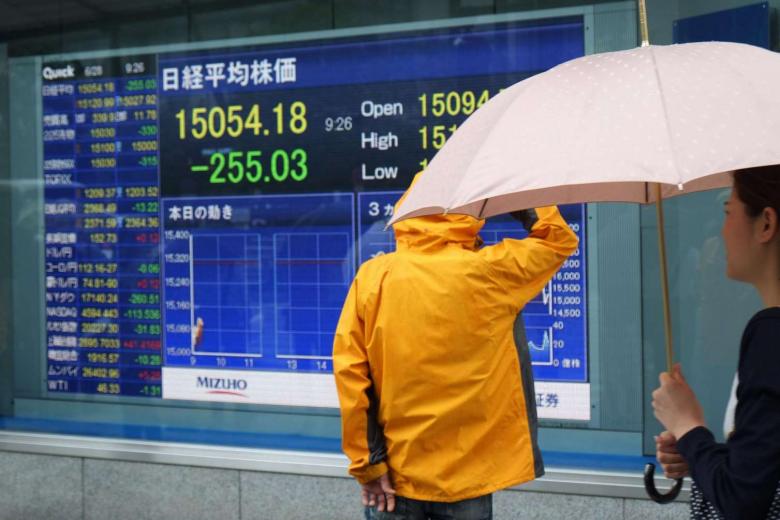

Japans government say it is not relying tax cuts boost income – Japan’s government say it is not relying tax cuts boost income, opting instead for a different economic strategy. This decision marks a significant departure from traditional approaches, prompting crucial questions about its potential impacts on the Japanese economy. What alternative policies are being pursued? What are the potential short and long-term consequences? This exploration delves into the rationale behind this choice, examining potential economic effects, social implications, and the historical context.

The Japanese government’s rationale for rejecting tax cuts as a primary economic stimulus is multifaceted. This analysis considers the government’s stated reasons, contrasting them with the potential benefits of tax cuts, and evaluating alternative policies currently in place. Historical precedents will also be examined to provide context.

Government Rationale for Not Relying on Tax Cuts

The Japanese government’s recent stance against relying on tax cuts to boost income reveals a strategic approach to economic recovery. Instead of immediate stimulus through tax reductions, the government prioritizes long-term structural reforms and targeted investments. This approach suggests a nuanced understanding of Japan’s economic challenges and a belief that tax cuts alone may not address the underlying issues.The Japanese government, acknowledging the limitations of simple tax cuts, favors a more comprehensive strategy.

Japan’s government seems to be taking a different approach to boosting income, stating they aren’t relying on tax cuts. This contrasts with the concerns raised about potential Medicaid cuts in the Jeff Van Drew, Trump Republican budget bill, a bill that highlights the complex political calculations surrounding economic stimulus. While Japan’s strategy might seem unconventional, it’s a testament to their unique economic circumstances and a clear departure from some of the more direct approaches seen elsewhere.

Ultimately, both situations highlight the ongoing debate about the most effective ways to boost economic activity.

Their focus is on fostering sustainable economic growth rather than short-term gains. This entails substantial investments in infrastructure, research and development, and human capital development. The rationale behind this choice lies in the belief that these long-term investments will ultimately yield higher and more stable economic growth than the potentially temporary boost from tax cuts.

Alternative Economic Policies

The Japanese government is actively pursuing several alternative economic policies to stimulate income and growth. These policies are designed to address the structural weaknesses in the Japanese economy. Key among these are:

- Infrastructure investment: The government is prioritizing investments in infrastructure projects, including transportation, energy, and communication networks. This strategy aims to boost productivity and facilitate economic activity across various sectors.

- Research and development (R&D) initiatives: The government is supporting R&D efforts in key technological sectors to promote innovation and create new industries. This is aimed at enhancing Japan’s competitiveness in the global economy and creating future job opportunities.

- Human capital development: Programs focused on workforce training and education are being implemented to improve the skills and adaptability of the workforce. This investment in human capital is viewed as crucial for attracting foreign investment and improving productivity.

- Support for small and medium-sized enterprises (SMEs): Recognizing the vital role SMEs play in the economy, the government is implementing measures to provide financial and technical support to these businesses. This is meant to foster entrepreneurship and create more jobs.

Potential Economic Impacts

The government’s approach, contrasting with tax cuts, is expected to have a gradual but sustained positive impact on the Japanese economy. It aims to address fundamental issues, like aging population and low productivity, rather than providing a short-term boost.

- Long-term growth: By investing in infrastructure and human capital, the government aims to build a stronger and more resilient economy, capable of sustained long-term growth. This is contrasted with the potentially fleeting effects of tax cuts, which might not address the root causes of economic stagnation.

- Increased productivity: The government’s focus on R&D and human capital development should lead to improved productivity and efficiency across various sectors. This is expected to generate a more stable and sustainable increase in income over the long term.

- Structural change: The policies are designed to drive structural change, moving the economy away from reliance on traditional industries towards innovation and new opportunities. This strategy seeks to make the economy more resilient to external shocks and promote a more dynamic economic landscape.

Historical Context

Japan has a history of pursuing similar strategies to stimulate growth. The government’s decision to prioritize long-term investments over short-term tax cuts echoes past approaches, which have sometimes yielded significant economic benefits. For instance, post-war reconstruction and investments in infrastructure have been pivotal in Japan’s economic ascent.

Economic Indicators

The Japanese government is considering several key economic indicators when making decisions. These include:

| Indicator | Rationale |

|---|---|

| GDP growth rate | This reflects the overall performance of the economy. |

| Productivity levels | A key indicator of economic strength and potential. |

| Employment rates | Indicates the health of the labor market. |

| Inflation rate | Impacts the purchasing power of consumers and businesses. |

| Government debt levels | Important to consider when evaluating the fiscal sustainability of the chosen approach. |

Potential Impacts of the Decision: Japans Government Say It Is Not Relying Tax Cuts Boost Income

Japan’s government has opted not to rely on tax cuts as a primary economic stimulus. This approach, while potentially rooted in fiscal prudence or other considerations, raises important questions about the short- and long-term consequences for the Japanese economy. This decision necessitates careful consideration of potential impacts across various sectors, including consumer spending, investment, employment, and international trade relationships.The rationale behind this decision has been detailed, but the potential repercussions demand an examination of the likely outcomes.

The subsequent sections delve into the potential short-term and long-term effects of this choice, as well as its comparison to strategies employed by other developed nations. This analysis also explores potential social impacts and the ramifications for Japan’s global economic standing.

Potential Short-Term and Long-Term Economic Effects

The Japanese government’s decision not to utilize tax cuts as a stimulus might affect economic activity in the near term. A lack of immediate fiscal boost could translate into decreased consumer spending, as individuals may not feel the impact of increased disposable income. This could dampen economic growth in the short term. Furthermore, businesses may delay investment decisions if they perceive reduced consumer demand.

The resulting reduced demand for goods and services could also lead to job losses in various sectors.

Japan’s government isn’t counting on tax cuts to magically boost incomes, a rather straightforward approach. Interestingly, similar to the ongoing debate surrounding Musk’s Starlink plans for a satellite link in Switzerland, Musk’s Starlink plans for a satellite link in Switzerland highlight the complex interplay of technological advancements and government policy. Ultimately, Japan’s focus on more sustainable income growth strategies seems a wiser long-term approach than relying on short-term fixes.

| Impact Category | Short-Term Effect | Long-Term Effect |

|---|---|---|

| Consumer Spending | Reduced consumer confidence and spending due to lack of immediate financial incentive. | Potential for decreased long-term consumption patterns if confidence isn’t restored. |

| Investment | Reduced business confidence and subsequent delays in capital expenditure. | Potential for slower long-term economic growth due to lower investment levels. |

| Employment | Potential for job losses in sectors sensitive to consumer spending and investment declines. | Long-term structural unemployment could emerge if industries fail to adapt to changing economic conditions. |

| GDP Growth | Lower growth rates as consumer spending and investment are affected. | Potentially slower economic growth compared to scenarios with tax cuts or other stimulus. |

Comparison with Other Developed Nations’ Approaches

Japan’s approach to economic stimulus differs from those of other developed nations. A comparative analysis reveals variations in strategies.

| Country | Approach | Economic Indicators (e.g., GDP Growth, Unemployment Rate) |

|---|---|---|

| United States | Historically, the US has employed tax cuts and other fiscal policies to stimulate growth, often in response to recessions. | Historically varying GDP growth and unemployment rates, dependent on specific policies and economic conditions. |

| Germany | Germany often focuses on investment incentives and infrastructure projects to boost economic activity. | Generally, high employment rates and moderate GDP growth, although subject to economic fluctuations. |

| France | France has used a combination of fiscal and monetary policies, including direct spending on public works. | GDP growth and unemployment rates have shown variations, reflecting the complex nature of the French economy. |

| Japan | Japan has relied on a range of methods in the past, but its current approach eschews tax cuts as a primary stimulus. | Historical GDP growth and unemployment rates have shown various trends, depending on the particular economic policies. |

Social Consequences of the Approach

The decision’s social consequences could disproportionately affect specific demographics. Lower-income households might experience a greater impact from reduced consumer spending, as their disposable income is more vulnerable to economic downturns. This could exacerbate existing social inequalities.

Impact on Japan’s International Trade Relationships

The Japanese government’s approach could impact international trade relationships. If economic growth slows, Japan’s demand for imports could decline, potentially affecting global supply chains. The global impact will depend on how other nations respond and whether they take counter-measures.

Public Perception and Discussion

The Japanese government’s decision not to rely on tax cuts to boost incomes has sparked considerable public debate. This divergence from traditional economic stimulus strategies raises questions about the government’s priorities and the potential impact on various segments of society. The public discourse reveals a spectrum of opinions, ranging from support for alternative approaches to concern about the effectiveness of the chosen path.This decision necessitates a nuanced understanding of the various perspectives surrounding it.

Analyzing public discourse, stakeholder viewpoints, and media portrayals provides valuable insights into the potential political ramifications and the challenges ahead. Examining the arguments for and against this approach, along with the different perspectives of key players, helps paint a clearer picture of the situation.

Public Discourse on the Decision

The public’s response to the government’s decision is multifaceted. Concerns have been raised regarding the potential economic consequences of forgoing tax cuts, particularly for lower- and middle-income households. Supporters of the government’s approach argue that alternative policies, such as infrastructure investment, might yield better long-term results. The debate underscores the complexity of economic policy and the differing priorities among various stakeholders.

Japan’s government, it seems, isn’t pinning all its hopes on tax cuts to boost incomes. While economic strategies are always complex, this approach might seem a bit… well, predictable. Perhaps a more innovative strategy could be inspired by looking at the alarming decline in America’s wildlife, like the issues explored in this insightful essay on america wildlife animals extinction essay.

Maybe focusing on sustainable solutions and responsible growth could offer a more long-term, impactful path for increasing income, rather than solely relying on short-term tax cuts. Ultimately, Japan’s approach still needs to prove its effectiveness.

Arguments For and Against the Approach, Japans government say it is not relying tax cuts boost income

- Arguments for the chosen approach: Proponents highlight the potential benefits of alternative strategies, such as investments in infrastructure or education. These investments, they argue, can stimulate long-term economic growth and create sustainable jobs. The emphasis on long-term economic stability is a key argument, emphasizing the benefits of sustained, planned development over short-term boosts. Furthermore, proponents point to the potential for reducing the national debt through efficient resource allocation.

Examples of successful infrastructure projects in other countries are often cited as evidence of the approach’s effectiveness.

- Arguments against the chosen approach: Critics argue that the government’s approach may not effectively address the immediate economic anxieties of citizens. They contend that tax cuts could provide more immediate relief to households and stimulate economic activity more quickly. These arguments emphasize the need for short-term economic measures to address potential economic downturns and support businesses. Concerns are often voiced about the potential for widening income inequality if the focus remains on long-term growth strategies rather than immediate income support.

Stakeholder Perspectives

- Businesses: Businesses may express concerns about the potential impact of alternative policies on their profitability and investment decisions. Some businesses might prefer tax cuts to stimulate demand and boost their revenues. Others might view the government’s approach as a long-term investment that benefits the economy as a whole, ultimately supporting their business growth.

- Labor unions: Labor unions might be concerned about the potential job losses or reduced wages if alternative policies do not generate sufficient economic activity. They may favor tax cuts as a means to boost overall income and demand, leading to increased employment opportunities. Their perspective often emphasizes the immediate needs of workers and their families.

- Citizens: Citizens’ perspectives vary greatly depending on their economic situation and personal priorities. Those facing financial hardship may favor tax cuts to ease their burden, while others may prioritize long-term economic stability over immediate relief. The diverse experiences and viewpoints within the general public contribute to a complex and nuanced public discourse.

Media Portrayal of the Decision

The media has presented varying interpretations of the government’s decision. Some outlets have highlighted the potential long-term benefits of the alternative approach, while others have focused on the potential for short-term economic hardship. The tone and emphasis in media coverage have varied significantly, reflecting the differing perspectives and priorities of various news organizations.

Political Implications

The government’s decision not to rely on tax cuts carries potential political implications. Public perception of the government’s economic policies will be a significant factor in future elections. The decision’s success or failure in boosting economic confidence and improving public well-being could significantly influence the government’s standing and future political strategies. The government’s approach could also impact the relationships with various political factions and interest groups.

Historical Precedents and Comparisons

Japan’s government decision not to rely on tax cuts for income stimulation warrants a look at historical precedents. Examining similar economic situations and government responses in Japan and other countries provides valuable context for understanding the current rationale. By analyzing past successes and failures, policymakers can learn from history and make informed decisions about the most effective strategies for economic growth.

Historical Instances of Government Tax Cuts and Economic Stimulus

Examining previous instances where governments have used or avoided tax cuts as a stimulus measure provides a crucial lens for understanding the current Japanese government’s approach. This analysis highlights the complex interplay between economic conditions, government policies, and eventual outcomes.

- The 1990s Japanese “Lost Decade”: During the 1990s, Japan experienced a prolonged period of economic stagnation. While various government measures were implemented, including tax cuts, their effectiveness was limited. This period underscores the challenge of stimulating an economy in the face of deep-seated structural issues.

- The 2008 Global Financial Crisis: Many countries responded to the 2008 crisis with significant tax cuts, aiming to boost consumer spending and business investment. The effectiveness of these measures varied across nations, reflecting the specific economic conditions of each country. Some economies saw a modest recovery, while others struggled to regain momentum.

- The 2020 COVID-19 Pandemic Response: Numerous countries implemented large-scale fiscal stimulus packages, including tax relief measures. These measures aimed to support businesses and individuals during the pandemic’s economic downturn. The extent to which these tax cuts directly stimulated economic activity varied, depending on factors like the specific nature of the relief, the severity of the downturn, and the overall economic structure of each nation.

Comparative Analysis of Economic Conditions and Outcomes

A comparative analysis of past government actions, economic conditions, and outcomes provides a crucial framework for evaluating the current decision.

| Year | Government Action | Economic Condition | Outcome |

|---|---|---|---|

| 1990s | Various tax cuts and stimulus measures | Prolonged stagnation, deflationary pressures, and asset bubbles | Limited impact, economy remained sluggish |

| 2008 | Tax cuts in various countries | Global financial crisis, sharp decline in economic activity | Mixed results, some saw modest recovery, others struggled |

| 2020 | Fiscal stimulus packages, including tax relief | Economic downturn due to pandemic | Varied outcomes, dependent on factors such as specific relief measures, economic structure |

| Present | No reliance on tax cuts | Inflationary pressures, labor shortages, supply chain disruptions | Unknown, as the effectiveness of the chosen strategy will be determined in the future |

Lessons Learned from Previous Decisions

The historical precedents offer valuable lessons for the current situation. The effectiveness of tax cuts as a stimulus measure is not guaranteed, especially when economic stagnation is linked to deep-seated issues. Furthermore, the specific economic context—including inflation, labor market conditions, and global factors—plays a significant role in determining the outcome of any economic policy. Furthermore, the interaction between various factors, such as fiscal and monetary policies, must be considered to avoid unintended consequences.

Focus on structural reforms and long-term economic strategies is often more beneficial than short-term stimulus measures.

Alternative Policies and Their Implications

Japan’s decision not to rely on tax cuts as a primary economic stimulus reflects a nuanced understanding of the country’s current economic landscape. Instead of a broad-based approach, the government likely seeks policies with more targeted impact and potentially long-term benefits. This approach suggests a shift from short-term solutions to fostering sustainable economic growth.Alternative policies offer a diverse range of potential benefits and drawbacks.

Implementing them effectively requires careful consideration of their potential impact on different sectors of the economy and the population. The success of any alternative policy will depend heavily on factors like public support, effective implementation, and external economic conditions.

Potential Alternative Policies

The Japanese government could explore various alternative policies to stimulate economic growth, including investments in infrastructure, education, and technology. These policies aim to address underlying structural issues and foster long-term economic resilience. Such investments can create jobs, enhance productivity, and improve living standards.

- Investing in Infrastructure: Projects like upgrading transportation networks, improving energy grids, and developing digital infrastructure can create jobs and boost productivity. The positive impact on economic activity is often substantial. However, these projects can be costly and require careful planning to avoid waste and ensure long-term value.

- Education and Skills Development: Investing in education and training programs to address skill gaps in the labor market can lead to a more productive and adaptable workforce. This can enhance long-term economic competitiveness. The challenge lies in aligning training programs with the evolving needs of the job market.

- Technological Advancement: Promoting research and development in emerging technologies like artificial intelligence, robotics, and renewable energy can drive innovation and create new industries. This approach can yield high returns in the long run but requires significant upfront investment and supportive policies.

- Targeted Subsidies for SMEs: Small and medium-sized enterprises (SMEs) often face challenges in accessing capital and financing. Targeted subsidies and financial incentives can help them expand, innovate, and create jobs. This approach, however, can be complex to administer and may not always reach the most deserving recipients.

Evaluating Alternative Policies

| Policy | Potential Impact | Challenges | Success Rate (estimated) |

|---|---|---|---|

| Investing in Infrastructure | Increased productivity, job creation, improved quality of life | High upfront costs, potential for bureaucratic delays, environmental concerns | Medium-High (70-80%) |

| Education and Skills Development | Enhanced workforce skills, increased productivity, improved employability | Alignment with industry needs, long-term return on investment, funding requirements | Medium (60-70%) |

| Technological Advancement | Innovation, new industries, economic growth | High initial investment, potential for disruption of existing industries, attracting and retaining talent | Low-Medium (50-65%) |

| Targeted Subsidies for SMEs | Increased business activity, job creation, economic diversification | Administrative complexities, risk of misallocation of funds, potential for corruption | Medium (65-75%) |

Rationale Behind Policy Selection

The rationale behind selecting these alternative policies stems from the belief that they address underlying structural issues within the Japanese economy. Focusing on long-term solutions like infrastructure development and education aims to build a more resilient and competitive economy. Furthermore, these policies often have a broader impact on society, improving overall quality of life beyond immediate economic gains.

Targeted support for SMEs is also crucial as they are the backbone of the Japanese economy.

Final Conclusion

Japan’s decision to forgo tax cuts as a primary economic stimulus raises significant questions about the effectiveness of alternative strategies. This analysis highlights the complexities of economic policymaking, demonstrating how different approaches can lead to varying short and long-term outcomes. The potential consequences for the Japanese economy, society, and international trade relationships are examined, offering a comprehensive understanding of the decision’s potential impact.