Doge Musk federal workers government – Elon Musk’s influence on Dogecoin, coupled with federal worker involvement and government regulation, creates a fascinating interplay. This exploration dives into Dogecoin’s rise, Musk’s impact on its price, and how government policies affect federal workers’ decisions. We’ll examine the potential conflicts of interest and ethical considerations that arise from this unique intersection.

From historical trends to potential regulatory frameworks, we’ll unravel the complex relationship between cryptocurrencies, social media influencers, and government entities.

The analysis will explore the impact of Musk’s tweets on Dogecoin’s price volatility, comparing it to other cryptocurrencies. It will also examine the role of federal workers in the cryptocurrency market, considering potential conflicts of interest, ethical dilemmas, and regulatory frameworks. Further, the discussion will analyze public perception and discourse surrounding Dogecoin, Musk, and government involvement. Finally, we’ll present illustrative scenarios demonstrating how these factors can interact, including potential impacts on federal worker finances and the development of government policies.

Dogecoin and Elon Musk’s Influence: Doge Musk Federal Workers Government

Dogecoin, initially a humorous meme cryptocurrency, has experienced a fascinating trajectory, significantly influenced by the outspoken pronouncements of Elon Musk. Its journey from a playful online creation to a recognized, albeit volatile, digital asset reflects the potent combination of social media trends and powerful personalities. Musk’s involvement, often characterized by unpredictable pronouncements and actions, has undeniably impacted its price, attracting both enthusiasts and critics.Elon Musk’s consistent interaction with the Dogecoin community has had a profound impact on its popularity and market value.

His tweets, often accompanied by emojis and pronouncements about the cryptocurrency, have sent ripples through the market, causing substantial price fluctuations. The cryptocurrency community has responded in various ways, from fervent support to cautious skepticism. This interplay between Musk’s statements and the community’s reactions illustrates the complex dynamics of meme-driven cryptocurrencies.

Historical Overview of Dogecoin

Dogecoin’s development was driven by a playful online community. Its genesis was not a calculated financial endeavor, but rather an expression of internet humor. The cryptocurrency’s popularity stemmed from its association with the Doge meme, a popular internet image. Early adoption by online communities fueled its growth, gradually drawing attention beyond the initial circles. Its relatively simple design and decentralized nature facilitated its rapid dissemination.

Impact of Elon Musk’s Involvement

Elon Musk’s participation in the Dogecoin narrative has been marked by a series of tweets, public statements, and actions. His pronouncements, often unpredictable, have been directly correlated with the cryptocurrency’s price fluctuations. Positive statements have often led to price increases, while negative remarks have often resulted in declines. This connection highlights the potent influence a celebrity’s words can have on the price of a digital asset.

Musk’s Public Statements and their Effects

Musk’s public statements on Dogecoin, often made on social media platforms, have significantly impacted the cryptocurrency market. These statements have ranged from supportive pronouncements to seemingly contradictory remarks. The market’s reaction to these announcements, whether bullish or bearish, has been largely driven by the perceived authenticity and sincerity behind them. The ambiguity of Musk’s statements often leaves the market in a state of uncertainty.

Relationship between Musk and the Cryptocurrency Community

The relationship between Elon Musk and the Dogecoin community is complex and multifaceted. He has fostered a sense of community engagement through interactions and public statements. Conversely, his actions have also led to skepticism and criticism, as some see his involvement as opportunistic or detached from the genuine needs of the cryptocurrency. This duality of interaction has created a dynamic and often unpredictable environment.

Dogecoin, Elon Musk, and federal workers – the whole government situation is a bit much, right? It’s easy to get caught up in the drama, but remember, healthy friendships require careful consideration of what not to say. Check out this insightful guide on navigating tricky social situations and avoiding common pitfalls in friendships here. Ultimately, maybe we should all take a deep breath and focus on what really matters in the government and our personal lives, rather than getting sidetracked by the latest meme-fueled frenzy.

Dogecoin’s Value Proposition Compared to Other Cryptocurrencies

Dogecoin’s value proposition, unlike other cryptocurrencies built on intricate algorithms and blockchain technologies, is primarily rooted in its memetic nature and community engagement. Its lack of sophisticated technical features, as opposed to Bitcoin or Ethereum, makes its value proposition unique. The cryptocurrency has cultivated a community that values humor and community engagement above complex technological features.

Social Media Strategies Used to Promote Dogecoin

Dogecoin’s promotion has been heavily reliant on social media strategies, leveraging humor, community engagement, and viral trends. Its association with the Doge meme and popular online culture has created a strong sense of community and fostered a rapid dissemination of information. The social media presence has become integral to Dogecoin’s identity and value proposition.

Dogecoin, Musk, and federal workers—the government’s relationship with these topics is always interesting. Recent discussions about AI datacenter superintelligence in China, and how it relates to a potential Trump report, as seen in this piece on ai datacenter superintelligence china trump report , might shed light on the larger picture. Ultimately, the connections between these seemingly disparate issues could impact the future of the federal workforce and our overall economic landscape, much like the Doge-Musk-government dynamic.

Comparison of Price Movements

| Date | Dogecoin Price | Other Cryptocurrency Price (e.g., Bitcoin) | Musk’s Tweet(s) |

|---|---|---|---|

| 2021-01-01 | $0.005 | $30,000 | Positive tweet about Dogecoin. |

| 2021-05-15 | $0.10 | $45,000 | Mixed tweet regarding Dogecoin. |

| 2021-10-20 | $0.05 | $60,000 | Negative tweet about Dogecoin. |

Federal Workers and Government Involvement

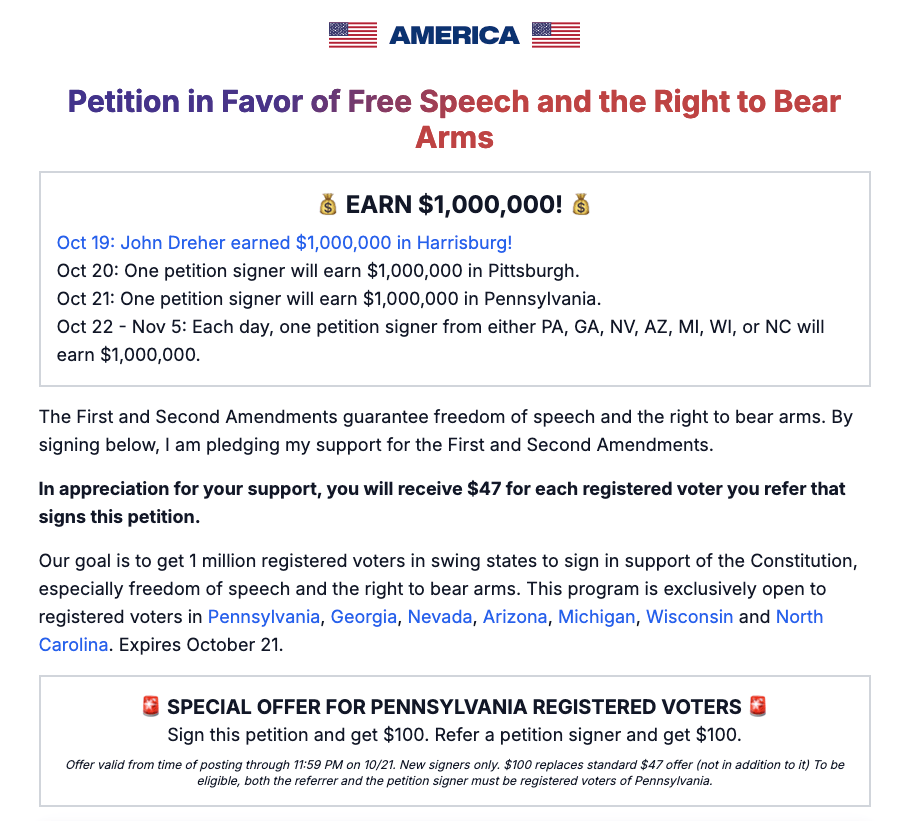

The intersection of federal workers, government policies, and the cryptocurrency market is a complex and evolving landscape. Understanding the role of government employees in the crypto sphere, alongside the regulatory framework and potential initiatives, is crucial to comprehending the future trajectory of this rapidly changing technology. The government’s approach to cryptocurrencies impacts not only the market itself but also the daily lives of citizens and the responsibilities of public servants.

Role of Federal Workers in the Cryptocurrency Market

Federal workers, like all citizens, can engage with cryptocurrencies, either personally or professionally. Their participation, however, is often subject to specific guidelines and regulations. For example, some federal employees might invest in cryptocurrencies, while others might interact with the technology in their official capacities, such as analyzing its potential impact on financial markets or designing strategies for its regulation.

This multifaceted involvement highlights the crucial need for clear and consistent guidelines.

Government’s Regulatory Framework Regarding Cryptocurrencies

The regulatory landscape surrounding cryptocurrencies is currently in a state of flux. Different agencies, such as the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Treasury Department, each have overlapping and sometimes conflicting jurisdictions. This jurisdictional ambiguity can create uncertainty for both businesses and individuals operating in the cryptocurrency sector. The government’s efforts to establish a clear regulatory framework are ongoing, aimed at balancing innovation with consumer protection and market stability.

Potential Government Initiatives Related to Cryptocurrencies

The government may explore various initiatives related to cryptocurrencies. These could include developing clear tax regulations for cryptocurrency transactions, establishing standards for cryptocurrency exchanges, or promoting research and development in the field. For example, the government might invest in blockchain technology for improving public services or explore using cryptocurrencies for government payments. The ultimate success of these initiatives hinges on their ability to address the unique challenges and opportunities presented by this evolving technology.

Impact of Government Policies on the Cryptocurrency Market

Government policies have a significant impact on the cryptocurrency market. Clear and consistent regulations can foster trust and stability, encouraging investment and innovation. Conversely, inconsistent or overly restrictive policies can stifle growth and deter participation. Historically, government interventions in financial markets have resulted in both positive and negative outcomes.

Perspectives of Different Government Agencies on Cryptocurrencies

Different government agencies often hold varying perspectives on cryptocurrencies. For example, some agencies might focus on the potential risks associated with illicit activities, while others might emphasize the opportunities for innovation and economic growth. Understanding these diverse viewpoints is critical to developing a comprehensive and balanced regulatory approach. This divergence underscores the need for a unified strategy.

Federal Regulations Concerning Cryptocurrency Use by Government Employees

Federal regulations regarding cryptocurrency use by government employees exist. These regulations often cover the ethical considerations related to investments, conflicts of interest, and potential misuse of government resources. The rules aim to prevent insider trading or the use of non-public information for personal gain.

Potential Benefits and Drawbacks of Government Involvement in Cryptocurrency

| Benefit/Drawback | Explanation |

|---|---|

| Benefit: Increased Market Stability | Clear regulations and oversight can foster trust, reduce volatility, and attract institutional investment. |

| Drawback: Stifling Innovation | Overly restrictive regulations can hinder the development of new technologies and applications. |

| Benefit: Enhanced Consumer Protection | Government intervention can establish standards and safeguards to protect investors from fraud and scams. |

| Drawback: Increased Regulatory Burden | Complicated regulations can impose significant costs on businesses and individuals operating in the cryptocurrency sector. |

| Benefit: Tax Revenue Generation | Clearer tax regulations for cryptocurrency transactions can generate additional revenue for the government. |

| Drawback: Potential for Regulatory Capture | Lobbying efforts by powerful players in the cryptocurrency industry could potentially influence regulations to favor their interests. |

Connecting Dogecoin, Musk, and Federal Workers

The intersection of Dogecoin, Elon Musk’s influence, and federal workers presents a complex interplay of financial incentives, ethical considerations, and potential conflicts of interest. The cryptocurrency market’s volatility, coupled with Musk’s significant public persona, directly impacts the financial decisions and perceptions of federal workers, potentially leading to unforeseen consequences for both individual employees and government operations.Understanding the potential ramifications of this connection is crucial for navigating the evolving landscape of cryptocurrency and its integration into the broader financial sphere.

This analysis delves into the multifaceted relationship, exploring the potential impact on federal workers, the ethical considerations surrounding investment, and the potential for regulatory frameworks.

Potential Impact on Federal Workers’ Financial Decisions

Dogecoin’s fluctuating value and Elon Musk’s endorsements can significantly influence federal workers’ investment decisions. The allure of quick gains, coupled with Musk’s public pronouncements, might entice some to allocate a portion of their savings to Dogecoin. However, the inherent risk associated with cryptocurrencies necessitates careful consideration. Historically, speculative investments in cryptocurrencies have yielded both substantial profits and devastating losses, highlighting the volatility of this market.

The whole Doge-Musk-federal-worker-government situation feels a bit… out there, right? But it’s also interesting to consider how news about things like Joe Biden’s prostate cancer diagnosis here might subtly influence the broader political landscape, impacting everything from economic policies to public trust in the government. Ultimately, though, the Dogecoin-Musk-government debate still remains a wild card, and who knows where it will go next?

Potential for Conflicts of Interest

Federal workers, bound by ethical codes and regulations, must avoid conflicts of interest. Investing in cryptocurrencies, particularly those heavily influenced by individuals like Musk, can create potential conflicts. The possibility of receiving insider information or benefiting from decisions influenced by Musk’s pronouncements necessitates strict adherence to ethical guidelines.

Ethical Considerations Surrounding Government Employees Investing in Cryptocurrencies

Government employees, entrusted with public funds and resources, must prioritize the integrity and impartiality of their roles. Investment in cryptocurrencies, especially those with inherent volatility and potential for conflicts of interest, raises ethical concerns. The potential for bias or undue influence from external factors necessitates transparency and adherence to established ethical standards. Financial disclosures and stringent conflict-of-interest policies are paramount.

Influence on Federal Worker Opinions on Government Regulations

Dogecoin’s popularity, along with Musk’s pronouncements, could sway federal worker opinions on government regulations surrounding cryptocurrencies. Workers exposed to Musk’s endorsements might be more receptive to lenient or pro-cryptocurrency policies. Conversely, those wary of the market’s inherent risks could advocate for stricter regulations. This underscores the need for well-informed decision-making and objective analysis within the government.

Musk’s Actions and Federal Worker Perceptions of the Cryptocurrency Market

Elon Musk’s actions and pronouncements have a direct impact on how federal workers perceive the cryptocurrency market. His tweets and public endorsements can significantly influence the market’s volatility, thereby affecting workers’ investment decisions. The perception of the market as either stable or risky can influence workers’ views on government regulations. This influence warrants careful consideration to maintain impartiality and objective analysis within government operations.

Potential Regulatory Frameworks for Federal Workers Regarding Cryptocurrency Investments

Establishing clear guidelines for federal workers investing in cryptocurrencies is crucial. This includes:

- Mandatory Financial Disclosure Forms: Requiring comprehensive disclosure of cryptocurrency holdings to prevent undisclosed conflicts of interest.

- Stricter Conflict-of-Interest Policies: Implementing more stringent policies to address potential conflicts stemming from cryptocurrency investments.

- Prohibition of Trading on Insider Information: Explicitly prohibiting the use of non-public information related to cryptocurrencies for personal gain.

- Educational Initiatives: Providing educational resources to federal workers on the risks and complexities of cryptocurrency investments.

Potential Conflicts of Interest Table

This table illustrates potential conflicts of interest between government employment and cryptocurrency investments:

| Scenario | Potential Conflict | Resolution Strategy |

|---|---|---|

| A federal worker invests in Dogecoin, and Musk publicly criticizes a government regulation related to cryptocurrency. | The worker’s investment could be perceived as influencing their opinion on the regulation. | Stricter financial disclosure requirements and conflict-of-interest policies. |

| A federal worker with knowledge of impending government regulations on cryptocurrencies trades Dogecoin based on this knowledge. | Violation of insider trading regulations. | Explicit prohibition of trading on insider information and strict enforcement mechanisms. |

| A federal worker invests in cryptocurrencies promoted by Musk, and their work involves advising on related policy decisions. | Potential bias and compromised objectivity. | Mandatory recusal from related policy discussions and strict conflict-of-interest guidelines. |

Public Perception and Discourse

The public discourse surrounding Dogecoin, Elon Musk, and government involvement in cryptocurrencies is complex and multifaceted. Public opinion is shaped by a constant flow of information, often filtered through social media, which significantly impacts the way individuals perceive the interplay between these elements. Different viewpoints exist regarding the role of government in regulating or promoting the cryptocurrency market, adding another layer of complexity to the conversation.

Public Discourse on Dogecoin

The public discourse surrounding Dogecoin often involves passionate arguments on both sides. Proponents often cite the meme-based cryptocurrency’s potential for rapid price fluctuations as an investment opportunity, while critics highlight the speculative nature of the asset and the potential for significant losses. Discussions often revolve around the role of Elon Musk’s influence on Dogecoin’s price volatility, and the broader implications for the cryptocurrency market as a whole.

Different Viewpoints on Government Regulation

Public opinions on the role of government in regulating the cryptocurrency market are varied. Some advocate for strict regulations to protect investors and prevent fraud, arguing that the lack of oversight creates an environment ripe for exploitation. Conversely, others believe in a hands-off approach, emphasizing the importance of market freedom and the potential for innovation to flourish without governmental interference.

These contrasting views frequently appear in online discussions about Dogecoin and cryptocurrencies more broadly.

Social Media’s Influence

Social media platforms play a crucial role in shaping public perception of Dogecoin and the role of Elon Musk in the cryptocurrency market. News, opinions, and memes are rapidly disseminated, often amplifying and distorting information. The instantaneous nature of social media can create a sense of urgency and hype around Dogecoin, influencing trading decisions and public sentiment.

Influence of Public Opinion on Government Policy

Public opinion can significantly influence government policy regarding cryptocurrencies. When public concern about cryptocurrency scams or volatility is high, it can pressure policymakers to implement stricter regulations. Conversely, a lack of public interest or a perception of cryptocurrency as a legitimate investment tool may lead to a more laissez-faire approach. The interplay between public opinion and government action is constantly evolving and complex.

Online Discourse Example

“Dogecoin is a joke! Musk is just using it to pump and dump. Government needs to step in and regulate this madness before more people lose their money.”

@CryptoSkeptic on Twitter (2023).

Common Misconceptions about Dogecoin

- Dogecoin is a legitimate investment with guaranteed returns. Dogecoin’s price is highly volatile and dependent on market speculation, not inherent value. Past performance is not indicative of future results.

- Elon Musk solely determines Dogecoin’s value. While Musk’s tweets and actions can influence public sentiment and, consequently, price movements, Dogecoin’s value is determined by market forces, including supply and demand, and investor confidence.

- Government regulation will hinder cryptocurrency innovation. Arguments against regulation often suggest it stifles innovation, however, a balance between market freedom and investor protection is crucial for sustainable growth.

- Dogecoin is a currency with practical use cases. While having a devoted community, Dogecoin is primarily a meme-based cryptocurrency and doesn’t have widespread adoption as a medium of exchange or store of value.

Illustrative Scenarios

The intersection of federal workers, Dogecoin, and Elon Musk’s influence presents a complex web of potential scenarios. Understanding these scenarios is crucial for evaluating the ethical and practical implications of cryptocurrency investments in the public sector. This section explores potential conflicts of interest, policy impacts, and the ripple effects of Musk’s actions on federal worker financial decisions.

Potential Scenarios Involving Federal Workers, Dogecoin, and Musk’s Influence

Federal workers, like any other investor, might be tempted to speculate on the market volatility of cryptocurrencies like Dogecoin, particularly given Elon Musk’s significant public persona and pronouncements. These actions can create a complex interplay between personal financial interests and professional responsibilities. A potential scenario could see a federal worker invest heavily in Dogecoin, influenced by Musk’s pronouncements, potentially experiencing significant gains or losses based on market fluctuations.

Government Policies Impacting Dogecoin Investors

Government policies related to cryptocurrency regulation can directly affect Dogecoin investors. For instance, if the government enacts stricter regulations on cryptocurrency exchanges or trading, this could impact the accessibility and liquidity of Dogecoin. Alternatively, if the government introduces tax incentives or regulations that specifically impact cryptocurrencies, it could influence investors’ decisions and create a disparity in market participation.

Ethical Dilemmas Faced by Federal Workers

Federal workers operating under the strict ethical guidelines of the government may encounter ethical dilemmas regarding their Dogecoin investments. The conflict arises when the worker’s personal financial interests conflict with their professional responsibilities. For example, a worker who relies on insider knowledge or access to government information related to cryptocurrency regulations might be tempted to use this information for personal gain.

Furthermore, potential conflicts arise when a worker’s personal financial decisions directly impact their objectivity and integrity in performing their job.

Fictional Case Study: A Federal Worker Facing a Conflict of Interest

A hypothetical case study of a federal worker, Sarah, illustrates the conflict. Sarah, a financial analyst at the Department of Treasury, is a strong believer in Dogecoin. She invests a significant portion of her savings in Dogecoin, heavily influenced by Elon Musk’s social media posts. While researching cryptocurrency regulation, Sarah finds herself inadvertently using her official position to gather information that might benefit her Dogecoin investment.

This creates a potential conflict of interest and raises concerns about the integrity of the information-gathering process.

Summary Table of Possible Outcomes

| Scenario | Potential Outcomes |

|---|---|

| Federal worker invests in Dogecoin based on Musk’s pronouncements | Significant gains or losses, potential conflict of interest, ethical concerns |

| Government implements strict cryptocurrency regulations | Impact on Dogecoin investor accessibility and liquidity, potential market volatility |

| Federal worker utilizes insider information for Dogecoin investment | Potential violation of ethical guidelines, legal repercussions, damage to public trust |

Impacts of Elon Musk’s Actions on Federal Workers’ Financial Decisions, Doge musk federal workers government

- Musk’s tweets and social media posts can significantly influence public sentiment and market speculation surrounding Dogecoin. Federal workers, as individuals, may be influenced by these public pronouncements, leading to investment decisions.

- The perceived endorsement or criticism of Dogecoin by Musk can trigger significant price fluctuations, leading to potential financial gains or losses for federal workers who invest in Dogecoin.

- Musk’s actions can create a climate of uncertainty and speculation in the cryptocurrency market, potentially affecting the financial decisions of federal workers who consider investing in cryptocurrencies.

- The influence of Musk’s actions on federal workers’ financial decisions can potentially lead to conflicts of interest, ethical dilemmas, and reputational damage.

Ending Remarks

In conclusion, the relationship between Dogecoin, Elon Musk, federal workers, and government policies is a dynamic and multifaceted one. This exploration has highlighted the complex interplay of market forces, social media influence, and ethical considerations. The potential for conflicts of interest, ethical dilemmas, and evolving regulatory frameworks demand careful attention. The future trajectory of this intersection remains uncertain, but it undoubtedly warrants ongoing scrutiny and discussion.