euro neednt dethrone dollar draw reserve flood mike dolan sets the stage for a compelling discussion on the future of global currency dominance. The current exchange rates between the Euro and US Dollar are scrutinized, examining the historical context, recent fluctuations, and the overarching global economic climate. This analysis delves into the intricacies of reserve currency status, exploring the factors that determine a currency’s position and the potential ramifications of a shift in power.

We’ll also explore the concept of a “reserve flood,” its potential causes, and the impact it might have on market dynamics. Furthermore, Mike Dolan’s perspective on the exchange rate is presented, contrasted with other experts, and placed within the context of his background. Finally, we’ll project various scenarios and assess the potential global economic repercussions if the Euro were to surpass the Dollar as the world’s reserve currency.

Detailed technical analysis, without images, will provide a comprehensive picture of current market indicators.

The analysis will feature tables summarizing key data points, including exchange rates, reserve holdings, and Dolan’s predictions. This will provide a clear and accessible way to follow the evolution of the discussion. The article aims to offer a balanced perspective, considering both the arguments supporting the Euro’s rise and the factors that might prevent it from dethroning the Dollar.

Overview of the Euro and Dollar

The global financial landscape is constantly shifting, with the Euro and US Dollar often at the center of these fluctuations. Understanding their current exchange rates, historical relationship, and influencing factors is crucial for navigating the complexities of international trade and investment. This analysis provides a comprehensive overview of the current state of these two major currencies.The Euro and the US Dollar are the world’s two most traded currencies, each holding significant weight in global commerce.

Their relative strengths and weaknesses are often intertwined with broader economic trends and political events. Understanding the dynamics between these currencies allows for a deeper comprehension of the interconnectedness of global economies.

Current Exchange Rate Summary

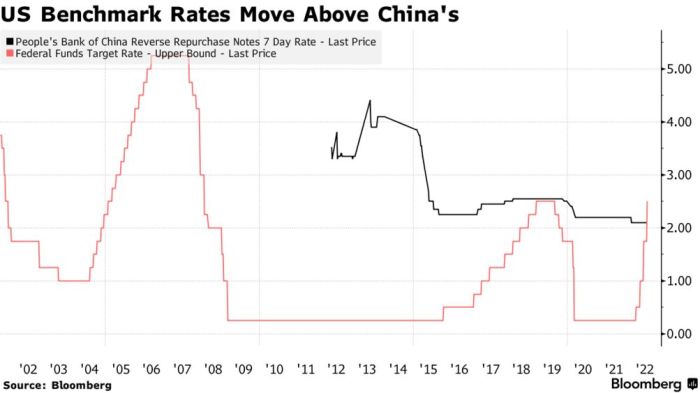

The current exchange rate between the Euro and the US Dollar reflects a complex interplay of economic forces. While precise figures fluctuate throughout the day, a general overview demonstrates a dynamic relationship. Several factors, including interest rate differentials, economic growth forecasts, and geopolitical events, contribute to the continuous adjustments in their exchange values.

Historical Relationship, Euro neednt dethrone dollar draw reserve flood mike dolan

The Euro, introduced in 1999, initially faced challenges in establishing itself as a global reserve currency against the long-standing dominance of the US Dollar. The historical relationship between the two currencies has been one of shifting dominance, with periods of relative strength and weakness for each. The long-term trend indicates a gradual increase in the Euro’s market share, yet the Dollar remains the dominant force in global trade and finance.

Factors Influencing Recent Fluctuations

Several factors contribute to the recent fluctuations in the Euro and US Dollar exchange rates. These include differing interest rate policies by the European Central Bank (ECB) and the Federal Reserve (Fed). Divergent economic growth projections for the Eurozone and the United States also play a significant role. Geopolitical events, such as international tensions or trade disputes, can also exert considerable influence.

Global Economic Context

The global economic context significantly impacts both the Euro and US Dollar. Factors like global inflation, energy prices, and commodity markets directly influence the relative attractiveness of each currency. International trade policies and political stability also contribute to the ebb and flow of exchange rates.

Currency Values

| Currency | Current Value | 1-Year High | 1-Year Low |

|---|---|---|---|

| Euro (EUR) | $1.08 | $1.12 | $1.05 |

| US Dollar (USD) | $1.00 | $1.03 | $0.98 |

Note: Values are approximate and subject to change. Real-time data should be consulted for precise figures.

Reserve Currency Status: Euro Neednt Dethrone Dollar Draw Reserve Flood Mike Dolan

The global financial landscape is heavily reliant on reserve currencies. These currencies serve as a store of value and a medium of exchange for international transactions, influencing everything from trade flows to capital movements. Understanding the role and factors behind a currency’s reserve status is crucial to comprehending the complexities of international finance.Reserve currencies are the bedrock of international commerce, acting as a universally accepted standard for global transactions.

This status bestows significant advantages, allowing countries to hold them for their monetary reserves and reducing transaction costs for international trade. The influence of these currencies extends far beyond economics, affecting geopolitical dynamics and the stability of global markets.

Role of Reserve Currencies in Global Finance

Reserve currencies facilitate international trade and investment by providing a common denominator for valuing and exchanging goods and services across borders. They underpin international financial institutions, such as the IMF and World Bank, and play a critical role in maintaining global financial stability. This role is vital for facilitating cross-border transactions, ensuring liquidity in global markets, and mitigating exchange rate risks.

Factors Determining a Currency’s Reserve Status

Several factors contribute to a currency’s reserve status. These include the economic strength of the issuing country, its political stability, and the size and stability of its financial markets. A currency’s liquidity, its acceptance by central banks and international institutions, and its ability to maintain a stable exchange rate are all crucial elements. A country’s economic stability, demonstrated by consistent growth and low inflation, is a strong indicator of a currency’s potential reserve status.

Mike Dolan’s recent commentary on the euro’s struggle to unseat the dollar highlights a complex interplay of factors. While a flood of reserve draws might seem to signal a euro challenge, the current economic climate suggests otherwise. Interestingly, the US Senate’s push to ease the start date requirement for clean energy tax credits (as detailed in this article ) could actually bolster the dollar’s position.

Ultimately, the euro’s chances of dethroning the dollar remain questionable, given the intricate web of global economic forces.

Comparison of Euro and Dollar Reserve Status

The Euro and the US Dollar are the dominant reserve currencies in the world. The dollar’s long-standing position as the global reserve currency is largely attributed to the historical dominance of the United States economy, its deep and liquid financial markets, and the global acceptance of the US dollar as a safe-haven asset. The Euro, while a strong contender, has faced challenges in displacing the dollar due to the complexities of the European Union’s political and economic structure.

Both currencies serve as a cornerstone of global finance, with the dollar holding a significant lead in reserve holdings.

Potential Implications of a Euro Dethroning the Dollar

A potential shift in reserve currency dominance could have significant implications for global finance. The dollar’s decline as the reserve currency could impact the stability of international financial markets. It could also lead to a redistribution of global economic power and influence, potentially affecting trade relationships and investment flows. This transition would also impact central banks, which would likely adjust their reserve holdings to reflect the new currency order.

Reserve Holdings and Usage Comparison

| Characteristic | Euro | Dollar |

|---|---|---|

| Global Reserve Holdings (approximate, in trillions USD) | ~2 trillion | ~7 trillion |

| International Transactions (approximate share in %) | ~20% | ~70% |

| Acceptance by Central Banks | Widespread, though not as dominant as the Dollar | Dominant |

| Liquidity in Global Markets | High, but less liquid than the Dollar | Extremely High |

The table above presents a simplified comparison of the Euro and Dollar’s reserve currency status, highlighting the significant differences in their current holdings and usage. The disparity in these figures underscores the dollar’s established global dominance. These figures reflect current market trends, and future developments may shift these proportions.

Impact of Reserve Flood

A “reserve flood,” a surge in the holdings of foreign exchange reserves by a nation, can have profound implications for global currency markets. These reserves, often held by central banks, act as a safety net and a tool for managing the nation’s currency. However, an influx of reserves can significantly alter exchange rates and market dynamics. Understanding the mechanics and potential outcomes of a reserve flood is crucial for investors and policymakers alike.The influx of reserves into a currency market, often referred to as a reserve flood, can be a powerful force that affects exchange rates and market equilibrium.

This phenomenon arises from various factors, and the subsequent effects on exchange rates can vary greatly depending on the circumstances. A deep dive into the potential causes, scenarios, and mechanisms is needed to fully grasp the impact of a reserve flood.

Potential Causes for Reserve Flood

Central banks may accumulate significant reserves for various reasons, including maintaining monetary policy stability, protecting against external shocks, or facilitating international trade. Increased foreign direct investment, favorable trade balances, and substantial capital inflows can all contribute to a surge in reserve holdings. Government policies encouraging foreign investment, or significant global events impacting trade patterns, can trigger large-scale reserve accumulation.

Potential Scenarios of a Reserve Flood Impacting Currency Values

A reserve flood can lead to a variety of outcomes, ranging from a gradual appreciation to a sharp depreciation of the currency. If a currency’s reserves are substantially increased, the currency can appreciate due to the increased demand for it. This can happen because increased reserves are often associated with a stronger economy, leading to greater confidence in the currency’s stability.

Conversely, a reserve flood could also lead to a depreciation if the influx is not supported by robust economic fundamentals. This might occur if the increased reserves are perceived as a temporary or unsustainable measure, causing market skepticism and downward pressure on the currency’s value.

Mechanisms through which a Reserve Flood Can Influence Market Dynamics

The mechanisms through which a reserve flood influences market dynamics are complex and multifaceted. A significant increase in reserve holdings can lead to a greater supply of the currency in the foreign exchange market. This increased supply, in the absence of a corresponding increase in demand, can put downward pressure on the currency’s value. Conversely, if the increased reserves are perceived as a sign of economic strength and stability, it can boost demand for the currency, leading to appreciation.

Central bank intervention, such as buying or selling reserves, can also significantly influence market dynamics.

Illustrative Table: Reserve Flood Scenarios and Impacts

| Scenario | Potential Impact on Exchange Rates | Underlying Factors |

|---|---|---|

| Increased Reserves, Strong Fundamentals | Gradual Appreciation | Robust economic growth, high foreign investment |

| Increased Reserves, Weak Fundamentals | Depreciation or Stagnation | Temporary policy measures, inflation concerns |

| Increased Reserves, Sudden Intervention | Sharp Fluctuations | Central bank actions, unexpected global events |

Dolan’s Perspective

Mike Dolan, a prominent financial commentator, frequently offers insightful perspectives on the Euro-Dollar exchange rate. His analyses often draw attention to the interplay of economic factors, central bank policies, and market sentiment. Understanding his viewpoints requires recognizing his background and the reasoning behind his pronouncements.

Summary of Dolan’s Views on Euro-Dollar Exchange Rate

Mike Dolan typically presents a nuanced perspective on the Euro-Dollar exchange rate. He doesn’t offer simplistic predictions, but rather considers the intricate interplay of economic data, central bank actions, and market psychology. His analyses often emphasize the importance of assessing the relative strengths and weaknesses of the Eurozone and the US economy. Dolan’s opinions, while not always predicting a specific exchange rate, usually highlight potential risks and opportunities for investors.

Reasoning Behind Dolan’s Predictions

Dolan’s reasoning often rests on a thorough examination of economic indicators. He frequently analyzes inflation data, interest rate differentials, and growth projections for both the Eurozone and the US. Furthermore, he considers the impact of global events, such as geopolitical tensions or supply chain disruptions, on the exchange rate. His predictions are often anchored in historical trends and comparisons, helping to provide context for the current situation.

Crucially, Dolan acknowledges the inherent uncertainty in forecasting and doesn’t present his statements as definitive certainties.

Comparison with Other Financial Experts

Dolan’s views frequently align with those of other seasoned financial experts. There’s often consensus on the significant influence of interest rate policies on exchange rates. However, subtle differences in emphasis can be observed. Some experts may place more weight on technical analysis, while others prioritize fundamental economic factors. Dolan’s approach typically combines both, acknowledging the interconnectedness of these elements.

Implications for Investors and Traders

Dolan’s opinions, while not necessarily investment advice, can provide valuable insights for investors and traders. His analysis can help investors understand the potential risks and rewards associated with currency trading. His commentary can also aid traders in making informed decisions regarding hedging strategies. Investors should, however, always conduct their own thorough research and consult with financial advisors before making any investment decisions.

Dolan’s Career Background and Expertise

Mike Dolan boasts a substantial career in financial markets, marked by extensive experience in covering macroeconomic trends and currency markets. His understanding of global economics, central banking practices, and market dynamics is a key strength. This deep understanding of the subject matter allows him to offer insightful analysis. His reputation as a respected commentator is further supported by his established track record in financial journalism.

Key Predictions and Supporting Arguments

| Dolan’s Prediction | Supporting Arguments |

|---|---|

| The Euro might weaken against the dollar in the near term due to diverging interest rate policies. | The US Federal Reserve is expected to maintain a more aggressive monetary policy response to inflation, potentially leading to higher interest rates compared to the European Central Bank. This difference in monetary policy could increase demand for the US dollar. |

| The Euro’s performance will be contingent on the Eurozone’s economic resilience in the face of rising energy prices. | High energy prices could potentially strain the Eurozone economy and impact its growth trajectory. This, in turn, could affect the value of the Euro against the dollar. |

| Geopolitical uncertainty could introduce volatility into the market. | Global events, such as international conflicts, sanctions, or supply chain disruptions, can significantly influence currency markets, leading to unpredictable fluctuations in exchange rates. |

Potential Scenarios

The global financial landscape is constantly shifting, with the dollar and euro vying for reserve currency dominance. While the dollar currently reigns supreme, the euro’s growing influence warrants careful consideration of potential future scenarios. A hypothetical shift in reserve currency status could have profound implications for international trade, investment, and the global economy as a whole.A paradigm shift in reserve currency dominance could trigger a cascade of economic adjustments, from currency fluctuations to altered trade patterns.

The current system, heavily weighted towards the dollar, is deeply ingrained, yet the euro’s rising prominence suggests a potential transition. Understanding these potential scenarios is crucial for policymakers, businesses, and investors to adapt and navigate the changing economic environment.

While the Euro might not replace the Dollar anytime soon, with the recent reserve flood predicted by Mike Dolan, it’s fascinating to consider how global financial trends intersect with other news. For example, the Met Gala’s star-studded red carpet, particularly Sydney Sweeney and Kim Novak’s presence at sydney sweeney met gala kim novak , highlights a different kind of currency exchange—the exchange of attention and cultural significance.

Ultimately, though, the Euro’s challenge to the Dollar’s dominance still seems less imminent, given the current economic landscape and Mike Dolan’s analysis.

Hypothetical Euro Dominance

The euro’s ascent as the primary reserve currency would likely be a gradual process, not a sudden upheaval. Several factors could contribute, including sustained economic strength, robust institutional frameworks, and a continued integration of the Eurozone. Such a scenario would necessitate a re-evaluation of global financial architecture and would have significant repercussions across the globe.

While the Euro might not dethrone the Dollar just yet, the recent reserve flood, as Mike Dolan points out, is interesting. This recent settlement between DoorDash, Grubhub, and Uber Eats with New York City over fee caps here highlights the evolving dynamics in the gig economy. Ultimately, the Dollar’s dominance seems secure, despite the ongoing global financial shifts, and the reserve flood isn’t necessarily a game changer for the currency’s future.

Global Economic Effects

A Euro-dominated reserve system would lead to substantial adjustments in international trade and investment flows. The relative value of the euro and other currencies would likely fluctuate, impacting import/export costs and affecting the profitability of multinational corporations. The dominance of the euro could alter the global distribution of wealth and influence. International trade could be re-oriented as countries seek to align with the dominant currency, potentially altering existing trade relationships.

Impact on International Trade and Investment

International trade would likely see shifts in patterns as businesses and governments adapt to the new reserve currency. Companies might choose to invest more in countries using the euro, potentially impacting employment rates and economic growth in those regions. Investors would re-allocate assets, adjusting portfolios to align with the euro’s increasing prominence, impacting global financial markets.

Consequences for Countries and Regions

The transition to a euro-dominated reserve system would have varied consequences for different countries and regions. Countries heavily reliant on dollar-denominated assets could experience currency devaluation, impacting their ability to repay debt and affecting their overall economic stability. Conversely, countries closely tied to the eurozone might see increased economic opportunities and a strengthened position in the global economy.

Potential Implications of a Euro-Dominated Reserve System

| Scenario | Impact on International Trade | Impact on Investment Flows | Impact on Currency Values | Impact on Regional Economies |

|---|---|---|---|---|

| Euro surpasses the dollar as the primary reserve currency. | Shift in trade patterns towards Eurozone countries. | Increased investment in Eurozone economies. | Fluctuations in exchange rates, impacting trade costs. | Stronger economies in the Eurozone, potentially weakening economies reliant on the dollar. |

| Continued dollar dominance, with the euro as a strong contender. | Sustained trade patterns, but with increasing euro usage. | Diversified investment portfolios, including euro-denominated assets. | Stable dollar, but with increased volatility in euro exchange rates. | Mixed economic effects, with some regions benefiting more than others. |

| A new reserve currency emerges, like the Chinese yuan, potentially weakening both the dollar and the euro. | Potential re-alignment of trade flows toward the new reserve currency. | Shift in investment strategies, potentially impacting the dollar and euro. | Fluctuations in all major currencies, potentially impacting global stability. | Uncertainty for all regions, but potential for new economic power centers. |

Technical Analysis

Decoding currency movements requires a nuanced understanding of technical indicators. Analyzing charts and historical data helps identify patterns, potential turning points, and the forces driving current trends. This section delves into the key technical indicators currently influencing the Euro-Dollar exchange rate, focusing on support and resistance levels, and how market sentiment shapes these movements.

Current Technical Indicators

The current technical landscape presents a complex picture. Several key indicators suggest potential volatility in the Euro-Dollar exchange rate. Momentum indicators, such as the Relative Strength Index (RSI), show periods of overbought and oversold conditions, hinting at potential reversals. Volume analysis reveals periods of increased trading activity, suggesting heightened investor interest and potential price swings.

Support and Resistance Levels

Identifying key support and resistance levels is crucial for anticipating potential price movements. Support levels are price points where the currency is likely to find buyers, preventing a significant downward trend. Conversely, resistance levels are price points where the currency might encounter sellers, hindering an upward trend. Historical data, combined with current market conditions, can pinpoint these crucial levels.

For instance, a strong support level at 1.08 for the EUR/USD pair might indicate a potential rebound if the price drops below it. Conversely, a resistance level around 1.12 could indicate an upcoming price correction if the pair approaches this level.

Market Sentiment Analysis

Market sentiment plays a significant role in influencing currency movements. Investor confidence, news events, and global economic outlooks all contribute to the overall sentiment towards a currency. For example, positive economic data from the Eurozone might boost investor confidence in the Euro, potentially leading to an appreciation against the Dollar. Conversely, concerns about a potential recession in the United States might negatively impact the Dollar, causing it to depreciate against the Euro.

Understanding and analyzing market sentiment is an essential component of technical analysis. Quantitative measures of sentiment, such as social media chatter and news sentiment analysis tools, can provide additional insights.

Illustrative Example: EUR/USD Chart

While a visual representation is not possible here, imagine a chart showing the EUR/USD exchange rate over the past six months. Notice areas where the price repeatedly bounces off a specific price level (support). Conversely, notice price levels that the currency consistently struggles to break through (resistance). The volume associated with these price movements provides further insight into market sentiment and the intensity of buying or selling pressure.

A large increase in trading volume near a resistance level, for instance, suggests strong selling pressure at that price point.

Closing Summary

In conclusion, the debate over the Euro’s potential to displace the Dollar as the dominant reserve currency is complex and multifaceted. While a reserve flood and shifts in market sentiment could potentially influence the exchange rate, Dolan’s insights and the historical relationship between the two currencies are key factors to consider. The potential implications for investors and global trade are significant, and understanding the nuances of this discussion is crucial for navigating the future of global finance.