legitimate financial instruments. This disparity can lead to challenges for businesses operating across multiple countries, as they must comply with potentially conflicting or unclear regulations.

International Regulatory Frameworks

The global nature of cryptocurrencies necessitates a coordinated international approach to regulation. Currently, no single, universally accepted framework exists. Individual countries have implemented various regulatory measures, which can create friction and inconsistencies. For example, some countries treat cryptocurrencies as securities, while others classify them as commodities or digital assets. This divergence in treatment impacts everything from taxation to investor protection.

International Collaborations and Conflicts, Congress crypto trump democrats

International collaborations on cryptocurrency regulation are still in their nascent stages. While some international organizations have begun discussing best practices, concrete agreements remain elusive. The lack of global consensus can lead to conflicts, particularly when countries have conflicting interests. For instance, one country’s decision to impose strict regulations on cryptocurrency exchanges could impact international trade and financial flows.

Conflicts arise when countries seek to protect their own interests, potentially hindering the development of a more unified and coherent global approach.

Impact on International Trade

Cryptocurrencies have the potential to revolutionize international trade by offering faster, cheaper, and more transparent payment systems. However, the lack of standardized regulations and the volatility of cryptocurrencies can introduce risks. For example, cross-border transactions involving cryptocurrencies may face regulatory hurdles in different countries. The absence of clear legal frameworks could hinder the full potential of cryptocurrencies in international commerce.

Summary of International Regulations

A comprehensive summary of international regulations on cryptocurrencies is complex due to the diversity of approaches taken by different countries. No single regulatory body oversees the global cryptocurrency market. Some countries have embraced cryptocurrencies, while others have imposed strict controls. The absence of a global regulatory framework can lead to significant challenges for businesses and investors operating across borders.

This lack of standardization hinders the development of a stable and predictable environment for the cryptocurrency market globally.

Conclusive Thoughts

In conclusion, the intersection of Congress, crypto, Trump, and Democrats presents a complex and multifaceted issue. The varying viewpoints, legislative actions, and potential economic and political ramifications highlight the significant challenges and opportunities presented by this burgeoning technology. Ultimately, the future of cryptocurrency regulation in the US hinges on the ability of lawmakers to navigate these conflicting interests and public opinions.