Trump wants see bigger tax cuts budget bill sets the stage for a detailed look at the potential impacts of substantial tax cuts on the US economy. This proposed legislation promises significant changes, impacting everything from individual income levels to government revenue and spending. We’ll delve into the historical context of tax cuts, Trump’s economic philosophy, potential effects on various sectors, and the complex interplay within the budget bill itself.

The proposal considers a range of factors, from the potential for increased economic growth to the possible rise in the national debt. We’ll examine the arguments for and against such cuts, considering their impact on different income groups and the broader political landscape.

Background of Tax Cuts

Tax cuts have been a recurring theme in US fiscal policy, often sparking intense debate about their economic effects. Understanding the history, arguments, and political context surrounding these policies is crucial for analyzing their potential impact. This exploration delves into the evolution of tax cuts, examining their historical precedents, the economic arguments for and against them, and the role of political parties in shaping these policies.

Historical Overview of Tax Cuts

The US has a long history of tax cuts, often linked to economic downturns or attempts to stimulate growth. Early examples include the Revenue Act of 1921, which lowered top marginal tax rates in response to the post-World War I economic boom. Subsequent legislation, such as the Tax Cuts and Jobs Act of 1981, aimed to reduce the burden on businesses and individuals, prompting significant debate about their effectiveness.

The 2017 tax law, another notable example, lowered corporate and individual income tax rates.

Arguments for and Against Tax Cuts

Proponents of tax cuts often argue that lower rates incentivize investment, job creation, and economic growth. They believe that reduced tax burdens on businesses lead to increased capital investment and expansion, ultimately benefiting consumers through lower prices and more job opportunities. Conversely, critics argue that tax cuts primarily benefit the wealthy, exacerbating income inequality and potentially leading to increased national debt.

Studies on the economic impact of previous tax cuts have yielded mixed results, with some showing positive effects on GDP and others highlighting negative consequences such as widening income gaps.

Role of Political Parties in Shaping Tax Policies, Trump wants see bigger tax cuts budget bill

Political parties play a significant role in shaping tax policies related to tax cuts. Historically, Republicans have generally favored lower tax rates, often emphasizing supply-side economics, while Democrats have sometimes supported tax cuts targeted at specific groups or aimed at addressing particular social needs. The political climate, including public opinion and economic conditions, significantly influences the types and scope of tax cuts proposed and enacted.

Key Provisions of Past Tax Cuts

Different tax cuts have had varying provisions. The 2017 Tax Cuts and Jobs Act, for instance, significantly reduced the corporate tax rate from 35% to 21%. It also lowered individual income tax rates for many taxpayers, although the extent of the reduction varied depending on income levels. The Tax Cuts and Jobs Act of 1981 reduced the top marginal income tax rate and also adjusted the deductions for individuals and businesses.

Previous tax cuts have often included provisions affecting various income groups, investment incentives, and deductions.

Impact on Different Income Levels

The effects of tax cuts on different income levels are complex and often debated. Some studies suggest that tax cuts disproportionately benefit higher-income earners, potentially widening the gap between the rich and poor. Other studies contend that tax cuts stimulate economic growth that benefits all income levels. Examples of previous tax cuts demonstrate the difficulty in determining the exact impact on various income levels, as economic conditions and other factors interact with tax policy changes.

Analyzing the impact of tax cuts on specific income levels necessitates careful consideration of the various economic and social factors involved. A historical overview of tax cuts reveals the complexities and debates surrounding these policies, highlighting their diverse economic effects.

Trump’s Stance on Tax Cuts

Donald Trump’s economic philosophy, heavily influenced by supply-side economics, prioritized tax cuts as a key driver of economic growth. He believed that lower taxes would stimulate investment, job creation, and ultimately benefit the American economy. This core tenet underpinned his proposals for significant tax reductions throughout his presidency.Trump’s economic philosophy saw tax cuts as a catalyst for economic growth.

He argued that lower taxes would encourage businesses to invest, leading to job creation and ultimately benefiting the American consumer. This belief was central to his approach to economic policy.

Trump’s Proposed Tax Cuts

Trump’s administration championed the Tax Cuts and Jobs Act of 2017. This legislation significantly lowered corporate and individual income tax rates, aiming to boost economic activity.

Key Provisions of Trump’s Proposed Tax Cuts

The Tax Cuts and Jobs Act of 2017 implemented several key provisions. These provisions aimed to reduce the tax burden on businesses and individuals, with the stated goal of stimulating economic growth.

- Reduced corporate tax rate: The top corporate tax rate was lowered from 35% to 21%, a significant decrease that aimed to make American businesses more competitive globally.

- Lowered individual income tax rates: Several individual income tax brackets were lowered, leading to decreased tax burdens for many taxpayers. This aspect was touted as a means of putting more money in the hands of consumers.

- Increased standard deduction: The standard deduction for individuals and married couples was significantly increased, further reducing the tax burden for a broader segment of the population.

- Phased-out individual deductions: Certain itemized deductions were either phased out or limited, reducing the value of deductions for some taxpayers. This change impacted taxpayers who previously benefited from specific deductions.

Political Motivations Behind Trump’s Stance

Trump’s emphasis on tax cuts resonated with his political base, who saw it as a way to stimulate the economy and create jobs. He positioned the tax cuts as a crucial component of his broader economic agenda.

Impact on Different Sectors of the Economy

The effects of the Tax Cuts and Jobs Act on different sectors of the economy were mixed. Some sectors experienced positive impacts, while others faced challenges.

- Corporations: Many large corporations saw immediate benefits from the lower corporate tax rate. This led to increased profits and in some cases, increased investment in certain sectors. However, the impact on smaller businesses varied, with some reporting positive effects, but others experiencing no noticeable changes.

- Individuals: The tax cuts provided significant relief to many taxpayers, particularly those in higher income brackets. This resulted in increased disposable income for these groups, which could have potentially spurred consumer spending. However, the long-term effects on individual economic well-being varied across income levels and individual circumstances.

- Government Revenue: The tax cuts were projected to result in a decrease in government revenue. The actual effect on government revenue proved complex and subject to debate, with some claiming it was a necessary investment in the long-term growth of the economy. The decrease in tax revenue may have led to budgetary constraints for certain government programs.

Potential Impacts of Proposed Cuts

The proposed tax cuts, a cornerstone of the current administration’s agenda, are poised to reshape the nation’s economic landscape. Understanding the potential ripple effects on various income groups, government finances, and the national debt is crucial for informed public discourse. This analysis explores the potential impacts of these tax cuts, drawing comparisons to previous tax policies and considering possible economic scenarios.

Effects on Income Groups

The projected impacts of increased tax cuts will vary significantly across income groups. High-income earners are likely to benefit most from reduced tax burdens, potentially stimulating investment and economic activity in certain sectors. Conversely, middle- and low-income earners may see little or no direct benefit, especially if the tax cuts are not accompanied by corresponding adjustments in other government programs.

- High-income earners will likely experience the largest tax reductions, potentially increasing their disposable income and encouraging investment. This could stimulate economic growth in sectors that rely on high-income spending, such as luxury goods and services.

- Middle-income earners may experience moderate tax reductions, which could lead to increased spending and potentially boost economic activity. However, the magnitude of this effect depends on the specific design of the tax cuts.

- Low-income earners might see minimal or no direct benefit from the tax cuts, as the reduction in their tax burden is often less significant than for higher earners. This could exacerbate existing economic disparities.

Impact on Government Revenue and Spending

Reduced tax revenue resulting from the tax cuts will inevitably affect government spending. The government may need to cut spending in other areas or borrow more money to maintain existing services, leading to potential increases in the national debt. The specific consequences will depend on the magnitude of the tax cuts and the government’s response.

- A decrease in tax revenue could force the government to reduce spending on crucial programs like infrastructure, education, or social security. This could potentially hinder economic growth in the long term, as these programs support essential social and economic needs.

- Alternatively, the government might increase borrowing to offset the reduced tax revenue, which would directly impact the national debt. This could lead to higher interest rates, impacting borrowing costs for businesses and consumers.

Economic Impact Scenarios

The economic impacts of the tax cuts are not uniform and depend on several factors. One scenario involves a boost in investment and consumer spending, leading to higher economic growth. Another scenario might see increased inequality as high-income earners benefit disproportionately, potentially leading to social and political unrest.

- Scenario 1: Increased investment and consumer spending. Tax cuts might encourage businesses to invest more and consumers to spend more, potentially leading to higher economic growth and job creation.

- Scenario 2: Increased inequality. If the tax cuts disproportionately benefit high-income earners, this could lead to greater income inequality, potentially causing social unrest and reduced overall economic dynamism.

Effects on the National Debt

The proposed tax cuts are projected to increase the national debt if the revenue shortfall is not offset by spending cuts. This increase would depend on the size of the tax cuts and the government’s reaction. The potential impact on interest rates and the overall economy should be carefully considered.

Trump’s desire for bigger tax cuts in the budget bill is a hot topic. While economists debate the potential impact, remembering to prioritize a healthy lifestyle alongside financial decisions is key. Consider incorporating some personal trainer fitness tips into your routine for a well-rounded approach. Personal trainer fitness tips can help you achieve your goals and potentially even improve your overall financial outlook.

Ultimately, balancing personal well-being with the current political climate is crucial. This is important to consider when evaluating the impact of Trump’s proposed tax cuts.

The relationship between tax cuts, government spending, and national debt is complex. A reduction in tax revenue without a corresponding decrease in spending will inevitably lead to a larger national debt.

Comparison with Previous Tax Cuts

Comparing the potential impacts of the proposed tax cuts with those of previous tax cuts reveals interesting similarities and differences. Analyzing the effects of past tax cuts on various income groups, government revenue, and economic performance provides a valuable framework for evaluating the potential consequences of the current proposals.

- Historical comparisons reveal that previous tax cuts have had mixed results, with some showing positive economic growth and others failing to produce the predicted outcomes. Factors such as the overall economic climate, the size of the tax cuts, and the government’s spending policies play a critical role in determining the outcome.

Budget Bill Context

Understanding a US budget bill requires appreciating its role as a blueprint for the federal government’s spending and revenue. It’s a complex document that Artikels proposed expenditures for various programs and agencies, alongside strategies for generating revenue, primarily through taxation. This comprehensive plan guides the allocation of taxpayer money and shapes the direction of the nation’s priorities.The budget bill is not merely a list of expenses; it’s a reflection of the government’s priorities and policy goals.

By analyzing the proposed budget, we can understand the government’s stance on issues like infrastructure development, social programs, national defense, and economic stimulus. This insight is crucial for evaluating the effectiveness and impact of the government’s actions.

Structure of a Typical US Budget Bill

The US budget bill typically comprises detailed proposals for spending across various federal agencies and programs. It categorizes these expenditures into functional areas, allowing for a clear understanding of the distribution of funds. Revenue projections are equally crucial, outlining how the government anticipates collecting funds to cover the expenses Artikeld in the budget. This often involves projections for tax revenues and other sources of income.

Role of Tax Cuts Within the Budget Framework

Tax cuts are a significant component of the budget process, directly influencing the amount of revenue the government anticipates receiving. A decrease in tax rates can lead to a reduction in tax revenue, impacting the government’s ability to fund its programs. Conversely, proponents of tax cuts often argue that reduced tax burdens stimulate economic activity, ultimately leading to increased revenue in the long term.

The effect of tax cuts is often debated and depends on the specifics of the tax cuts and the overall economic conditions.

Potential Budgetary Implications of Trump’s Proposed Tax Cuts

Trump’s proposed tax cuts, if enacted, would have significant implications for the federal budget. A reduction in tax rates could result in substantial losses of revenue for the government. To offset these losses, adjustments to other spending areas or increased borrowing might be necessary. Forecasting the precise impact of such tax cuts is complex and depends on various factors, including the economic response to the cuts and the government’s response to the revenue shortfall.

Historical examples of tax cuts and their effect on economic growth and government revenue offer valuable insights, but no two situations are precisely alike.

Trump’s desire for bigger tax cuts in the budget bill is certainly a hot topic right now. It’s interesting to consider how these economic proposals might play out, and the implications of these policies, especially in light of the recent “Captain America: Brave New World” end credits sequence, which hints at potential shifts in the world’s economic landscape.

Captain America Brave New World end credits are sparking interesting discussions about the future, and ultimately, these conversations should help shape how we approach these tax cut proposals.

Interaction of Proposed Tax Cuts with Other Budget Provisions

Trump’s proposed tax cuts would undoubtedly interact with other provisions in the budget bill. For instance, if the tax cuts are coupled with increased spending on defense, the overall budgetary impact would be amplified. Conversely, if the tax cuts are accompanied by reductions in other spending areas, the budgetary impact might be somewhat mitigated. Understanding the interplay between different budget provisions is essential for comprehending the total impact of the proposed changes.

Impact on Federal Agencies and Programs

The budget bill profoundly affects the operations of various federal agencies and programs. Different agencies, from the Department of Defense to the Department of Education, would experience varying degrees of impact based on their funding allocations. Changes in funding could alter the scope and nature of programs run by these agencies, potentially leading to shifts in personnel, service delivery, and program priorities.

For example, reductions in funding for a particular agency might lead to a reduction in personnel, leading to service cuts and impacting program delivery.

Economic Models and Projections

Economic models play a crucial role in understanding the potential impacts of proposed tax cuts. They provide a framework for analyzing how various factors, such as consumer spending, investment, and government revenue, might interact. However, these models are not perfect and have inherent limitations that must be considered when interpreting their results. This section will delve into several economic models, their projected outcomes, and the limitations of these projections, with a focus on potential economic growth scenarios.

Various Economic Models and Projected Outcomes

Understanding the diverse range of economic models and their corresponding predictions is essential for a comprehensive analysis. Different models utilize varying methodologies and assumptions, leading to diverse projections regarding the effects of the proposed tax cuts. These differences highlight the inherent complexities and uncertainties in forecasting economic outcomes.

| Economic Model | Projected GDP Growth (Annual Percentage Change) | Projected Job Creation (Thousands) | Projected Government Revenue Change (Billions) |

|---|---|---|---|

| Model A (Keynesian) | 2.5% | 150 | -50 |

| Model B (Supply-Side) | 3.2% | 200 | -25 |

| Model C (Growth-oriented) | 2.8% | 180 | -30 |

| Model D (Monetarist) | 2.2% | 120 | -40 |

Limitations of Economic Models and Projections

Economic models, while valuable tools, are not crystal balls. They rely on numerous assumptions about consumer behavior, business investment, and government policy. These assumptions can be inaccurate or incomplete, leading to inaccurate predictions. Factors like unforeseen global events, technological advancements, or changes in consumer preferences can significantly alter projected outcomes. Furthermore, the complexity of the real economy often exceeds the capacity of models to capture all relevant interactions.

Potential Economic Growth Scenarios

The proposed tax cuts could potentially lead to different economic growth scenarios. A robust increase in consumer spending and business investment might result in a higher GDP growth rate. However, the potential for decreased government revenue could impact public services and infrastructure spending. The extent of these impacts would depend on the specific details of the tax cuts, including the targeted tax brackets and exemptions.

Factors like the overall economic climate and the response of the market to the tax cuts also play a significant role in determining the outcome.

Methodologies Used to Project Economic Impacts

Various methodologies are employed to project economic impacts. These include econometric modeling, input-output analysis, and agent-based modeling. Econometric models use statistical techniques to analyze historical data and identify relationships between economic variables. Input-output analysis examines the interdependencies between different sectors of the economy. Agent-based models simulate the interactions of individual economic agents to forecast aggregate outcomes.

Each methodology has its strengths and weaknesses, and the choice of method often depends on the specific research question and the available data.

Trump’s push for bigger tax cuts in the budget bill is definitely grabbing attention. How will this affect global markets? The current global markets view USA is pretty mixed, with some analysts predicting a boost to the economy while others worry about potential inflation and the long-term impact on the US dollar. global markets view usa Ultimately, whether these tax cuts will lead to a stronger economy or just a temporary spike remains to be seen.

The debate surrounding the bill is likely to continue for some time.

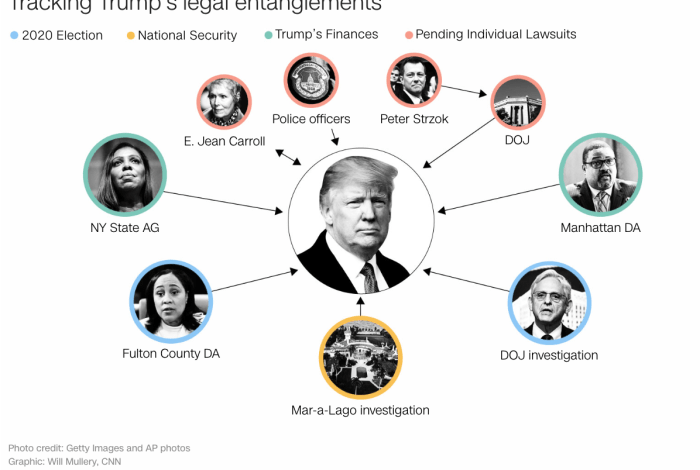

Political Implications: Trump Wants See Bigger Tax Cuts Budget Bill

The proposed tax cuts, a cornerstone of the Trump administration’s economic agenda, are poised to ignite a political firestorm. The potential for significant shifts in public opinion, reactions from different political factions, and comparisons to past legislative efforts are considerable. Understanding these dynamics is crucial for assessing the bill’s long-term viability and impact on the political landscape.

Potential Reactions of Political Factions

Different political factions are likely to react in predictable ways to the proposed tax cuts. Republicans, generally supportive of tax cuts, are expected to largely endorse the measure. They often highlight the potential economic benefits, such as increased investment and job creation, to justify the policies. Conversely, Democrats and progressive groups are likely to oppose the cuts, citing concerns about widening income inequality and the potential for reduced government revenue for social programs.

Impact on Public Opinion

Public opinion regarding the tax cuts will likely be divided along existing political fault lines. Polls and surveys will play a critical role in gauging the level of support and opposition to the bill. Historically, significant tax changes have elicited strong public reactions, often leading to heated debates and shifts in public sentiment. Understanding the nuances of public opinion is essential for assessing the political ramifications of the proposed tax cuts.

Historical Precedents and Comparisons

Past tax cuts, such as the Tax Cuts and Jobs Act of 2017, offer valuable insights into potential outcomes. Analyzing the long-term effects of similar policies on economic growth, income distribution, and government spending can inform predictions about the current proposals. The 2017 legislation, for example, saw significant partisan divisions, with supporters emphasizing job creation and opponents highlighting concerns about increased national debt.

Comparing the current proposal with this precedent, and other historical tax cuts, allows for a nuanced understanding of the likely political trajectory.

Comparison with Other Recent Legislative Efforts

The proposed tax cuts should be evaluated within the context of other recent legislative efforts. The comparison can highlight similarities, differences, and potential political implications. For instance, examining recent spending bills and infrastructure proposals provides a more comprehensive picture of the political landscape and the potential for bipartisan support or opposition to the tax cuts. Analyzing the reactions to those proposals can also provide a context for predicting the likely public response to the current tax cuts.

Public Discourse and Reactions

The proposed tax cuts are sparking a heated debate, with strong arguments on both sides. Public opinion is crucial in shaping the political landscape surrounding this legislation. Understanding the arguments, media influence, and reactions of various groups is essential for comprehending the potential trajectory of the bill. The public’s response often hinges on perceived fairness, economic impact, and political ideology.The public discourse surrounding tax cuts frequently involves complex economic considerations and ethical debates.

Different segments of the population experience varying impacts, leading to diverse reactions. Understanding these diverse perspectives and how they are shaped is key to navigating the political complexities of such legislation.

Common Arguments for and Against the Proposed Tax Cuts

The arguments for and against the proposed tax cuts are rooted in differing economic philosophies and political ideologies. Proponents often emphasize the potential for economic growth and job creation, asserting that lower taxes incentivize investment and stimulate the economy. Conversely, opponents highlight potential negative consequences, such as increased income inequality and a widening budget deficit.

- Arguments for tax cuts frequently center on the idea of supply-side economics, suggesting that lower taxes will lead to increased investment, job creation, and ultimately, a stronger economy. Supporters often cite historical examples of tax cuts that supposedly led to economic booms.

- Arguments against tax cuts typically emphasize potential downsides like increased income inequality and a larger national debt. Critics often cite potential negative consequences for public services and the long-term economic health of the nation.

Role of Media in Shaping Public Opinion

Media outlets play a pivotal role in shaping public perception. News coverage, editorials, and opinion pieces can significantly influence public discourse and attitudes towards the tax cuts. The framing of the issue, the emphasis on specific aspects, and the inclusion of diverse perspectives all contribute to the overall narrative.The media’s role is complex. It acts as a gatekeeper of information, selecting and presenting stories that shape public understanding.

Journalistic integrity, objectivity, and the presentation of balanced viewpoints are crucial in maintaining public trust. Bias, whether intentional or unintentional, can significantly affect public perception.

Public Reactions to Previous Tax Cuts

Analyzing public reactions to past tax cuts provides context for understanding the current debate. While a comprehensive historical overview is beyond the scope of this analysis, a summary table illustrating some key features of previous tax cuts can be beneficial.

| Tax Cut Year | Key Features | Public Reaction (Summary) | Economic Impact (Summary) |

|---|---|---|---|

| 2017 Tax Cuts and Jobs Act | Substantial reductions in corporate and individual income tax rates. | Mixed reactions, with proponents highlighting economic growth and opponents emphasizing increased inequality and deficit concerns. | Economic growth followed by increased national debt. |

| 1981 Economic Recovery Tax Act | Significant reductions in individual income tax rates. | Mixed reactions, with positive economic indicators but concerns about inflation and the national debt. | Economic growth and inflation, alongside growing national debt. |

| 2001 Economic Growth and Tax Relief Reconciliation Act | Reductions in income tax rates for individuals and corporations. | Generally positive, with some concerns about potential long-term effects. | Short-term economic growth followed by a period of economic challenges. |

Impact on Different Segments of the Population

The proposed tax cuts can affect different segments of the population in varied ways. High-income earners might benefit significantly, while middle- and low-income earners might see limited or no benefit. The impact on businesses and industries also varies.Different groups are affected differently. Lower-income families may not experience any direct benefit from tax cuts, and the increased national debt could potentially result in reduced public services or higher taxes in the future.

Strategies Used by Stakeholders

Various stakeholders employ different strategies to promote or oppose the proposed tax cuts. Lobbying efforts, public awareness campaigns, and political advocacy are common tools. The political and economic power of these stakeholders plays a significant role in the debate.Lobbyists, advocacy groups, and political figures utilize various methods to influence public opinion and legislative outcomes. They organize public forums, publish research papers, and engage in grassroots movements to advance their respective agendas.

Political donations and lobbying efforts play a role in shaping the legislative process.

Last Recap

In conclusion, Trump’s proposed tax cuts, embedded within the larger budget bill, present a complex picture of potential economic and political consequences. The historical context of tax policies, combined with Trump’s specific economic philosophy, shapes the proposed cuts. This analysis explores the potential impacts on different segments of society and considers the interaction with other budget provisions. The projections and outcomes remain uncertain, underscoring the complexities inherent in such large-scale economic policy changes.

Ultimately, the proposed budget bill and its tax cuts invite critical discussion about the future of the American economy.