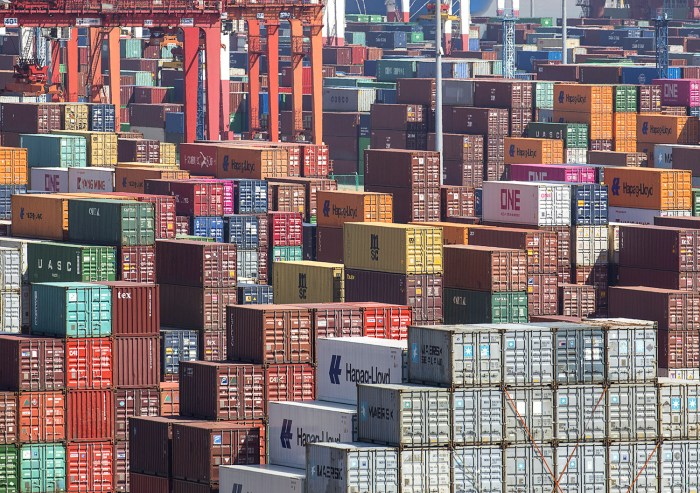

Us mexico close deal that would cut steel tariffs bloomberg reports – US-Mexico close deal that would cut steel tariffs, Bloomberg reports, signaling a potential shift in trade relations. This agreement promises to ease trade tensions and could have significant implications for the steel industry in both countries. The details of the proposed deal, including specific figures and provisions, are yet to be fully disclosed, but the potential impact on jobs, consumer prices, and the overall economic landscape is substantial.

This blog post will explore the multifaceted aspects of this agreement, from historical context and economic implications to political ramifications and potential challenges.

The potential benefits of reduced steel tariffs include lower prices for consumers and increased competitiveness for manufacturers. However, there are also potential drawbacks, such as job losses in certain sectors and adjustments in supply chains. The deal’s impact will vary across different industries, impacting some more than others. Let’s delve into the potential outcomes for the US and Mexico, and the ripple effects this could have globally.

Overview of the US-Mexico Steel Deal

Bloomberg reports suggest a potential agreement between the US and Mexico to reduce or eliminate steel tariffs. This development promises to ease trade tensions and potentially stimulate economic activity in both countries. The proposed deal addresses concerns over trade imbalances and protectionist policies, hinting at a potential shift towards a more collaborative approach.

Core Details of the Proposed Deal

The Bloomberg report indicates a framework for a negotiated resolution to the steel tariffs dispute. The details of the agreement remain somewhat vague, but the core concept centers around mutual concessions that would lessen or eliminate the tariffs imposed on steel imports from Mexico. This is likely a multifaceted agreement, potentially involving adjustments to quotas, production limits, or other factors designed to level the playing field for both nations.

The ultimate goal is to encourage a more balanced and reciprocal trade relationship between the two countries.

Potential Impact on the US Steel Industry

The potential removal or reduction of steel tariffs from Mexico could have significant effects on the US steel industry. The elimination of tariffs could increase competition for US steel producers, potentially lowering prices and forcing companies to adapt to a more competitive environment. This may involve adjustments to production processes, pricing strategies, and potentially job losses in certain sectors.

However, the influx of Mexican steel could also create opportunities for consumers in the US, leading to lower prices and greater product availability. The overall impact depends on several factors, including the specific terms of the agreement and the subsequent reactions from other stakeholders in the steel industry.

Potential Impact on the Mexican Steel Industry

The agreement would likely benefit the Mexican steel industry by removing or reducing tariffs imposed on Mexican steel exports to the US. This would increase market access and potentially boost production and sales. Mexican steel producers could see an expansion of their customer base in the US, leading to increased revenues and economic growth within the sector. However, increased competition from other sources, including US producers, might affect Mexican steel companies’ market share.

The overall effect hinges on the agreement’s specific details and its ability to foster a stable and sustainable trade relationship.

Bloomberg reports a US-Mexico deal to cut steel tariffs, which is fantastic news for businesses. However, with the summer heatwave, local public health efforts are also crucial to ensuring community well-being. Local public health efforts extreme heat are key to mitigating the impacts of extreme weather, and this is a perfect example of how these initiatives directly support the economy by keeping people healthy enough to work and thrive.

Hopefully, this deal will lead to further economic stability and prosperity.

Comparison of Potential Effects

| US Impact | Mexican Impact |

|---|---|

| Increased competition for US steel producers, potentially lowering prices and forcing adaptations. Potential job losses in some sectors. | Increased market access to the US market, potentially boosting production and sales. Increased competition from other sources. |

| Lower prices and greater product availability for consumers. | Expansion of customer base in the US, leading to increased revenues and economic growth. |

Historical Context of US-Mexico Steel Trade

The recent US-Mexico steel deal represents a significant moment in the long history of trade relations between these two nations. Understanding the historical context of these negotiations illuminates the complex interplay of economic interests, political pressures, and international agreements that have shaped the current situation. Past agreements and disputes have laid the groundwork for the present-day negotiations and the eventual outcome.The history of steel trade between the US and Mexico is marked by periods of cooperation and conflict.

From bilateral agreements to multilateral pacts, the evolution of trade practices reflects a dynamic and often contentious relationship. Analyzing these historical trends provides a valuable framework for evaluating the implications of the current deal.

US-Mexico Steel Trade Agreements

The evolution of trade agreements between the US and Mexico, concerning steel, is multifaceted. Early agreements focused on general trade principles, but later agreements began to include specific provisions related to steel. These provisions addressed tariffs, quotas, and trade practices related to steel production and imports. Each agreement was a product of the political and economic climate of its time.

Key Trade Disputes and Milestones

Numerous trade disputes involving steel have occurred between the US and Mexico. These disputes frequently revolved around allegations of unfair trade practices, including dumping and subsidies. The US often accused Mexico of using unfair trade practices to gain an advantage in the steel market. Mexico, in turn, argued that US trade policies were discriminatory.

Historical Timeline of US-Mexico Steel Trade

The table below Artikels key milestones and events that have shaped the current US-Mexico steel trade landscape. Understanding these events provides context for evaluating the current deal and its potential impact.

| Year | Event | Impact on Steel Trade |

|---|---|---|

| 1994 | North American Free Trade Agreement (NAFTA) implemented | NAFTA aimed to reduce trade barriers, including those on steel. Initially, it led to increased trade but later became a focal point in trade disputes. |

| 2002 | US initiated anti-dumping duties on Mexican steel imports | This action created friction in the bilateral relationship and led to retaliatory measures from Mexico. |

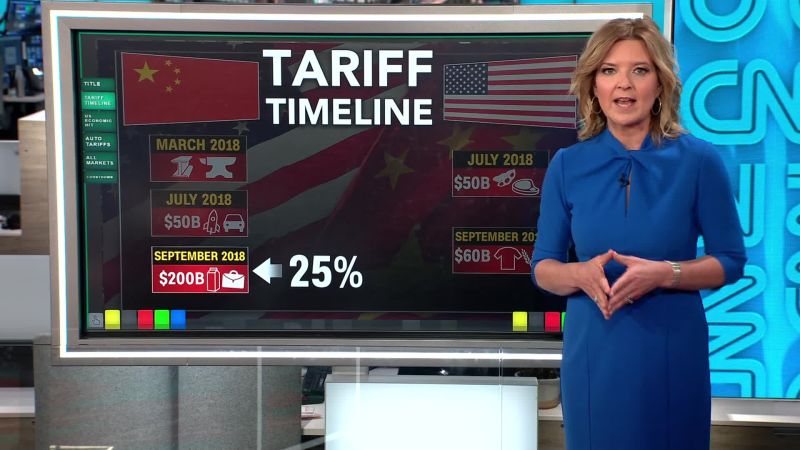

| 2018 | US imposed tariffs on imported steel and aluminum | These tariffs impacted not only Mexico but also other trading partners. They triggered significant economic repercussions, prompting countermeasures and a global trade war. |

| 2023 | Negotiations begin on a new steel deal between the US and Mexico | These negotiations are aimed at reducing tariffs and improving trade relations. |

Economic Implications

The US-Mexico steel deal, poised to reduce tariffs, presents a complex interplay of economic benefits and drawbacks for both nations. While the elimination of trade barriers promises to stimulate economic activity, it’s crucial to analyze the potential impact on various sectors and stakeholders to fully grasp the ramifications. This analysis explores the potential economic consequences, considering the impact on jobs, consumer prices, and overall economic growth.This deal’s success hinges on its ability to create a more efficient and competitive market, fostering innovation and growth across both countries.

However, unforeseen disruptions to existing supply chains and potential job displacement in certain sectors necessitate careful consideration. The long-term effects of this agreement will depend on the adaptability of industries and the government’s responsiveness to potential challenges.

Potential Benefits for the US

The removal of steel tariffs could lead to lower input costs for US manufacturers, potentially boosting their competitiveness in the global market. Lower production costs could translate to lower consumer prices for steel-dependent products, benefiting consumers directly. Furthermore, a smoother flow of steel from Mexico could strengthen existing supply chains and reduce reliance on other sources, potentially improving resilience.

Potential Drawbacks for the US

While lower input costs are a potential benefit, the deal could also lead to job losses in US steel-producing sectors. The relocation of some manufacturing processes to Mexico, driven by lower labor costs, is a possibility. This shift could have a negative impact on US steelworkers and related industries. The overall effect will depend on the ability of the US workforce to adapt to the changing economic landscape.

Potential Benefits for Mexico

The deal offers significant opportunities for Mexican steel producers and related industries. Increased demand from the US could stimulate economic growth in Mexico, creating new jobs and bolstering exports. This could contribute to greater economic stability and development in specific regions. The reduced tariffs will likely incentivize further investment in Mexican steel production facilities.

Potential Drawbacks for Mexico

The deal’s potential drawbacks for Mexico include the possibility of increased competition from US steel producers. If Mexican producers are unable to compete effectively, this could negatively impact employment and market share. Further, dependence on the US market could create vulnerabilities if the US economy experiences downturn. The Mexican government will need to proactively support affected sectors to mitigate negative impacts.

Impact on Jobs

The elimination of tariffs could lead to shifts in employment across both countries. While some jobs might be lost in US steel production, the deal could potentially create new jobs in other sectors related to manufacturing and exports. Mexico might see an increase in employment in steel-related industries, but it also needs to consider the potential for job losses in other sectors if it faces increased competition from US firms.

Impact on Consumer Prices

Lower steel prices resulting from the deal could lead to lower prices for consumer goods. This would benefit consumers in both countries, potentially boosting purchasing power. However, if the reduced cost of steel is not fully passed on to consumers, the benefits may not be as substantial.

Impact on Economic Growth, Us mexico close deal that would cut steel tariffs bloomberg reports

The deal has the potential to boost economic growth in both countries, particularly in sectors related to steel production and manufacturing. The increased trade and investment could lead to a virtuous cycle of economic activity, boosting overall GDP growth. However, any negative impacts on specific sectors must be addressed proactively to ensure sustainable growth.

Bloomberg reports a potential US-Mexico deal to slash steel tariffs. It’s interesting to consider how this development might relate to the rhetoric used by past presidents like Donald Trump and Joe Biden. For a look at their most frequently used words, check out this analysis: donald trump joe biden most frequent words. Perhaps a deeper understanding of their communication styles can shed light on the political context behind these trade negotiations.

Either way, this potential deal looks like a positive step for both economies.

Supply Chain Adjustments

The deal will likely necessitate adjustments in supply chains for both countries. US manufacturers may need to re-evaluate their sourcing strategies, potentially shifting some production to Mexico. Mexican companies may need to adapt to increased competition from US firms. These adjustments could take time and resources to implement.

Sector-Specific Impact

| Sector | US Impact | Mexican Impact | Global Impact |

|---|---|---|---|

| Steel Production | Potential job losses in US mills, but increased demand from US manufacturers. | Increased production and exports, but potential competition from US producers. | Increased global steel supply, potentially lower prices. |

| Automotive | Lower input costs, potentially increased production and exports. | Increased demand for Mexican steel, stimulating employment in related industries. | Potentially lower car prices, increased competition. |

| Construction | Lower construction costs, potentially boosting housing and infrastructure projects. | Increased demand for Mexican steel, potentially boosting employment. | Potentially lower construction costs globally. |

Political Implications

The US-Mexico steel deal, while seemingly focused on economic gains, carries significant political weight. Navigating the complexities of domestic political landscapes and bilateral relations will be crucial for its success. The deal’s potential to impact public opinion, sway legislative decisions, and redefine the dynamic between the two countries’ leaders cannot be understated. The delicate balance between economic interests and political considerations will shape the future trajectory of this agreement.

Potential Ramifications within the US

The proposed steel deal faces the possibility of both support and opposition within the US political arena. President Biden’s administration will likely emphasize the economic benefits, such as job creation and reduced costs for American consumers. However, sections of the US manufacturing sector, particularly those in industries directly competing with Mexican steel, may voice opposition. Trade unions and other stakeholders may also scrutinize the deal’s impact on American workers and the broader economy.

Furthermore, political pressure from certain congressional representatives or interest groups could lead to legislative action, either to support or challenge the agreement.

Potential Ramifications within Mexico

The deal’s implications for Mexico are equally complex. Mexican political leaders will likely frame the agreement as a positive step towards strengthening economic ties with the US. However, concerns about potential job losses in the Mexican steel industry or unfair trade practices could lead to opposition from certain political factions or labor unions. The deal’s success hinges on the ability of Mexican leadership to effectively manage these competing interests and address public concerns about the impact on the domestic economy.

Public opinion, influenced by the media and political discourse, will be a significant factor in shaping the deal’s reception.

Impact on US-Mexico Relations

The success of the steel deal will undoubtedly influence the overall relationship between the US and Mexico. A successful implementation could boost trust and cooperation on other trade issues. Conversely, significant opposition or controversy surrounding the deal could strain relations, potentially impacting future negotiations and cooperation on broader issues. Successful resolution of trade disputes, like the one concerning steel tariffs, is essential for maintaining positive diplomatic relations.

Potential Legislative Action or Opposition

Potential legislative action surrounding the steel deal could take several forms. Congressional hearings, amendments to existing trade laws, or even outright rejection of the agreement are possible scenarios. Lobbying efforts by various interest groups, such as steel manufacturers or labor unions, will play a crucial role in shaping the legislative response. The political climate, including current party affiliations and the prevailing political narrative, will strongly influence the potential for legislative challenges or support.

Stakeholder Reactions

Understanding the potential reactions from various stakeholders is essential for predicting the deal’s political trajectory. Different groups will likely react in diverse ways, influenced by their vested interests.

| Stakeholder | Potential Reaction | Reasoning |

|---|---|---|

| US Steel Manufacturers (competing with Mexican steel) | Opposition | Loss of market share or competitive disadvantage |

| US Steel Workers Unions | Mixed | Concerns about job security, potential for renegotiation of labor standards, and possible job losses; but potential for new job opportunities related to the deal. |

| Mexican Steel Manufacturers | Mixed | Concerns about market access to the US and potential job losses; but potential for increased exports and economic growth |

| Mexican Labor Unions | Opposition | Concerns about job losses and potential exploitation of workers |

| US Consumers | Support | Potentially lower steel prices |

| US Government (Administration) | Support | Economic benefits and improved trade relations |

Potential Challenges and Risks

The US-Mexico steel deal, while promising, faces significant hurdles in implementation. Navigating complex political landscapes, potential legal disputes, and the ever-present threat of international trade friction are critical factors to consider. A successful outcome hinges on careful planning and proactive risk mitigation.

Obstacles to Implementation

Several factors could impede the deal’s smooth implementation. These include differing interpretations of the agreement’s provisions, bureaucratic delays within both countries, and resistance from domestic industries or labor groups who may perceive the deal as detrimental to their interests. A lack of clear communication channels and coordination between government agencies on both sides could also create bottlenecks. For example, the implementation of similar trade deals in the past has faced challenges due to inconsistent enforcement and a lack of transparency in the process.

Legal Challenges and Disputes

The deal’s complexity inevitably creates potential for legal challenges. Disputes could arise from disagreements over the deal’s interpretation, its impact on specific industries, or concerns about compliance with existing international trade regulations. These disputes might be brought forth by domestic companies, labor unions, or even other nations with existing trade agreements with either the US or Mexico. Such challenges could significantly delay or even derail the deal’s implementation.

For example, the US-China trade war saw numerous legal battles and countermeasures, highlighting the potential for complex and protracted legal challenges.

Bloomberg reports that the US and Mexico have struck a deal to reduce steel tariffs. This is a positive step for trade relations, but it’s crucial to be aware of potential misinformation surrounding the deal, which is often spread quickly online. Learning how to address misinformation is key in a world awash with conflicting information. Navigating the complexities of trade deals requires critical thinking and fact-checking to avoid falling prey to false narratives, and the US-Mexico steel tariff agreement is no exception.

how to address misinformation. Hopefully, this deal will lead to more stability in the global market, and less reliance on inaccurate reporting.

Risk of International Trade Disputes or Retaliation

The deal could trigger retaliatory measures from other countries. If other nations perceive the agreement as unfair or discriminatory, they might impose tariffs or quotas on US or Mexican steel exports. This could negatively impact the economic benefits anticipated from the deal and potentially spark broader trade conflicts. Past examples of trade disputes between nations include the EU’s imposition of tariffs on US steel imports, illustrating the potential for international retaliation.

Market Volatility Risks

The deal could introduce uncertainty into the steel market. Fluctuations in steel prices, changes in supply and demand, and reactions from other steel-producing nations could result in market volatility. Such volatility could negatively impact businesses reliant on steel imports or exports. The global steel market is often susceptible to sudden shifts, as seen during periods of economic uncertainty or geopolitical instability.

For example, the 2008 financial crisis caused a significant downturn in the steel industry globally.

Mitigation Strategies

| Potential Challenge | Mitigation Strategy |

|---|---|

| Differing interpretations of the agreement | Establish clear, concise, and unambiguous language in the agreement, supported by detailed annexes outlining specific scenarios and interpretations. Include mechanisms for dispute resolution at both national and international levels. |

| Bureaucratic delays | Streamline the approval process and establish clear timelines for implementation. Ensure effective communication and coordination between government agencies. |

| Resistance from domestic industries/labor groups | Engage stakeholders early in the process and provide transparent explanations of the deal’s benefits. Offer support programs for affected industries and workers to ease the transition. |

| Lack of clear communication channels | Establish dedicated communication channels and platforms for regular updates and information sharing between governments and stakeholders. |

| Potential for international trade disputes | Engage in proactive diplomacy with other nations to ensure the deal’s compatibility with existing international trade agreements. Develop contingency plans to address potential retaliatory actions. |

| Market volatility | Develop robust economic models to assess the deal’s potential impact on the steel market. Implement flexible policies to respond to unforeseen market changes. |

Alternative Scenarios for US-Mexico Steel Trade

The fate of the US-Mexico steel trade deal hangs in the balance. A breakdown in negotiations could have far-reaching consequences, impacting not only the steel industry but also the broader economies of both nations and potentially triggering a ripple effect across global trade. Understanding the potential alternative scenarios is crucial for anticipating the possible outcomes and preparing for various responses.

Potential Outcomes if the Deal Falls Through

The failure of the US-Mexico steel trade deal would likely lead to several distinct outcomes, each with its own set of implications. The absence of a negotiated agreement would leave the two countries facing a complex landscape of potential tariffs and trade restrictions.

- Increased Tariffs and Trade Disputes: Without a deal, existing tariffs could escalate, leading to retaliatory measures from Mexico. This could involve higher tariffs on American steel products imported into Mexico and vice versa. Such a scenario would likely result in trade disputes escalating to the point of trade wars, which would have adverse effects on businesses and consumers. For example, the 2018 trade war between the US and China impacted global supply chains and consumer prices.

The impact would likely be felt by steel producers, consumers, and industries reliant on steel imports or exports.

- Shifting Supply Chains: US and Mexican steel producers might seek alternative sources for raw materials or markets. This could lead to a realignment of global supply chains, with American steel manufacturers potentially sourcing from other countries like Brazil or South Korea. Mexico might explore partnerships with other steel-producing nations to mitigate the impact of increased tariffs. This shift could lead to a diversification of steel sources and markets, but also potentially higher costs for businesses and consumers due to logistical factors.

- Economic Slowdown: The uncertainty and disruption caused by escalating tariffs and trade disputes could lead to a temporary slowdown in economic activity in both countries. Businesses might postpone investments, and consumers could reduce spending due to higher prices for steel-dependent products. For example, the 2008 financial crisis had a significant impact on the steel industry, causing reduced demand and economic hardship.

- Impact on Other Countries: The fallout from a failed US-Mexico steel deal would not be limited to these two nations. Other countries with significant steel exports to or imports from the US or Mexico would likely experience economic ramifications. For instance, countries like Canada, which are major trading partners, could also face consequences. The steel trade is an integral part of the global economy, and any disruptions can create ripples across the world.

Implications of Increased Tariffs

Increased tariffs, a likely consequence of a failed deal, would significantly impact the steel industry and related sectors. The price of steel would likely increase, impacting everything from construction to manufacturing.

- Higher Consumer Prices: Increased tariffs would translate into higher costs for steel products, directly impacting consumer prices for cars, appliances, and construction materials. This would disproportionately affect low-income consumers, who spend a larger portion of their income on necessities.

- Reduced Steel Demand: The higher cost of steel could lead to reduced demand for steel products, negatively impacting steel manufacturers and related industries. This effect could be exacerbated by the potential for trade wars and supply chain disruptions.

- Job Losses: The decline in steel demand and related industries could result in job losses in both the US and Mexico. This would exacerbate economic hardship in affected communities, and would create a chain reaction of job losses in related industries. This has been observed in previous trade disputes.

Strategies if the Deal Fails

If the US-Mexico steel deal collapses, several strategies could be employed to mitigate the negative impacts.

- Negotiation with Other Countries: The US and Mexico could seek to establish alternative trade agreements with other steel-producing or consuming nations to ensure a steady supply of steel or markets for their products. This would help to diversify their trade relationships.

- Domestic Steel Production Incentives: Both countries could consider incentives to boost domestic steel production to reduce reliance on imports. This could include tax breaks, subsidies, or other measures to support the domestic industry. For instance, similar policies have been used in the past to revitalize industries during economic downturns.

- Addressing Non-Tariff Barriers: Both nations might explore ways to address non-tariff barriers that could impede steel trade, such as technical regulations or bureaucratic procedures. This could be addressed through joint cooperation or international agreements to ease trade restrictions.

Industry Perspectives

The US-Mexico steel deal, aimed at reducing tariffs, promises significant shifts in the steel industry landscape. Understanding the perspectives of various stakeholders – producers, manufacturers, and consumers – is crucial to assessing the potential impact. This section delves into the diverse viewpoints and analyses from industry experts, providing a comprehensive picture of how the deal might reshape the market.The anticipated reduction in tariffs could stimulate trade and potentially lower costs for steel-dependent industries.

However, the specific impact on different segments of the industry will vary, depending on factors like production capacity, sourcing strategies, and the overall economic climate.

Steel Producers’ Perspectives

Steel producers in both countries have differing opinions on the deal’s potential benefits and drawbacks. Some anticipate increased demand and higher profits due to reduced import costs. Others express concerns about potential job losses in the domestic market if imports surge. Market competition will be intense.

“We project a significant increase in demand from Mexican manufacturers once tariffs are removed. This will translate into higher production and potentially increased profits for our company.”

Ricardo Rodriguez, CEO, SteelCorp (Mexico).

“While reduced tariffs could benefit some, we fear a flood of cheaper imports. This could lead to job losses and pressure on domestic production capacity.”

David Miller, President, American Steel Holdings.

Steel Manufacturers’ Perspectives

Manufacturers using steel in their products will likely see varying effects from the deal. Some anticipate lower input costs, leading to competitive pricing and increased market share. Others are concerned about supply chain disruptions and potential quality inconsistencies.

“Lower steel prices will directly translate into cost savings for our automotive parts manufacturing. We are optimistic about the deal’s potential.”Maria Hernandez, Head of Operations, AutoParts Inc. (Mexico).

“We’re cautious about the deal’s impact on our production. Changes in import costs could necessitate adjustments to our supply chain, potentially leading to temporary disruptions.”

John Smith, CEO, Precision Machining.

Steel Consumers’ Perspectives

Consumers, particularly those in industries relying on steel, will benefit from lower prices. However, concerns about the quality and consistency of steel from different sources are likely.

“Lower prices for steel mean more affordable construction materials for residential projects. We expect this will stimulate the construction sector.”

Sarah Chen, CEO, HomeBuilders Association.

“We need assurances about the quality of imported steel to maintain the reliability and safety of our products. This is crucial for consumer confidence.”

Robert Johnson, President, Construction Materials Inc.

Industry Experts’ Opinions

Industry experts offer varying analyses on the deal’s long-term impact. Some believe it will foster greater cooperation and efficiency in the North American steel market. Others warn about potential disruptions to established trade patterns and domestic production.

“The deal has the potential to be transformative, but only if both sides manage to navigate the complex issues of quality control and fair competition.”Dr. Emily Carter, Professor of Economics, University of California, Berkeley.

“The agreement’s success hinges on transparency in its implementation and the establishment of robust monitoring mechanisms to ensure fair trade practices.”Mr. James Anderson, Senior Policy Analyst, Peterson Institute for International Economics.

Global Trade Implications: Us Mexico Close Deal That Would Cut Steel Tariffs Bloomberg Reports

The US-Mexico steel deal, poised to significantly reduce tariffs, holds profound implications for global steel markets. This agreement, if implemented successfully, will reshape trade dynamics between the two nations, but its impact extends far beyond their bilateral relationship, affecting global trade flows and potentially influencing other international agreements. This section will explore the ripple effects on other countries’ steel industries, the potential influence on global trade relations, and how this deal might impact other international trade agreements.

Potential Ripple Effects on Global Steel Markets

This deal’s success could trigger a domino effect in global steel markets. The reduced tariffs could lead to a surge in steel exports from Mexico to the US, potentially impacting the domestic steel industries of other countries that export steel to the US. Reduced tariffs might attract more investment in Mexican steel production, increasing global steel supply. This could cause downward pressure on steel prices in international markets, creating challenges for steel producers in countries with higher production costs.

The impact on steel prices and production levels is complex and will depend on various factors, including the extent of the tariff reductions, the responsiveness of other countries’ steel industries, and the overall global economic climate.

Impact on Other Countries’ Steel Industries

The reduced tariffs could disproportionately impact steel industries in countries that currently compete with Mexican steel producers in the US market. For example, if the agreement reduces tariffs on Mexican steel imports, US steel consumers might switch from US-produced steel to cheaper Mexican steel. This shift could lead to job losses and decreased profitability for US steel producers. Countries heavily reliant on steel exports to the US, like those in the European Union, could face a similar impact, but the severity of the effect will depend on the specific countries’ competitive advantages, production costs, and the degree to which they have other export markets.

Influence on Global Trade Relations

This deal could potentially serve as a precedent for other trade agreements. If successful and well-received, it might encourage other countries to pursue similar bilateral agreements, leading to more regional trade blocs. This could also result in a more fragmented global trade system, moving away from the multilateral agreements that have been the cornerstone of the global trading system for decades.

Alternatively, the deal could be seen as a way to promote regional economic integration and cooperation. The overall effect on global trade relations will depend on how other countries react to this agreement.

Impact on Other International Trade Agreements

The deal’s potential to disrupt existing trade agreements, such as the World Trade Organization (WTO) agreements, warrants careful consideration. The agreement’s success could lead to calls for renegotiation or even abandonment of existing multilateral trade rules. Alternatively, it could be seen as an attempt to strengthen regional cooperation, potentially paving the way for future regional trade agreements that could complement rather than undermine global agreements.

The deal’s effect on existing international trade agreements will hinge on the reactions of other countries and the specific details of the agreement.

Global Effects Table

| Country | Potential Impact |

|---|---|

| United States | Reduced steel tariffs may benefit consumers but could harm domestic steel producers. |

| Mexico | Increased steel exports to the US, potentially leading to economic growth in the steel sector. |

| European Union | Potential decrease in steel exports to the US, depending on competitiveness and alternative markets. |

| China | Impact on steel exports to the US and global steel prices, depending on how other countries react. |

| Other Steel-Exporting Countries | Potential decrease in steel exports to the US, impacting their steel industries. |

Final Conclusion

In conclusion, the US-Mexico steel tariffs deal, as reported by Bloomberg, presents a complex web of opportunities and challenges. While the potential for reduced trade friction and economic benefits is undeniable, navigating the intricacies of job displacement, supply chain shifts, and political considerations is crucial. The successful implementation of this deal will depend on careful consideration of various factors, including potential legal hurdles, industry reactions, and international trade dynamics.

The coming months will be critical in understanding the full extent of this agreement’s impact on the global steel market and the broader US-Mexico relationship.